Last night, the myriad Curve haters scored their biggest “W” to date.

After years of trying, and failing, to see Mich’s loans fail, they finally got the vengeance they so vindictively wished for. Congrats!

Since the advent of DeFi, Mich had long played the role of artful dodger. He thrived at successfully playing high stakes lending games onchain for years. Though he enjoyed borrowing right up to the bleeding edge of liquidation, he always proved adept and successful at avoiding intentional liquidations. The harrowing experience was part of his inspiration for the LLAMMA soft liquidation mechanism… so he could get a sound night’s sleep.

Last night, and quite possibly while asleep, his undefeated streak came to a crushing end.

His haters and even some frens spent years cautioning that last nights’s events loomed like a Sword of Damocles over the Curve protocol, claiming that Mich’s liquidation might, through some vague and unexplained sequence of events, somehow trigger some kind of “Death Spiral” that might cause the end of Curve.

The situation is fast developing, but let’s check in on what we know so far. Bear in mind that nothing we say here, except the above post from Mich, represents the official word of Curve. Consider it the ramblings of a left-curve Curve fan piecing together info on Curve from various public channels. We reserve the right to edit this article as events warrant.

Naturally the haters are taking their victory lap. If you want to see grave dancing just check nearly any of your favorite influencer’s 𝕏 account.

But how did their predictions of a “death spiral” play out versus what we’ve seen unfold so far during the proceedings.

Token Price

Naturally, we saw the token price went down during a liquidation event, arguably an unsurprising prediction. However, the expectations that the price would collapse to zero have, as of yet, not materialized (…stay tuned?)

The phenomenon of DeFi tokens going down is one anybody still lurking in crypto is surely plenty familiar by now. But this blog is focused on the tech, not price.

If we cared about price, do you really think we’d still be writing about Curve every day?

If you want thoughts on price, there’s no doubt many commenters who can draw some lines on charts for you.

But we can chalk this up as a correct prediction for the death spiral team… they warned Mich would get liquidated and price would go down, and they were right.

Curve DEX

So is Curve the protocol, as opposed to $CRV the token, now dead? We were told a “death spiral” might trigger a feedback loop, as a declining token price would get commingled with an exodus of liquidity.

On this front… not yet. In fact, TVL is ever so slightly up from yesterday.

Curve DEX TVL has been relatively stable despite its falling token price the past year, with most of the largest pools by TVL earning receiving below market rate $CRV emissions.

Liquidity is a complex story…

We’d contend that the liquidity that was likely to leave already left after the reentrancy exploit last year. The reasons users stick around now are varied, but increasingly disconnected from token price.

At any rate, the Curve DEX is not even the primary Curve cash cow since the introduction of $crvUSD, so a flight in DEX liquidity may be less impactful than it might have been in prior years.

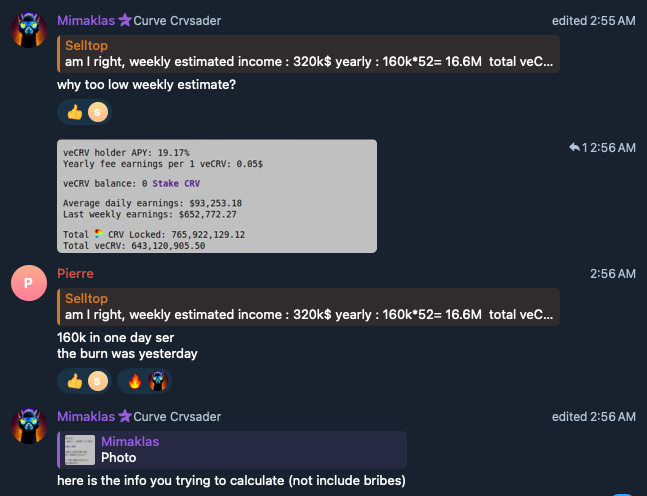

The Flywheel

But what about the flywheel protocols tied to the Curve ecosystem, that were meant to be dragged into the death spiral. We heard so often that Mich’s lending was supposedly dragging down the flywheel?

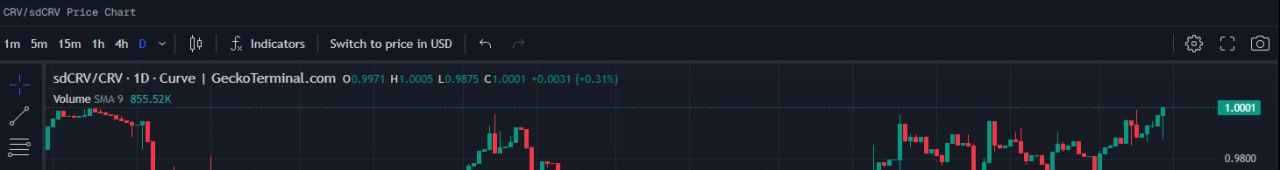

In fact, $CRV wrappers actually look to be stronger than ever.

In fact, $sdCRV went over peg…

Maybe just normal effects of cash flows staying strong while token price drops?

$crvUSD

How about $crvUSD, did the sudden drop in $CRV price cause the wheels to come off the protocol’s revenue generating engine?

The $crvUSD story was certainly the most interesting by far. $crvUSD saw its first significant upwards depeg, as is expected in such debt-based stablecoins when a rush to repay kicks in.

We caught it as high as 1.07

Some reportedly saw even higher.

But it was a short-lived phenomenon. Just as $crvUSD spikes borrow rates when the stablecoin price dips, it also plummets borrow rates when the coin depegs upwards.

The other effect of the stablecoin price going up is to see the peg keepers start taking on additional debt.

In our opinion $crvUSD has sailed through yet another stress test with ease, as it was designed to do.

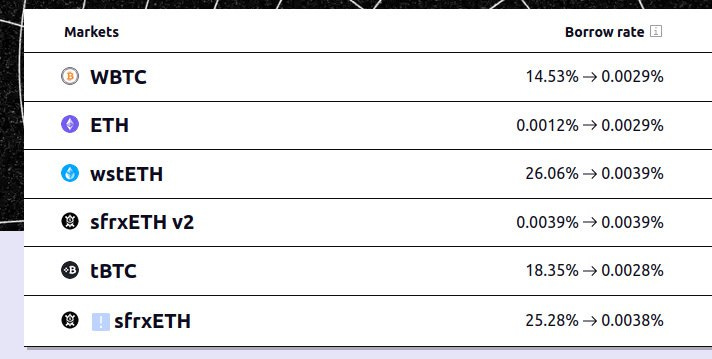

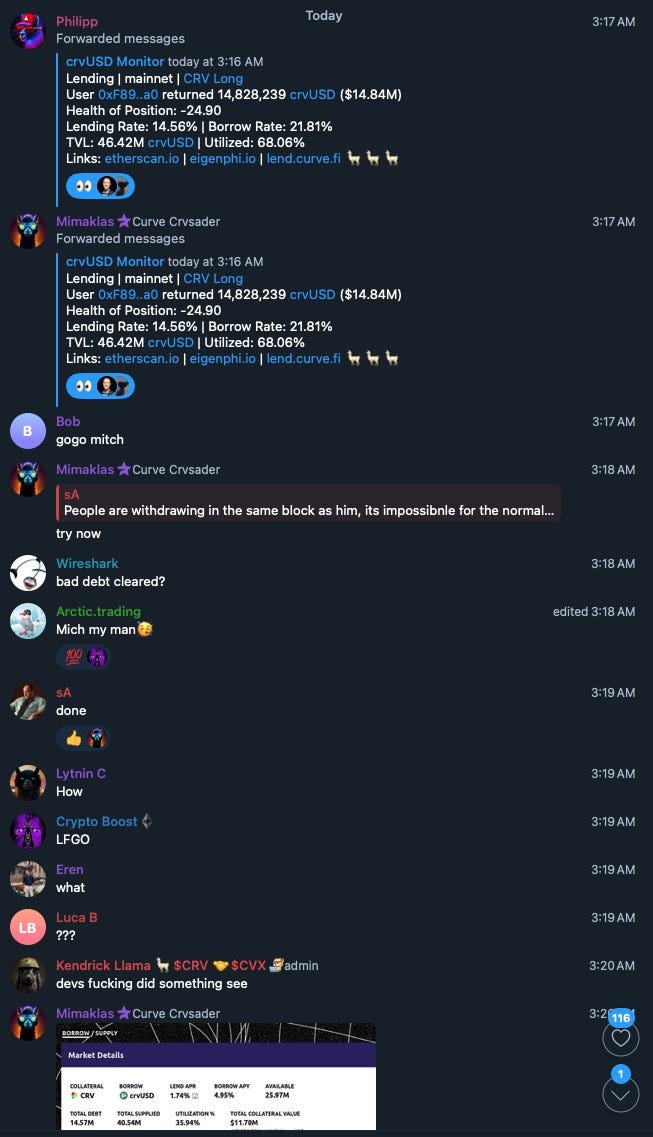

Llama Lend

So what of the newer Llama Lend? Curve Llama Lend’s isolated markets meant possible bad news for the $CRV long market accumulating bad debt.

On this point, your favorite influencers took their grandest victory lap. Stablecoins on stablecoins, WTF?

On the trip down, the $CRV collateral got partially converted into stablecoin, but there appeared to be risk of up to ~$11MM in bad debt, in which it is not profitable to liquidate the loan.

However, on this point, the DeFi 1.0 brains are perhaps overly blinded by traditional hard liquidations, which constitute a single point in time. The bad debt in Llama Lend might have indeed been rough if it stuck, but LLAMMA can liquidate and it can potentially de-liquidate.

Therefore, one path out was simply for the token price to go back upwards. If $CRV went up in price, the collateral would again become fungible in the AMM part of LLAMMA, and suppliers could be repaid by the open market.

We’ve see liquidations cascades, but might Llama Lend the first protocol to show off a deliquidation cascade?

In fact, most of the Curve bad debt simply got repaid…

As of publication it’s down to about $1MM. Stay tuned…

Other Lenders

The haters have relentlessly castigated other lending protocols, who were so reckless as to lend to Mich. Moralizing about lending practices is nothing new, recommend to read through Debt: The First 500 Years for a great study on the topic.

Fortunately, all the protocols proved strong and capable of doing business with a customer of size.

Silo is, of course, siloed.

Frax took on no bad debt:

Same with Inverse:

As for UwU… well… they may have reopened a touch prematurely.

But by and large, this was handled like adults settling things between borrower and seller.

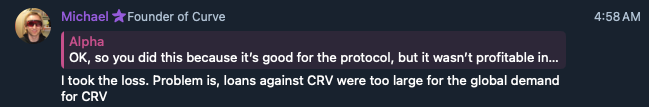

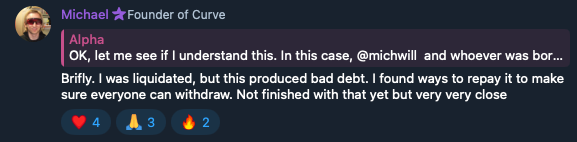

Mich

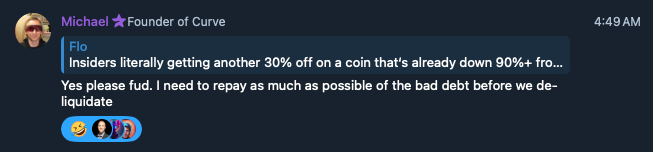

So, as we’ve long maintained might be the case… the primary victim of a “$CRV death spiral” would not be the protocol, nor DeFi writ large. The victim might be Mich himself, suffering a blow to both his net worth and reputation for escaping liquidations. Here was the first public statement we could find as he began to resurface:

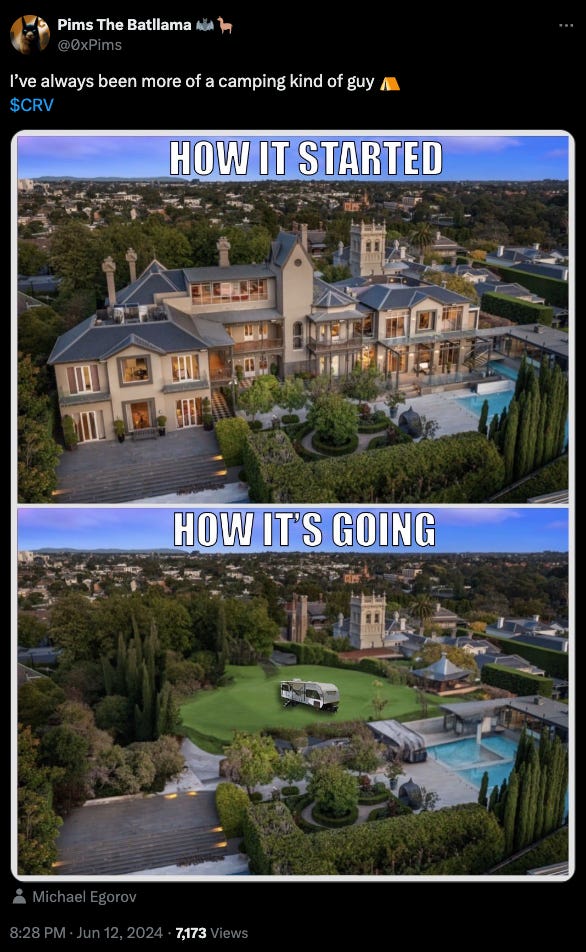

The haters’ portrayal of Mich is some sort of cartoonishly greedy figure who slyly plans to dump $CRV via convoluted lending protocol design to fuel his addiction to mansions.

The reality among those who interact with him is quite different. He’s hyper-involved in Curve, spending every waking moment, weekdays and weekends, in the Curve channels. As approachable and willing to chat as he is, his actions always speak louder. Last night he turned uncharacteristically quiet, as he was busy “doing.”

As we saw, his actions resolved the situation very quickly.

If he was indeed the villain his haters suggest, he might have simply walked away at many points over the past four years.

Instead, he acted quickly to make it right.

And he’s already back to the characteristic sense of humor we all appreciate.

Conclusion

In our occasional attempts to give credence to FUDster’s warnings about a “death spiral,” we never found it persuasive. However, I think it’s a failure to communicate… I view the protocol in terms of tech, where I think most of the enemies are speaking purely in terms of token price.

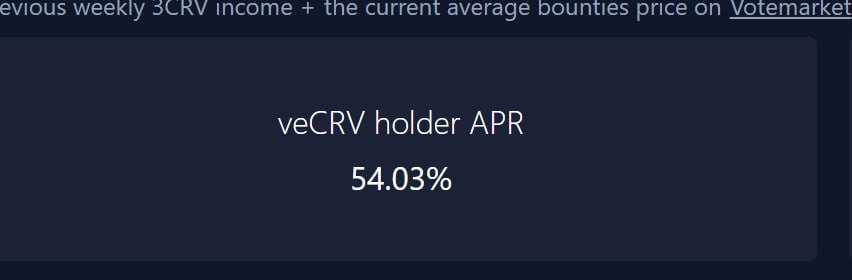

As a long time Curve follower, we’re plenty acclimated to the fact the token can always go lower, so it doesn’t particularly bother us (especially if it keeps paying stables)

But to be clear: “Don’t buy $CRV because liquidations may cause negative price action” is a perfectly respectable viewpoint. We grok that most people in this space are here to get rich quick, not for the tech. We know it puts us in the minority, and please feel free to unsubscribe if you think this puts you in the wrong room.

What we see on the operational and tech side is that everything looks to be running smoothly, this latest incident just another stress test.

And as much as one might hope that the Sword of Damocles finally falling (unlike in the legend) might mean the FUD has finally ended, we know that the haters will rebound with newer and sillier FUD. Yet, if Curve FUD proves eternal, this also implies Curve too is also eternal. We know it’s building for a 300 year time horizon.

Few protocols have proven such a degree of resilience and focus on duration. Curve has perhaps endured more catastrophic events than any other protocol, and emerged stronger each time.

We remain among the Curve fans, and we’re pleased to see we’re not alone

Disclaimers! Author is long $CRV, $SILO, $INV, FXS