Today’s governance proposals are tomorrow’s yields. Plan wisely, anons.

Here are the current gauges up for a vote…

CLever

We warned you the CLever team are clever. As an organization, Aladdin DAO launched into the most brutal of crypto winters and managed to thrive. In the next bull, they’ll be nigh unstoppable.

The team is currently pursuing three gauge votes for their three Curve pools. These pools have magically accumulated over a million in TVL, despite death spiral00000rs repeated assurances that Curve cannot function without $CRV emissions.

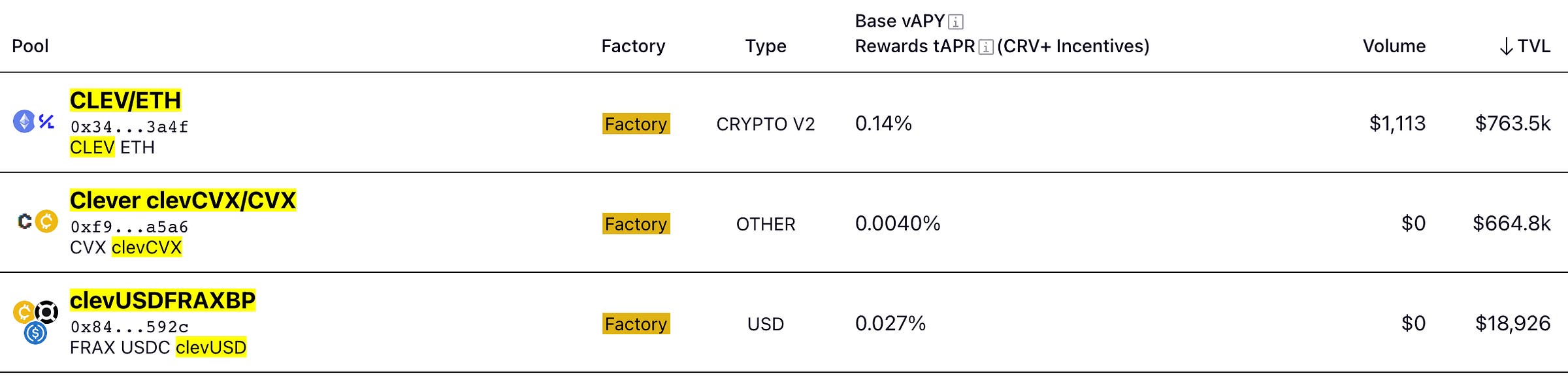

$CLEV

The team’s governance token, $CLEV, is forked from $CRV with a far lower supply (about 1MM now, max of 2MM). The token carries exposure to flywheel assets through the protocol’s operation. The CLEV/ETH pool up for a gauge vote is the main source of liquidity for the token at present… worth keeping an eye on!

$clevCVX

The CLever launch offering, allowing users to claim Convex yields upfront, has been live for about a year and quite successful. The team has accumulated a significant stash of $CVX, enough to make them a formidable belligerent in the Convex Wars.

One of the major consequences of the popularity of CLever has been the imbalance of the clevCVX/CVX pool — about 90% imbalanced.

CLever operates a furnace to allow $clevCVX to be converted back to $CVX, but the furnace refills slowly. The Curve pool serves as the backup. However, due to the imbalance, $clevCVX sits below peg.

The imbalance has been the subject of a recent Crypto Risk team report, recommended reading to understand the entire ecosystem:

The incentives would aim to attract liquidity, to keep the pool as a healthy alternative to the furnace.

$clevUSD

The much anticipated $clevUSD is the next major launch from the CLever team. Just as $cvxCRV allows users to borrow future Convex yields immediately, $clevUSD allows users to borrow up to 30% of your future yields from any Frax pool.

We covered $clevUSD in greater detail last month:

In addition to the Crypto Risks report, check the Forum post for more discussion and vote your conscience!

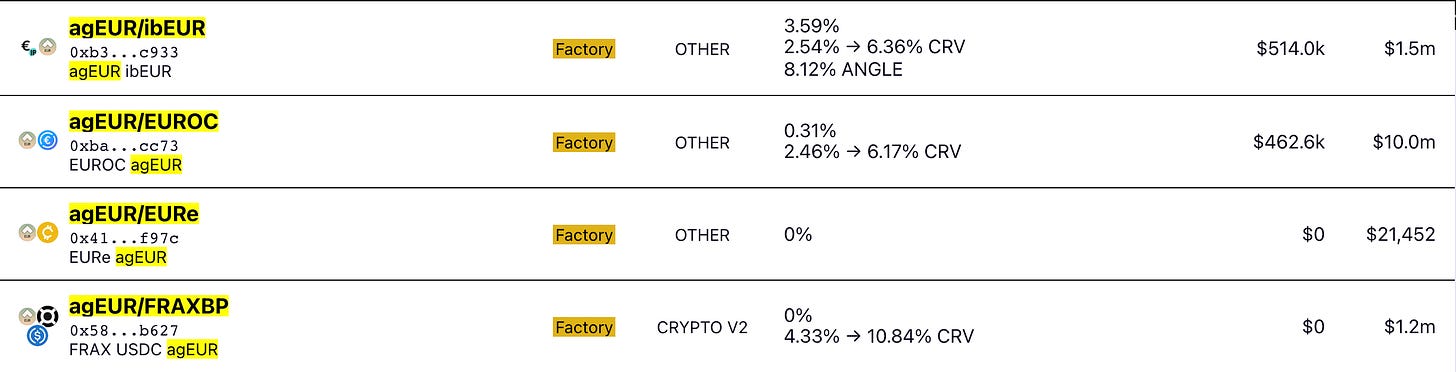

Angle Protocol

Another vote is up for a new Angle Euro pool. A few others Angle pools already exist, which have attracted 7-8 figures of liquidity and been decently successful for our Eurofrens.

The new pool pairs agEUR with EURe, a stablecoin issued by Monerium. Monerium has a mission of getting a trillion Euros onto the blockchain (are there even so many? Better get printing!)

We don’t know a lot about it, but it got some buzz around its gnosis pool launch from the great What’up on Curve newsletter.

The Angle half of the pool recently received a good Crypto Risk Assessment:

PitchFXS

You’ve likely come across Pitch pretty frequently if you’re active in the Vote Market. Pitch is quite active in the governance space, particularly in Frax

We generally recommend against voting for proposals that haven’t kissed the ring of the Crypto Risks team, but given the proposal has already got heavy support from Convex voting our “tsk-tsk”-ing may be moot.

TRYB

The TRYB pool is interesting, as a means of allowing the many crypto-natives in Turkey to trade Turkish Liras to dollars.

The potential opportunity sounds huge, so it will be nice if the volume gets captured on Curve v2 as opposed to other sources. Inflation in Turkey is so bad it managed to pop onto our radar even though we don’t even read the news.

That said, our default editorial stance is to not vote for gauges until the Crypto Risks Team has weighed in, so we’d feel more comfortable if the team applied after seeking the team’s blessing.