Another day, another traumatizing event…

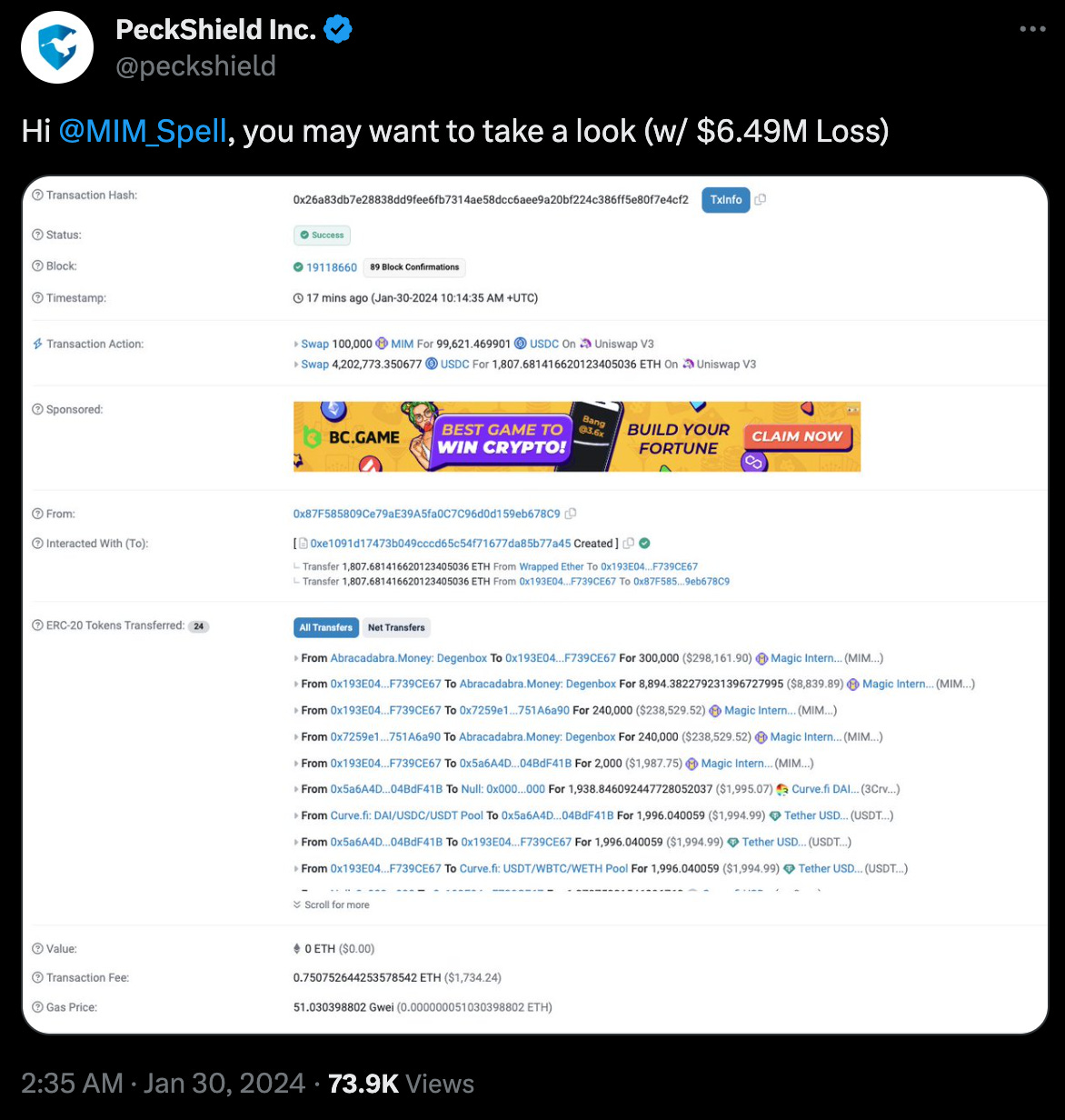

A few hours ago, PeckShield performed one of their “retroactive” audits on Abracadabra Finance, preserving their ability to see bugs in hindsight with 20/20 clarity.

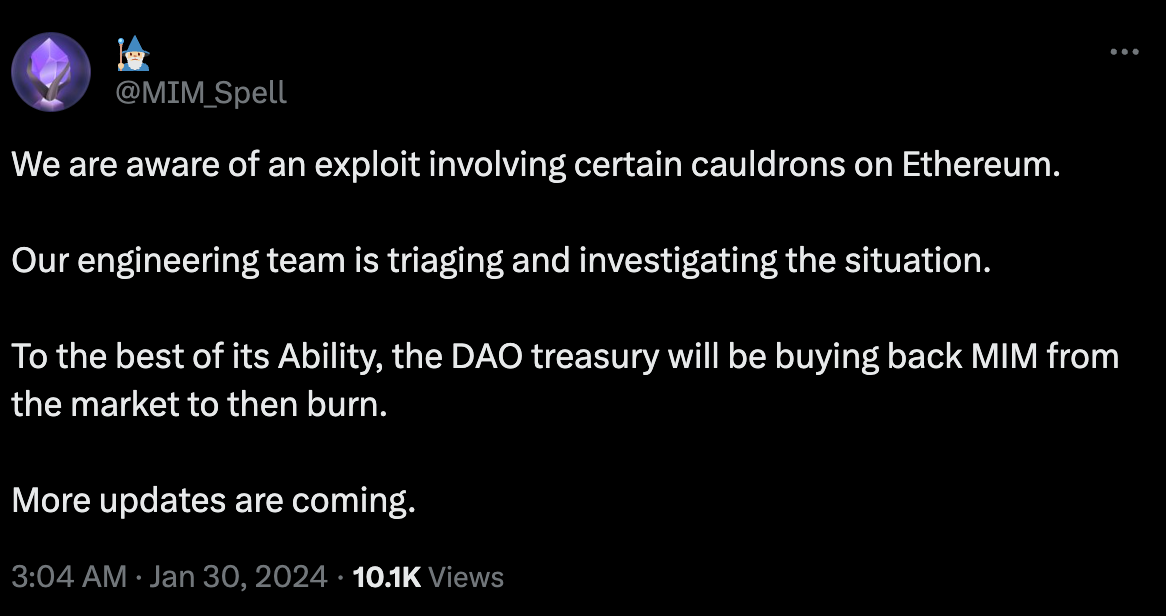

Abracadabra quickly investigated the situation, and announced a buyback/burn to support the stablecoin.

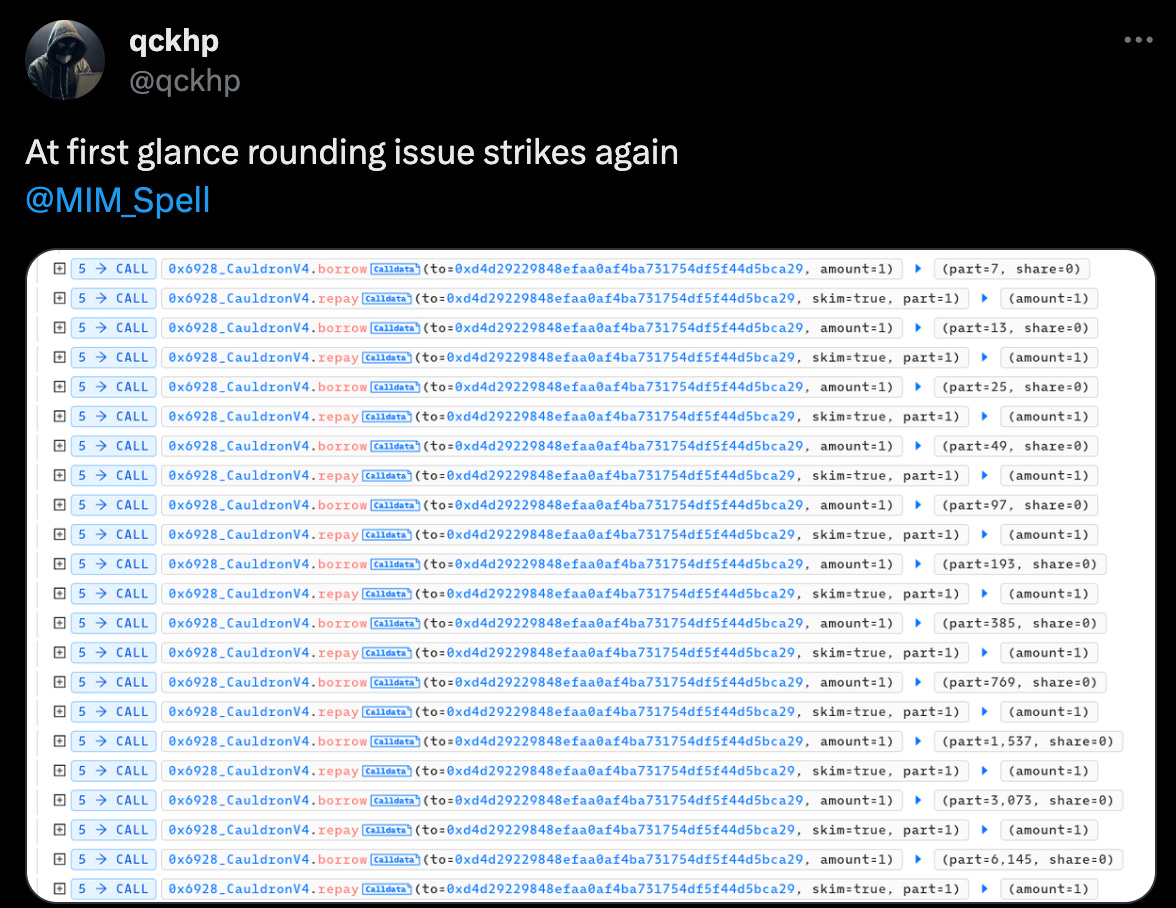

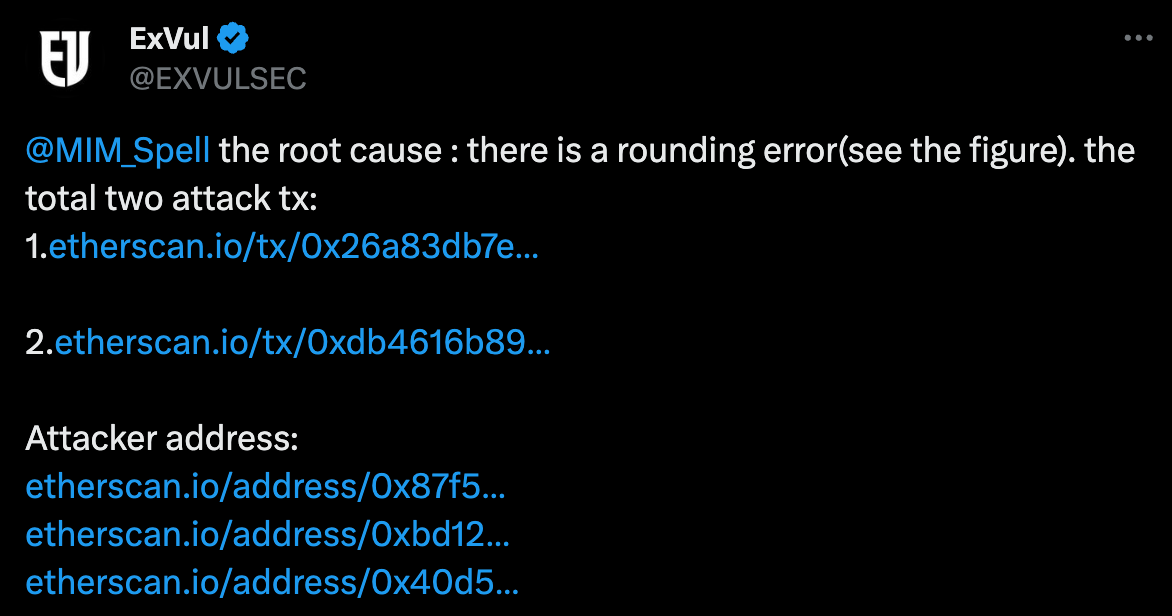

At issue is an apparent rounding bug, though a full report has yet to be made.

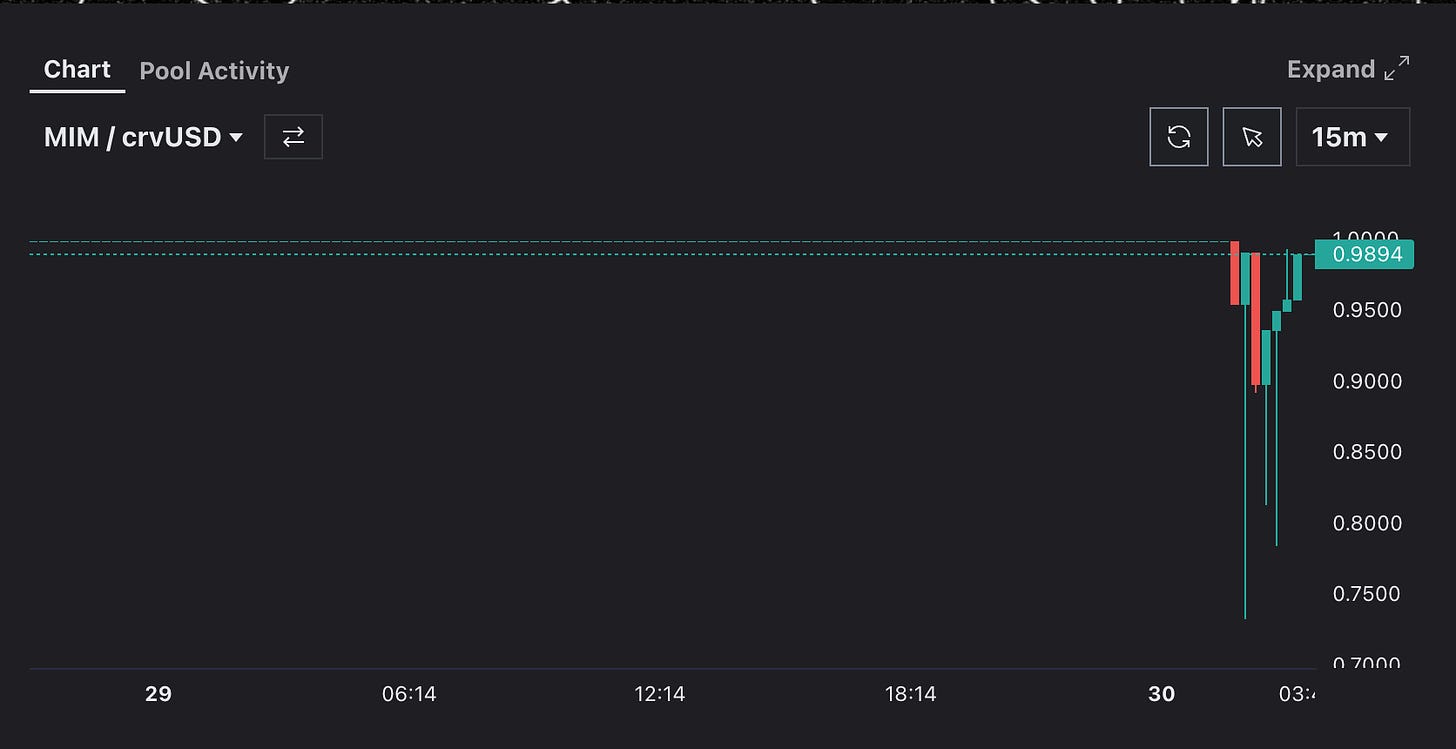

Fortunately the team’s rapid response may have paid off. $MIM traded as low as $0.75, but the peg appears to be recovering quickly.

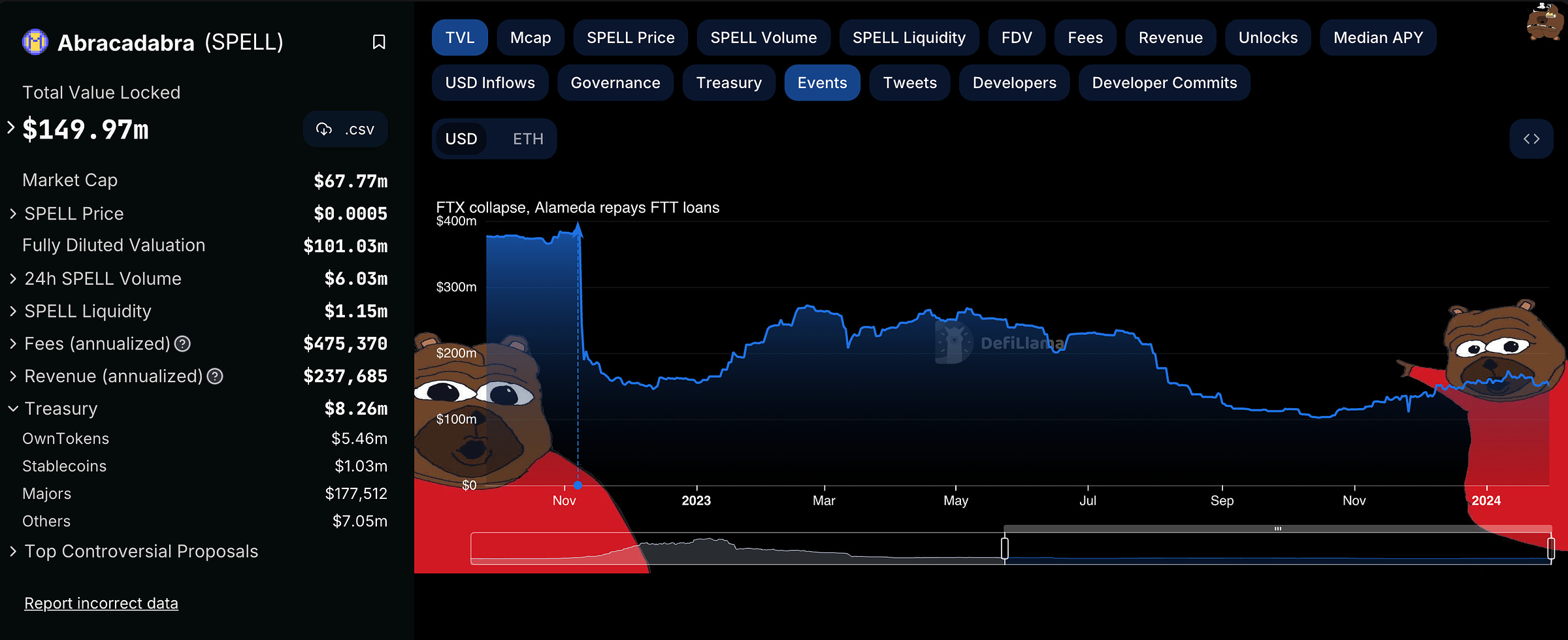

While $6.5MM sounds like a small-ish hack for DeFi, it marks a significant blow to the protocol. At present they have $150MM in TVL, with a treasury just barely able to cover the loss.

And lest you think we’d escape the incident and be able to simply count fees without enduring a fresh round of Curve FUD, think again…

A $1.59MM sell order may be imminent. While this amount might scarcely register as a blip relative to usual $CRV trading volumes, recall that the worst FUDsters’ overactive imaginations tends to dwarf their prehensile comprehension of basic arithmetic.

Honestly though, the protocol we are most concerned about is not Curve but Abracadabra. As a crypto boomer, we are anchored to recall Abracadabra as the protocol with over $6 billion in TVL, occasionally getting shoutouts from misshaped potato Brad Sherman, the unctuous microbrained representative from CA-32.

Over the past couple of months the team had seen some progress towards recapturing its glory days. $MIM may have faced some degree of competition from other decentralized stablecoins launching with a more modernized feature set, yet the base mechanics of $MIM remained reliable and new integrations were proceeding steadily.

Repaying the latest hack could leave the beleaguered protocol in a tough position if it suffers any future hacks.

Yet throughout our years in DeFi, we’ve seen Abracadabra is the protocol that takes a licking and keeps on ticking. We certainly hope the stalwart stablecoin lives to see more bullish markets.

With the window of time closing where you might buy $MIM at a discount and bet on a repeg, how should you play this?