Thank you to all who turned out to ETH Barcelona and attended the panel on Risk Factors in Stablecoin/DeFi Design. Really enjoyed this conversation, make sure to follow giga-brain fellow panelists @TheBlockAdopter and @Tiza4ThePeople as well as the outstanding moderator @jessicarsalomon (unless everybody’s already moving over to Thread?)

Couch Cushions

Curve yields are down to “only” about 10% in pure stables. Does this mean the magical money fountain beneath the ample Curve couch cushions has run dry?

What’s the value of a golden goose that keeps providing you free money in good times and bad? Probably ZERO, so please dump it!!

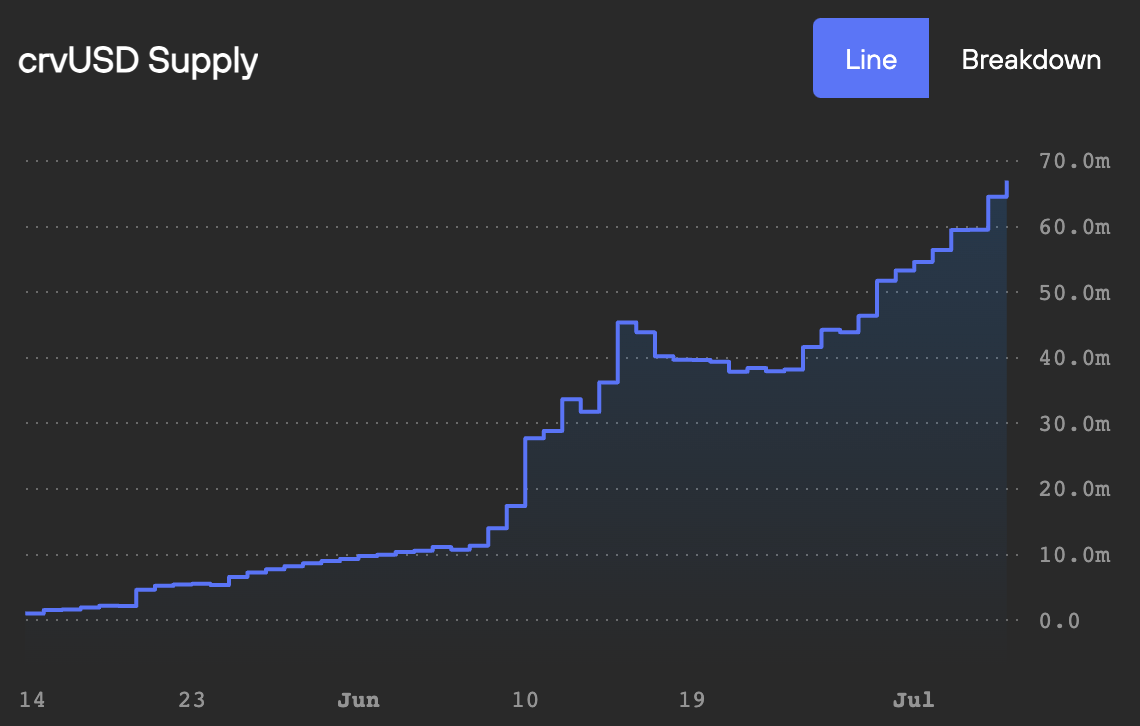

That said, the growth of $crvUSD is really something to behold.

Mind you, this growth is before borrow rates plummeted, which can only increase the yield premia.

Perhaps holders of veCRV may have something to look forward to.

Anyhow, the real question is not about the rationality or irrationality of crypto prices are irrational, we’ll never solve that one and it’s not that interesting.

The real question… why does Curve keep seemingly “forgetting” about free money that it found lying around its ecosystem? Wouldn’t you think if Curve was truly death spiralling, they would be desperate to collect every last penny?

The fees tab on 0xAlunara’s Curve Monitor helps explain the situation:

As you can see, the weekly fee dump isn’t so simple thing… the above screenshot is just page one of about a kajillion pages. Curve has gauges scattered across nearly a dozen chains. The biggest pools that make up the lion’s share of the revenue are already well automated, but the long tail tends to play host to the uncollected fees.

Usually, the “couch cushions” are just picking off the lowest hanging fruit. In the screenshot above, it looks clear that XDai is the gauge most worthy of being unclogged… “Oh, people are actually using XDai? Who knew… probably worth checking what’s wrong with the bridge!” Sidechain bridges are sometimes not straightforward and need custom scripting to enable fee collection. For the case of XDai, it’s one of the smaller chains on which Curve launched, so fees have been gradually accumulating uncollected, until suddenly they become worthy of attention.

Why the seeming lack of urgency? Well, if the quantity currently orphaned on XDai did flow into your pockets, it would only amount to about $0.00017 per veCRV. As a staker, you wouldn’t really notice it these fees started flowing. Fees are basically pocket change scattered among a few hundred pools. Individually, they don’t move the needle, but aggregate them all together and it adds up to meaningful cash flow.

Often times, particularly on sidechains, funds get overlooked or stuck and don’t burn correctly for whatever reason. Sometimes it’s simply not worthwhile to harvest (due to gas costs). Devs do eventually get to it though as the money starts to pile up, and combined together it becomes the firehose of money Curve stakers enjoy.

In other words, no matter what, there’s almost always more money in the couch cushions. The only issue is that spending the time to unclog the money pipeline may not necessarily be the most productive use of time. All the same, too much money is hardly the worst problem facing a DeFi protocol in 2023.

Possibly a reason that veCRV locking has been ripping lately?