An unorthodox strategy driving the new $PUSd-3CRV pool is capturing attention. Crazy? Or crazy like a fox?

Once the alfa has expired, we’ll unpaywall this post so the general public can access the detailed playbook on how to execute this unique strategy.

Note there’s no secrets contained below… everything is pieced together from public comments. Paying subscribers gain only the time spent compiling the saga into an easily digestible format.

Thus far, everything has been seemingly playing out according to a highly public plan. About a week ago @Tetranode issued an unusually specific prediction:

Some people have previously blocked the rabbit-whale and missed the public alfafa. Others may have followed his advice and made a few extra bucks in an otherwise punishing market.

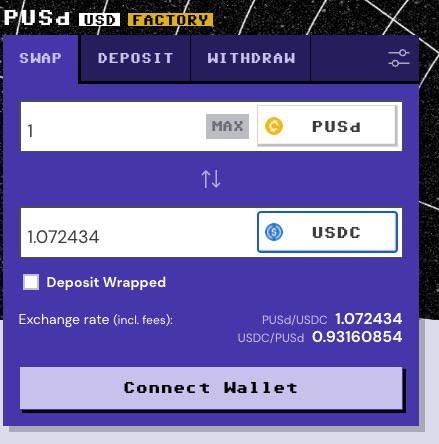

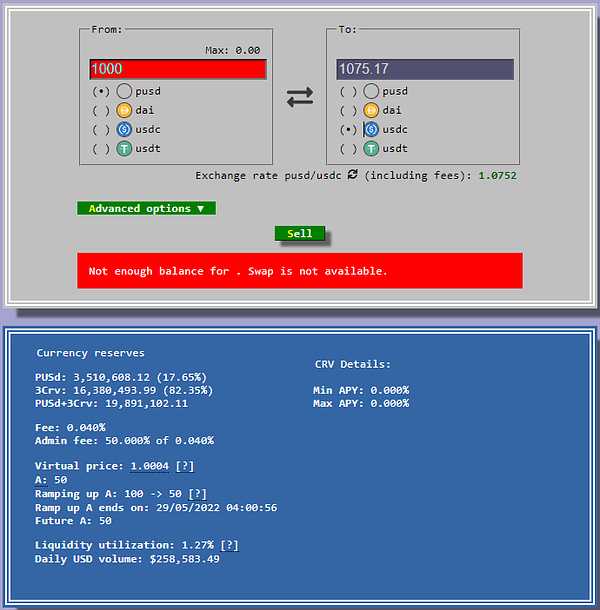

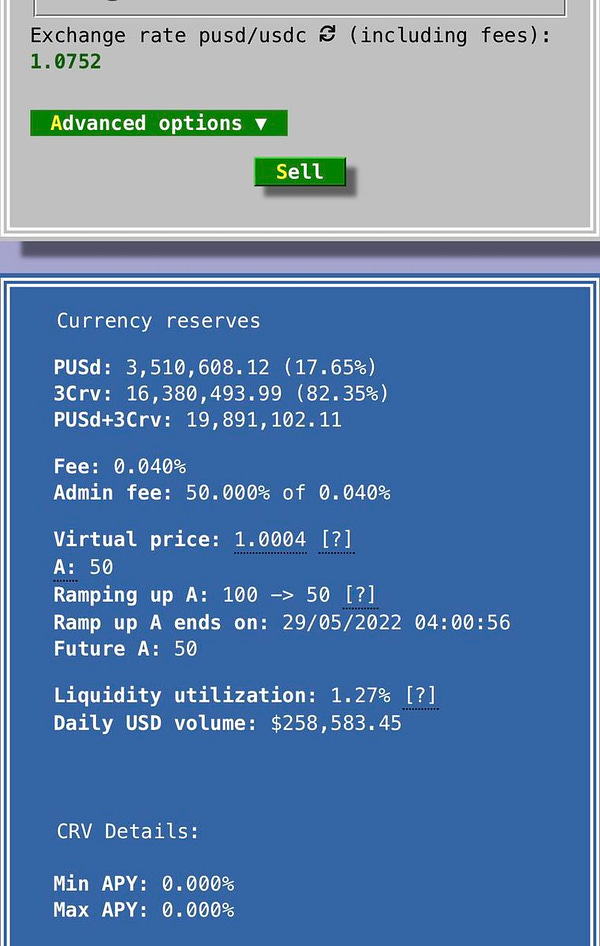

Exactly as predicted, today the pool is currently about 7% above peg.

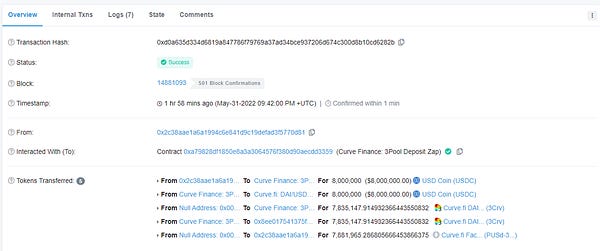

Over the past week, millions of dollars has been dropped into the pool at great expense to intentionally depeg the coin to the positive. As we’ll soon see, these costs may be reimbursed shortly.

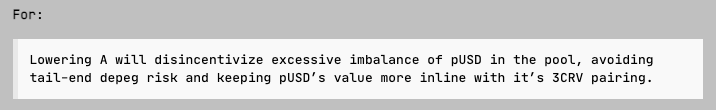

Correspondingly, on the governance forums, the team has moved to aggressively lower the pool’s A parameter.

The terse statement glosses over the unusual nature of the request. Typically Curve pools seek very high A parameters, which has the effect of keeping the pool tightly pegged during extreme imbalances.

Here we see the team intentionally doing the opposite.

In this case, the team is executing the reverse maneuver, in an effort to attract holders of $PUSd to jump into the pool.

At the moment anybody who deposits $PUSd into the pool gets a nice bonus — free money for parking their cash in the pool.

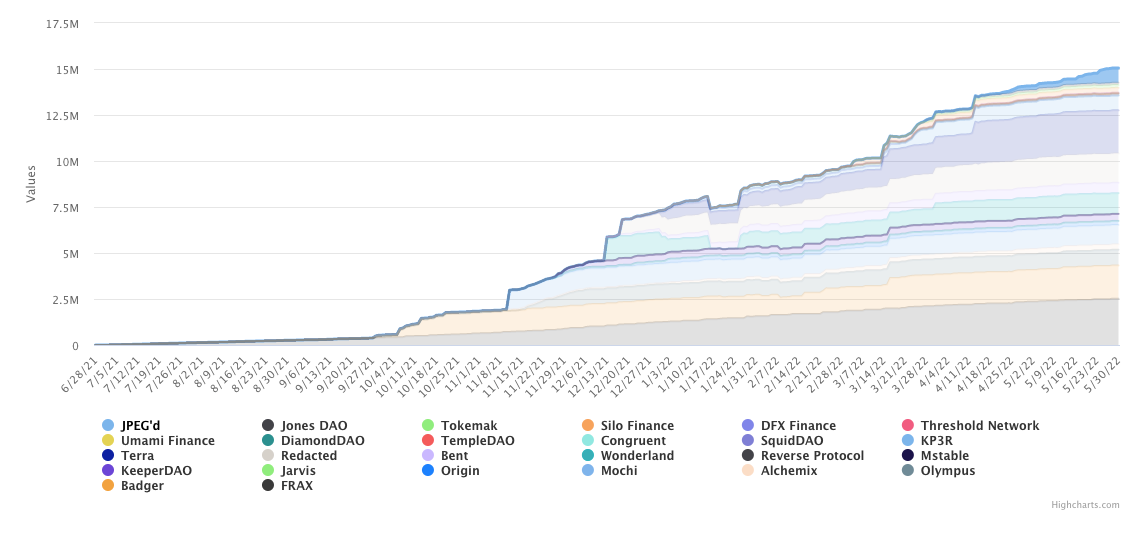

It’s not the only incentive to jump into the pool. The $JPEG team has been scooping up cheap $CVX over the past month.

As of tomorrow the pool party is about to get lit.

The pool is being engineered to be the only viable destination for anybody holding $PUSd.

If you’re familiar with the mechanics of $PUSd, then the master plan starts to make fall into place. Let’s review the mechanics of JPEG’d, the protocol which has the sole discretion to mint $PUSd in the first place.

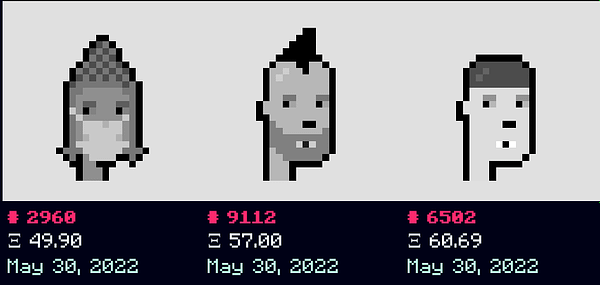

JPEG’d is a lending platform for blue chip NFTs, currently rocks and punks. Most NFTs just sit around collecting dust, so JPEG’d allows users to deposit their NFTs and take out a loan in $PUSd for about a third of its floor price at 2% interest.

For users who can earn >2% on their $PUSd, this becomes an opportunity to earn free money on their NFT. If the Curve pool smells like a >2% opportunity, this provides a strong incentive for NFT holders to jump into JPEG’d.

For holders of rocks and punks, JPEG’d has engineered the entire tokenomics to be an irresistible chain of incentives. It’s the ultimate VIP experience.

Observers are already noting the easy play to profit from the imbalance.

The properties of the pool also allows for more complex strategies.

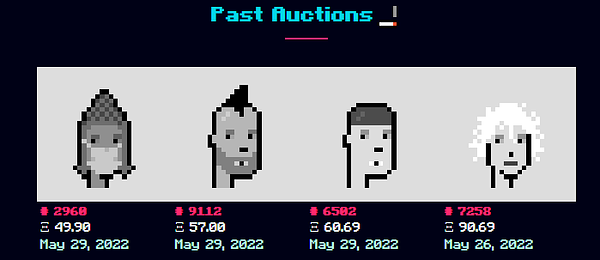

Naturally, none of this is without risk. A few early users of JPEG’d who were tempted by the prospect of free money already found themselves burned. In the most recent market dip, several users lost their punk. These punks recently got put on the auction block, all of which further expanded JPEG’s coffers.

If you’d like to study the plan in further detail, simply refer to the entire 0xBarry thread, who monologued the entire proceedings in public.

Degens always want alfa. Often times the alfa lurks inaccessibly in private channels. The best source is always building it yourself. Be the alpha you seek

Plenty of times the alfafa is laying out directly in public for anybody to grab. The trick becomes parsing the signal from the noise. If you’re not making the market yourself, your best bet is to keep track of who’s cashing the checks their mouth is writing.

In this case, the entire plan was made public. Now the only question is if you trust the source. Interestingly, in this case much of this leaked from users who are commonly blocked. Tetranode’s brash style has attracted several enemies. Napgener’s on-again, off-again relationship with $CVX FUD has earned him scorn from the community.

In this case, both (the former) had a hand in architecting the JPEG’d tokenomics. Block people if you must, but be warned that blocking too liberally may only restrict your flow of information.

edit:

Judging the credibility of the information is another story. Which hot tips are accurate and which should be ignored? Who is turning you into exit liquidity, and who is making you rich?

Sadly, I’m not qualified to judge this myself, even while I work daily to hone this skill. I do my best to pay attention to who makes reliable predictions, yet forecasting the future is always an impossible task.

Even with so much alfa floating around, not everything is available in public. Some topics remain forever shrouded in mystery…