Since Curve launched cross asset transactions a week ago, it’s been heavy action. But what kind of action exactly? We took a deeper look at the last 150 transactions from January 24th and before.

SELL ETH

The Curve community has a reputation as Eth-heads, yet they’re selling ETH like it’s going out of style. Granted, Ethereum recently hit all time highs amidst this period, perhaps some people may be dollar cost averaging.

These also constituted a lot of whale moves. Sells out of the ETH pool were larger than any other pool, an average value of $4.7 million per transaction, with 7 of the 46 transactions being for >$10MM.

By contrast, the second most sold pool was USD, with a large number of tiny USD->EUR trades. These were smaller in size, $30MM in volume on twice the transactions (90), for an average of $300K per trade. Don’t USD holders care about gas prices? We chalk it up to the fact that America’s public school system isn’t exactly teaching a lot of math nowadays.

BUY BTC

Where are they moving their money?

A lot of buying Bitcoin. $100MM bought over 10 big ticket transactions. It’s a little bit confusing, given how Ethereum enthusiasts like to scoff at Bitcoin for being relatively primitive technology. Yet their revealed preference is to stack sats.

Although many people are buying Bitcoin, it’s just the second most popular denomination for recent Curve activity.

BUY USD

What do Curve users think is more valuable than Bitcoin? Good ole’ Uncle Sam 🇺🇸

Despite America’s aforementioned educational issues, it’s still where everybody wants to put their money.

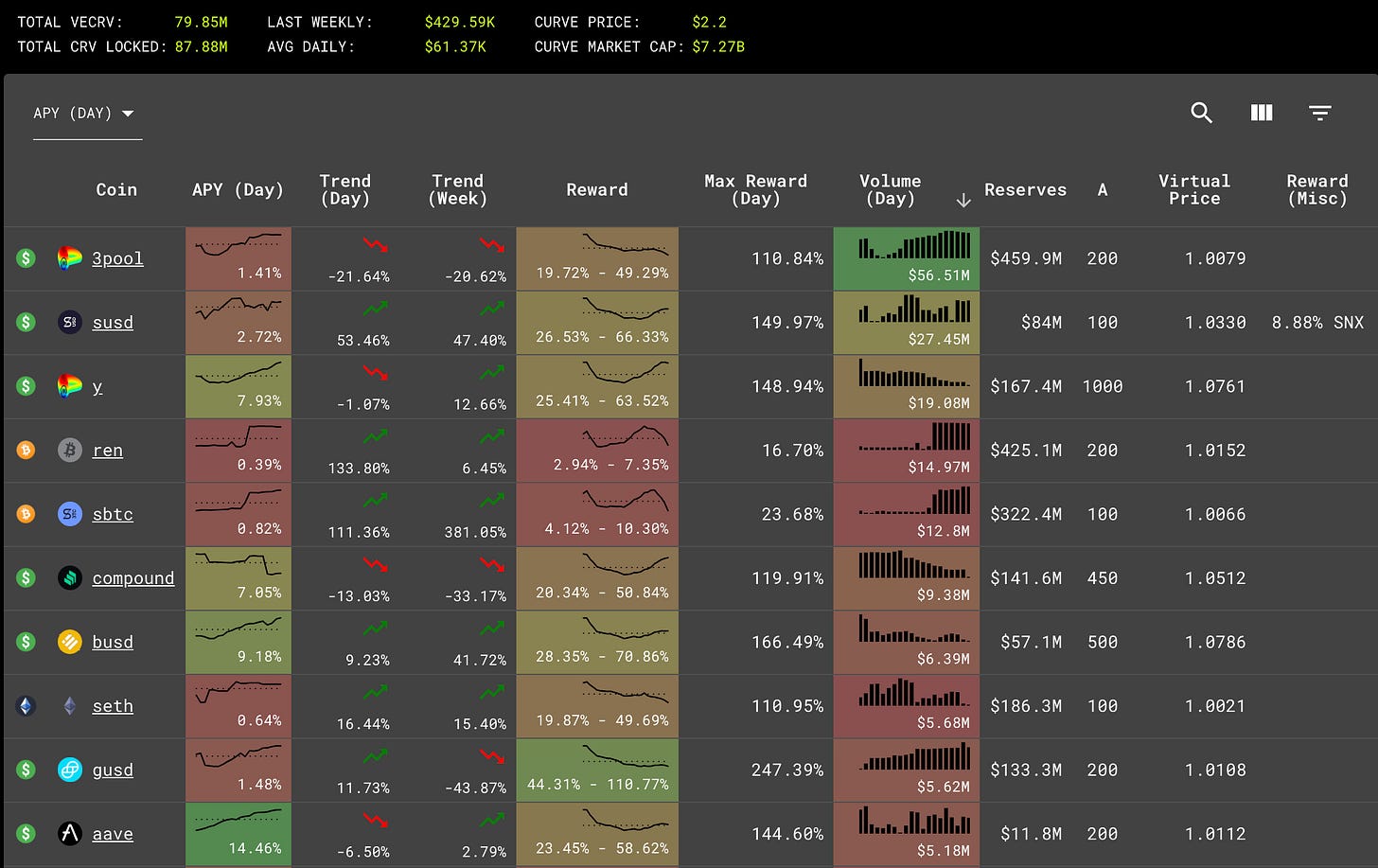

Like our analysis? We’re adding more data to https://curvemarketcap.com/ all the time. We’re also now Web3 enabled — link your Metamask and we’ll be granting you additional powers to follow the Curve action.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice.