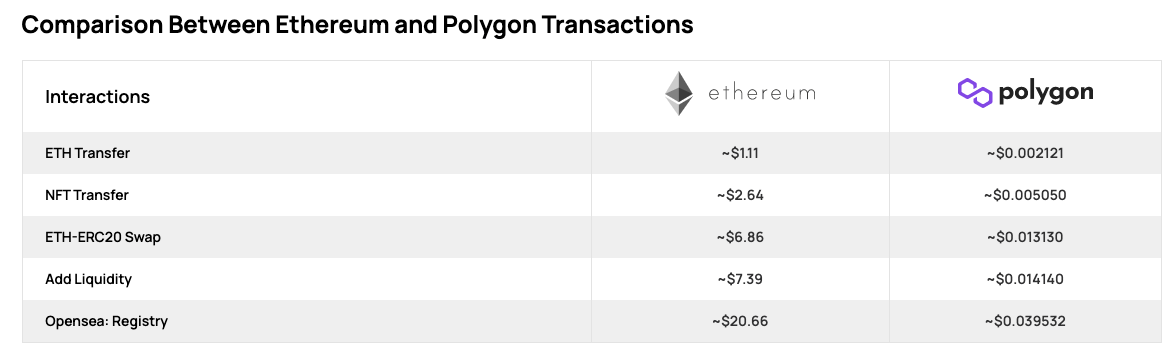

Whenever Ethereum gas prices starting to trickle back up into double digits, or even spike into quadruple digits on a hot new NFT launch, Polygon remains an attractive destination for the DeFi community.

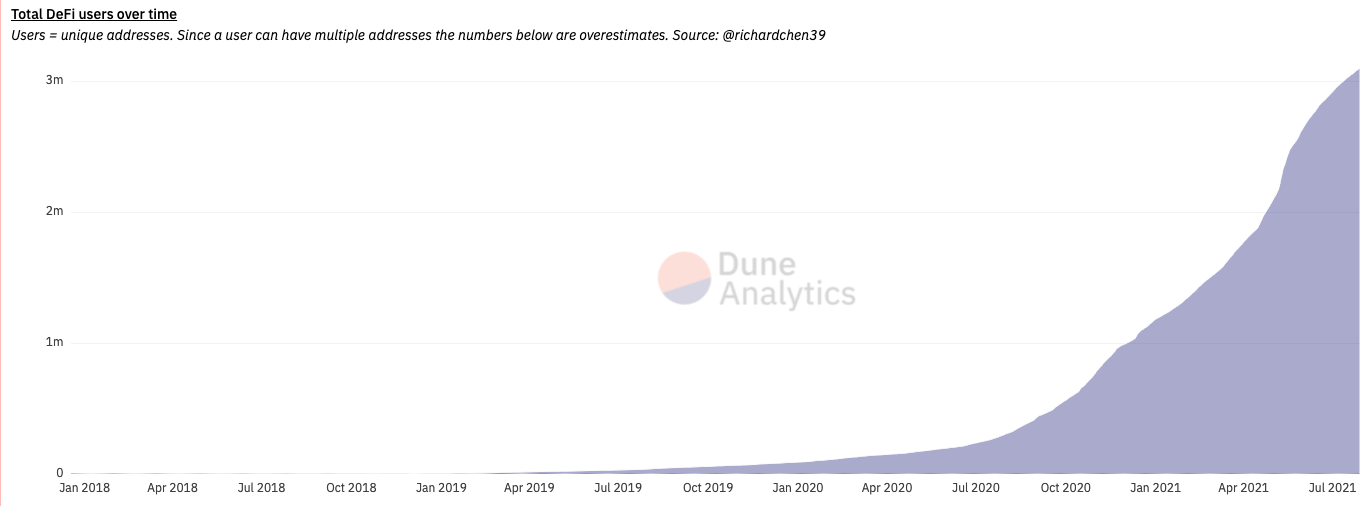

Amidst the broader cryptocurrency market pullback of the past several months, DeFi usage has remained strong:

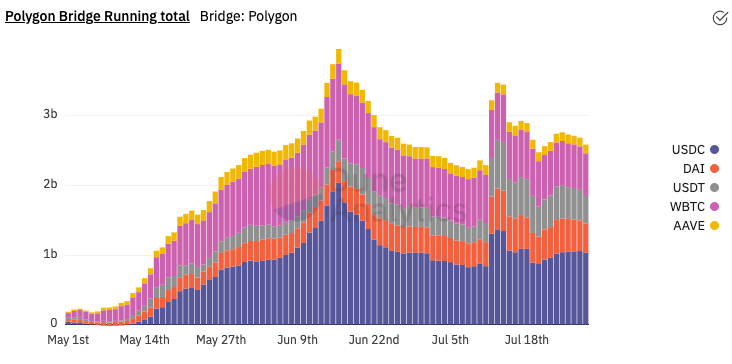

Thanks to their EVM compatibility and large userbase, most popular DeFi apps and assets have an equivalent on Polygon. We’ve seen assets continually crossing the bridge to make use of Polygon even during the bear phase.

Mirroring attempts on Ethereum to create a fully-collateralized stablecoins, Polygon developers are also starting to create similar native tokens. One such project is QiDao

QiDao is themed around the 道德经 (Dao De Ching), the seminal work by 老子 (Lao Zi) underlying all of Taoism. Their official documentation even leads with a quote from the text:

The Dao is like a well: used but never used up.

It is like the eternal void: filled with infinite possibilities.

The QiDao protocol includes two native tokens. Their Qi token serve as a governance token, which has a four year locking system for eQi (escrow Qi) that looks to be inspired by CRV-veCRV tokenomics. Qi staking earns “Qi Powah,” or a larger share of Qi votes, as well as 30% weekly repayment of fees to stakers. Last week these staking rewards were quite juicy:

The second token is the collateralized stablecoin $MAI (MIMATIC), which is softly pegged to the USD price and used for borrowing. A handful of cryptocurrency assets can be offered as collateral for 0% interest loans through the QiDao protocol to mint $MAI. Other than the 0% interest, the process has similarities to MakerDAO. The protocol earns revenue in the form of 0.5% repayment and deposit fees.

For the duration $MAI has been tracked by CoinGecko, its dollar peg has mostly held:

There is currently $78MM $MAI in circulation. It’s most commonly created by lending collateral, typically carrying a collateral-debt ratio of 200-400%.

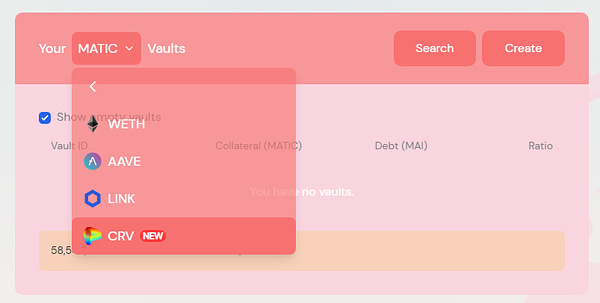

Most importantly is that beautiful rainbow Klein bottle in the last row. As of yesterday, QiDao opened a vault for $CRV.

Polygon has been a popular sidechain for Curve, with over $500MM in deposits. Since $CRV rewards landed on Polygon in addition to $MATIC rewards, it’s been a great destination for stakers. In some cases, these rewards end up significantly outperforming rewards for Curve on Ethereum. TriCrypto on Polygon, for instance, is recently earned >9% CRV, >9% WMATIC, along with >5% base APY.

The only rough part for Polygon stakers is that direct $CRV staking is not available on Polygon — users would have to send the $CRV back across the bridge. The existence of a $CRV pool on QiDao presents a new option for users to put this $CRV to work directly on the Polygon chain, by using $CRV to mint $MAI which can be used across the MAI Universe.

For this reason, the new QiDao Curve pool has been well received across the ecosystem:

If you’re interested, don’t take my word for it, as I’m talking about it but have not aped. As the old master put it:

知者不言, 言者不知

Those who know do not speak. Those who speak do not know.

Thanks for your positive reaction to PACMAN DAO yesterday. Among the great feedback you provided, one action was was to set up a better Telegram group that actually allowed conversation.

One other upshot: the community is crowdsourcing a public directory of all politicians who presently accept cryptocurrency donations. If you have friends working on campaigns, have them check it out! It would sure be a shame if somebody airdropped them…

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial or political advice. Author is a $CRV maximalist, and has no stake in QiDao or MAI — #知者不言, 言者不知