Here are today’s trends to watch from Curve Market Cap:

As we’ve seen, the rapid expansion of Curve pools is heavily responsible for over $3B in value locked. So what might Curve add next?

Second AAVE Pool

According to the official Telegram channel, another Aave pool is in the works. The existing Aave pool has been a major success for Curve. It’s very popular, currently the fourth highest daily volume with just over $10MM. This also converts to a large amount of trading fees (10.78% return) and a potential max ROI of over 200% based on current $CRV prices.

Even better for Aave, there is some Twitter rumors about potential liquidity mining on the way.

Gold Pool

Since September’s governance post about a tokenized gold pool, the Curve community has been quite excited.

The community voted on which tokens to include, with UPXAU, PAXG, and CACHE GOLD the most popular.

Yet with so many great opportunities for new pools, gold pools have lost a little momentum compared with other immediate opportunities.

Still, with a large drumbeat of tokenized gold bugs in the community, this could potentially emerge any day.

Other Assets

Curve’s stablepool formula works well for any n number of coins that keep the same value. On the governance forums there have already been calls for:

These are all in various stages of development, and we surely missed many more. Also, with the productivity of the Curve devs, it’s entirely possible a pool on nobody’s radar could emerge almost overnight.

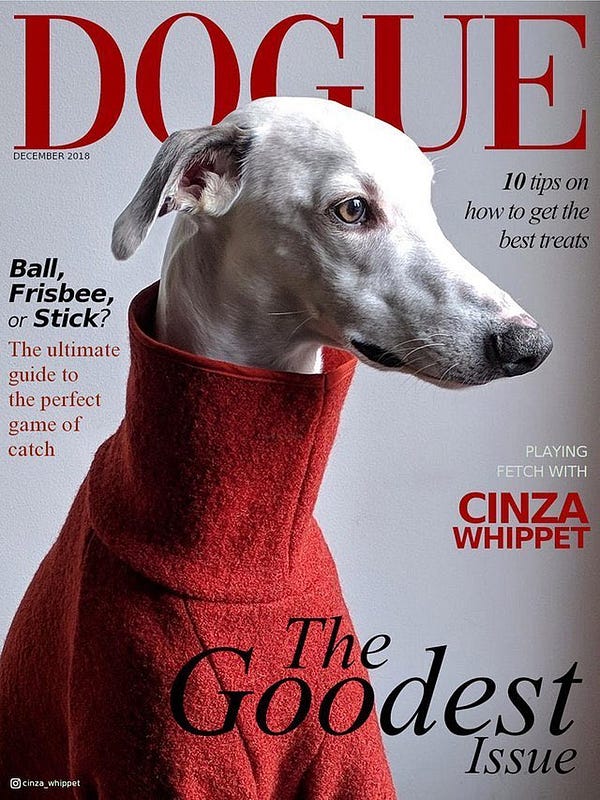

Given the news of the last few days, we’re just listening to the doge that’s not barking.

Bark at us in the comments and tell us what pools you’d most like to see!

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice.