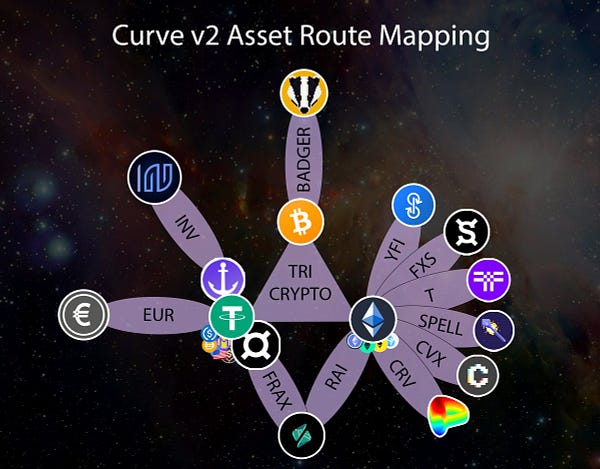

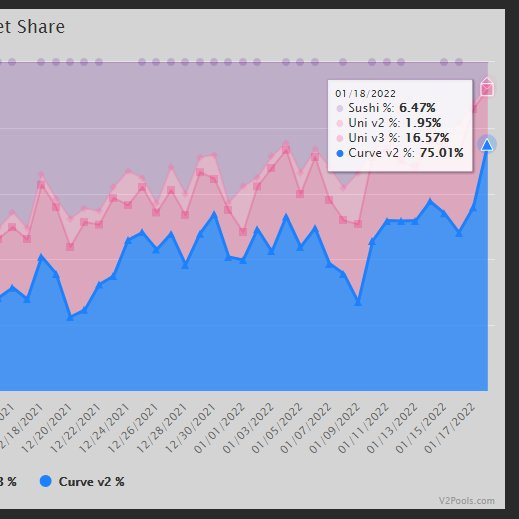

It’s starting to get a little crowded as we update our asset route mapping to reflect the newest factory pools. In less than 24 hours of the v2 Factory being pushed live, suddenly the number of crypto pools has nearly doubled. We doubt this chart will be possible to maintain in two dimensions much longer.

At least two of these are already up for gauge votes, so they could be shortly in line for rewards. Given the exquisite bribe game several of these protocols are playing, these gauge votes could be worth watching. Subscribe to cryptorisks.substack.com if you haven’t already to see if they weigh in on these new additions.

Here are all the new pools at time of publication.

FRAX

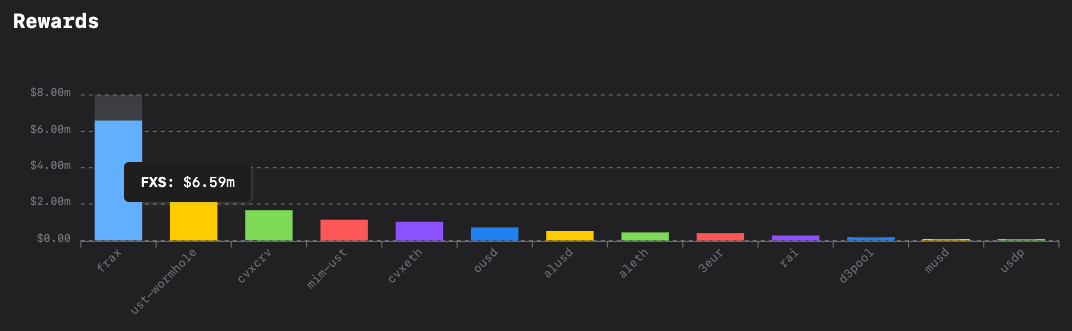

First out of the gate was the $FXS pool, followed soon by a $FRAX/$RAI bridge. The ceremonial status of $FRAX feels fitting, given the most recent Votium rounds where $FRAX bribe action has dominated.

$FRAX launched as the “world’s first algorithmic stablecoin.” While several other attempts at algorithmic stablecoins mostly failed, the $FRAX peg has proven resilient against severe market swings. As governments step up persecution of cryptocurrencies, the ascendance of decentralized dollarcoins is taking on increased importance. The extensive network of FRAX partnerships positions their empire at the head of the pack.

Part of the issuance algorithm is that one can mint $FRAX not only using dollarcoins, but also with a floating percentage of the $FXS governance token at rates set automatically based on supply and demand. The $FXS token represents the best way for users who are bullish on the $FRAX ecosystem to participate more heavily.

Notably, they were also early to adopt a veFXS system like Curve, and became the second token inducted into the Convex bribewheel.

To learn more about the $FRAX ecosystem:

…or for users with a few $FRAX to their name, you can try this…

Badger

Where $FXS was first as part of the Curve core team testing the UI, $BADGER had the courage to launch their own V2 pool on their own almost immediately after the factory opened.

While most of the v2 pools to date have been based on $ETH, Badger naturally launched the first $WBTC pair. Badger’s mission, of course, has been bringing DeFi to Bitcoin. Arguably, the only way to successfully DeFi Bitcoin is to first wrap it into Ethereum, where it will almost inevitably run into the massive Badger ecosystem.

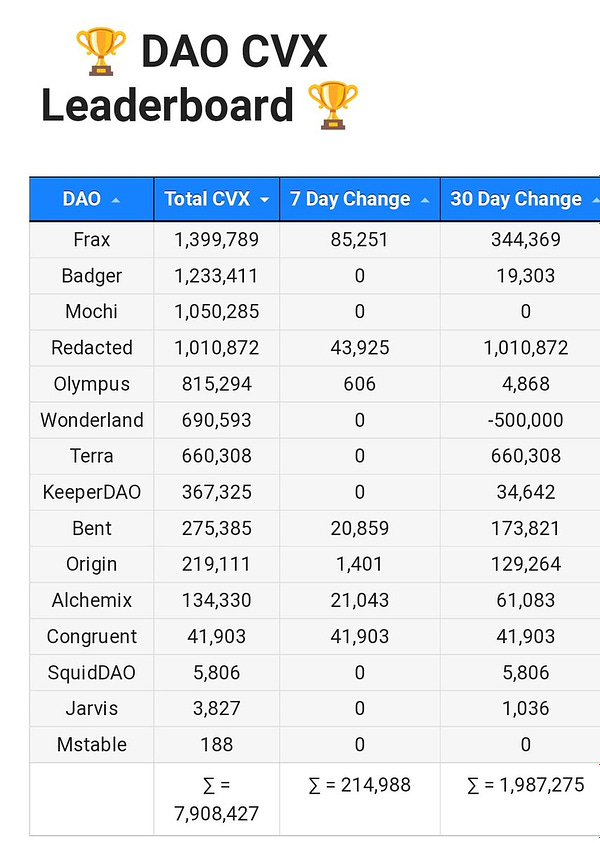

The protocol has faced plenty of challenges in its mission, most recently rallying to recover from a pernicious UI hack. Badgers have persevered throughout, and the protocol claims nearly $1B in value locked from 30,000 orange pilled users. With this massive war chest, they’ve been able to throw their weight around recently in the Curve Wars.

Inverse Finance

Inverse Finance has been riding high after its recent Coinbase listing.

Inverse’s community has always been highly engaged, due in part to the early decision to mandate participation or see your precious $INV seized. As a result, they’ve built out their ecosystem shaped strongly by community wishes. This has uniquely shaped Inverse Finance’s development in several regards, such as its strong composability with the $FLOKI community.

Inverse made great use of the first Curve Factory to backstop its $DOLA dollarcoin, with $13MM worth of liquidity and up to 8% rewards emissions. With the coin’s anchor successfully holding thus far, $DOLA is set to form the basis of the first v2 factory dollar pool. Through the factory, $DOLA trades with the protocol’s $INV governance token, which is currently available around the $600 range.

Reflexer Finance

Reflexer Finance had a busy 2021, and in their recent entry into the Votium bribe-o-rama they’ve earned highest $/vlCVX in both of the last two rounds.

RAI is an ETH-backed stablecoin with a managed float regime, in which the algorithm attempts to match its market price to a floating redemption price. Generally this has held in the ballpark of $3 for the entirety of the coin’s existence.

While RAI worked to make use of the v1 Factory, the floating price makes RAI a more natural fit for the v2 Factory. RAI has already shipped two v2 pools to easily bridge RAI to both the dollar and ETH worlds.

Eager users may want to keep an eye on the gamma rate. The various parameters of v2 pools are complex and understood mostly by @newmichwill, so it may require some fine tuning before the RAI-ETH pool is humming.

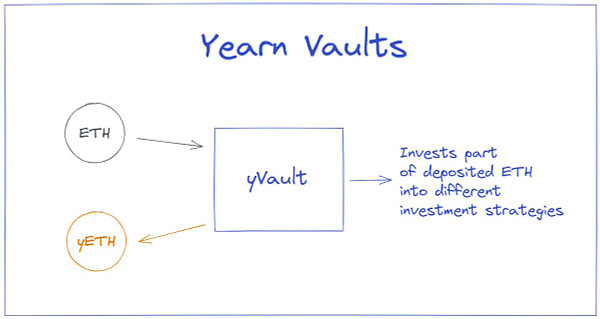

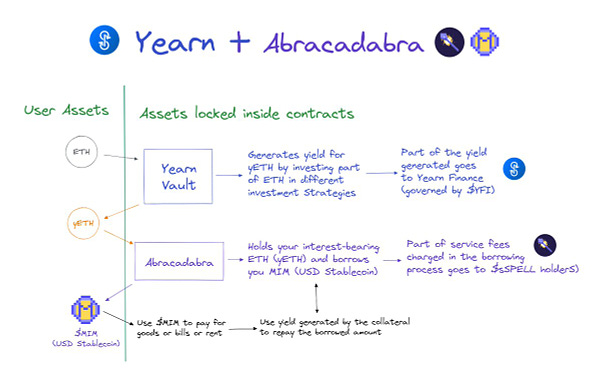

Yearn Finance

Latest to the party but certainly not least, DeFi stalwarts are sure to know about the radical experiment in decentralization that is Yearn Finance. Yearn has worked in some capacity with nearly every protocol around DeFi, including several Curve pools featuring Yearn wrapped assets. Yearn is most familiar for their composable vault strategies.

Even if you’ve never used a Yearn vault, you’ve quite possibly been the beneficiary of their pulchritudinous marketing campaigns.

One place we haven’t seen Yearn turn up yet is the Votium bribe game. In 10 rounds of bribing, Yearn has had no presence. On the other hand, Yearn recently made moves towards a veYFI tokenomics, so we’re very likely to see them continue to exist around the flywheel ecosystem.

We’re less than 24 hours in, still no approved gauges and several prominent bribers with no v2 pools shipped yet. We hope you’re enjoying watching Curve v2 expand in realtime.

Disclaimers! Author has a position in Badger’s ibBTC pool, but no other protocols mentioned.