We’ll be quiet the next few days with travel, as the US celebrates Democracy Day!

We don’t want to abandon our frens and fam suffering abroad in oppression. Before we hit the road, we’ll be livestreaming today at 9 AM PT with our frens from Yieldnest discussing a big announcement.

Plus we’ve crammed this article full of tons of weekend reading for you…

Napier

Is there anything more American than insiders peddling their vote for rewards?

July figures to be the launch of the protocol’s ambitious plans to bring a slice of Pendle’s success to the flywheel.

The protocol is executing its ambitious roadmap with the deployment of their first yield trading pool on Curve.

And as discussed above, if you have voting power, you can cash in for POINTS!

Napier marks the first even within our weekend of holiday entertainment for you, as they have a star-studded space blocked off for July 4th. Enjoy the fireworks!

Convex

Nobody has enough CVX, not even Binance.

The token has been added to Binance’s “monitoring” list — one of Curve’s other language chats suggests this is because they do not use a market maker that can shore up liquidity, like some other crypto tokens.

But, even if Binance does drop Convex, does it matter? We may see a market pop up on Llama Lend (Arbitrum) to replace it…

Llama Lend

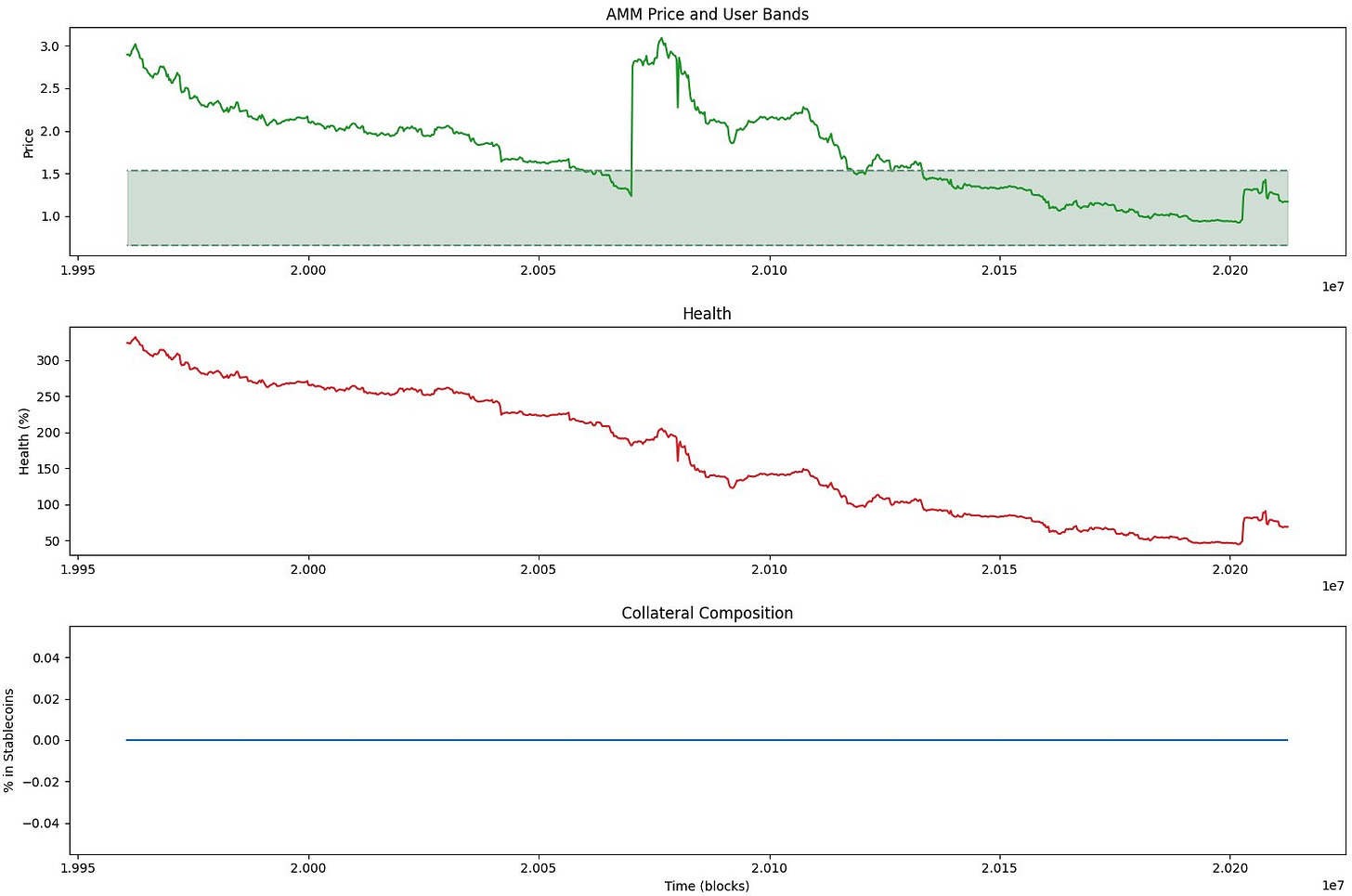

Llama Lend had quite an eventful day, as the price of $UwU took a massive dip.

We’ve mentioned before that as the altcoin bear market grinds on, several tokens become very easily manipulable by whale traders. We’ve seen this happen to some degree with $CRV lately, and that is relatively higher market cap than many altcoins.

Cash flow tokens are interesting in that they make bedfellows of both users with short and long term time horizons. Long-term focused users just stake tokens and earn consistently, not particularly caring about short term fluctuations. Short-term focused traders meanwhile take advantage of the market’s relative lack of interest in cash flow tokens by causing or enjoying the volatility available in tokens that can see prices easily spiked. So you wind up with this phenomenon where fundamentally sound tokens can also trade like memecoins…

The $UwU token is one such cash flow token that provides incredible revenues back to users.

But in the wake of the $UwU hack, liquidity plummeted to near zero… nothing on CEXes, and just 1MM on Sushi. As a result, during the massive drop in the token’s price, traders were not able or willing to perform soft liquidations.

This resulted in bad debt for the market, which was later cleared by Sifu.

We’ve seen a pair of small cap tokens on Llama Lend have trouble out of the gate, previously with $FXN on Arbitrum where little existed in the way of liquidity and arb trading.

Small cap tokens can work in Llama Lend’s isolated lending markets, but the checklist of conditions to make the markets successful continues to grow. In addition to requiring lots of liquidity at launch and bots willing and able to arb trade the pool, there must be constant monitoring of liquidity conditions. If liquidity conditions plummet, as happened in the wake of the hack, then previously adequate markets may become untenable.

Fortunately the issues were isolated to just this market. For your holiday reading, we strongly recommend the recent Llama Risk report on conditions where fluctuations in the price of $crvUSD, the base token for Llama Lend, can bleed across other markets, particularly markets like the hyper-leveraged stablecoin-to-stablecoin markets where users can trade depegs.

Or, if you’re into watching livestreams, check out WormholeOracle performing live!

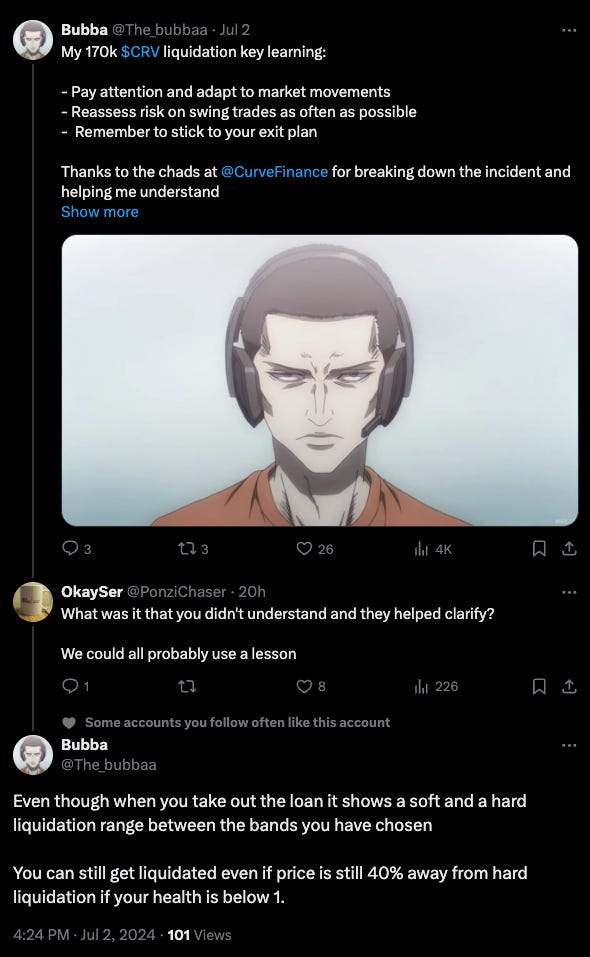

Relatedly, read through one user’s experience of getting hard liquidated.

Convergence

Is $CVG undervalued? A good read on one particular flywheel token relative to the field.

Well, in our opinion, everything in DeFi is undervalued, so at this point it’s trying to measure who’s more undervalued. AAVE has performed stronger than most, and that is also undervalued.

Conic

Conic is creating a $GHO omnipool!

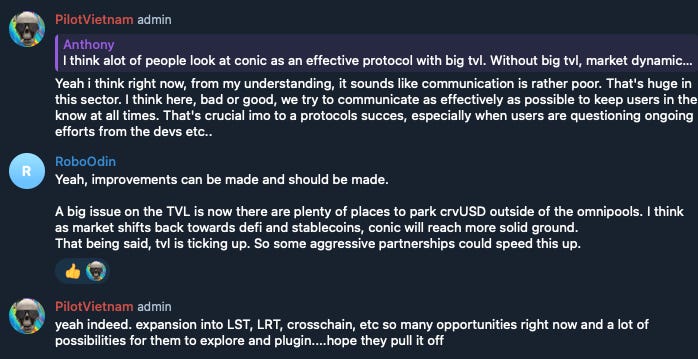

The protocol has been quiet since its relaunch, in terms of both its TVL and, per critics, the general communication. Reference this discussion in the governance forums.

Conic remains a favorite of ours. They’re shouldering the tricky expectations of needing to move quickly to catch the rapidly shifting trends in crypto, while also moving slow enough to ensure safety following the hack. We do believe that however much the narrative changes, interest in stablecoin yields will always be of interest to a core group of users, which is bullish for several protocols across the flywheel..

Incidentally, some unannotated updates on stablecoins that caught our attention…