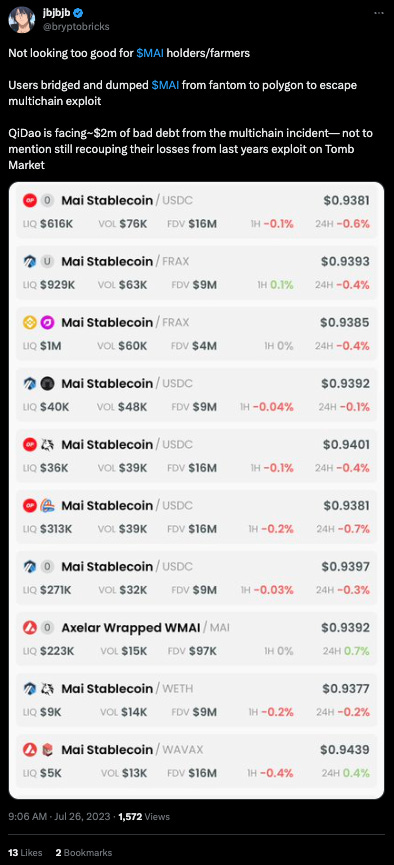

Qi DAO’s $MAI stablecoin has been trading significantly below peg lately.

What is going on here? Time to panic?

If you mostly stick around mainnet, you may not be terribly familiar with $MAI. They do exist on mainnet, jumping about this time last year, but this was only after they conquered every other chain first. The protocol’s core remains cross-chain.

Operating primarily off of mainnet means that transaction fees are very cheap. As a result, the stablecoin is extremely popular among retail users. On rankings of TVL, $MAI is a mere $40MM, putting it 26th on DeFi Llama’s list of stablecoin TVL rankings.

Yet in terms of total number of users, not TVL, $MAI is consistently in the top tier. This is the retail adoption playing out on rollups like we all want, so it’s particularly tragic when we see small money players getting hosed.

The Qi DAO platform has developed incredible facility at allowing funds to move across several chains. When the Multichain hack hit, Qi DAO jumped to red alert.

Pretty much every asset on Fantom is essentially worthless at the moment. This meant the vaults there became bad debt for Qi DAO. Fortunately, the team was able to shut down the Multichain bridge and isolate this chain, which contained the overall impact. They describe how they handle bridge risks more in their documentation.

Although $MAI is trading below peg, interestingly enough it became a lifeline for users on Fantom. With nearly every other asset suddenly worthless, there became a massive run on the $MAI pool on Fantom. Users drained the $MAI pool so they could dump it on Polygon.

With $MAI having a relatively small TVL in terms of the overall cryptocurrency space, this exodus caused the initial $MAI depeg.

What’s funny about this, is that the design of $MAI is extremely robust. $MAI is overcollateralized by ~1.5x. The depeg provides an opportunity for users who have minted $MAI to simply repay their loan at a discount. So we see reason for optimism that $MAI could ultimately repeg.

If you want to bet on a further depeg, you would not be the only person selling the stablecoin short.

Alternately, if believe it will repeg, there are plenty of ways to bet on this phenomenon. You can simply buy $MAI at a discount, giving you a nice 6% bonus if it does repeg. It’s a potential gamble for users who took a 2% haircut in the Conic Finance exploit. Users can use $crvUSD to acquire $MAI on the cheap directly from their pool (albeit with just about $250K liquidity).

Another potential way to gamble on either side of this bet is Y2K Finance’s Repeg Vaults, which allow users to bet on the price of $MAI and $MIM at a future block. More on Y2K from the great 0xMughal:

In the meantime, Fantom Foundation has announced they are working to make users whole. Meanwhile, Qi DAO is working to move away from the concept of “concentrated liquidity” in their main pools to provide more resilience in the future.

More on this from this morning’s Leviathan Livestream

Those interested in more on Qi DAO should check our prior Llama Party with Benjamin

June 1, 2023: Benjamin @ Qi DAO🦙🥳

Frens, join us at 8 AM PT for a live llama party featuring Benjamin of Qi DAO! Discord: https://discord.gg/wK2dVrcq?event=1113982575099265065 YouTube: https://youtube.com/live/UOJYEwPp_NU?feature=share For those new to Llama Parties, they are perfect ways for llamas to socialize without needing to leave the comfort of their computer. We host the guest in a

glad you saved Ben from the Do Kwon quotation :kek: