Good morning to all, especially the haters. We have so many wonderful tangents we could talk about this fractal Friday. For instance, how often do we get treated to pure alpha from the pure alpha himself, Curve founder Michael Egorov interviewed in Rekt’s feature on Curve Wars:

We thought we could take some time to talk about Binance’s troubles, or Circle’s IPO, or a gallery of llama airdrops… all super interesting topics. But I’m interested in nerd things, so I want to talk about the hot topic of Maxi/Miner Extractable Value.

Bitcoin FUD always be scary stuff like kidnappings, nukes, and boiling oceans, while Ethereum FUD is so deliciously dorky there’s only a few dozen people who even bother to follow it. For several reasons, we’re not likely to see Bitcoin MEV FUD hitting the tabloids any time soon.

At scale, most blockchains run up against a few natural speed limits: speed, decentralization, and security.

The only exception may be Dogecoin, where potentially promising devs have teased a solution so good it not only solves all these competing factors at once, but I hear it may even be capable of simultaneously detecting a particle’s momentum and position!

Ethereum is the busiest blockchain, and the industrious ETH devs have done their best to optimize these various factors right up to the Pareto frontier. At this bleeding edge of efficiency, we’re seeing MEV emerging as the big issue.

For those underinformed about MEV, it’s not that arcane. If I may be permitted a boomer reference… back in the day people used to use a thing called a “checkbook” for making payments. Banks would charge overdraft fees on any checks that bounced. Imagine a customer with $9,000 in their account making a $2,000 deposit on the same day they write several $20 checks and a $10,000 check. How should the bank process this sequence?

Obviously, they clear the $10,000 one first, causing all the other small checks to then bounce and be subject to overdraft fees. Then they apply the credit. They could theoretically be nice and order it in a way where there were no overdraft fees, but as bank it’s up to their discretion.

This analogy is imperfect, like all analogies, but it’s a parallel phenomenon to MEV. If you have the power to reorder Ethereum transactions in such a way as to generate more profit, why wouldn’t you? If you’re a miner, this gives you a lot of power. Why wouldn’t you prioritize incoming transactions in whatever way benefits you most? You need not even be a miner to reap the benefits, you can simply watch the mempool for pending transactions and sneak in your own transactions with higher priority.

MEV has evolved quite a bit, this article from April provides a good primer. In the early days MEV was more likely to take the form of simple front-running: you see a large trade sitting in the mempool waiting for confirmation, so you snake them by inserting a trade beforehand so they get rekt.

Nowadays strategies are growing increasingly sophisticated. If you get a free sandwich today, more than likely it’s a 💩 sandwich.

MEV is a high profile issue within Ethereum, such that July kicked off with a MEV.wtf summit. The most notable reaction to MEV for the past several months has been Flashbots, a collective of researchers who are providing resources to absorb these effects.

Rather than suppressing MEV, the team built MEV-geth, which moves a lot of the competition for extracting MEV off-chain into a Flashbots auction. My uneducated hillbilly take is that on-chain competition for MEV is what caused the high gas prices of Q1 2021, and the coinciding increased usage of Flashbots deserves credit for reducing the pain at the pump.

The most recent kerfuffle that has everybody panicked is a recently floated concept of “reorgs” (we sometimes see it hyphenated, but we’ll go unhyphenated in hopes people start rhyming reorg with old-timey name Georg.)

Instead of simply front-running a block that’s about to be mined, why not just rewrite the past few blocks to make conditions more favorable? You can’t really rewrite a block with several hundred confirmations, but the very tip of the blockchain is still fuzzy.

The concept is being built in public, but has not officially been released just yet so the problem remains mostly theoretical.

The flashbots approach is to essentially assume reorgs are more or less inevitable, and to build tools to democratize access to reorgs among those competing to rewrite history.

Several voices are strongly opposed to reorgs on principle.

This thought experiment akshually tends to convince me that reorgs are in fact inevitable. Flashbots creates the means, while such a hack would provides both opportunity and motive. Any prosecutor would declare this to be case closed.

If reorgs are indeed inevitable, the best strategy is to look at how to mitigate.

Just as Flashbots to date has appropriated the worst effects of MEV, we’re cautiously optimistic that building tools and generally preparing for reorgs will offset the worst effects. Some speculate that increasing offloading to L2s may play a role in resisting reorgs.

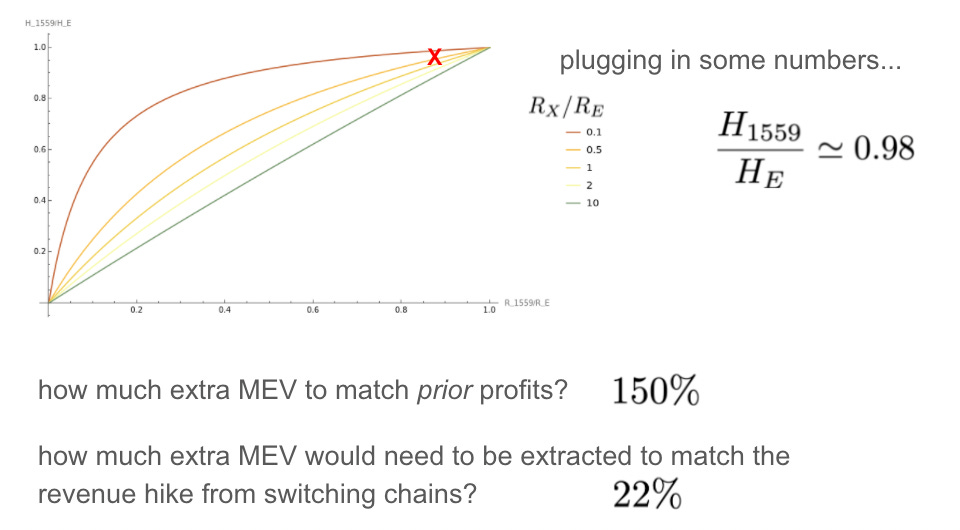

Notably, the MEV.wtf conference didn’t mention much about reorgs given last week was a lifetime ago. They did run some helpful numbers on shifting incentives in a post EIP-1559 world:

Of course, there is one sure-fire way to guarantee reorgs don’t happen anytime soon.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial or technical advice. Author is a $CRV maximalist. If I got any details wrong shout it out and we’ll give you credit.