Yes, yes, once again, it’s all over.

We’re amplifying this because a lot of bad info going around…

Bears can rip out our innards, but they’ll never remove our innate faith in the concept of DeFi maximalism.

A reminder of what we’re fighting for in a short piece we call “DeFi and Conquer”

DeFi

Reasonable people can disagree, but here’s our view as of summer 2024.

Despite the myriad attempts to kill cryptocurrency over the years, crypto will survive and thrive. It’s proven antifragile as a quasi-religious core belief for too large a community. Attempts to kill a core belief only render it stronger.

Rational nocoiners would confess that last weekend’s Crowdstrike outage is a bulletproof argument in favor cryptocurrency. We certainly don’t expect them to concede so easily though, as this entire event has already been memory holed.

Still, a shout out to everybody whose worldview happens to actually align with reality…

Most importantly, the killer use case of cryptocurrency is DeFi, regardless of chain.

If you look at Bitcoin, the largest cryptocurrency, the narrative has shifted. Years ago it was just for HODL-ing, and it was a good narrative… we HEDL and we did well.

Lately though, Bitcoin has begun to adopt all the best technology forged and proven on the Ethereum mainnet.

The narrative shift is now complete. DeFi has found a foothold on BTC. Once its dug its claws in, it will never go away.

Ethereum has always been the beachhead battlefield for DeFi. One day DeFi on Bitcoin, Solana, or some other chain may flippen it. DeFi Maximalism will endure wherever its focal point. Perhaps ETH maxis’ pain is BTC maxis’ gain

Ethereum is particularly interesting, because it’s tried its hardest to push several alternate narratives and products. All the while, it’s worked to distance itself from the narrative of “DeFi.” A dirty word given the shady actors of the past few years.

Yet DeFi hasn’t gone anywhere. Quite the opposite, DeFi remains the only use case of Ethereum that has not only survived, but actually thrived.

Remember DAOs? DeSci? We still hold out hope that these narratives revive in better times. DeFi needs no such hopium. It’s battered and bloody, but still winning.

It’s a great time to be a DeFi maximalists because reality is aligning in our favor.

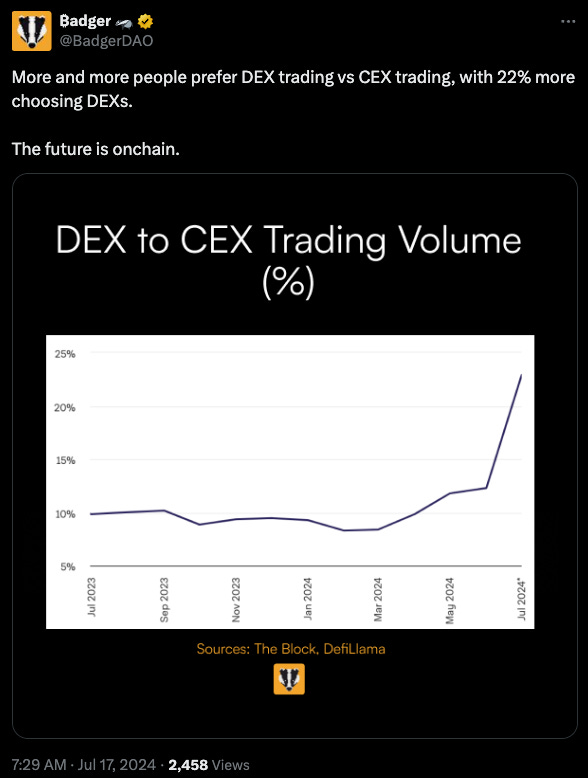

DEX to CEX spot trade volume is at an all time high.

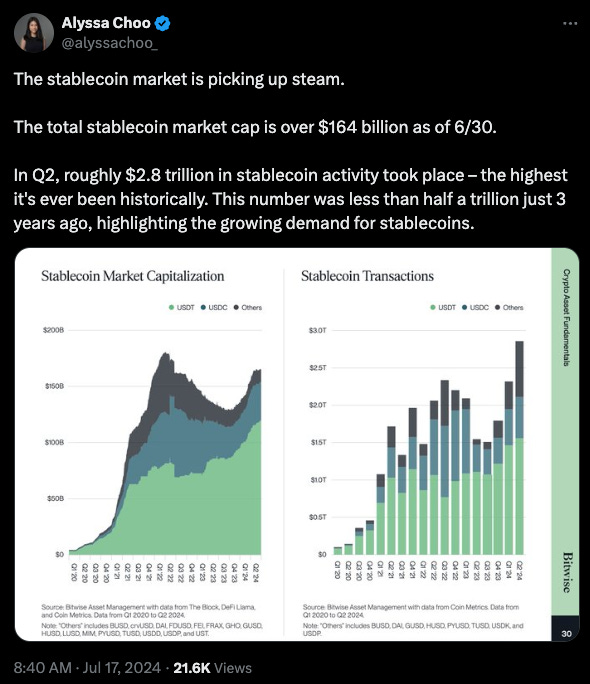

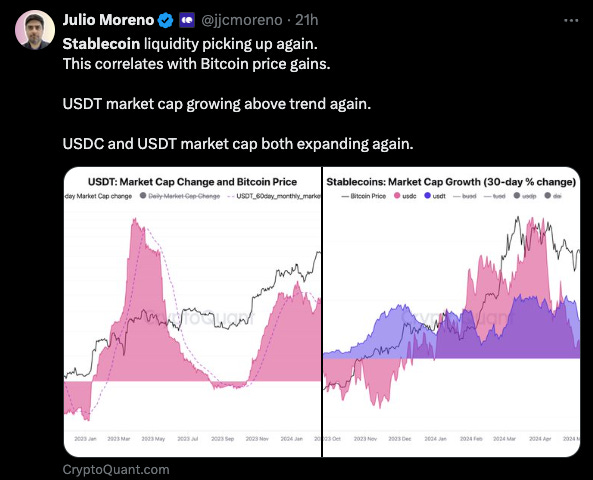

The killer use case of DeFi remains stablecoins. Any pain in markets lately obscures the fact that stablecoins are “up only.”

Mostly this remains driven by centralized stablecoins. USDC and USDT are king, and the absolute best business model in the past few years of rate hikes.

This “winner take all” effect notwithstanding, stablecoin innovation has only accelerated through the bear market. Some of the hottest stablecoin tech didn’t even exist last year.

It’s a great time to be a DeFi maximalist.

Of course, the final piece of DeFi maximalism is where we acknowledge we may lose common cause with other DeFi innovators. We believe Curve remains the beating heart of DeFi.

The most critical pieces of DeFi infrastructure are the DEX, stablecoins, and lending markets. Curve’s v2 remains unrivaled DEX technology for optimizing efficiency with a passive LP experience. The peg of $crvUSD remains unrivalled among decentralized stablecoins amidst numerous “black swan” events. The LLAMMA lending market remains such a leap forward in user experience that the market has demonstrated it will willingly pay a significant premium for the privilege.

But our advocacy for Curve is not meant to disparage the incredible innovation occurring in DeFi. We don’t believe any one protocol can or will gain a monopoly — there are far too many distinct use cases for a single protocol to solve them all. DeFi maximalism is a rising tide that will lift all the great builders whenever the market catches up to this reality.

Consider how many DeFi protocols persisted through the lean times…