Join our new Telegram Group for Curve Market Cap! Here are today’s trends to watch from Curve Market Cap:

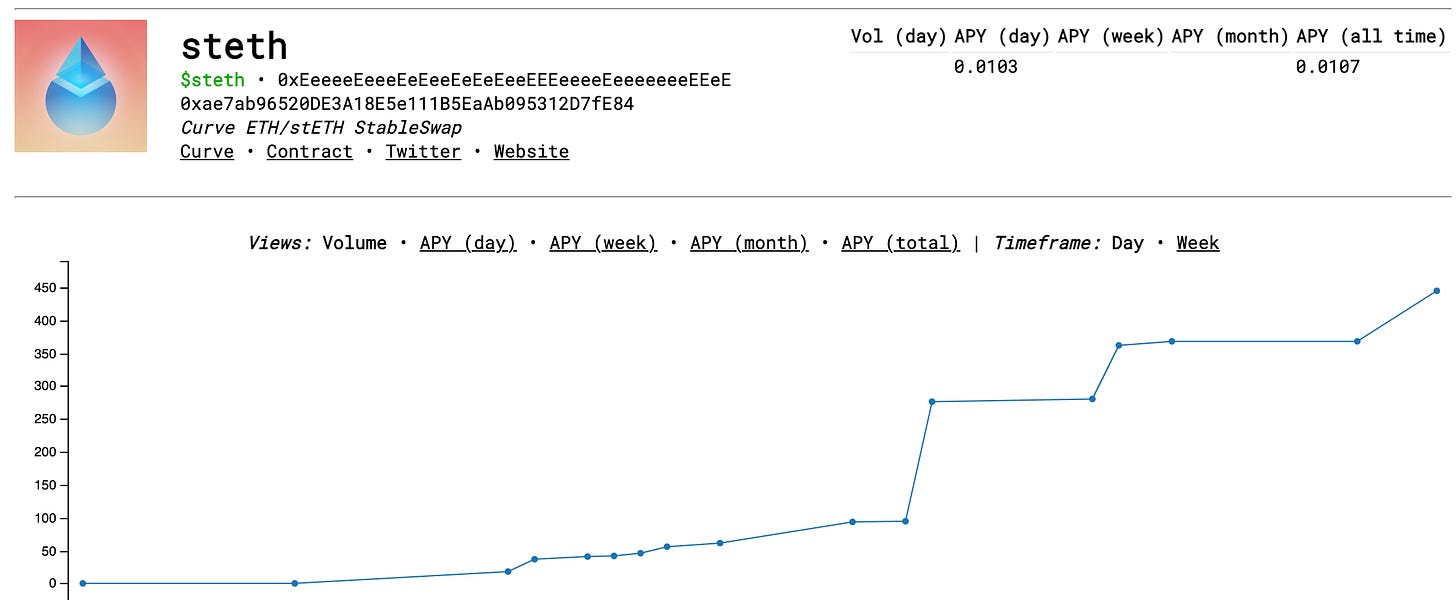

Eth season continues, as Curve launches its new $stETH pool.

The Staked Ethereum ($stETH) offered by Lido provides a convenient bridge between ETH 1.0 and ETH 2.0. Users can stake ETH and receive stETH on a 1:1 basis. The staked value accrues staking rewards daily, while the stETH token remains fully liquid and can be used in place of normal ETH. The ETH tokens remain locked until Ethererum 2.0 launches, at which point it becomes possible to redeem stETH back to ETH. Users must also stake multiples of 32 ETH.

Lido also has a governance token used for participation on their active DAO. At the moment, Curve does not offer any rewards, but there’s already a community vote to add a liquidity gauge for the liquid token, and at the moment Curve users are unanimously in favor of adding rewards.

Since launch, the $stETH pool is already at half a million dollars in volume. The Curve $SETH pool, which launched less than a month ago, is now consistently in the top ten by daily volume, so we expect the $stETH could also be a hit as ETH season heats up.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice.