Wassup, “$ARB” traders!

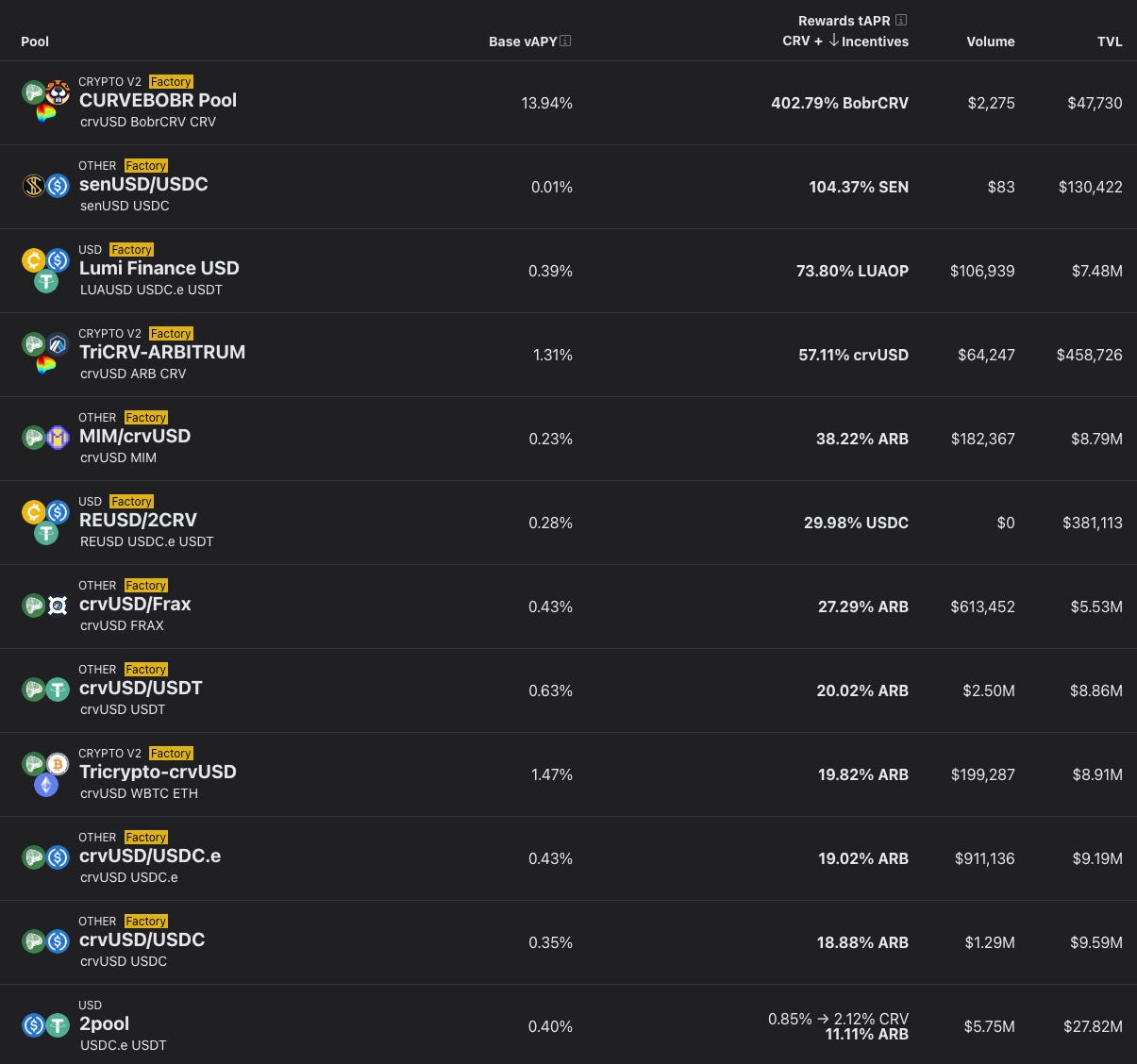

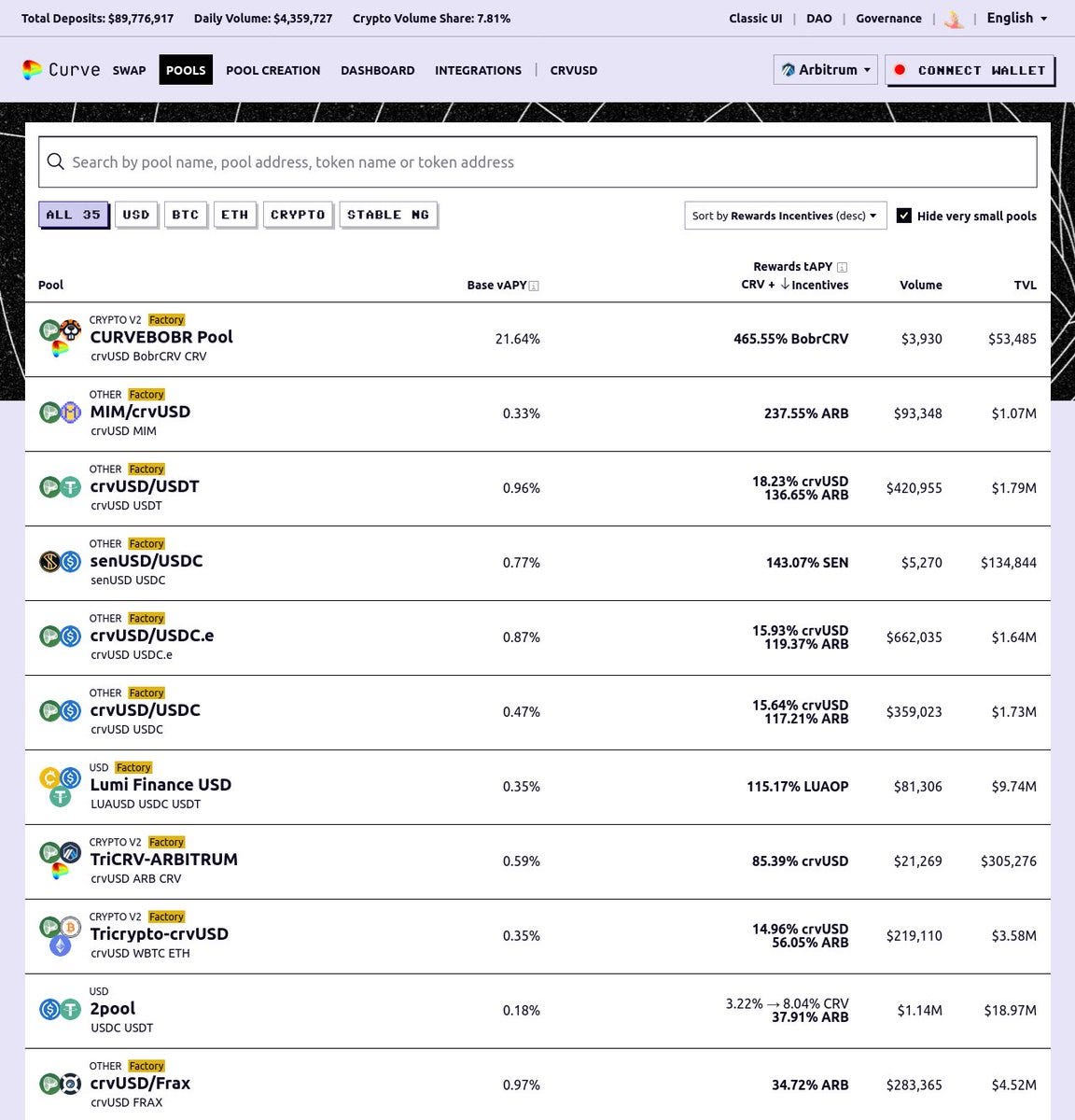

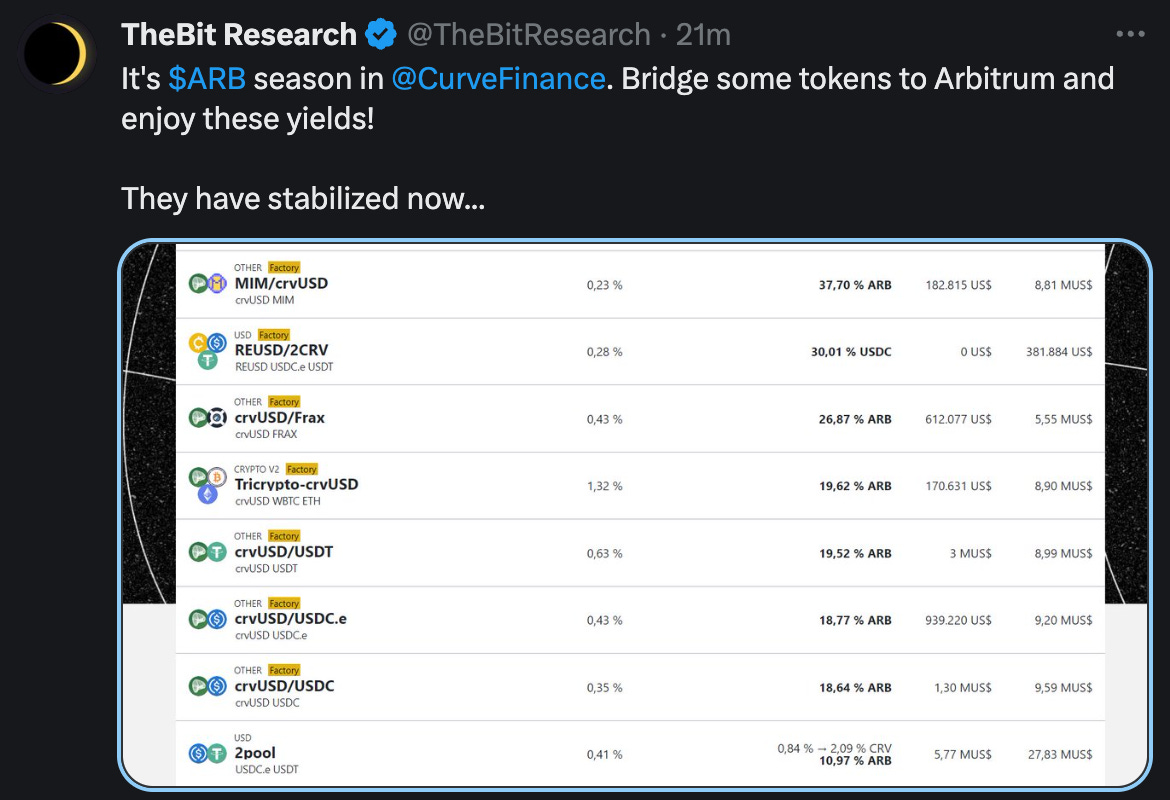

We won’t insult your intelligence and pretend that high rewards last forever. But, these are the “reduced” rewards after a bit of time to reach equilibrium.

The screenshots from when rewards got deposited 3 days ago were a bit higher, though not excessively so.

After three days of heavy publicity, is it fair to claim that rewards on Arbitrum have stabilized to market equilibrium?

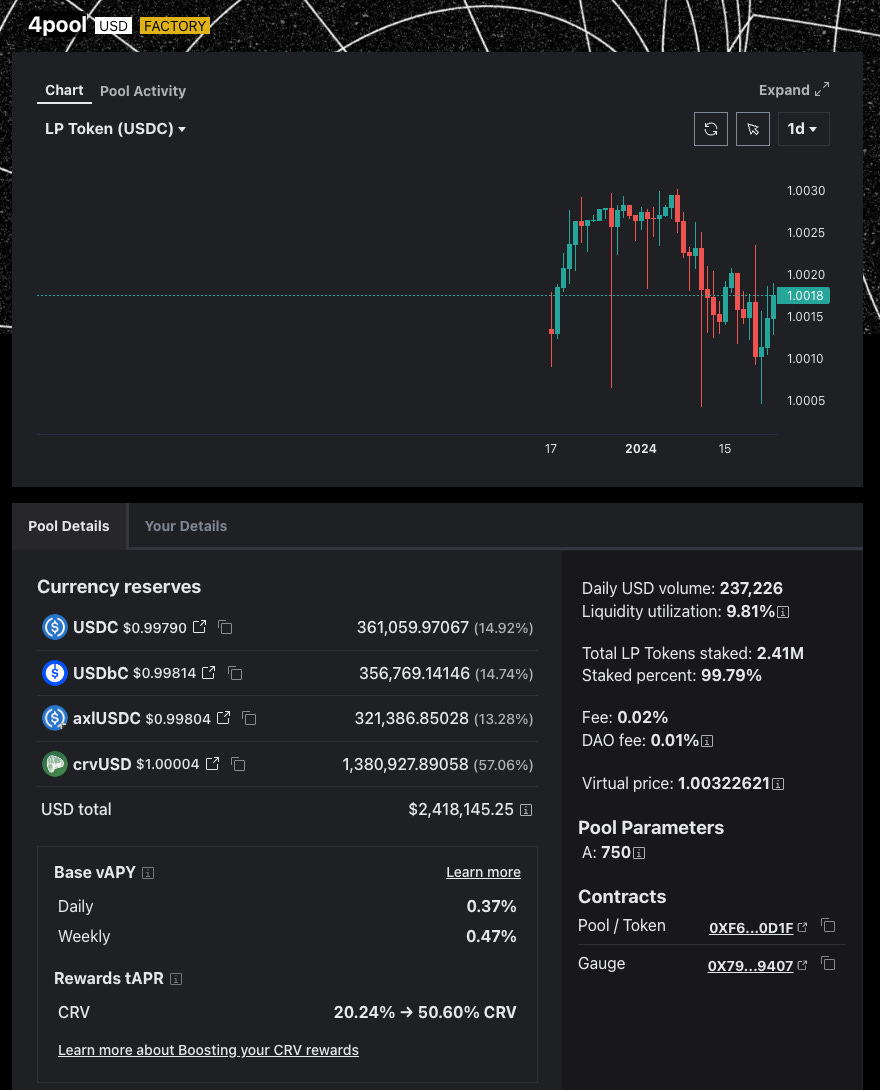

We can look at Base chain, where the Curve USDC/crvUSD 4pool is also yielding ~20%. So perhaps this is the going market rate to get users to bridge and take on rollup risk.

Perhaps the inflated Arbitrum yields are the market equilibrium? Only time will tell.

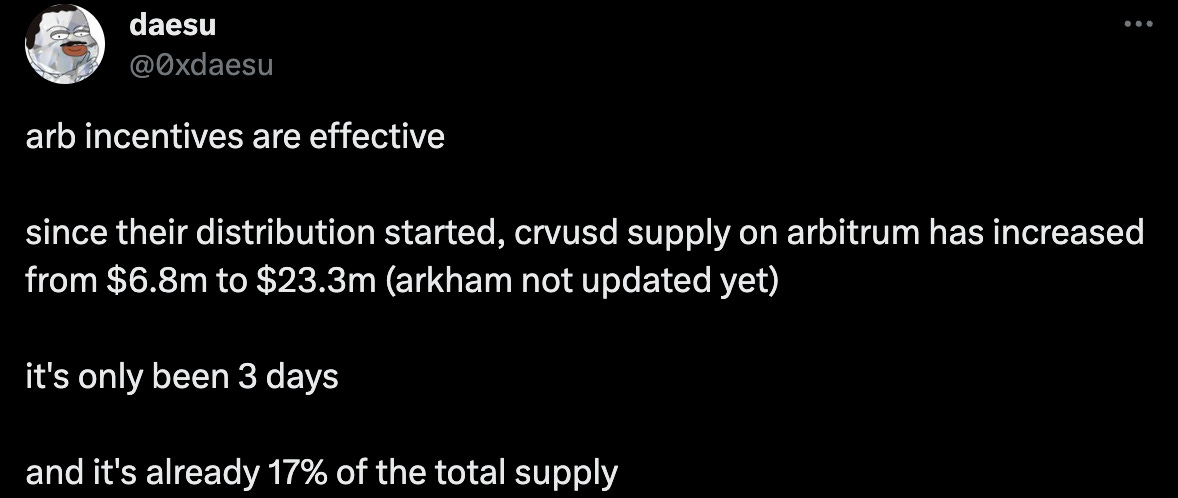

We can certainly agree with the take that incentives are “effective.”

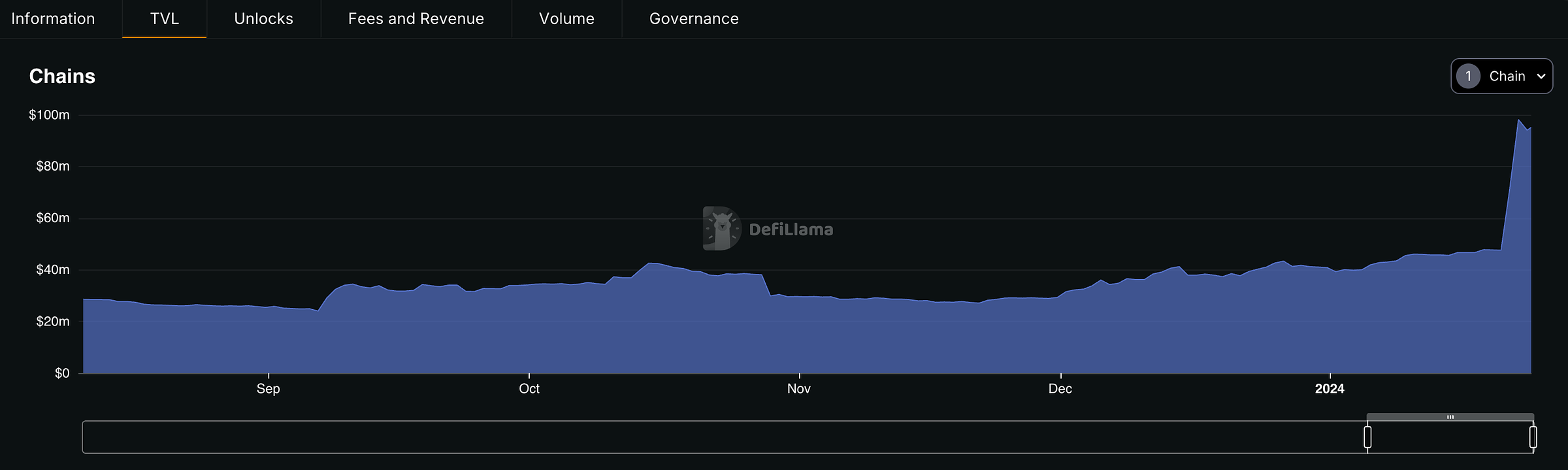

Observe the Curve TVL jump to chase these yields. From DefiLlama, Curve TVL on Arbitrum the past few days:

A butterfly flaps its wings, it rains in Brazil... Liquidity sloshing around has consequences.

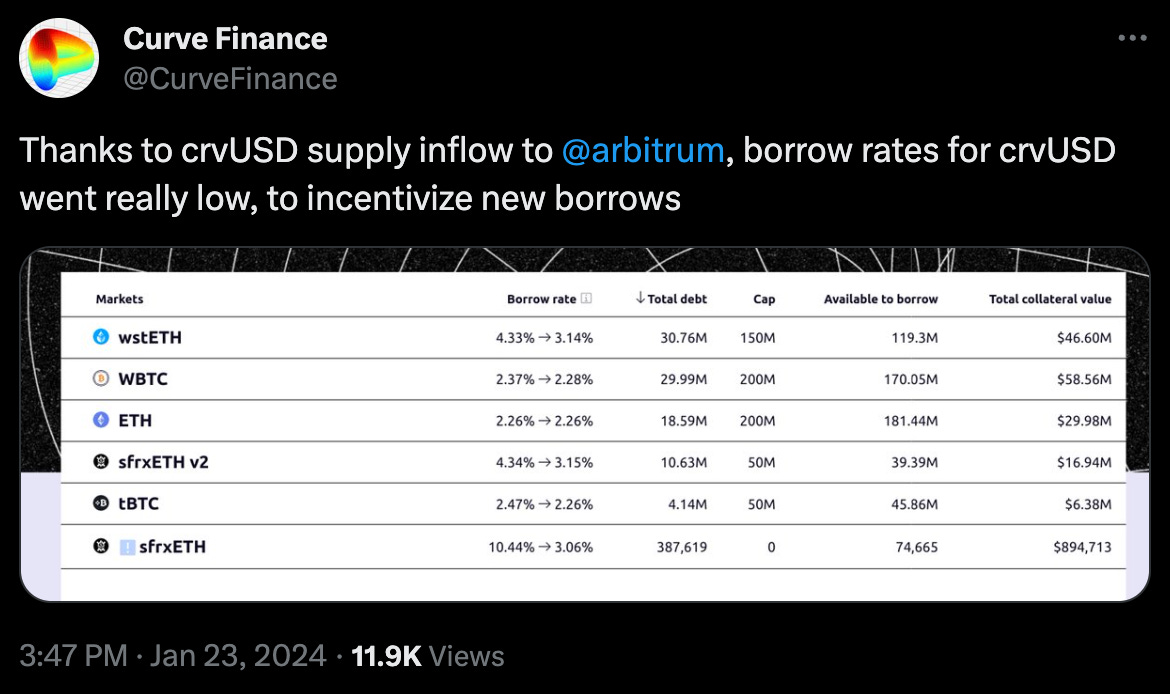

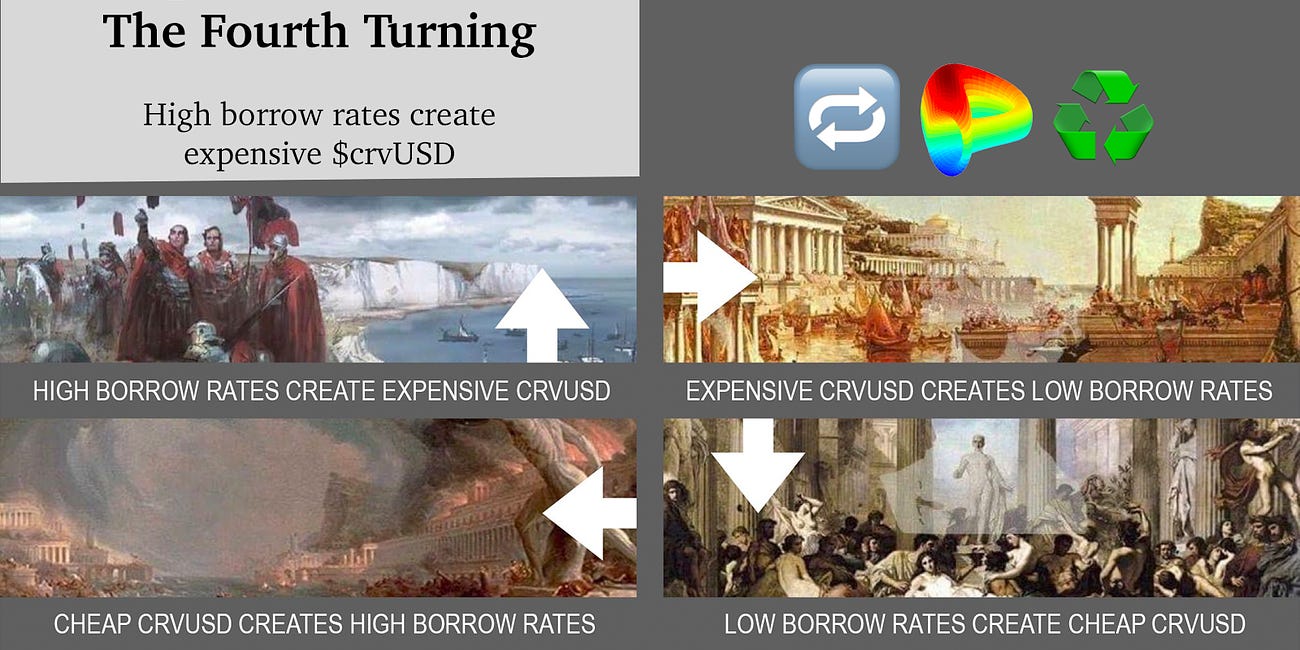

We’ve talked about the borrow rate cycle on $crvUSD a million times already so we won’t belabor it again.

Friday the 13th: The Fourth Turning 🔁♻️

Titanoboa Exciting news for devs… Titanoboa officially shipped, bringing it into compatibility with last week’s Vyper 3.10 release. Officially supported new features include deploying contracts directly using Titanoboa, Jupyter Notebook integration, and coverage.py support. Enjoy!

Incidentally, if you’re following $crvUSD peg so closely you want to trade it, now you can do so…

The cycle seems eternal, but in fact the wheel can be broken, if $crvUSD liquidity sinks exist. Whenever $crvUSD finds a home in large quantities, it effectively gets removed from the market. If you’ve bemoaned that $crvUSD can’t scale because of this cycle, the answer is more liquidity sinks. This is what brings $crvUSD to both good user experience AND a billion in TVL.

Suddenly, $crvUSD looking good again? Nah, we’re bracing for death spiral threads because fees are down.

We expect $ARB grants will be be sloshing around Arbitrum for quite a while as they compete furiously against competing L2s. We’re sure it would trigger death spiral threads it were $CRV rewards flooding the market, but for some reason we don’t expect any Arbitrum death spiral threads anytime soon.

All the same, we’re enjoying $ARB season. For instance, note how the $MIM is elevated in most of the screenshots.

Longtime readers may know we generally trust $MIM and have frequently parked ourselves in these pools whenever they briefly “depeg.”

It’s an interesting time… if you’re willing to expose yourself to $MIM, you can sit in $MIM on mainnet and max out at 14%. Or you can bridge to Arbitrum and get 38%. Should be free money, amirite? “Arb”itrage can’t last forever, amirite?

Yet $23.5MM worth of money is on sitting in Curve’s MIM pool on mainnet, $8.8MM on Arbitrum. Can’t explain that!

TRIGGER WARNING: MATH TO FOLLOW