Congrats to Frax on renewing Flywheel DeFi for another year!

The Flywheel DeFi team indiputably delivers the highest quality research in this corner of crypto. We can’t figure out how the team generates such a high caliber throughput, at a cost significantly below market rates, but this proposal is an utter bargain for the Frax community.

We’re excited to see the team will be sticking around to cover the impending launch of Fraxtal…

Curve Degen Leverage Bot

We’re one week into the Bitcoin ETF hammering the entire crypto market into smithereens. Brace yourselves for the next blow of the hammer, with Ethereum ETFs coming soon…

Since volatility and chaos back on the menu, it’s a good time to finally review the Curve Degen Leverage Bot built on Paloma chain.

Of course, we’ll caution with all the usual disclaimers up top… we’re not traders ourselves so we haven’t used this, leverage is dangerous and can make you much poorer, talk to your financial advisor, briptos are risky and likely to rekt your finances and emotional health.

But since you won’t listen anyway, why not launch your own bot?

For some background, curvebot.fi has been building templates to launch bots based on a variety of Curve-related trades. The bots come in a variety of flavors, such as lending, momentum, stop-loss, limit orders… pretty much anything a trader might demand from a CEX, but all onchain.

By volume and bot count, the most popular of these had historically been the Curve TWAP (Time-Weighted Average Price) bot. This bot breaks up trades into periodic and fixed amounts. This is useful for lowering slippage on larger trades, so little surprise it’s already driven millions worth of volume.

But not all of us are whales [yet]. The new Curve Degen Leverage Bot with TWAP bakes in leverage to allow smaller deposits to get more potential upside.

The interface will be familiar to anybody who has seen the $crvUSD interface. All the usual parameters, like the collateral markets (ie WBTC, wstETH, et al), N number of bands, and leverage.

Atop this they layer some helpful features that don’t otherwise exist in the Curve UI. For instance, deposits can be make to the bot using nearly any token

More importantly, the already friendly soft liquidation protection of $crvUSD gets even friendlier thanks to automatic repayments. That is, if your health falls below a threshold you set, the bot will automatically repay whatever percentage of the loan you specify.

We’ve seen the rare $crvUSD hard liquidation hit occasionally when users fall into soft liquidation. A small repayment, sometimes just $1, can be enough to avoid liquidation. But this still requires a modicum of user attention, so why not let bots manage this on your behalf instead?

Another feature curvebot.fi layers atop the standard $crvUSD interface is to set a custom duration, so you can shut off the bot after a preset number of hours or days.

With the bot executing transactions on your behalf, you may rightly have questions about gas prices. Per their fine print:

The Paloma blockchain charges a fixed gas fee of approximately 35 - 40 gwei and a bot duration execution fee of 0.5% for compute duration run by each bot.

The 35-40 gwei is in line with the upper end of recent gas prices.

We know $crvUSD is gas intensive to operate loans. Having never used Curve bots, we don’t know how many trades the bots execute over the course of its operation, so it’s worth doing your own research on this topic (and really all other topics) before you ape, particularly for smaller positions that could get eaten up.

Also in the fine print it mentions that all funds are custodied on the Paloma blockchain validator set. Since Paloma hasn’t even hit the radar of the diligent DefiLlama, you may rightly be curious about Paloma.

Paloma

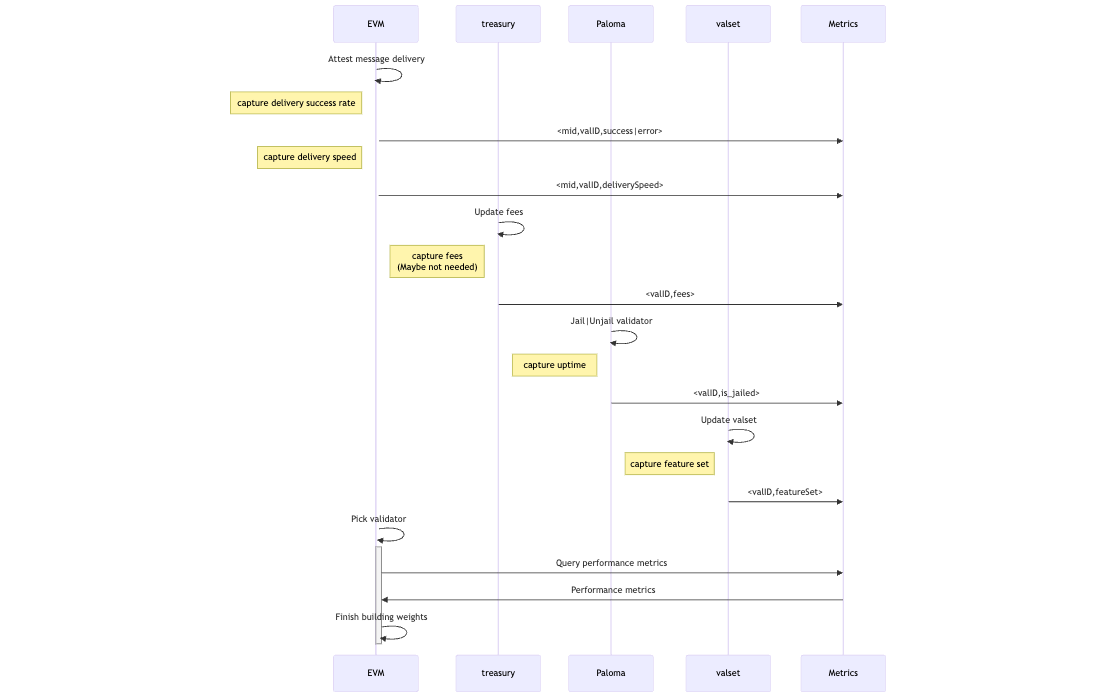

Paloma is a fast cross-chain messaging platform built on Cosmos. Paloma itself is secured by proof of stake validators, which monitor and execute state change instructions across various blockchains, including Ethereum, BSC Chain, Polygon, Ethereum L2s, and any Cosmos-SDK Chain.

Given the centrality of sending messages back and forth, the team chose the mighty pigeon as its mascot for its validators. The architecture looks like this:

The Paloma explorer site shows the validator set is decentralized to the tune of 28 validators.

These validators are rewarded by earning an untraded token called $GRAIN, for which it quotes an APR of nearly 90%. We continue finding ourselves astounded by just how deep the cryptocurrency rabbit hole goes…

The cross-chain messaging component makes it an ideal for building bots, which is how the website primarily markets the chain’s value add. Relative to most new chains which accumulate hefty TVL despite nearly zero value prop to differentiate themselves, we’re interested in a chain with such a specific use case.

More on Paloma can be found via their forum, where they post a daily update, or their active Github and developer documentation.

Disclaimers! Author has no affiliation with Paloma, $GRAIN, or Curve bots… the only affiliation we have is with fellow poors aspiring to become whales.