July 11, 2023: The Chad Fad 📊🎯

Explaining recent $crvUSD supply changes, growth, and volume trends

Within the grimy, inhospitable confines of a hovel no larger than a discarded shoebox, an unsettling scene takes hold. The air is thick with the tang of damp mold and the scurry of vermin is a constant background symphony, echoing eerily across the stained and mottled floor.

This is home for the solitary dweller known only as the deth spiral000r, a caricature of despair and obsession. His face, sallow and drained of color. His bloodshot eyes, round bulging orbs, each line underneath etched with years of unfulfilled vengeance, overflow with a steady stream of salty tears. A thin, hairless dome crowns his head, reflecting the sickly glow of light off his scalp.

His mouth is turned down in a perpetual frown, giving him the appearance of a man who’s swallowed too many bitter truths. His clothes are as shabby as his surroundings, a mishmash of greys and browns that seem to blend into the bleak scenery. Yet, despite his disheveled appearance, there’s a kind of grim determination in the set of his narrow shoulders, a relentless pursuit of his singular, unflinching goal.

A single, antiquated VGA monitor flickers sporadically, casting an otherworldly glow across the room and adding an ethereal quality to the dingy environment. The light dances over the cluttered floor, illuminating in its path an ancient keyboard and a rat gnawing at some unidentifiable morsel. This arcane technology is an odd centerpiece in such squalor, but it's this screen that the spiral000r's intense gaze is fixated upon. Captured within the cathode ray tube are fluctuating charts of Curve Finance metrics, their lines undulating like cryptic messages from another world.

DETH SPIRAL000R: (eyes widening, a flicker of excitement coursing through his veins) Is this it? Could this be the moment I've waited for, longed for with every fiber of my being? Is the sweet taste of vengeance finally upon my lips?

Only silence answers back. The chilling echo of his words reverberate off the dilapidated walls. The charts continue their cryptic dance, leaving the deth spiral000r suspended in a moment of excruciating anticipation.

But the deth spiral000r will be disappointed yet again. The charts he studies so intently do not prophesy the downfall he so desires. They will not validate his painstaking efforts. For those who eagerly await the downfall, the revelation will be as cold and bitter as the dank air that fills the hovel. And for the deth spiral000r, this will be a harsh, cutting blow.

How does Michi keep besting the deth spiral000r? In this case, the system is functioning exactly as intended.

When in doubt, remember the mantra from 0xstan’s simulator:

When crvUSD price goes lower, the rate goes higher.

When crvUSD price goes higher, the rate goes lower.

When DebtFraction goes lower, the rate goes higher.

When DebtFraction goes higher, the rate goes lower.

When rates were high, this was because the stablecoin’s price was too low and/or the debt fraction was too low.

Lately, the problem the monetary policy was trying to solve was the reverse — rates were too low, due to a combination of the price or debt fraction being too high.

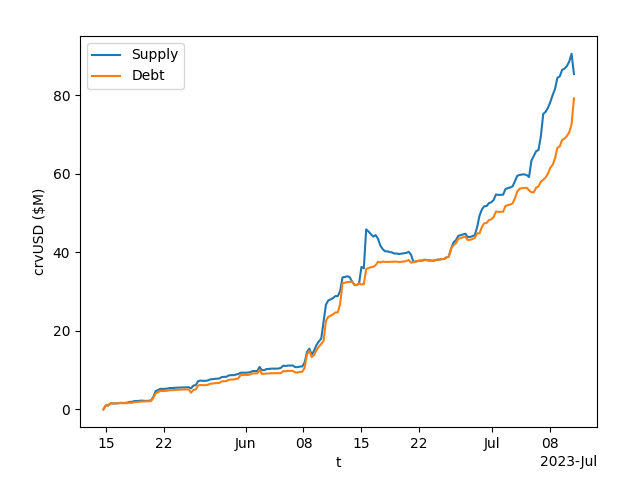

You may have been able to catch this on the charts. In the now bygone era of low interest rates, look at this divergence.

How did the blue line (supply) shoot up to above $80MM when there was only some $65MM worth of debt? The Peg Keepers are authorized to go into debt minting $crvUSD into the Peg Keeper pools in an attempt to stabilize the price.

But only to a point. They target a value of 10% debt. Eyeballing the above chart, you can clearly see at peak this was pushing maybe 15%. The entire system was therefore trying to entice degens to take out more debt to reduce this debt fraction, hence the enticing borrow rates near zero percent.

This did the trick of incentivizing more loans. But ultimately we’d see a sudden about face that would close the gap.

It’s a little understood piece of technical analysis known as the “Chad Fad”

The explanation here is provided by Curve:

Once Peg Keepers were able to repay their debts thanks to a quick rise in crypto prices, the total supply dropped and the debt fraction fell back within bounds. You can get the total value here:

At publication, we see 5228473.20 in total Peg Keeper debt on 79470345.17 total debt, a fraction of 6.6%. With the $crvUSD price fairly close to peg, it’s unsurprising to see the borrow rate go up in response.

At the moment, borrow rates are back around 5% for appreciating collateral and 3% on non-appreciating assets.

On Conic Finance this would yield about 13%, meaning 8-10% premia.

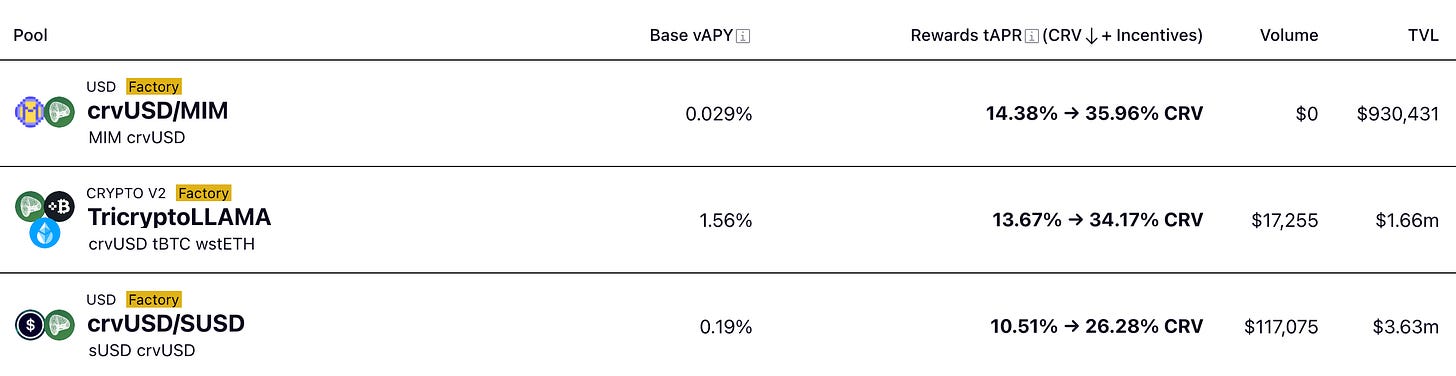

Or you could try depositing to handful of new $crvUSD pools and maxing out the boosts for higher rewards in pools that have not been absorbed into the Conic Finance omnipool.

The choice is yours, anon. It all means exciting times for Curve borrowers, and sadly for the haters, the death spiral is postponed another day.

Volume

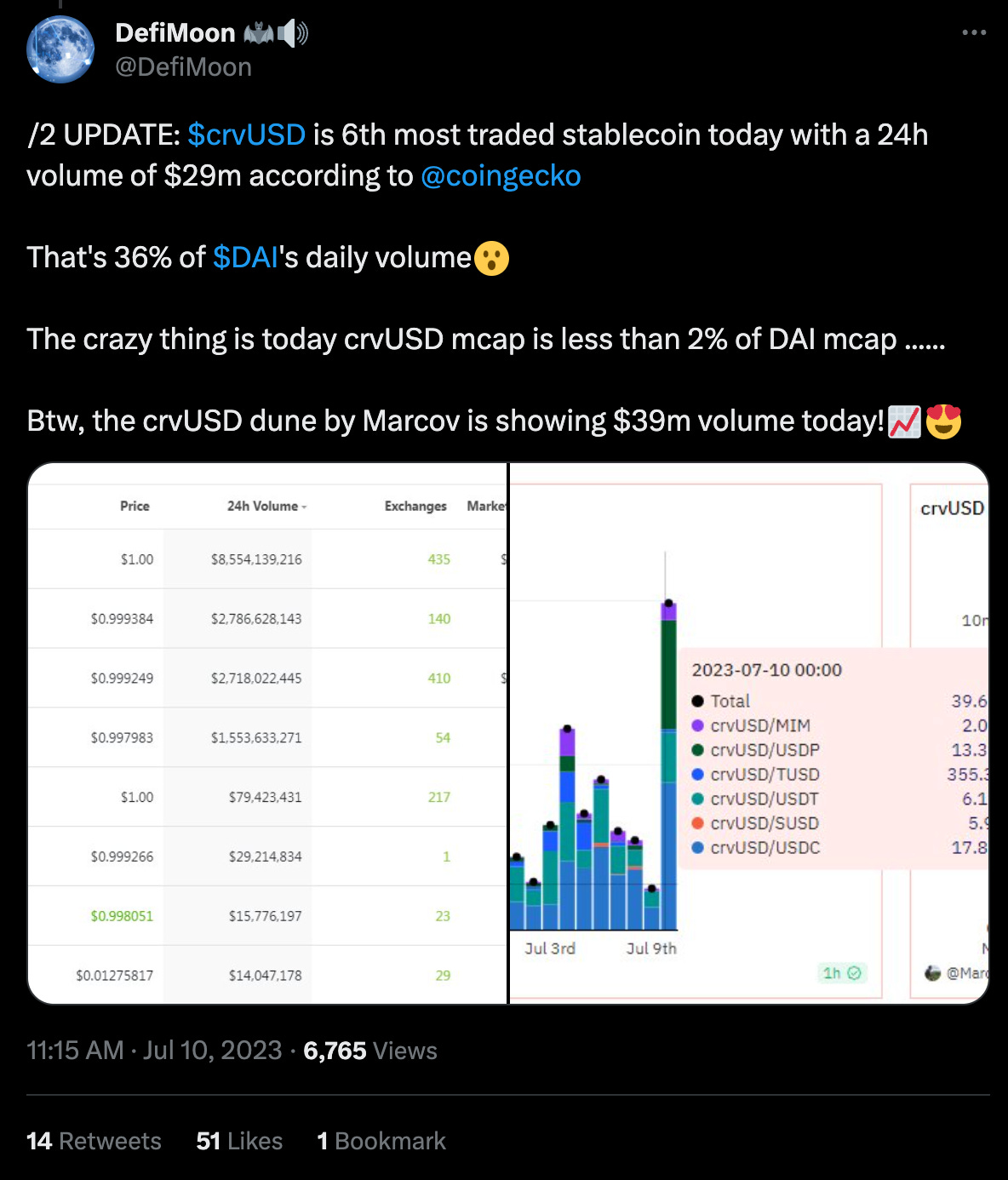

You may have noticed $crvUSD pools are becoming quite heavily utilized. Half of today’s top six pools:

By way of comparison, the largest stablecoin (Tether) had $20B volume in the past 24 hours on its $83B market cap (per Coingecko), and historically tends to sit in the top spot as the stablecoin with the highest utilization (24%).

Yet $crvUSD had $34MM in trading volume the past 24 hours, with a total supply of $85MM. This is a utilization of 40%!

Why?

We recommend you take a minute to read this great thread by the always entertaining DeFi Cheetah to understand why $crvUSD pools are attracting so much trade activity.

We do enjoy this thread, which describes how LLAMMA subsidizes some crypto trades which have the benefit of trading $crvUSD to parity, capturing more volume for Curve.

We’d suggest that “negative fees” is a bit hyperbolic — it’s a better price than market. It could be argued it’s negative if considering only transactions done under LLAMMA at borrower’s expense.

Additionally, the thread notes oracle choice in an attempt to reduce volatility. While the primary EMA oracle does have this effect, it’s not the intent of the design. The intent is to reduce reliance on oracles that may be manipulated. If a non-manipulable spot price oracle existed, it would have higher volatility but would still be preferable to the lower volatility EMA currently used.

Of course, these are extreme nitpicks. The broader point of the thread is that the fee structure encourages trades for common pairs like ETH→USD to run through the affiliated $crvUSD pools, ensuring massive volumes (especially as the token scales.)

Hence our constant recommendation to follow DeFi Cheetah and make sure to like everything he does!