Want trading alerts? Join our new Curve Market Cap Telegram group!

Here are today’s trends to watch from Curve Market Cap:

They say nothing in life is certain except death, taxes, and FUD about Tether. The stablecoin, now the third largest in the world has managed to always regain its peg for 6.5 years and reach a market cap of $23 billion.

Crypto vets often attribute a sudden pump in cryptocurrency prices to Tether printing, and the eye-popping bull market we’re currently experiencing is again reviving these calls. Particularly noteworthy is an upcoming January 15th court deadline.

Unsurprisingly, Tether’s team disputes these concerns:

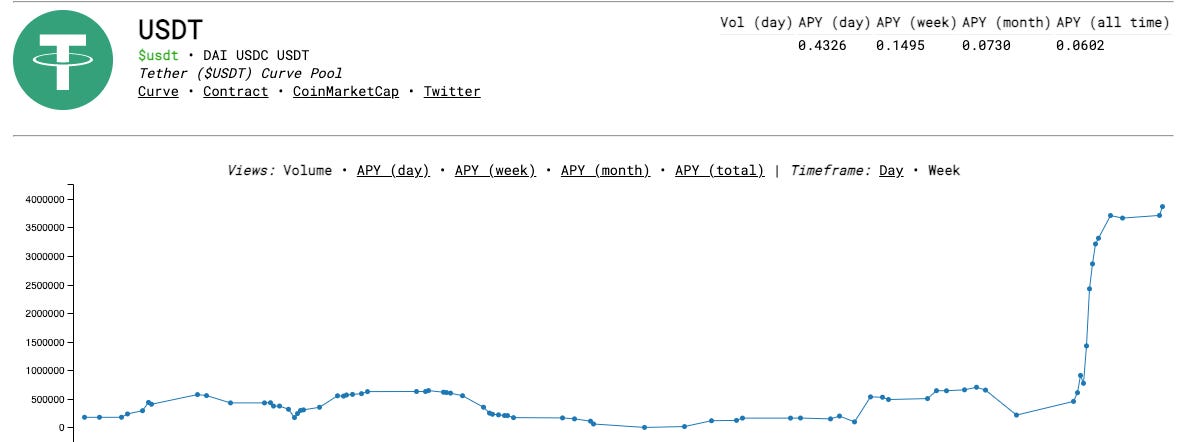

We’re not wise enough to know exactly what’s going on here. What we can do is observe how this debate is affecting Curve. At the micro level, the Tether pool has gone nuts lately, leaping to a 43.3% daily APY on trading fees.

At the macro level, if Tether collapsed, this could be a cataclysmic moment for the entire DeFi space. The existence of Tether is pivotal to the entire cryptocurrency space. Could the activity simply be shifted to another stablecoin? Consider that the next largest stablecoin, USDC, has a market cap of $4.5B, less than 20% of Tether.

If you’re interested in learning more, check out this thread in the Curve forums.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice.