Phew! IYKYK…

Of course, some of you perhaps joined crypto after the ICO crackdown and may not immediately understand why this was such an 0xC4AD move.

Let’s explain.

2018 was a brutal period in which regulators attacked everything that smelled like a coin. They were successful, cryptocurrencies died forever, and Paul Krugman and Nassim Taleb hopped on Clubhouse to throw a "ETH/BTC Breaking Down 0/0 Discontinuity Death of Crypto Party 🥳”.

Except the last part never happened. Curiously, despite regulators attempts, cryptocurrencies survived and even grew.

In fact, from the ashes of a kajillion 2017 s—coins sprung forth a new wave of innovation. The newer generation of ERC20 tokens learned the lesson of the first wave of attacks and rearchitected themselves to be more censorship resistant.

Just last week we attempted to parse the tea leaves of comments from US regulators. In the wake of these comments, users looked to some of the larger volume dexes for clues as for what’s next.

For instance, in this alpha-heavy interview, Curve alpha Michael Egorov comments that regulation is unmistakably coming and thoughtfully considers how he expects the chess game will play out:

PS: Thanks to the YouTube screencap for providing us v2 of the mind blown meme…

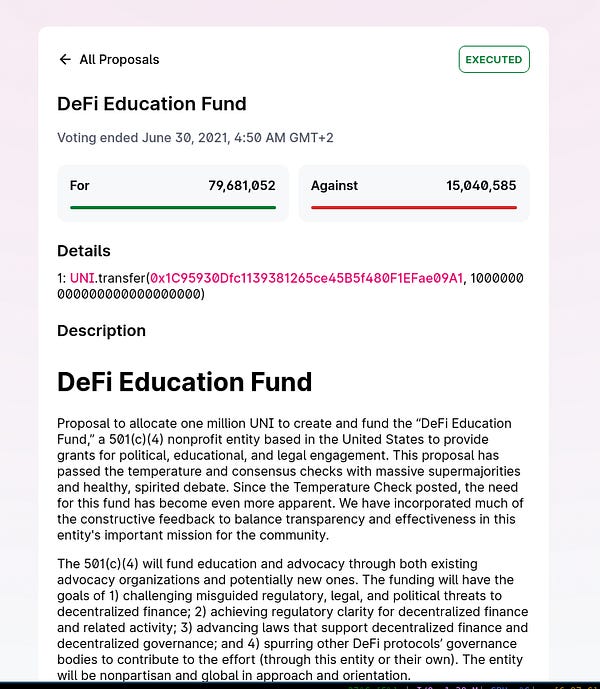

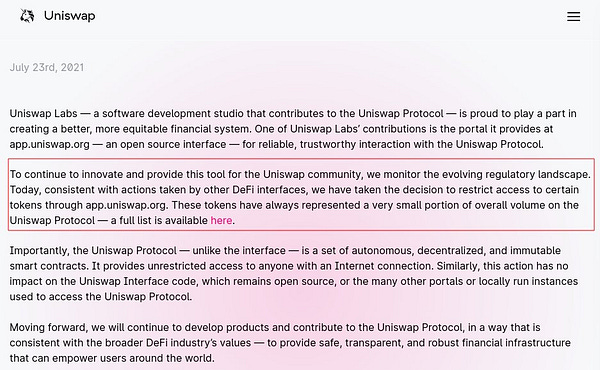

Uniswap Unravels

Uniswap, a protocol occasionally cited as a potential Curve competitor, reacted by micturating themselves.

Despite attempts to disappear this video, a Uniswap talk from EthCC lays out some of the team’s plans.

Uniswap’s recent blunders may inadvertently endear themselves to a younger crowd. Several Millennials and Zoomers also overpaid for an education.

Here’s some free “education.” If you’re a casual LP watching what Uniswap’s doing and thinking it’s a good time to play around in their pools, you might want to think a bit harder.

Curve Reaction

Curve’s major response was the aforementioned link: https://curve.eth.link/

This frontend interface to Curve was deployed using Interplanetary File System (IPFS). This filesystem is strongly decentralized, so it will now be essentially impossible to remove this frontend. If regulations intensify to the point that America starts dropping bombs on Switzerland in an effort to turn Curve HQ into a smoldering crater, Curve will continue without interruption.

This is in fact part of a growing trend in authoring censorship resistant protocols. DeFi protocols are often hosted on the blockchain in a manner that renders it impossible to shut down. The attack vector becomes the frontend. A webpage can be easily knocked offline. As sophisticated as crypto users are, a large chunk (probably the majority) still rely on a beautiful frontend to ape. Forced to transact entirely through Etherscan or Brownie, volumes would plummet, effectively killing the project.

Hosting on IPFS removes this attack vector to some degree.

Not all browsers support some of the decentralized hosting protocols, but IPFS-based hosting can provide users a degree of confidence in continuity amidst potential attacks.

Liquity protocol (LUSD) is one dollarcoin that has authored this concept into their core design. Liquity does not maintain a frontend, the only access to their protocol is through 3rd party frontends who can take their own cut.

Regulator Options

As regulators consider their actions, we’d like to again reiterate the options. One option is to fight. Like previous attempts, it would be unlikely to succeed. At best it may delay cryptocurrency adoption by a finite amount of time. It also has the effect of frightening away US-based developers, guaranteeing the next generation of innovation is built off-shore

The superior game theory option would be to incentivize innovation. Weaponize stablecoins to the country’s benefit.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist and long the US dollar.