Quite a feat to draw millions upon millions of dollars so quickly at such an early stage…

So then, what is $deUSD? And how has it soared to ::checks notes:: almost $90MM? As you’ll soon see, Elixir has a knack for bringing liquidity in size.

Most impressively, the token’s official launch is slated for today, per this thread.

How is this new stablecoin, modeled off the success of Ethena, seeing such immediate uptick? Let’s start by dissecting what is Elixir…

Their homepage makes it sound like a lot of buzzwords and fluff, but this is in fact a proven product solving a substantial pain point: Liquidity for order book style decentralized exchanges.

Order book style DEX contrast with AMM-style DEX like Curve. Order book style DEX have had growing pains that AMM DEXes abstracted away by using fancy MATH to provide trading quotes. We’ve given short shrift to the challenges facing order book DEXes over the years because of our laser focus on Curve and AMM-style DEXes, but we’ll briefly summarize the state of affairs now.

Below we’re paraphrasing the far better synopsis on Elixir by our frens at Blocmates. We recommend you read their piece for the full background. It even has better memes!

In a nutshell, nearly every centralized exchange runs an order book style execution that match buyers with sellers in realtime. This supports trade types like limit orders, stop loss, algorithmic trades, et al. Traders from the TradFi paradigm remain deeply attached to the order book style, but there’s been a ton of difficulty in trying to fit CEX style order books into onchain DEXes.

Onchain order book style DEXes have had a tougher time because chains can’t handle the juice and get clogged when trying to process high trade volume. You want to focus on trading, not convincing validators to accept your transaction.

Hence the “DPoS” (Delegated, or sometimes Decentralized, Proof of Stake) in Elixir’s pitch. Like a Republic to a Democracy, there’s no sense in putting every minor decision to a vote when you can elect representatives to vote on your behalf. We’ll ignore any snipping about the state of Western democracies these days and submit that a DPoS setup is the minimum compromise needed for a blockchain to support the throughput needed to run a DEX.

Elixir infuses just a touch more magic into the setup to make it all work, and that’s an eye towards the LP experience. The Uniswap v3 style “concentrated liquidity” mechanism requires LPs actively rebalance their position as prices fluctuate, generally requiring a whole toolset to adjust liquidity in realtime and making the LP game primarily accessible to pros.

It was a lot easier in the Uniswap v2 days, when you just deposited liquidity and let the x*y=k formula handle the rest!

This is the primary innovation underlying Elixir, which uses MATH to provide an LP experience more akin to the Uniswap v2 style. Specifically:

If you squint, the equation is not too different in principle from the math being done in Curve v2 pools — in that the formula is meant to be responsive to divergence from the target price. The important thing is that it allows liquidity to be provided in a “very similar risk/return profile to Uniswap v2 LPs”

For more on the derivation of this formula, refer to the 2018 paper on “Optimal High-Frequency Market Making” by Stanford researchers that is itself a good read and shows off the importance of properly concentrating liquidity.

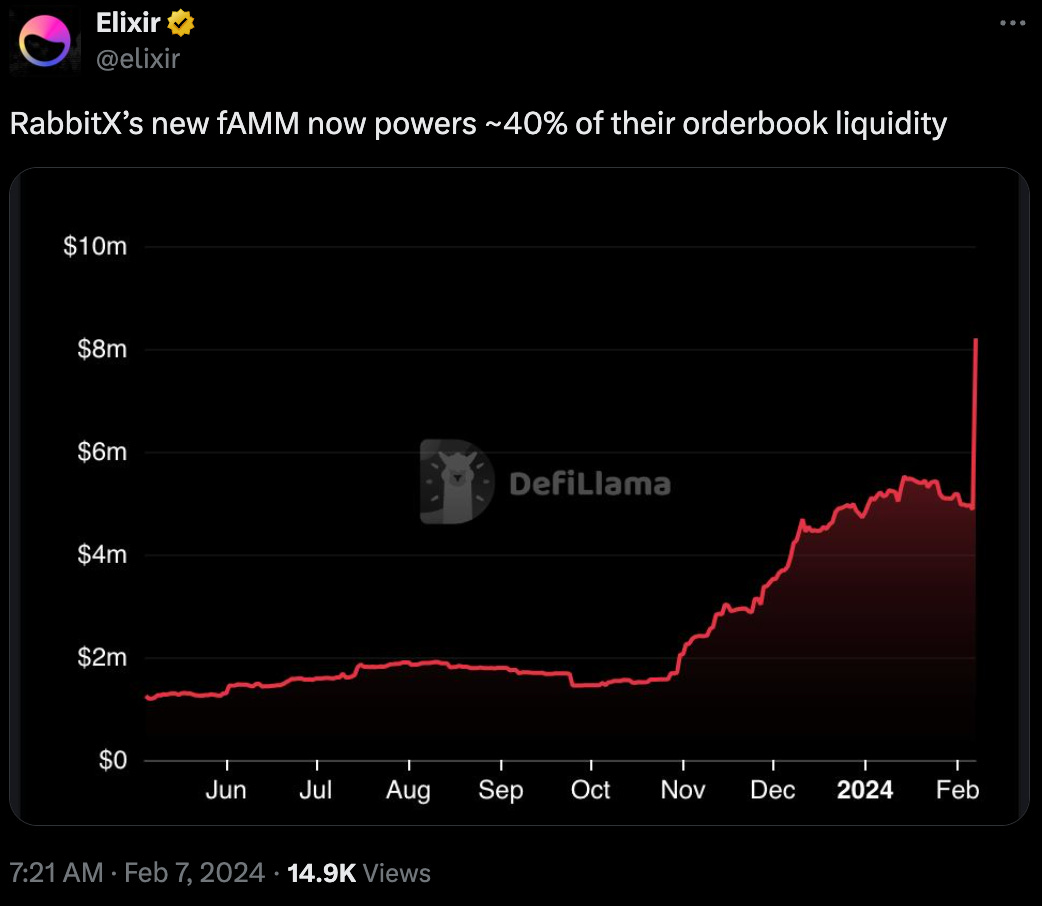

Armed with a means of bridging LP funds and order book style DEXes, Elixir has seen massive success in onramping liquidity at scale, by offering LPs a better experience along with rewards.

It’s a winning formula. Observe the effect on RabbitX

And Bluefin

And Orderly

Elixir is enabling order book style DEXes to scale quickly, and it’s revolutionizing the game.

We haven’t unpacked this chart to say if it’s specifically the effect of Elixir causing the uptick in DEX to CEX spot trade volume, but it’s fair to say that it’s certainly not hurting…

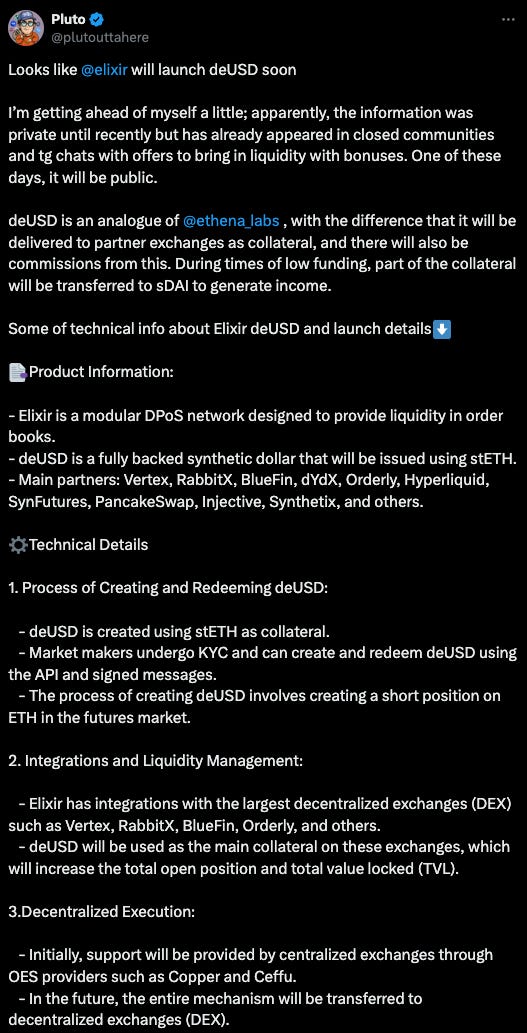

Their new stablecoin $deUSD operates in the same fashion as Ethena, and is meant to be the primary collateral for all their DEX partners. This post has the definitive details on deUSD:

In sum, it’s a tidy use case for a product with compelling adoption. No wonder the big brains have already been all over this…

We’re scarcely scratching the surface here. For more, recommend to check out the Elixir documentation and the aforementioned Blocmates piece.