Hippo Will Make You Jump 🦛🎤

The first 24 hours of Resupply

Keeping pace with reUSD’s launch has been a trip. Over $27MM in less than a day and still growing fast…

I had the privilege of meeting Ser Cryptovestor at ETHDenver, where he told me that we’d know very quickly, likely within the first 24 hours, whether the project was a boom or a bust. It’s abundantly clear that the project is a major success.

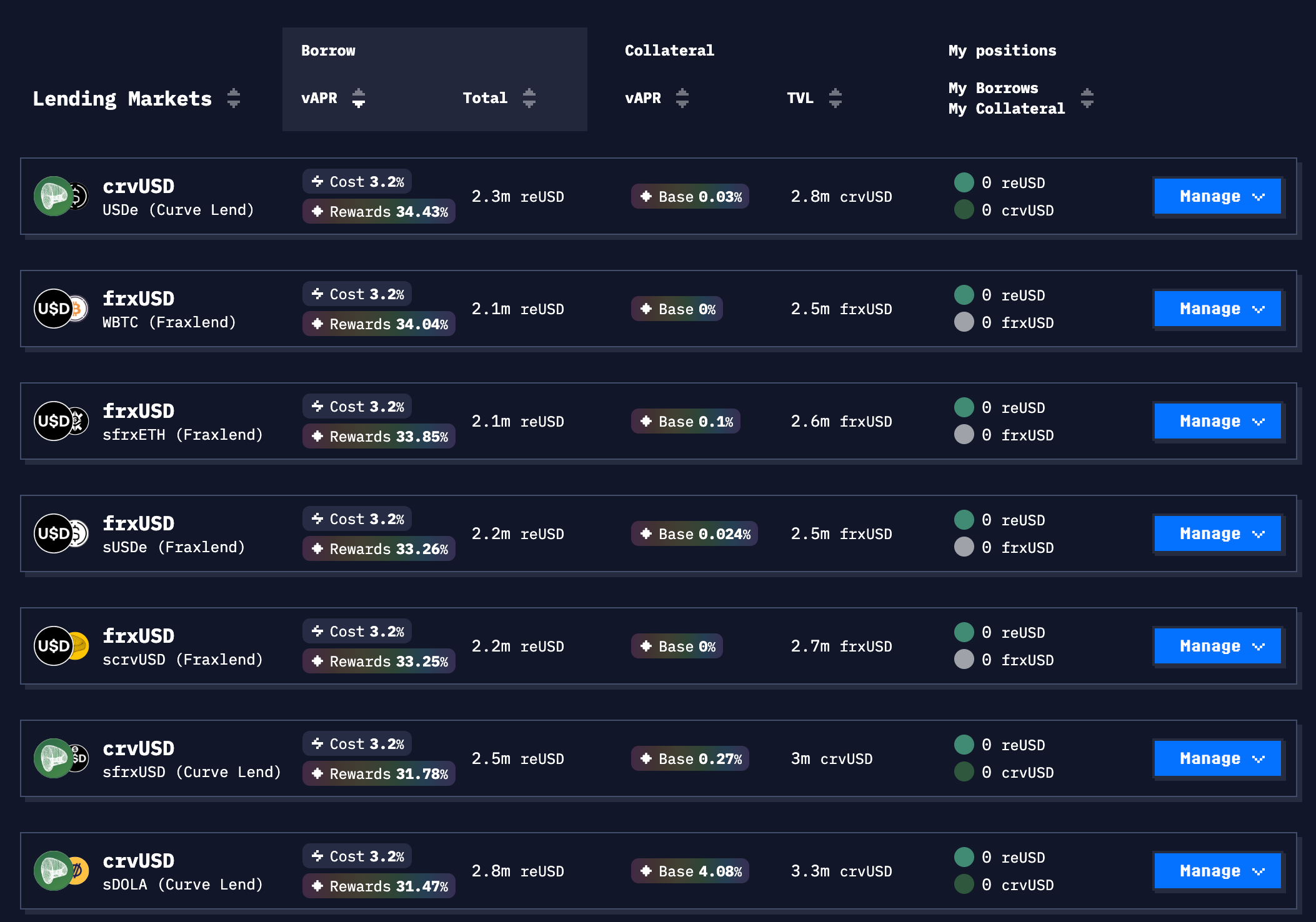

We’re not sure when the boom phase will subside, but with the project continuing to deliver 30%+ rewards for a 3.2% borrow rate, we expect the carousel will keep spinning.

One of the big long-term beneficiaries of Resupply’s success is enormous downward pressure on crvUSD minting rates as the stablecoin gets heavy minting pressure.

Promises made, promises kept…

Much of this has been due to the Peg Keepers working overtime, minting hefty amounts of $crvUSD to keep up with the demand.

At the rate the growth is continuing, the Peg Keepers will need to raise their ceilings to keep pace with the growth.

Meanwhile, the borrow rates have plummeted to free.

At these rates, it’s fully profitable to borrow against crypto, farm on Resupply, and print. However, this free money hack happened to open at a time when the economy is getting tariffed down a toilet, so pretty much nobody has the means nor motive to take advantage of the free money on the table.

We’ll have to take a closer look at how these rates compare with other lending markets once demand to borrow returns. If we ever are so fortunate as to witness a fabled bull market again, we may have the pleasure of observing a situation in which Curve’s lending markets have an unfair advantage: the entire Resupply ecosystem supplying immense pressure to push borrow rates below market average. Time will tell…

The big question we get in the moment is how to best play Resupply if you happen to have stablecoins for farming. Some may sit on the sidelines, expecting this is merely an artificially induced frenzy and elevated APYs will fall back to earth. Of course, this is always a possibility with new protocols.

Then again, if you’re a student of DeFi Dojo, you might recognize that 30% APYs are actually the norm if you are yield farming on advanced mode. To some extent, Resupply is effectively making advanced DeFi farming simpler and more accessible to the masses…

Our thoughts on how to play Resupply…. it’s all but likely that crypto influencers will soon be rushing to thread about how to farm Resupply… so we’ll discuss our thoughts and experiences politely below the fold.