February 9, 2021: DeFi Hack Attack #2! 🕵️💻

Curve Market Recap

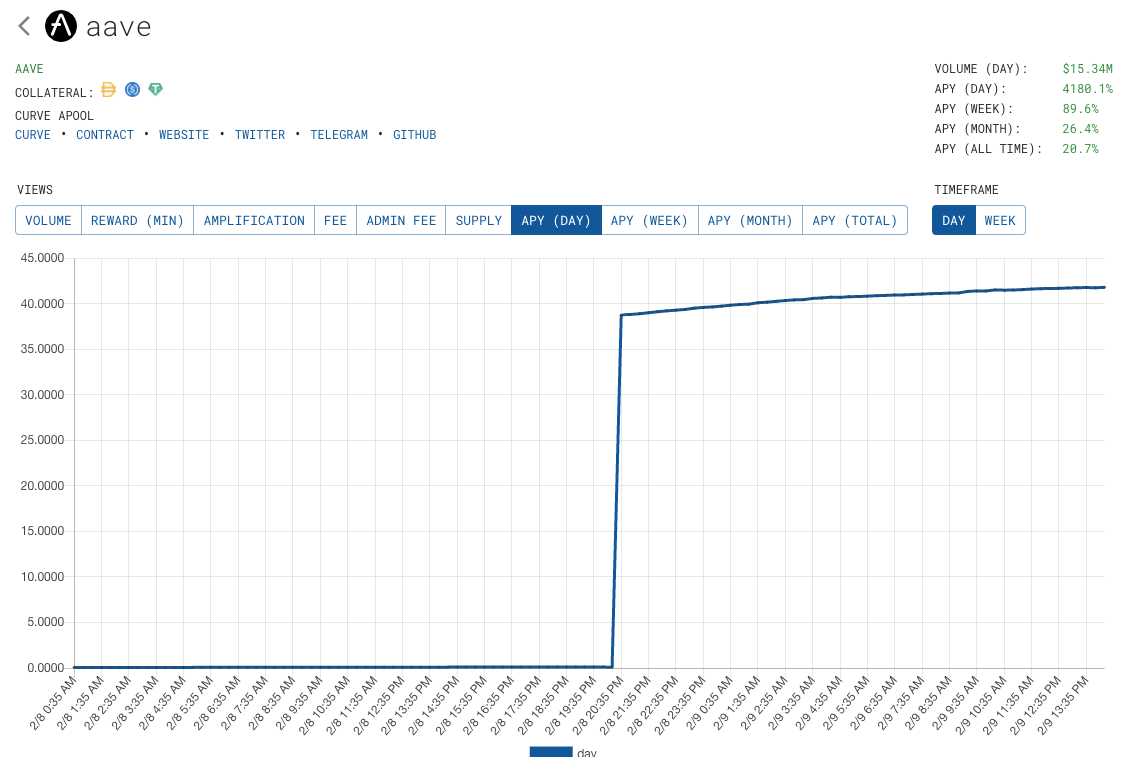

Aave Pool won’t stop making news. A >4000% APY? 👀

It’s real, and it’s spectacular. It looks to be the second major hack within the world of DeFi in the past week.

Slow down hackers, we’re still preparing the autopsy of the Yearn hack and yv2 pool issue! The issue is still under investigation, but it looks like an exploit of BT Finance:

For the sleuths out there, here are relevant hashes. It appears the hack also interacted with furubombo, which we reviewed recently.

https://etherscan.io/tx/0x82f95242963ac274d63e78234cb71c156f3135c32037e7e5b4424a6043da2a9a

https://etherscan.io/tx/0x0a51749d5394d60a67e7c31c345b675781226139e38ed936b41e00e5a9777362

https://etherscan.io/tx/0x7b88a6983f224d3d42fab1f2d28831ea0ad119b32133d1ea29eab99a5a404a87

https://etherscan.io/tx/0xa109ecf32bb1a3e29c126a7b52f56a02801c1583fe33e7e003465d3e8676784c

Thankfully, Curve pools yet again remain unharmed:

In fact, quite the opposite. Anybody sitting in Aave pool saw returns that would make Bitcoin blush.

“But wait!” you might ask, “If such major movements, why didn’t volume budge!”

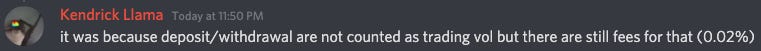

Kendrick Llama explains that deposit and withdrawal events are not calculated into trading volume, but there are still fees:

Why the rash of attacks? Coindesk recently released an explainer about Flash Loan attacks:

More generally speaking, our friend and Bitcoin maximalist Dan Held predicted this phenomenon while bashing DeFi during his recent 3-part interview with What Bitcoin Did:

“You’re telling me you’ve solved holy grail problems in finance? Your DEX is going to weather intense volatility? Once, like, the big hedge funds come in, these guys won’t blow your sh*t up to where they find a little fatal flaw and they’re willing to put in $1 billion to get a $3 billion return? Those are the big boy games.”

So to recap, we’ve seen two major hacks in DeFi in the past week, and they both actually redounded to the benefit of Curve stakers. Curve really is becoming a critical cog within the DeFi ecosystem. The development team pays a lot of attention to best practices and security, and as a result hackers today are building off of Curve’s infrastructure, rather than exploiting it.

If you expect additional hacks within the DeFi ecosystem and want to profit, you therefore might consider parking into Curve. If you do, first research heavily and make sure to do it the right way:

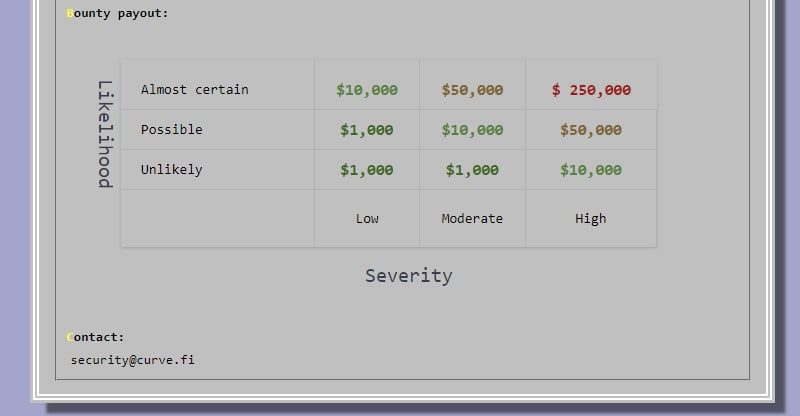

Of course, with Curve’s rapid rate of launching products, nothing is guaranteed. You can help keep the site resilient by helping find exploits before they become problems. Curve recently upped their bug bounty to a whopping 5.3 BTC:

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. The author performs development work for Curve compensated partly in $CRV, all content is otherwise independent.