We’ve written before on how DeFi mostly continues to work just fine, even despite today’s cartoon valuations 🤡. We see the issue of blue chip markets occasionally trading like memecoins, pumped and dumped by whales without regard to fundamentals, but that’s usually separate from protocol operation.

However, as DeFi is mired in the realm of memecoins, beware governance attacks…

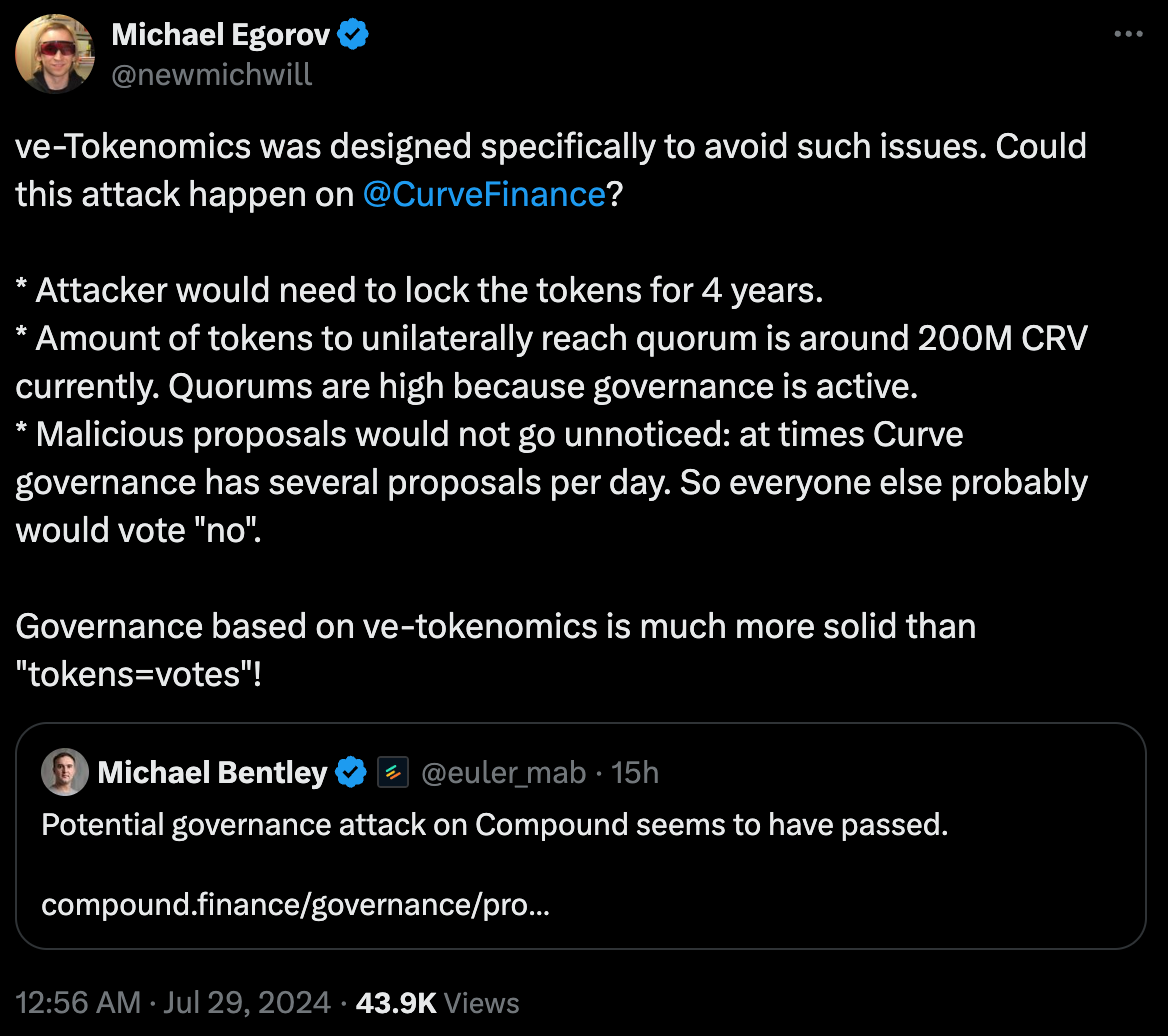

Curve’s suffered hard in terms of market cap, but fortunately was designed extra resilient for survival. Several projects have made clever iterations atop veCRV, but it should not be forgotten how it’s oft-imitated because veCRV has proven so strong at its core.

Advanced Farming Techniques

With gas approaching sub 1 gwei, it may be a good time to look at newer farming techniques, the result of advances in stablecoins and Curve’s DEX technology.

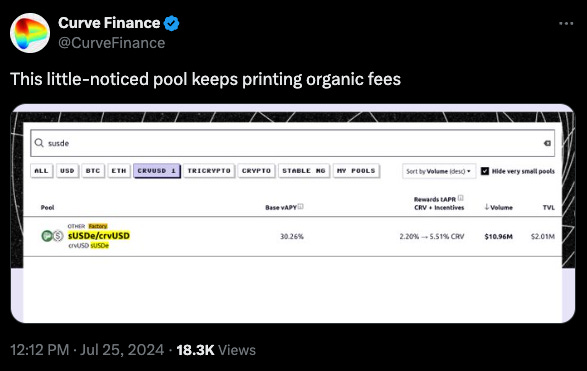

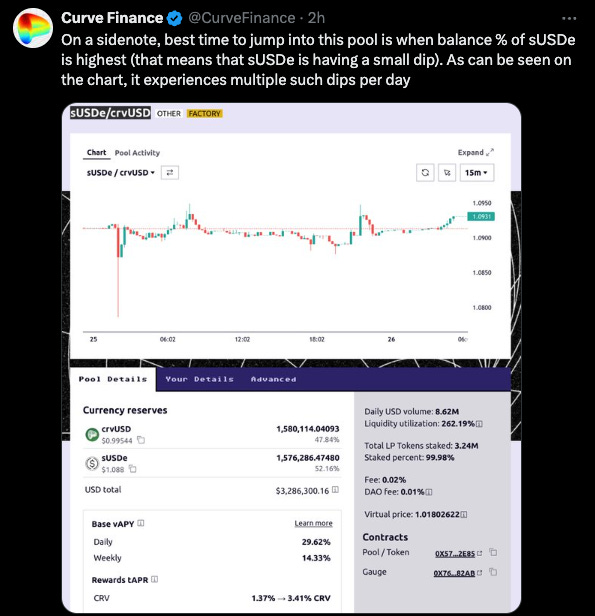

Consider the case of $sUSDe / $crvUSD

You can see the effect of sitting in $stETH… since 2021 the price of the LP token has [mostly] steadily increased, to about a 10% gain.

The promise of DEXes thriving very much depends on “pools that print,” as liquidity can only be propped up by advanced ponzinomics for so long before the tulip fields wither. The introduction of the dynamic fee is showing strong effect.

The dynamic fee allows for higher fees when the pool is out-of-balance, which effectively serves as a tax on arbitrageurs. When the pool is out of balance, there’s free money in trading the pool to a repeg, so the trade will occur regardless of any fee charged. Hence, coins that have higher trade volumes by being tied to leverage trading benefit strongly from this effect.

There’s also the piece of technological advancement that comes in the form of AMMs as regards redemption rates, explained in detail here:

It may not have been so efficient before, but as you can see there is some long history of such pools.

How should you, the humble yield farmer looking to juice returns with leveraged GMO crops, look to play this?

There’s something of a renaissance in stablecoin farming at the moment. Not Financial Advice, but of course one would expect that yields in DeFi must be superior to treasury yields given the inherent risks of DeFi.

Many interesting ways to play nowadays. Of course points are popular for both stablecoins and ETH restaking.

Usual money is making some noise by combining fast growth and a points program.

Our review of Usual Money is here

We don’t tend to look outside Curve for stablecoin farming too much, both because it hasn’t been necessary and because we’re slow to trust our stablecoins to new protocols, but we have enjoyed good results with f(x) Protocol

Soon to shake up stablecoin season is the introduction of flash loans…

$crvUSD is really in the first inning, if that…

As the stablecoin landscape grows competitive, Curve is also making adjustments to keep the $crvUSD peg keepers current.

We’ll have plenty more to say about merged markets and autobribes soon enough.

We maintain Curve innovation remains unparalleled, all part of the reason Curve remains the ever-beating heart of DeFi.