January 22, 2021: Curve's Alpha Flex💲2️⃣💪

Keep Ahead of the Curve

Here are today’s trends to watch from Curve Market Cap:

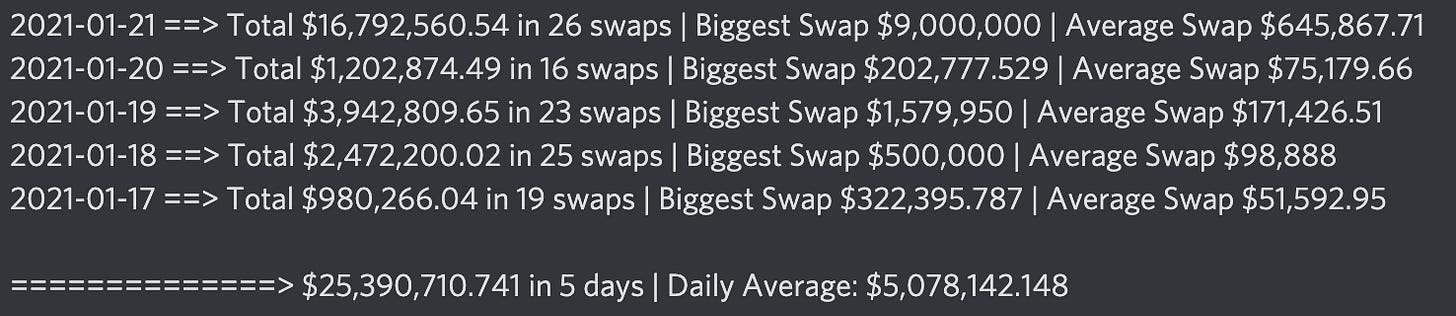

Curve’s low slippage cross asset transactions launched almost a week ago, and it’s a safe to say that it’s a hit.

A daily average of nearly $5MM per day already being transacted, including a handful of big ticket trades. One analyst was initially stunned by the size of trades occurring using the feature...

…but quickly revised their expectations upwards…

As nice as the early adoption has been, it still represents a relatively small volume of Curve’s overall usage. With daily trading volume typically between $200MM to $500MM, the vast majority of Curve activity is still within like kind trades. However, as the number of trades and average trade size trend upwards, this could come to represent a larger chunk of the pie, especially as people realize it’s not terribly economical to perform these trades on smaller values:

Thanks to the success of this feature, the Curve community has opened a spirited yet non-binding discussion on what to do with the newfound bounty, rewarding either veCRV holders, LPs, both or neither. Based on the comments, users seem to favor veCRV or both, although logistically it may be difficult to reward LPs.

It’s perhaps no coincidence that the price of the $CRV token has flexed its alpha relative to the broader cryptocurrency market. Although Bitcoin and Ethereum have traded down to sideways over the past week, $CRV has nearly doubled in that time, touching above $2 for the first time.

Of course, it’s very difficult to speculate on what actually drives these prices, because markets are irrational and unpredictable.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice.