July 26, 2023: Elections Have Consequences 🗳️✅

Is Curve planning to sunset CRV/ETH in favor of the new TriCRV Pool?

TriCRV

Elections have consequences, people.

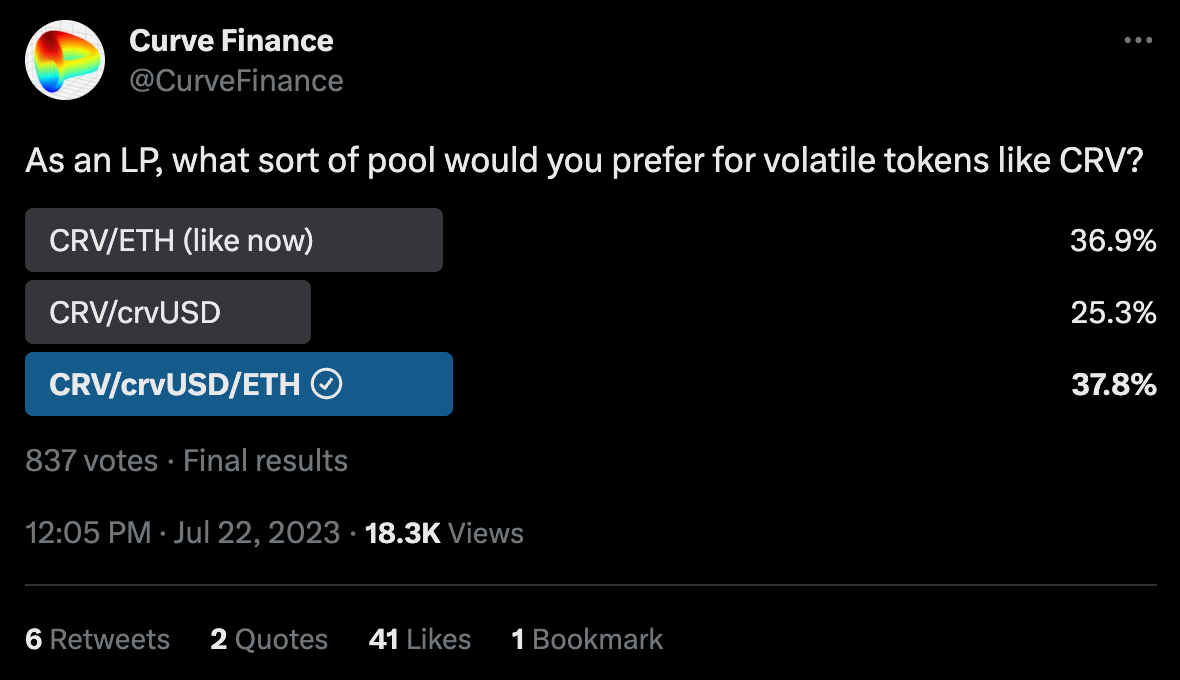

In a nail-biter of an informal poll, users recommended a newfangled TriCrypto:NG pool for $CRV liquidity instead of the classic CRVETH pool. The result looks to be about a 7 vote margin making up the difference. We don’t even know if these 7 voters informed themselves on the nuances of TriCrypto:NG operation or if they just wanted something shiny and new.

At any rate, the new TriCRV pool has been launched.

And it is about halfway to passing its gauge vote, though perhaps not in time for this week’s cutoff.

The CRVETH pool has been a mainstay since its launch. Users have many great options for what to do with their $CRV, but one consistently interesting option had been depositing it to CRVETH. The pool tended to hit around 20% boosted rewards for its lifecycle, making it competitive with other places to lock your $CRV.

Now, we’ll grant you, holding $CRV hasn’t exactly been the best investment for those who care about fiat denominations.

But on this front, the CRVETH pool may be seen as preferable if you expect $CRV to keep going towards zero because issa dump token. After all, CRVETH has only about half the volatility, so your losses (in ETH terms) from holding a CRVETH token will be reduced relative to holding a pure CRV token.

On this front, the new TriCRV pool may well hedge further relative to dollars, while also providing native trading pairs and greater utility for crvUSD.

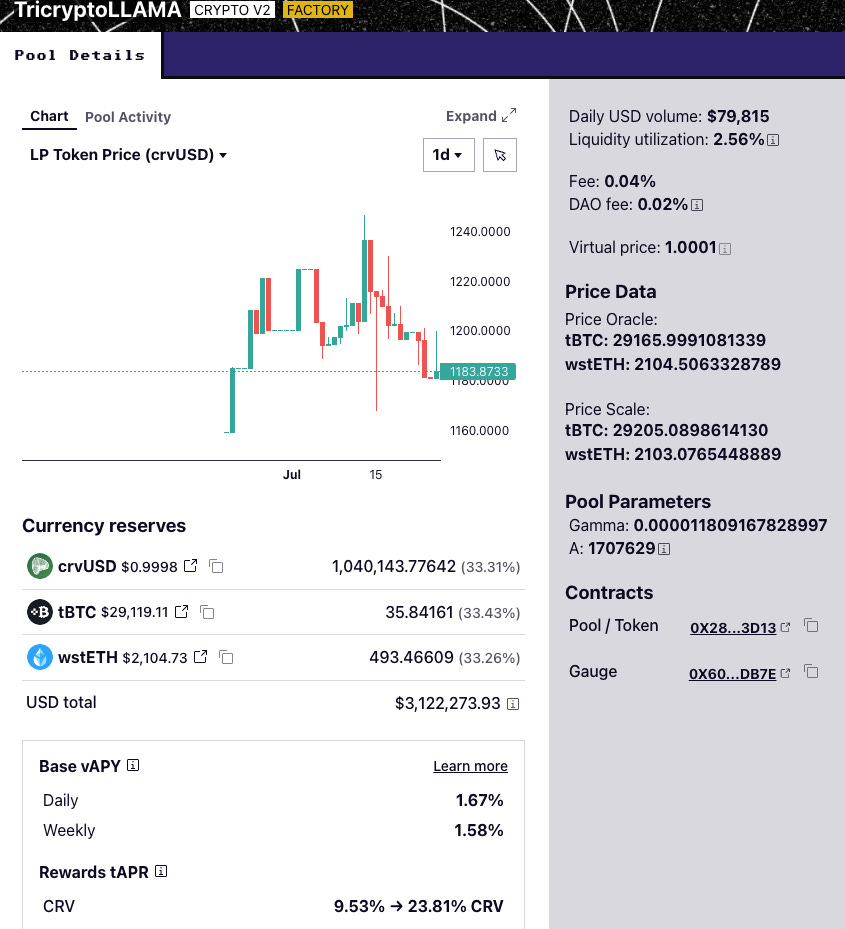

Of course, TriCRV is not the only crvUSD triplet hitting the scene. The TricryptoLLAMA pool has been hooked up with juicy rewards lately that are about double the other BTC-ETH-USD denominated pools.

One might imagine the new CRV-crvUSD-ETH pool also gets juicy rewards? Time will tell…

Conic Finance

An important vote for Coneheads… disable emissions to Conic omnipools while they are shut down?