January 10, 2023: Double-Bladed Frax 🪓⚔️

Frax's multifront gambit to win the Curve and LSD wars

Wait… you’re telling us numbers can go up?

It’s nice to see Convex birb numbers going up, in conjunction with broader markets also giving us our first glimpse of green in what feels like a year.

Yet the most intriguing story underpinning these numbers is not the dead cat bounce, but rather its composition.

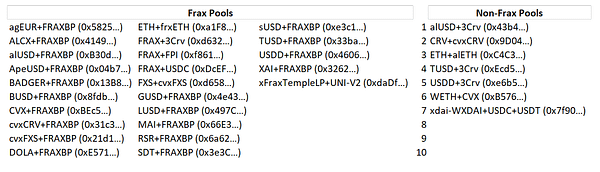

Look at who’s bribing.

It’s Frax all the way down.

We’ve often warned you Frax was spending the bear market building like crazy. Frax is grabbing serious market share to capitalize on the next bull market, whether it begins today or a decade from now.

Let’s look at how Frax is fighting… and winning… wars on multiple fronts.

Post is paywalled for 48 hours

The aforementioned pool bribes are costing Frax around a million dollars worth of flywheel tokens every few rounds. Fortunately for Frax, they own these tokens in abundance thanks to their early engagement in the Curve ecosystem.

Best of all, birbs are incredibly cost-effective at the moment.

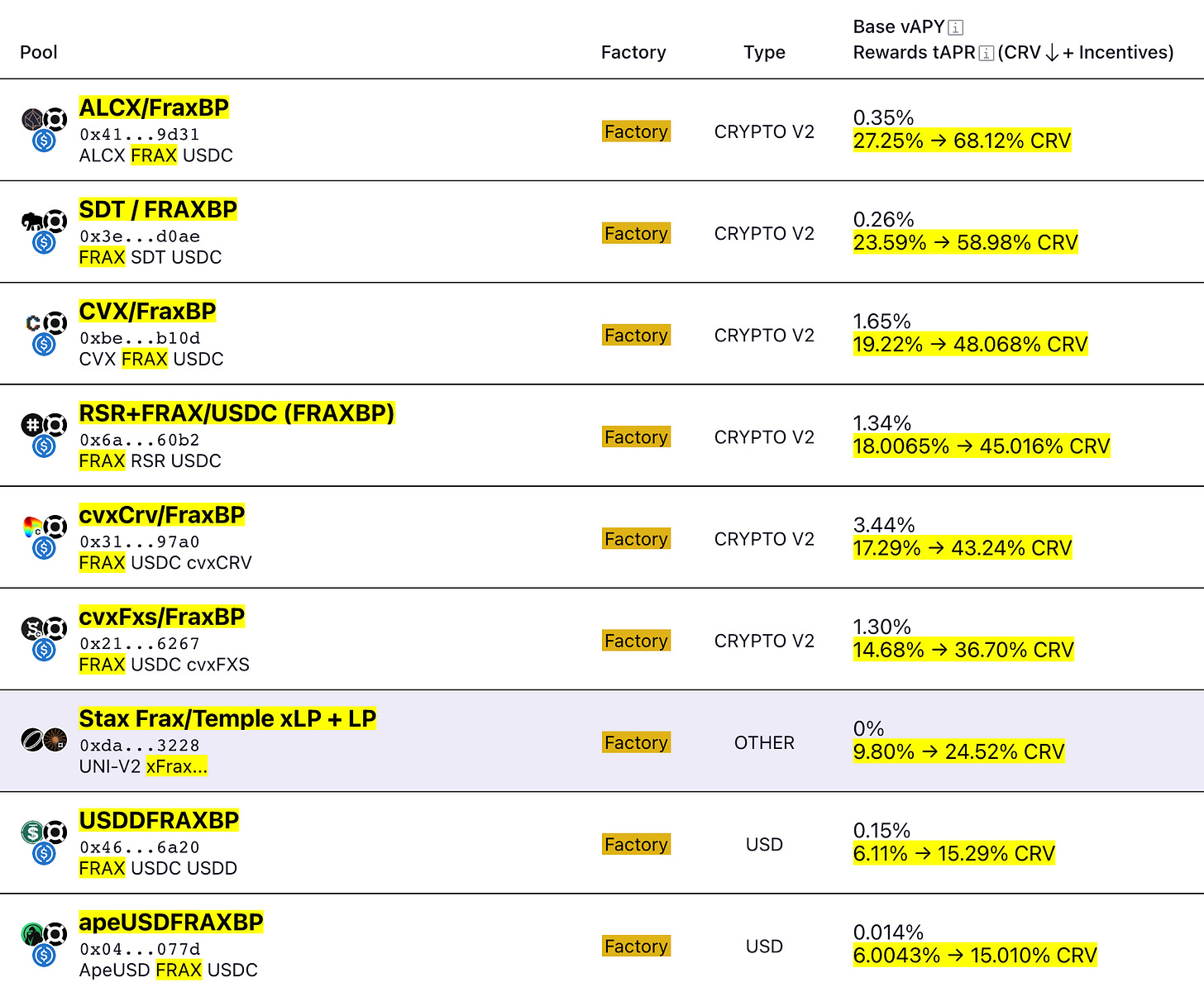

With so many other DeFi projects still on life support, it’s sort of a vacuum for Frax to spend big and spur adoption of FraxBP. Frax has taken advantage of this efficiency to guarantee high yield for Frax pools.

Money flows to yield, so Frax is ensuring liquidity will flow in Frax’s direction.

Frax’s playbook is hardly a secret. It’s also been incredibly effective at securing utter dominance in the Curve Wars.

Now, this same strategy is turning heads for followers of the newly trendy LSD narrative.

Frax is utilizing this same gambit towards staked ETH, and unsuprisingly it’s working well. Here is the week’s birbs on ETH/frxETH.

The $130K number is precisely calculated to position Frax just ahead of the pack, ensuring continued upward pressure on $frxETH adoption.

An efficient Curve game is just one piece of Frax’s dominant strategy. Frax is the first player to tokenize ETH yields into a two token model, with the ability to move seamlessly between the two.

Frax designed their system to provide extremely competitive yield.

Tokenized yield also allows degens to stretch the yield through more complex trading strategies, all under the umbrella of brilliant services Frax has architected.

Naturally, $frxETH has been shooting up the leaderboards. Of course, Frax has some distance to go before it catches the players who have been around the longest. Yet we’re quite likely to see $frxETH hit third place in short order.

So you think you’re finally caught up on Frax’s game plan?

Guess again.

The team is shipping faster than thread0000rs can keep pace.

Given the breakneck pace of innovation, we would be utterly unsurprised to see $FXS hit top 10 token status in the future. Of course, crypto markets are deeply irrational, so we’d also be unsurprised to see $FXS stay absurdly underpriced for years.

Price and trading aren’t too interesting to us. As an investment thesis, though, you could do a lot worse than simply betting on extremely innovative teams with a track record of winning.

Back in their days, Google and Microsoft were once innovative, and they grew to dominance. We’d apply the same heuristic to $FXS (NFA).

To learn more about Frax, check this recent space.

Also, make sure to subscribe to everything by Flywheel Pod. Not only are they the best way to stay plugged into the Frax ecosystem, they also have a great streak of only hosting exceedingly handsome guests in 2023.

handsome! 😂 humble? 🤷♂️ useful 💪🙏