July 5, 2023: Stablecoin Decentralization 🔍💱

Quantifying the murky concept of "decentralization"

What is “decentralization?”

In 2023 AD, there’s still not really a good answer. As

is fond of saying, ask 10 people, and you’ll get 12 answers.He helpfully propose a rubric for what counts as “decentralized.”

It’s a nice rubric to be sure. Perhaps the crucial takeaway is that decentralization isn't a binary switch, but rather a fluid spectrum. Most everything in DeFi is centralized to some degree, particularly at the outset.

As degens who prefer decentralized solutions, we tend to be forgiving of such centralization, provided the overall drift is towards greater decentralization as the protocol gains product market fit.

This is one of dozens of reasons why some attempt to quantify decentralization is important. We’d like to know whether or not a protocol is actually improving itself, or if its backsliding into centralization.

Mind you, not everybody on the planet actually likes decentralization. Venture capitalists often prefer centralized entities. This allows them more ability to finagle a sweetheart deal, or a specific phone number to dial if they need to yell at somebody. A lot of retail users like having somebody who can reset a forgotten password or manage their wallet.

Degens who have been around the block, however, have seen too many centralized exchanges blow up, while the decentralized exchanges keep functioning like clockwork. Whenever a protocol is too centralized, it often becomes an attack vector for hostile governments to shutter the protocol and rug user funds. If you kept your funds in decentralized protocols in the great crash of 2022, you probably ended up a lot better than if you’d parked your funds in the centralized web3 services.

The question of decentralization has been foremost on our mind as we’ve been trying to deconstruct the so-called “stablecoin trilemma,” which asserts that a stablecoin must pick two of the three: stable peg, capital efficiency, and decentralization. Whether or not this is indeed a trilemma (we are doubtful), it’s more or less impossible to argue either for or against point without an analytical definition of what “decentralization” actually means. (To say nothing of the other planks… but that’s a subject for another article.)

For instance, Luna’s $UST collapsed — does this count as a casualty of a “decentralized” protocol, which it claimed to be? Or should it count as “centralized?”

If you can quantify the level of decentralization of a protocol, then the entire question can be attacked as one of statistical analysis. Just run some multivariate regressions and correlation tests against peg mechanics and capital efficiency metrics. It’s yet another reason to pursue a formal definition of “decentralization.”

Sadly, such a definition remains elusive.

While there ended up being some valiant attempts at defining decentralization in the above replies, we decided to opt for a simpler yardstick: we consulted the wisdom of the crowds.

Under the premise that “nobody can specifically define decentralization, but they know it when they see it” — we decided to crowdsource the answer through a series of Twitter polls.

We tossed it out to the public to rate the level of centralization/decentralization of all the top stablecoins by market cap. These can be assigned point values and averaged to compute a decentralization score, in which a “3” would be a perfectly decentralized protocol.

Is this a perfect measure? Certainly not. A Twitter poll from an often shadowbanned account, therefore viewable disproportionately by Curve maximalists, is bound to be an imperfect sample. Trolls and cranks abound on Twitter. Protocols could have shared the post with their own fans to attempt to skew the results, though they thankfully didn’t.

Is this still a better ranking than anybody else has produced? Absolutely. We’ve read through every resource on the subject we could find, and nobody has attacked the question of decentralization from such a quantitative perspective. Haters will dismiss this analysis on grounds that it’s an imperfect sample, but we see it as raising the bar. We’re providing the best yet metric of decentralization for various stablecoins, in hopes that other armchair analysts can retort this by improving upon this methodology and delivering an even better metric. We’d use it!

Therefore, we release the results to the public to use as you see fit. We note that, whatever the potential issues, the results look mostly great. We can wonder how some trolls thought to mark $USDC as “very decentralized,” or $LUSD as “very centralized,” but nonetheless appreciate that the results shook out with both in their expected positions. We did not take any action here to remove potential outliers.

Here are the raw results. It passes the sniff test!

Here are the raw data so you can copy for your degenerate needs:

usdc 0.102

usdd 0.167

gusd 0.171

tusd 0.214

usdt 0.263

usdn 0.308

usdp 0.327

ust 0.684

dai 1.155

frax 1.508

mai 1.637

susd 1.730

mim 1.937

lusd 2.357

crvusd 2.392Plus the actual vote breakdowns

Note… USDN was still ongoing at time of publication.

There’s only one case where we’d dispute the results. We note that $crvUSD is ranked above $LUSD in terms of decentralization, but we don’t feel this is fair. After all, $LUSD is so decentralized it doesn’t even maintain its own web application. The tier may be accurate (these are the only two coins where the majority of voters labeled it to be “extremely decentralized.”). However, both stablecoins attracted a few votes for “very centralized” which suspect may be trolls.

We didn’t tamper with the data, just in case these votes were sincere and legitimate expressions of frustration. However, we note that recently Liquity bizdevs have been quite aggressive in verbally accosting $crvUSD. We suspect this cache of ballots may, in both cases, be vengeance votes from opposing camps seeking to contaminate the results. If we assume the “v0” votes are outliers and reweight, we would get:

crvUSD 2.564

LUSD 2.648We feel this is more accurate and puts LUSD as the most decentralized stablecoin. One might feel it important to do this at the other end, with $USDC, $GUSD, and $TUSD, but it wouldn’t change the rankings anyhow.

USDC 0.0519

GUSD 0.0592

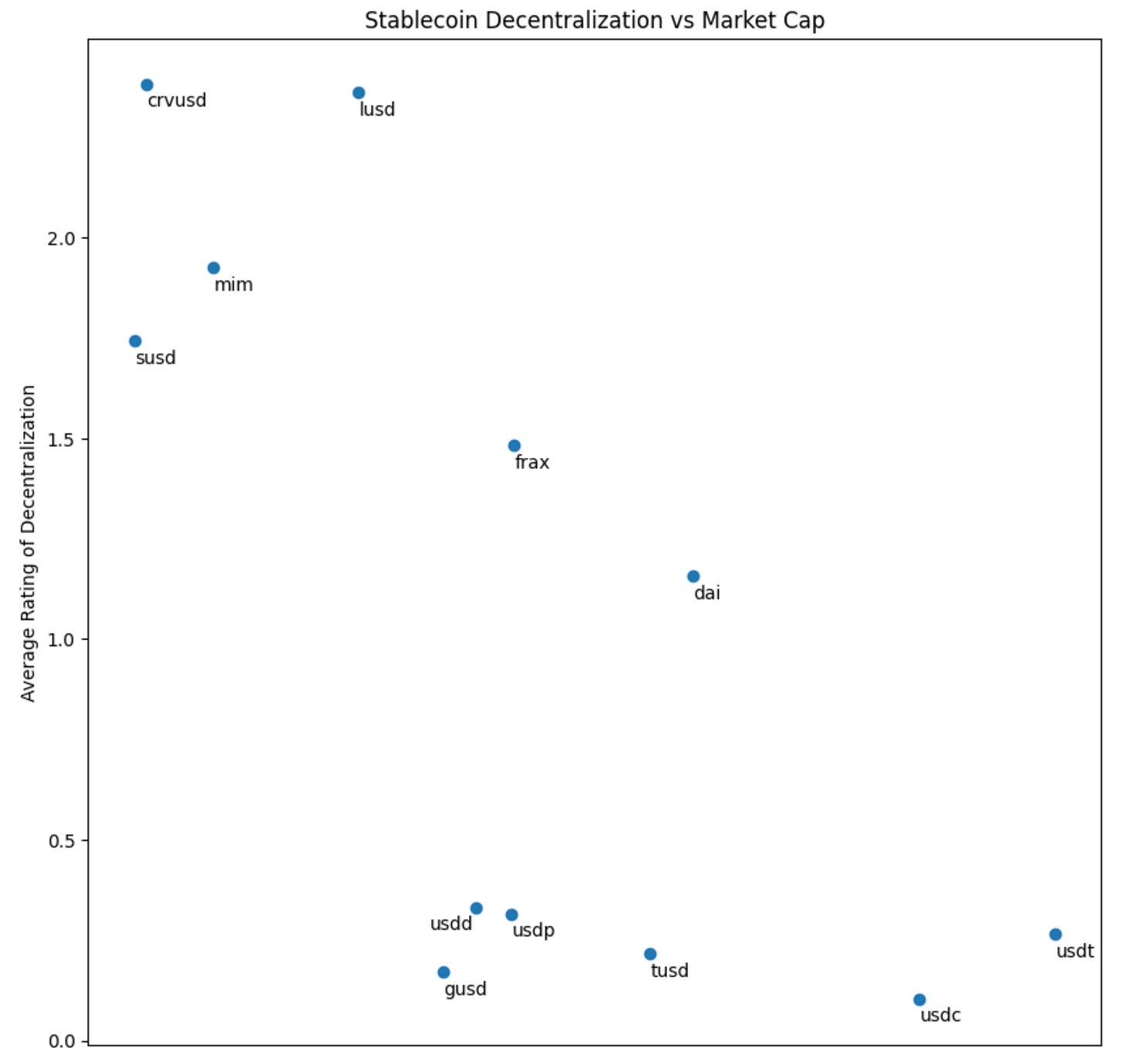

TUSD 0.0888You’ve read this far, so we will gift you with one takeaway. Plot these data against market cap (log scale) and you see that centralized stablecoins are winning at the moment. This plot (which excludes depegged tokens like USDN and USDC), shows off the challenge that decentralized stablecoins have had in scaling to date.

It’s a notable outcome that the coins ranked as semi-decentralized (FRAX/DAI) have had better luck to date at actually scaling than their more decentralized counterparts.

This is the first piece in a short series, in which we’re diving into the guts of some heavy data munging we’ll be doing in the run-up to ETH-CC.

Of course, we won’t be able to get into such gory level of detail onstage. Interested readers who want more detail on the presentation will be presented with links to these articles. Your help in proofreading and reviewing many of our foundational assumptions will help make the event a success!

super article. could you tell in which event you guys are presenting so that I can attend the same

indeed murky.

are you able to plot borrow rate vs. decentralization factor... is there any correlation of stability, rate premium,...?