Has $OHM flown too close to the sun?

The ascent of $OHM was truly stunning, capturing attention outside the crypto bubble in legacy print media. Throughout the rise, the coin was hounded by accusations its popular (3,3) mechanics were a thinly veiled Ponzi scheme, which investors noted and ignored. From October:

The dark irony of the (3, 3) reference, is that in most iterations of the Prisoner’s Dilemma, the prisoners don’t fare so well in the end. Depending on the configuration of the incentives, it’s generally presented as a cautionary tale that despite collusion being the theoretically maximal strategy for all, it inevitably descends into betrayal and ruin.

Yesterday, a single whale dump led to a major cascade.

As several bystanders tried to call out the mania amidst the rise, they found some members in the $OHM community to be anything but magnanimous. It’s only natural they now revel in Olympus DAO’s misfortunes. Moreover, for people who felt strongly $OHM was a Ponzi Scheme, the impulse to warn small investors is in fact meritable, given the need for us to self-police our ecosystem.

We will shortly wallow in the most vicious memes, but first we have to asterisk them with heaps of saccharine edification. Everybody be mindful that a lot of people are surely hurting a lot.

Among the blast radius is not just herd speculators, but a lot of extremely talented builders, the lifeblood of our burgeoning industry. If we want to keep our space free from the toxic cycle of government bailouts, we all have to keep our emotions in check as we ride the roller coaster, and support well-meaning builders throughout.

That aside, we’re not robots. We’re in this mostly for the kek. Some of the memes were top shelf, as even the $OHM team could acknowledge.

Moar…

Despite the troubles, we remain bullish on $OHM. The multi-digit APY was mostly a glossy gimmick to paper over a run-of-the-mill heavy token emission to early birds, similar to Ellipsis’s launch. Naturally this is going to attract the get-rich-quick speculative crowd, and we hope they’ve moved on.

We don’t particularly care so much how $OHM got to this point, as we care about where they are going from here. Amidst the rise and fall, Olympus DAO took advantage of its bull run to stuff its war chest. No matter what the price may do, the treasury is likely not going anywhere.

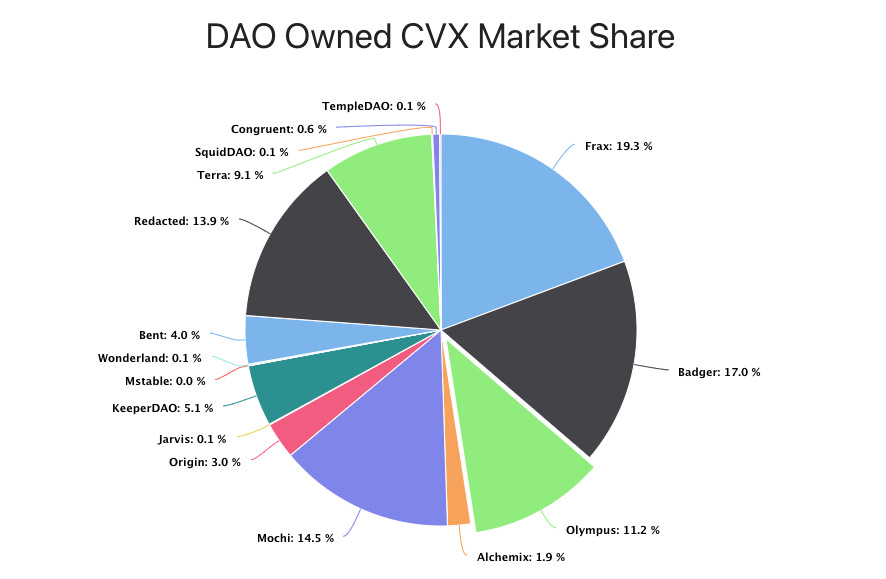

Among other assets, OHM owns nearly 10% of CVX. That generous slice of the pie could feed them the rest of their lives if they chose to do nothing else.

When it launched, each $OHM was backed by a worthless US Dollar, so you could see where a price north of $1K was a bit of a lofty multiplier. According to Olympus’s Dashboard one $OHM is presently backed by $66, which would be a multiplier of about 2x if true.

Given $CRV has also historically traded near its floor, I’ve always found it preferable to simply disregard price in favor of a focus on the technology. It’s difficult to do in $OHM’s case, as its mechanics led to extreme swings. Yet they have inspired many a builder.

Wherever Olympus is going next, the core team has a great pool of resources to build the next set of products. The technology they’ve built has inspired many builders to fork $OHM. Inspiring other developers and builders has historically been a great position in any technological endeavor.

Let’s take this opportunity to help our fellow $OHM-ies while they’re down.

Disclaimers about how this is never financial advice and the like. Author owns a small bag of $OHM.