We know the UwU hack looms large in everybody’s consciousness, but it’s quite literally yesterday’s news!

That is to say, we’ve updated the tail end of our post from yesterday with the remaining developments in the UwU hack and urge you to check there if you want the final updates on the subject.

It’s OK to ZK

Attention airdrop farmers… Curve coming to ZK soon…

Gearbox

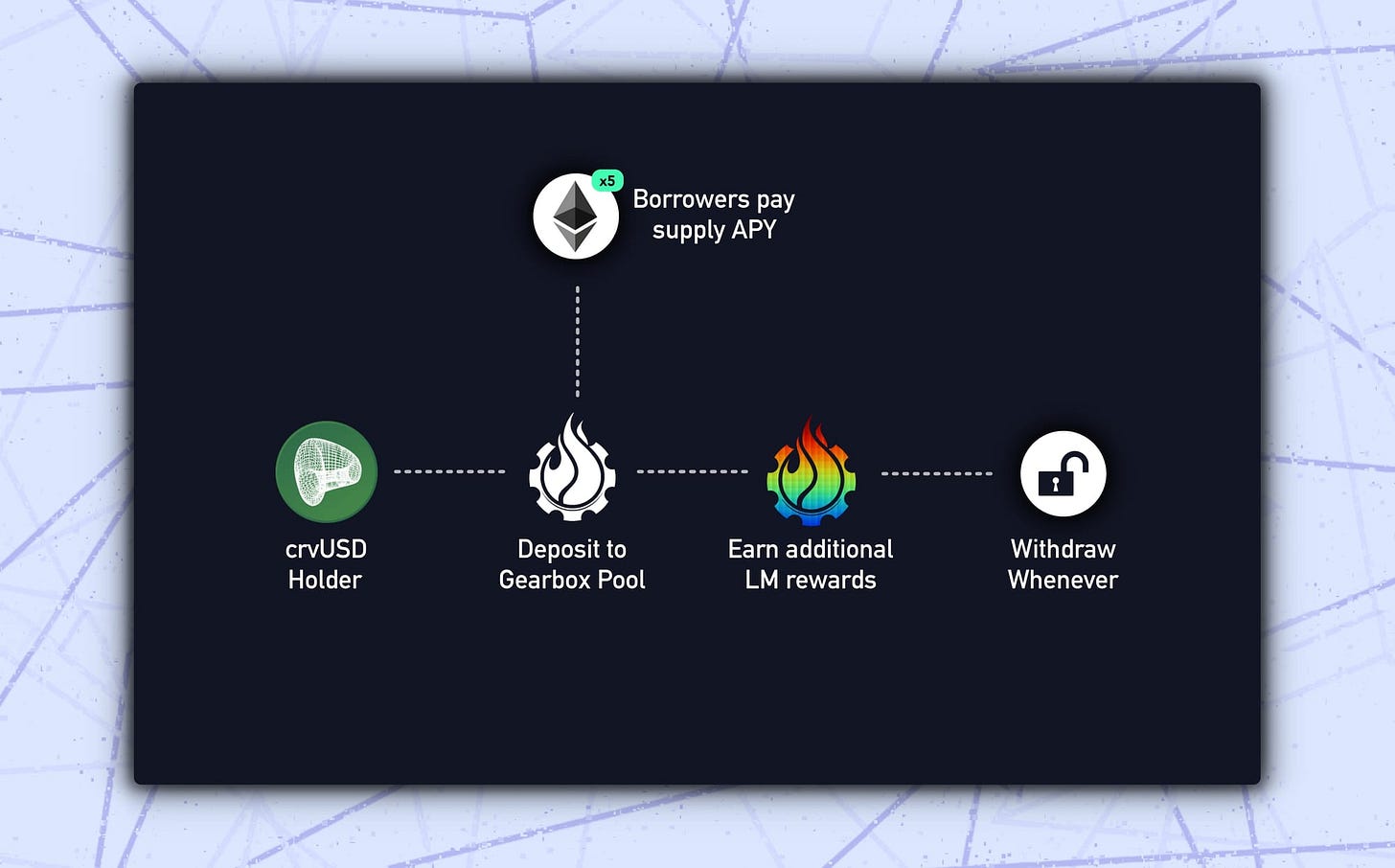

A $crvUSD lending pool has been launched on Gearbox

Non-US citizens can enjoy Gearbox’s fifth stablecoin pool, to passively earn rewards triply incentivized from three different sources, as laid out in their blog post:

As of publication this was sitting around 30.6%

All simple enough… incentivizes plus lending yields, analogous to supplying on Llama Lend.

The question on everybody’s mind after yesterday’s UwU hack is of course security.

You may perhaps take some reassurance that whatever “Lindyness” one might hope to see in this volatile space is Take some comfort in the fact that Gearbox has whatever “Lindyness” one might hope to see in this volatile space.

We first covered Gearbox in depth back in 2022, and they’ve remained one of our favorite DeFi protocols for the duration. Here’s a trip down memory lane:

December 20, 2022: Top $GEAR ⚙️🧰

We know crypto is supposed to be dead… so why is Gearbox shifting into overdrive? Let’s dive into the protocol that’s tearing up the racetracks.

Showing off how good of a business lending protocols really are, Gearbox TVL has been utterly ascendant in the intervening “DeFi is dead” several years....

Gearbox has a strong emphasis on the subject of security.

Indeed this is true of many protocols that later go on to get hacked. But they also have years of avoiding hacks, which matters:

“It's why we have never faced bad debt or an exploit in 2.5 years of Gearbox being live.”

It’s a great track record. Not that anything is guaranteed in this space. We know that even sophisticated DeFi veterans can get got, as master operator Mich found out in tragic fashion in yesterday’s UwU hack.

Playing on chain is a dangerous place, so we always recommend:

Don’t bother playing in DeFi… 5% yields from banks is good enough for most people when you take into account gas fees and exploit risk.

If you do play in DeFi, make sure it’s with money you fully expect to lose

If you check these boxes and still have money to burn, are in this boat and don’t mind lighting money on fire, then we offer such well-heeled users some considerations on DeFi. Because despite what the haters may presume, DeFi (and specifically Curve) has been profitable gambit for us.