Tromping around EthCC has been a blast. The products people around the Curve ecosystem are building is remarkable. While we can’t share all the alfa just yet, we look forward to seeing these various innovations go public over the subsequent weeks and months.

For today though, we’ll spotlight the undoxxed Convex Finance, whom might otherwise be overlooked amidst a fête for the doxxed.

Terra Terror

The Convex team might ordinarily be content to stay out of the spotlight entirely, as the upcoming months will see them navigating choppy waters and presumably therefore more than the usual amount of FUD. In the prior bull cycle, the now defunct Terra acquire almost 2% of the total Convex supply for the purpose of incentivizing their ambitions for a 4pool and the kill Dai.

Instead, Terra would collapse. Terra’s stash of CVX has since sat idle with the implicit threat of being dumped at any time. Their CVX bags have since cast a shadow that’s loomed over bear market survivors like a Sword of Damocles… at any moment it might fall and rekt users.

Recently the Terra wallet indeed opened up and began dumping steadily. At the rate its going, we’re likely to see several months of sell pressure every single day.

The good news is that, thus far, the token has withstood the sustained sell pressure. The CVX:CRV ratio typically sits around 5, and at the moment it’s holding steady at this mark.

In a potentially bullish sign that next cycle’s builders are outpacing last cycle’s rotting corpses, we noted last week that JPEG’d was planning on acquiring $5MM worth of CVX.

We hope the relatively relaxed pace of CVX dumping means the market is able to absorb any downward pressure without too much issue.

A FiRM Foundation

More interestingly, lately Inverse Finance onboarded $cvxFXS as collateral onto their FiRM market.

FiRM (short for Fixed Rate Market), is a DeFi lending solution that, appropriately, offers fixed-rate borrowing. They isolate collateral into what they dub “Personal Collateral Escrows” which provide access to rewards.

Their markets allow you to hold onto rewards, which in this case include rewards from both FXS and CVX. These rewards are currently about 9.56% (though of course you don’t need anybody to tell you that DeFi rewards are variable.) At a fixed lending rate of 6.4% for a year, you can ask your trusted and registered financial advisor to run some numbers and see if this makes sense.

What might you do with $DOLA, the token that you receive on the other side?

The Inverse Finance team recently launchd a $crvUSD - $DOLA pool, which they plan to incentivize.

The team has long maintained $DOLA liquidity on Curve, which has kept fairly close to peg.

That said, the Llama Risk team took a deep dive into $DOLA earlier this year. Inverse Protocol had suffered from some bad debt, and the renowned risk researchers issued some red flags.

The team has chosen to build their way out of the hole, a particularly admirable feat in the bear market. They’ve been providing a lot of transparency on their bad debt repayments, and the cvxFXS market is just one action the team has taken among a swarm of building activity.

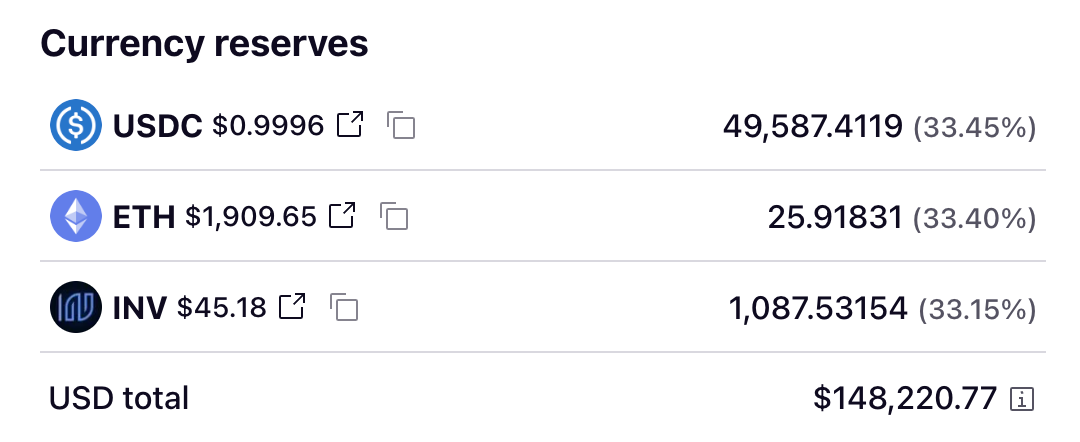

The team also recently launched a TriCrypto:NG pool allowing trading among USDC, ETH and their governance token INV.

They detailed the rationale behind the pool in their governance proposal.

Worth a thorough read and comment!

crvUSD

As we go to print, it looks as though $crvUSD will be soon passing $100MM!

Maybe it’s the plummeting borrow rates…

Or maybe the DeFi Saver integration, complete with a button to lever up…

Whatever the case, you know the big round milestone is an even billion.