Yesterday we took a look at the curious decisions of major players who appear to continue declining free money.

Today we glimpse some players winning the game at a god-tier difficulty level:

Farming is tough during a nuclear winter, but $OHM has been a rare bumper crop for DeFi. They’re building a floating algorithmic currency with a treasury-as-a-service inspired model.

The protocol is now wealthy. Its Treasury Risk Free Value is doubling each month, and truckloads of money are zipping back and forth between $FRAX and $OHM.

You’ve probably seen the Ohmies chillin’ around CT with the “(3,3)” meme or flashing their sleek custom referral cards.

If you have a lot of these people in your social media community, you maybe GMI. OHMies include a lot of whales. A rich following is a legit asset nowadays.

What are these whales doing with all this cash? Enter OIP-14, a proposal to stash $333K excess funds into Convex:

Olympus has about 3.6 million FRAX sitting idle in the treasury when it could be earning interest. Currently the Convex FRAX pool is paying 0.41% apr in trading fees, 7.82% apr in CRV tokens and 5.91% apr in CVX tokens - this is a substantial amount of value not currently being captured by Olympus (these percentages already account for Convex fees). This proposal seeks to trial a deposit of 333,333 excess treasury FRAX into the Convex FRAX pool in order to capture some of this value for Olympus.

Sort of a no-brainer, especially when they detail the mechanics of Convex.

Convex is a protocol that is allows for automated management of CRV pool assets. Convex does not charge deposit or withdrawal fees - it takes 16% of the CRV rewards which are distributed to Convex stakeholders. Convex currently has $3.8 in TVL.

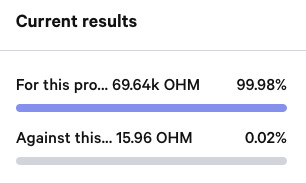

Unsurprisingly, the community is 99.98%+ smart money

They note the impossibility of using Curve directly, given the whitelist requirement for smart contracts.

Curve and Convex mesh like the gears of a Rolex. From a recent survey prompted by pushback from a previous article, the shrimp overwhelmingly prefer Convex, with whales narrowly leaning Curve. Neither part of the flywheel is a poor choice.

It’s always interesting to observe the performance of $CRV vs $CVX during a market dump. Nuclear blasts are indiscriminately targeted, often shellacking these cash-yielding tokens to comical discounts.

No wonder the wealthiest traders collect these tokens as soon as the bombings let up. What were we just saying about a wealthy social media community being an asset?

It’s no surprise the tokenomics of CVX and CRV are being held up as the crypto standard as additional protocols build out their offerings. For closing evidence, consider this statement by 0xMaki amidst the Trident rollout:

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV + $CVX maximalist, has no stake in $OHM or $SUSHI.