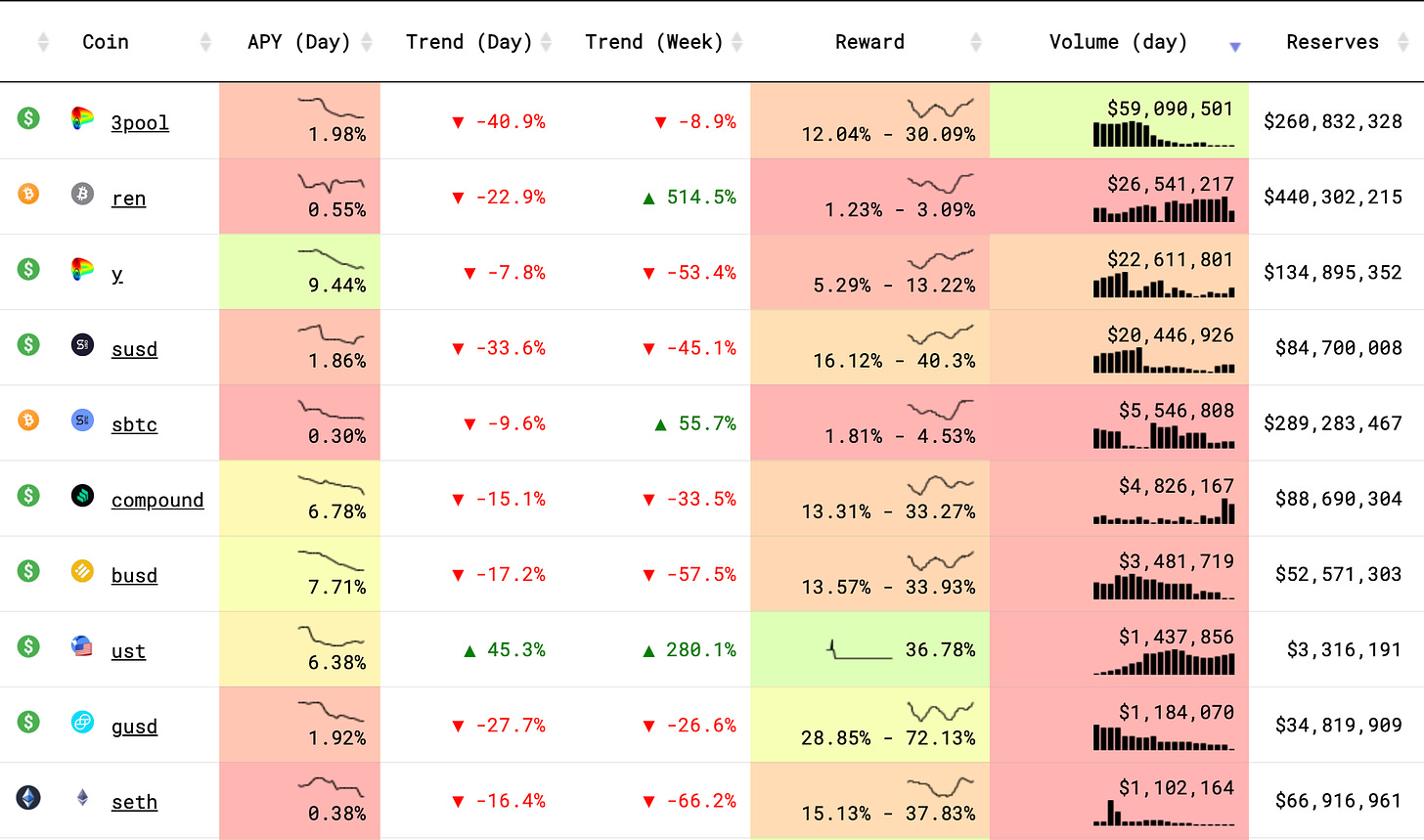

Here are today’s trends to watch from Curve Market Cap:

$AAVE turned 1 year old yesterday, and what a year.

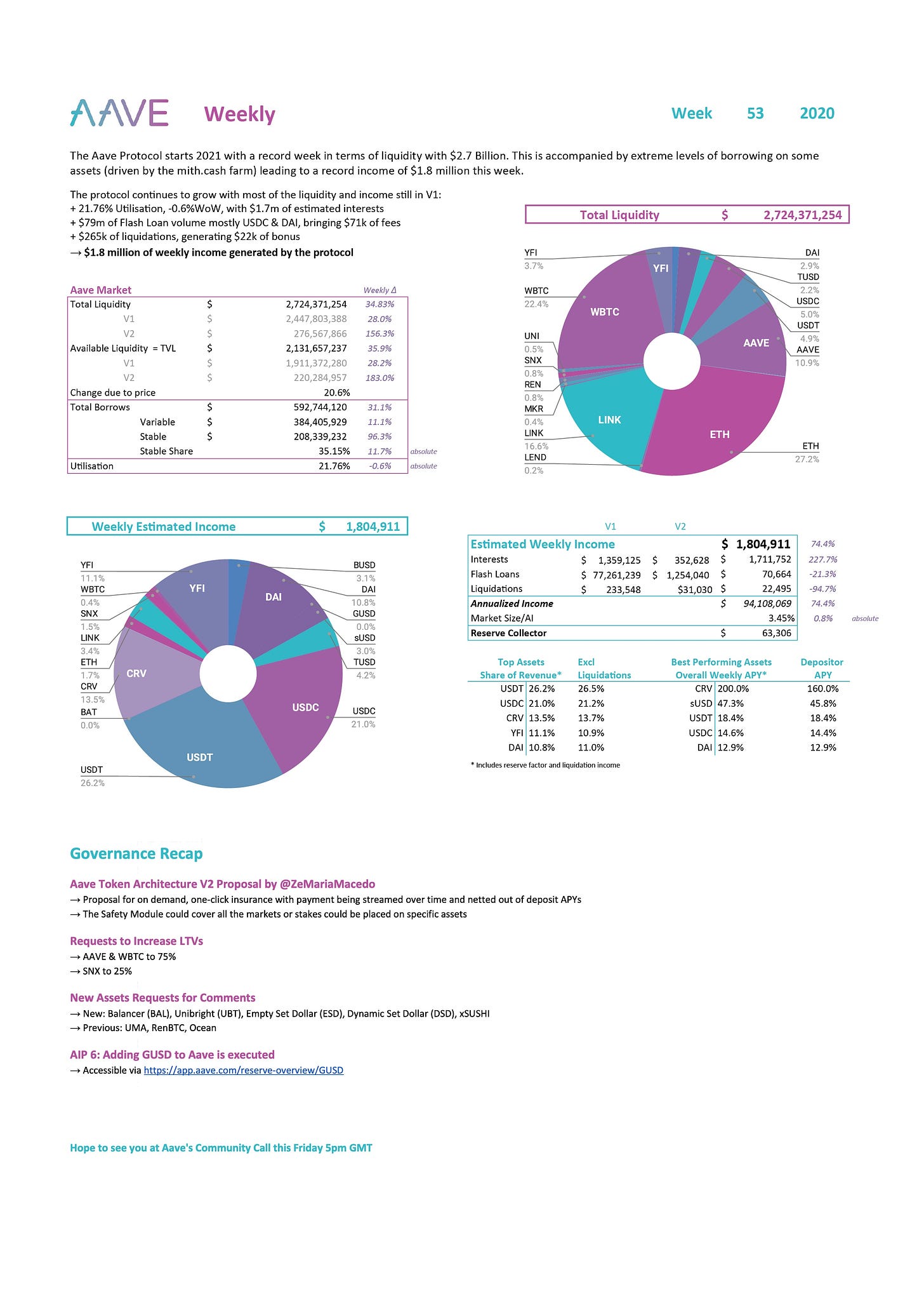

The decentralized finance protocol generated $1.8 million in weekly income on total liquidity of $2.7 billion. $CRV had the distinction of being the top performing weekly asset on AAVE over the past week, generating a 200% weekly APY.

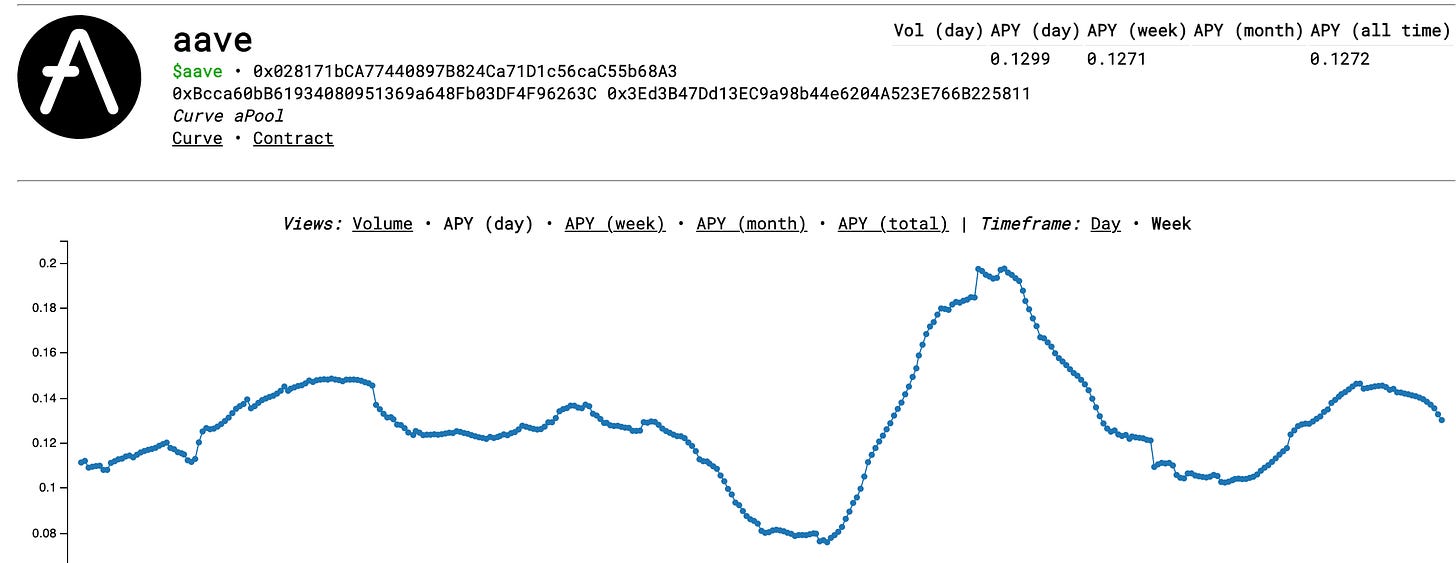

The good tidings also spilled back into the Curve $AAVE pool. The AAVE pool has generally provided north of 10% APY in terms of trading fees since its launch, currently providing the best return for stakers.

Much of this is tied to the general price rise of AAVE. The price hit a high of $123 this past week, up from a low of $26 on November 5.

Some have attributed this price run to recent OCC policy guidance. We’ll be watching closely to see if these policies persist as a new regime comes to DC.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice.