This Memorial Day, we asked: what did you do during the Great Curve Wars?

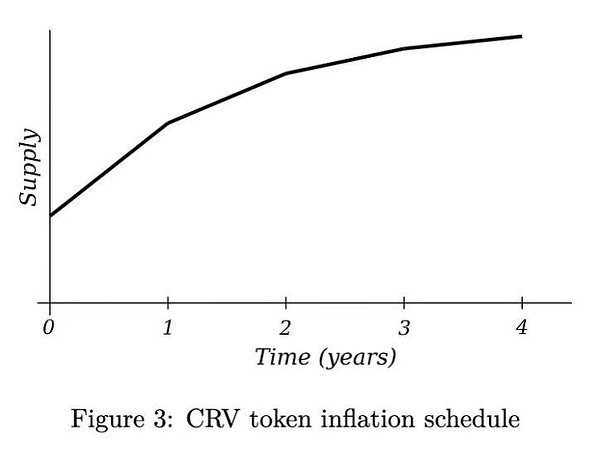

The Curve curve is flattening. Resources are growing scarce. The people talk of a great battle to come.

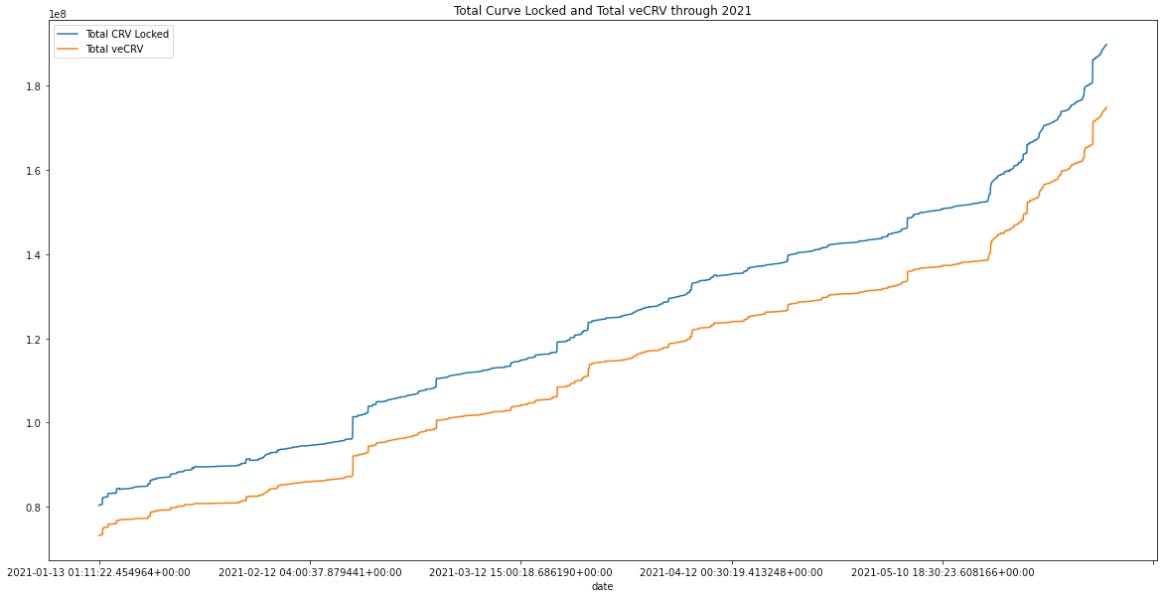

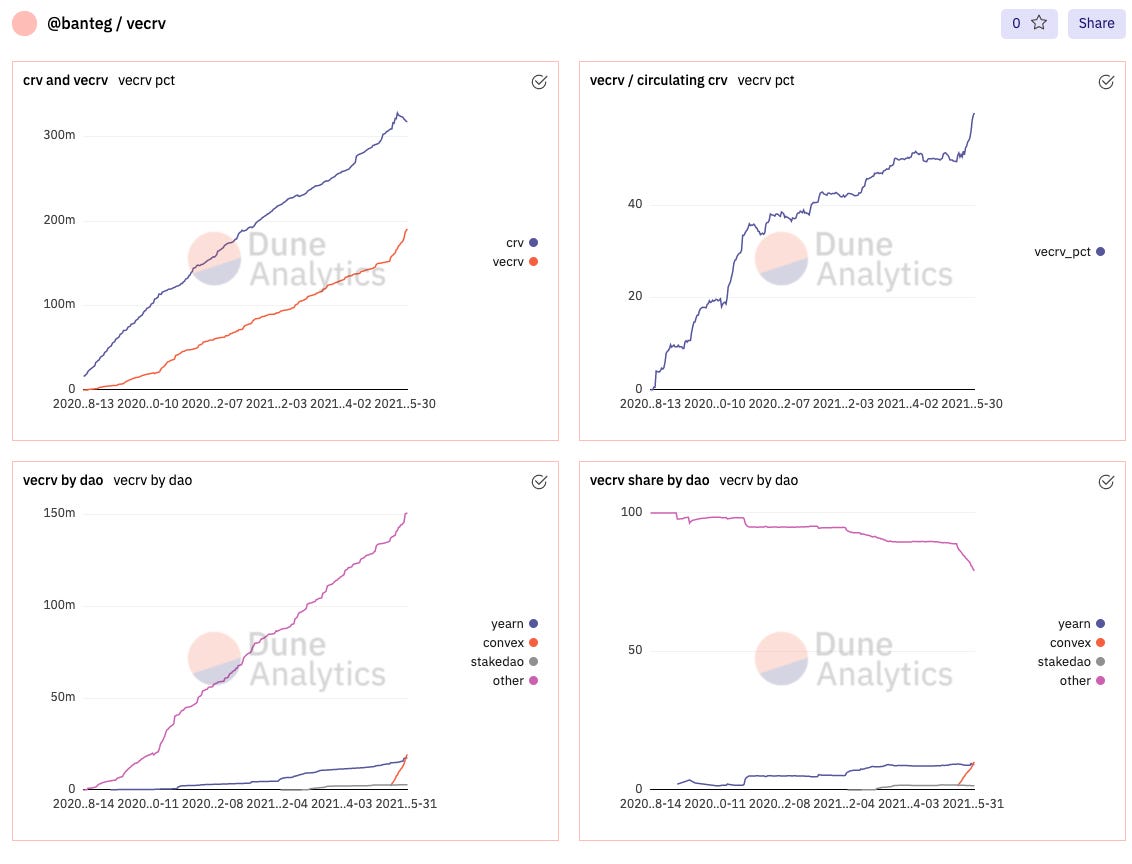

Among Yearn, StakeDAO and now Convex Finance, multiple DeFi protocols building on Curve can’t get enough $CRV to max out their boosts. With these protocols increasingly coming into competition with each other, they all hope to max out their APYs to best serve users. Observe the acceleration of veCRV locking the past month.

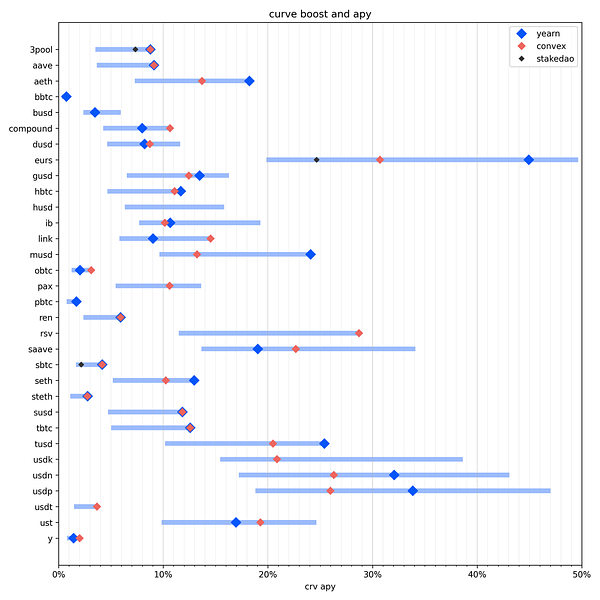

At the moment yields are a bit of a mixed bag and dependent on the protocol.

How did we get here?

The Run-Up

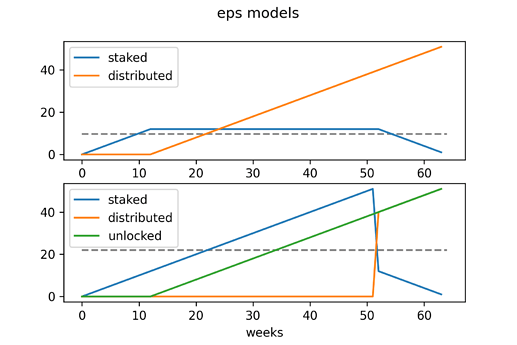

The groundwork for the events preceded the launch of Convex. Within the Yearn governance forum, the community had a detailed discussion about optimum farming strategies for the EPS airdrop.

YIP-60 laid the groundwork for moves, with speculation that it was planned all along to dump profits from the $EPS airdrop to buy $CRV. It’s a point of some debate.

The one thing everybody could agree on: this was a lot of money. Whatever the cause, the result was that Yearn would make large purchases of $CRV.

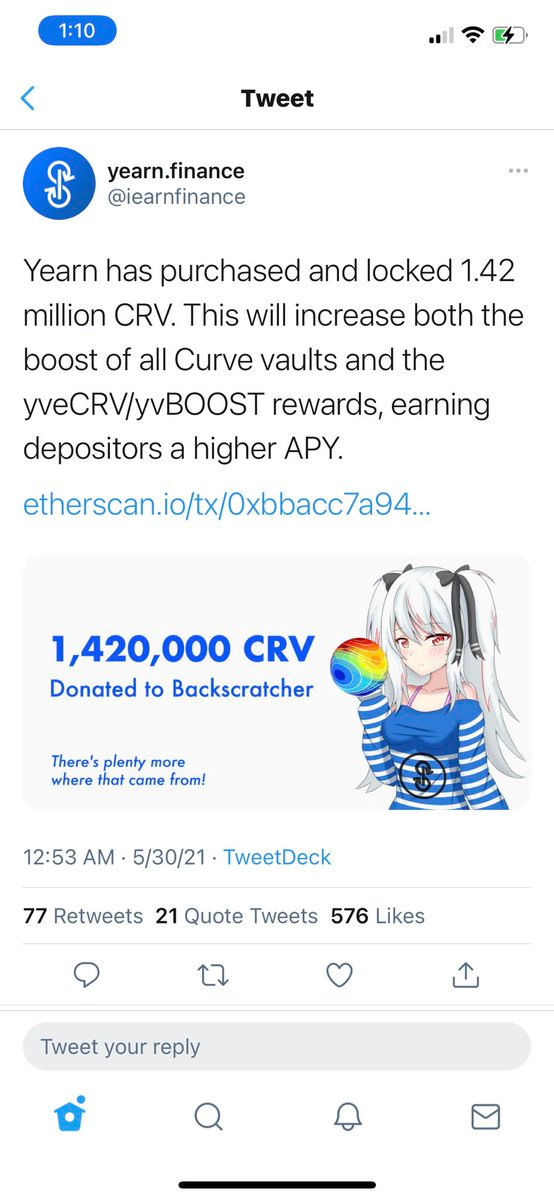

Indeed, Yearn has been very transparent about its interest in purchasing as much $CRV as possible.

Convex Launches

Just weeks ago, the launch of Convex proved about as successful as any new DeFi protocol could hope. The protocol already passed $1 billion in value locked. Just yesterday, Convex flippened Yearn in terms of total veCRV locked.

Cry ‘Havoc!’, and let slip the Curve War!

It’s Complicated

Crypto Twitter is already primed for blood just a week into the bear market. Imagine how insufferable a long winter will be.

At any rate, as much as we all enjoy a good battle, we think the talk of a heated competition is mostly overblown. After all, can you point to the spot on the chart where Convex touched Yearn?

At the moment there’s not any particular evidence Convex is cannibalizing Yearn or even impacting it in any way. Both Yearn and Convex are useful services with very distinct mechanics. In such situations, we often expect they’ll find a different userbase as they evolve in distinct directions.

If these two protocols are indeed actually a war, then one of the enemies has already breached the gates. Yearn already controls 42% of the Convex TVL.

Yearn operates more like a 2 and 20 hedge fund. Historically Yearn has shown capacity to shrewdly and swiftly aim their money cannon in the direction of whatever major development befalls the crypto world. They’ve deployed a whopping 178 strategies alone in pursuit of such opportunities since launch.

Yearn may also be able to corner a niche market among users who care about, say, women’s issues.

Convex’s offerings are not quite so complex, at least at the moment. They have a few tokens that throw off cash, in what users liken to a money flywheel.

The Curve War

While the competition between these two is overblown, we agree there is at least one point of competition. All parties want more $CRV, and not everybody can get it all. To this extent, a Curve War is very much in effect, in the form of a bloodless bidding war for $CRV.

More than ever, we can only recommend you buy stonks in Orville Redenbacher and enjoy the show. 🍿🍿🍿

** Update, 6/1 10:00 PT **

@Banteg passes along this helpful dashboard.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice so don’t actually buy stonks in Orville Redenbacher, a property of ConAgra $CAG. Author is a $CRV maximalist and has positions in Convex and an indirect interest in Yearn by way of the Ironbank pool.