We don’t often write about Uniswap simply because we don’t know much about it. We’ve literally never used it. We seldom convert assets between different tokens and its prices are typically unfavorable. If it was a better deal for the small LP perhaps we’d farm. It’s not, so we don’t.

Since many readers mistakenly assume our silly newsletter speaks on behalf of Curve, we also try to be somewhat careful about not talking about Uniswap. We don’t have any interest in feeding the contrived Curve v Uniswap narrative. It’s a mostly false narrative that exists because people like drawing comparisons between loosely related concepts. It’s not as if chess competes with tic-tac-toe just because both happen to be games.

That said, we like writing about amazing scams in the crypto space, so we have a duty to chat about the DeFi Education Fund.

Lessons in Multiplication

Protocols like Curve know how to flex their governance token to great effect. The complex mechanics of the $CRV token have been precisely engineered to return value to LPs and the Curve community. It’s amounts to a huge windfall that turns Curve users into loyal advocates.

In contrast, Uniswap has been traditionally hesitant to do much with their native $UNI token. This makes a lot of sense given Uniswap’s tight relationship with the VC community. A funny effect of the VC business model is that they often prefer pre-revenue startups to post-revenue startups.

A post-revenue startup can only be valued at some finite multiple of their revenue, putting a ceiling of their valuation at, say, 100x or 1000x current revenues. It can’t go to infinity. In Silicon Valley I’ve actually received feedback that my pitch would have been stronger if the startup wasn’t already profitable 🤯

A pre-revenue startup has no multiples. It may have a valuation, but you can’t multiply $0 in revenue by any real number to arrive at a postiive number. Therefore they can credibly claim its upside is theoretically infinite, and its valuation is quite easy to manipulate using the VC bag of tricks.

Similarly, the $CRV token has a real fundamental cash value. If you lock $CRV as veCRV, you can get back dollars earned from the protocol’s trading fees. VCs have a tougher time running Ponzi games to push this sort of token’s value to infinity.

In contrast, the $UNI token generates no cash flows and therefore has no fundamental value. To date it can only be used for governance voting. Having no peg to cash flows and therefore no ceiling, it becomes a bit easier for VCs to run their shell games.

Governance Extractable Value

Through the “DeFi Education Fund”, it seems some enterprising VCs have found a questionable method of squeezing at least some value out $UNI token ownership.

The contentious Uniswap Governance Proposal 5 was recently passed to award $20MM to a group called the “DeFi Education Fund.” Although it might be called an education fund, it appears it was so named because “Political Defense Fund” didn’t test well.

Indeed, the text of the proposal makes clear the funds are not earmarked towards education but political lobbying.

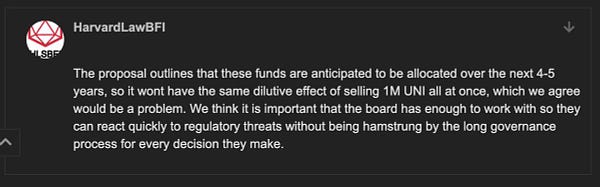

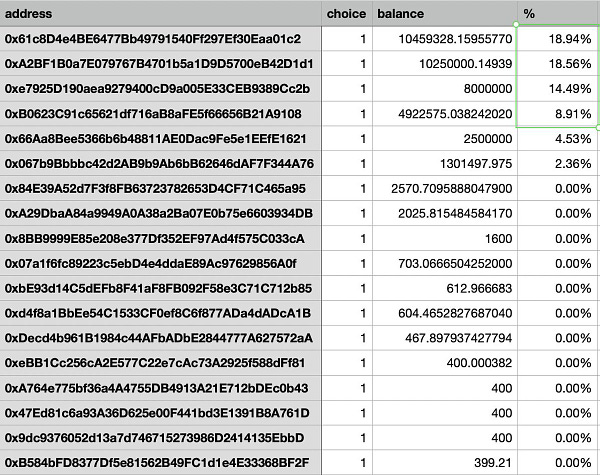

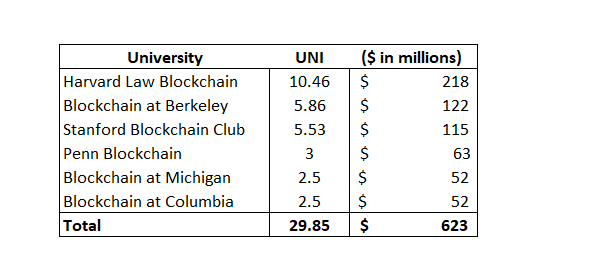

The only “education” connection seems to be in the suspect voting mechanics that got the proposal passed in the first place. Though voters were mostly opposed, the scales were tipped by a handful of student groups connected with Harvard, Penn, and UCLA — groups that appear to be fronts for VCs.

The proposal was quite contentious, but like good politicians they just brushed off hard-hitting questions and left their handlers plenty of space to clear the field.

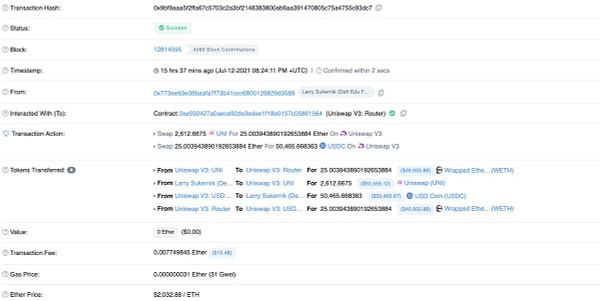

Like good politicians, they already broke at least one campaign promise. Unless it was implicit that funds be released on an exponential decay function?

Whenever there’s a notable hack in crypto, it is quickly dissected by the great @FrankResearcher, who stepped in here to provide helpful analysis.

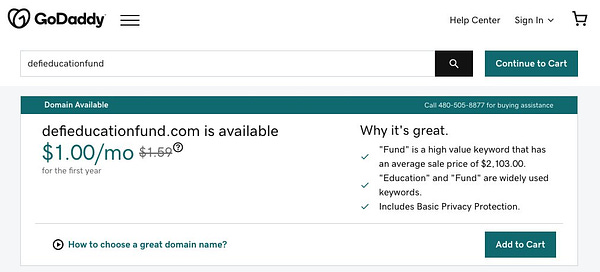

You could construct an argument that the group in fact needs money. They can’t even afford a website!

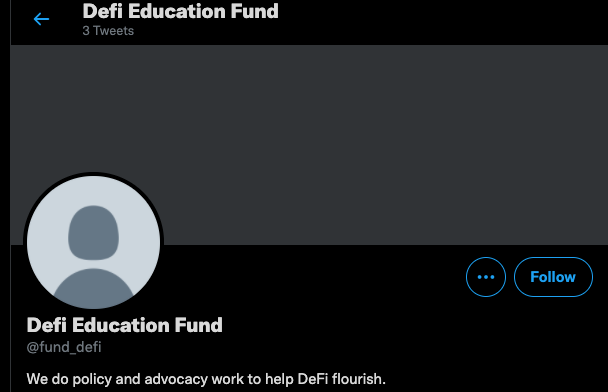

The group was so impoverished they couldn’t even afford to create a profile picture. Most rugs at least have the courtesy to shell out a few bucks on a nice logo, so you get to see something pleasant before you’re buried alive.

Remedial Education

One loser is DeFi in general. DeFi projects like to point to DAOs as being a superior form of organizing. This sort of action only serves to undermine the credibility of honest projects.

It’s arguably a bearish turn for the $UNI token itself. It’s no longer a pre-revenue token and can no longer claim an infinite ceiling. The token has now generated revenue for some of its holders, so it carries an implied valuation. It can generate cash flows from rug pulls. The multiple here is the number of future rugs to expect. At a current market cap of $10B, if you assume each rug is worth $20MM, the math shows the market expects 500 more rugs like this are yet to come. Brace yourselves!

As so many things crypto, the real winner is the popcorn industry though. Ouch… my sides… such great takes…

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist, has no position in $UNI.