June 14, 2022: There Will Be FUD 🩸🧸

Attacks against $CRV best bring evidence

It’s not just your imagination, the FUD is escalating. The knives are out for Curve.

Usually criticism is a good thing. It can help expose dangerous flaws, or improve product design. If people bring valid concerns, users need to be aware! Therefore, whenever people bring valid critiques of Curve, I have a standing offer to give them space in this newsletter to amplify their concerns to the community.

The problem with the recent Curve FUD: it’s mostly imbecilic. If leftwits complain about Curve, but lack basic comprehension about its mechanics, why should we entertain this in good faith?

Today we’ll dissect the recent FUD arguments. Where appropriate we’ll bring facts and data analysis — something FUD-sters seldom offer. With sufficient quantity of FUD now, we can start to build a rubric to more easily categorize and bucket it. We have the following categories

Beartards 🧸

Nebulous 🌌

Boomerang 🪃

Underinformed 📕

Death Spiral 🌀

We’ll order this loosely from smollest brain to largest.

1. BEARTARDS 🧸

The dumbest line of attack, commonly deployed by reply guys, goes along the lines:

“If Curve is good, why is $CRV price going down, huh?!? Checkmate!”

It’s a notably unpersuasive argument in a giga-bear market. You know what’s also down? Absolutely everything else! If your critique is that the speculative value of a token is not rocketing upwards while literally every asset class is cratering, you don’t deserve a seat at the big kids table.

Mind you, this bad faith argument is not unique to Curve. This has been lobbed at nearly every other token, including $ETH, $BTC and everything under the sun.

As a community, we need to invent a convenient catch-all label for this type of argument, so whenever anybody advances this argument we can bucket them and more easily block them. For instance:

Reply Guy: Looks like the market doesn’t think $ARSE is so good after all!

Chad: Blocked for #beartard logic

Haven’t found anything catchy yet… #pricetard… #pricewhine… #bearhead… nothing’s got the right ring yet. Look forward to naming suggestions in comments.

2. NEBULOUS 🌌

A lot of FUD consists of a harsh broadside extremely lacking in specifics.

How can anybody rationally reply to this metonym? Should we apologize to “crypto” for hurting its feelings? Can we invite “crypto” to join us in a struggle session where we all cry it out together?

Does crypto deserve to be a trillion dollar asset if it’s so emotionally over-sensitive? Apparently, the market agrees! IF CRYPTO IS SO GOOD, WHY DID PRICE GO DOWN?!? CHECKMATE!!!

3. BOOMERANG 🪃

One interesting line of FUD is to advance an argument so laughly disprovable, it ends up backfiring and damaging the credibility of the person making the argument.

If you want to attack the flywheel, that’s fine. Just bear in mind that smarter people than you have already tried to poke holes.

“Better to be thought a fool than open your mouth and confirm it.”

Unfortunately, this happened to the DeFi Safety team, who so badly shattered their credibility I’ve been forced to pivot from recommending for their service to actively recommending against them.

It’s sad because their mission is important and deserving of support. Yet in trying to poke holes in Votium, they’ve revealed how badly flawed their execution is. Take this ludicrous review of Votium.

Where to begin on this? We could write a whole article, but fortunately the community already nailed them so we don’t have to.

Since they prove just anybody can just make up numbers, let’s grade DeFi Safety!

Specifically, on the made up category of “trustworthiness” we assign them a score of 0. A casual reader may be fooled into thinking they are experts on smart contracts, when in fact they cannot code and don’t review the actual code in their reviews! Until they disclaim on their frontpage they lack basic comprehension of smart contracts, they are creating a real rug risk.

Sifu need only deploy rug.vy, add pretty documentation, and DeFi Safety would provide a glowing review, effectively lining up sheep to the slaughter for his scam. At this point, the very existence of DeFi Safety is in fact a critical bug in the ecosystem, given they could mislead people into thinking they’re auditors. Everybody please caution your readers against use of this service until they hire some coders.

However, since we believe their heart is in the right place, we’ll bump them up a bit in the “good intentions” category, so they rank a bit above 0

Fig 1. DefiSafety Score Card

4. UNDERINFORMED 📕

As you can see, we keep moving somewhat upwards along the IQ bell curve as we progress. Whenever we see intelligent people making FUD, our instinct is to hear them out. You help your credibility if you offer a cogent case with supporting arguments. Too often though, what appears to be an intelligent argument badly whiffs the details if you inspect it. What a letdown.

For example, what do you expect if you see a post from somebody with this bio:

Off the bat you notice he’s launching a rival DEX, so at least you understand his incentives for trying to FUD Curve… no complaints there. He also claims to previously be an MEV searcher and HFT quant, which are tough jobs, so you hope he’ll drop something smart.

So imajin my disappointment when the FUD turns out to be hot garbage.

It grossly misses the point, as several others also noticed.

Perhaps he’s unaware of the existence of Curve v2 pools, which can be succinctly be described as a “newer AMM mechanism that matches the capital efficiency without relying on hardcoded pegs.” The shorter version of his FUD appears to be: Curve is bad because things like Curve v2 exist? Or perhaps we misunderstood his point, in which case we invite him to clarify.

Even knowing it would just amount to unearned free publicity for his unlaunched AMM, we’re nonetheless happy to invite him to a written Q&A if he wants to clarify his thoughts. We’re sure it would be a fascinating conversation. However, in its current state, upon cursory inspection, there’s nothing to address.

5. DEATH SPIRAL 🌀

Finally, let’s whip out the pocket calculators to consider this gem.

Now, we’re not going to spend a ton of time on 0xHamZ directly. For starters, back in January when they first warned about a “death spiral” with seemingly tasty data-driven FUD, we already used up a whole column on the subject. HamZ’s underlying agenda is unclear, so it’s unclear, but we hope this extra attention helped advance their murky intentions. Mr. Colkitt can study this case as an example for how to use better FUD to capture more attention.

Anyway, if you’re here for the HamZ beef (pork?), the official Curve account already had a lengthy tete-a-tete we recommend you read:

We’re not going to rehash the play-by-play. 0xHamZ did not reply to request to hold a written Q&A with us, so we’re going to just leave it at that. Offer stands!

The “death spiral” claim more broadly is worth rebutting because others have tried to push this FUD too, albeit less articulately, dating back to before I first studied Curve.

We believe the “death spiral” is imperative to consider, and we see people are understandably worried about this logic given the struggles of $LUNA and $CEL. If $CRV is, in fact, a death spiral, wouldn’t you want to know this? If people bring evidence, we’ll share it.

My general problem with this variety of claim is that it’s (1) entirely theoretical and (2) easily slayed by evidence. As we hit publication, this thread by CoinGecko dropped, which perfectly exemplifies these two points.

Curve price up since this tweet, nice try #beartards 🙄… beware the #boomerang 🪃

The evidence was hinted at in the previous article, where DeFiMoon linked a specific window demonstrating the opposite effect. Naturally, one could rightly dismiss this as anecdotal: simply cherry-picking a favorable timeframe.

So let’s look at this rigorously. Let’s review the entire history of Curve TVL and price. It’s really easy to do — in fact, I’ve shared a Jupyter Notebook with all the code, so anybody can play along at home and help poke holes in my argument — it only takes a few lines of code.

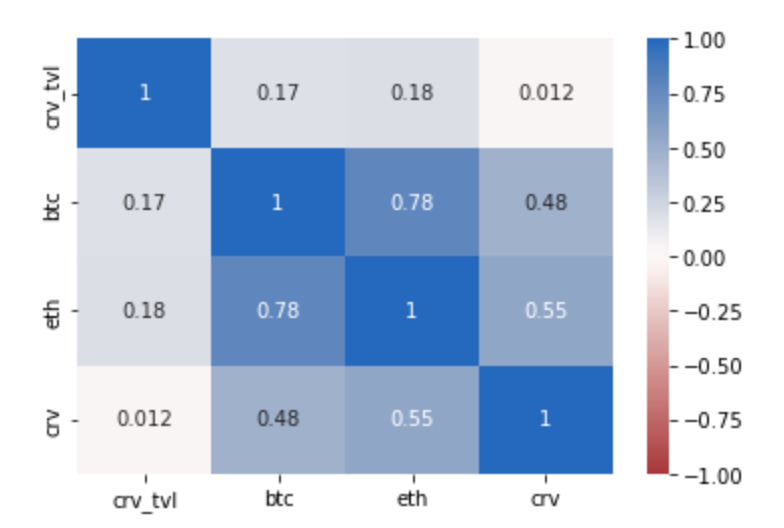

All we’re doing is scraping public data from DeFiLlama on Curve TVL, and calculating the correlation with the price of different assets as scraped from FUDGecko. We’ll consider prices of $BTC, $ETH, and $CRV.

If the death spiral argument is right, we’d expect TVL to be highly correlated with the $CRV price. This is the common assumption underlying most Death Spiral FUD. When $CRV prices are high, so too should TVL be high. A lower price should correlate with a reduction? Easy enough, right?

So let’s look at these three assets, $BTC, $ETH, and $CRV, and observe the correlation.

Fig 2. Curve TVL Correlation With Asset Prices

Of these three, $CRV is the least correlated asset, less than $BTC and especially $ETH. What stands out is the extreme correlation between Ethereum price and Curve TVL. This is itself an interesting finding of which I wasn’t previously aware. The popular stETH pool isn’t enough to explain this phenomenon fully, so it’s a bit of a mystery.

Now, before doomsayers point out the 54% correlation between $CRV and TVL, I’d point out a basic property of data science is to be aware of confounding factors. That is, if the strongest correlation Curve TVL to $ETH, then what % of the Curve TVL to $CRV can be explained by correlation between prices of $CRV and $ETH.

The the full correlation table helps depict this. You can see, indeed, all our crypto bags do run together to some degree. $CRV price mover is the biggest mystery.

Fig 3. Curve TVL & Asset Price Correlation Table

So let’s improve the framing of the problem. When doing financial analysis, you have to be careful with just looking at raw prices for all sorts of reasons. What you really care about is the first derivative… the direction of price movement. Is Curve TVL positive when $CRV prices go up, and vice versa. This would be extraordinarily persuasive evidence of a potential death spiral phenomenon.

Ergo, we rerun the correlation table, but this time look just at percent change. Results here are quite interesting.

Fig 4. Percent Change of Curve TVL & Asset Prices Correlation Table

So first up, a good sanity check here. We see $BTC/$ETH roll together about 78% of the time, exactly what you expect from these markets. In contrast, $CRV only moves about 48%-55% with these assets, significant but lesser. It all comports to our observations, so it’s a good sign our analysis is on the right track.

Here’s the kicker: the % change of the Curve TVL? The correlation here is extremely flimsy. TVL still moves slightly in accord with $ETH, but just 18% correlation. And the correlation with $CRV? Essentially 0. That’s the number you expect when values are extremely uncorrelated.

TL/DR: Correlation analysis suggests Curve’s existence is threatened far more by price of $ETH than price of $CRV.

Again, I’d really be interested in being proven wrong here. Maybe TVL lags (I tested some lagging windows here, but didn’t get time to try EMAs which would be interesting). Hopefully bigger brains can continue the analysis, because we’d all benefit from knowing if we were at risk of a death spiral.

In my view, the burden of proof for the “death spiral” hypothesis keeps getting higher. If you want to posit a credible death spiral hypothesis, your argument should also explain away the aforementioned evidence. Curve isn’t $LUNA, there’s far more complex factors that underlie the token speculative value.

It’s unlikely you’re better at math, tokenomics, or systems thinking than @newmichwill, so you are at extremely high risk of suffering a boomerang attack 🪃. Do you expect he tried to build an antifragile system but forgot to consider what would happen if prices went down?

CONCLUSIONS

Most of the FUD remains particularly ridiculous. A rational stance on Curve at the moment should properly be extremely boastful.

Curve v2 has not just survived several bear markets, but thrived. Unlike major legacy exchanges like NASDAQ, Binance, Coinbase, Uniswap, et al, Curve is the only service which can boast 24/7 resiliency throughout the most severe market tumbles. I don’t believe this has ever happened in human history, and people should properly be acclaiming this achievement from the rooftops.

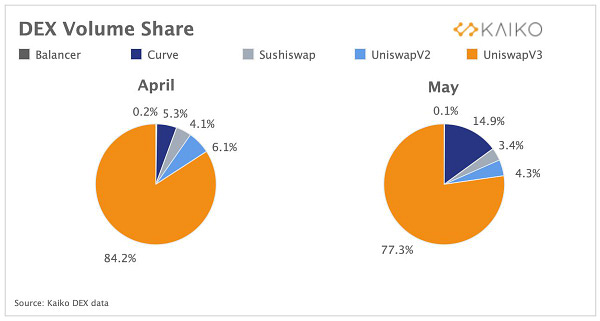

Additionally, the “death spiral” FUD feels particularly ludicrous at a time where Curve is approaching record highs in volume. Bears may be allergic to evidence and we’ve got plenty:

Although the source of these numbers is unclear and appears to undercount, we certainly agree it’s directionally accurate.

Much of the underlying speculative value of $CRV is the trading fees, so the most credible “death spiral” FUD likely involves some form of argument Curve will fail to grow trading volume. Curve recording breakthroughs in growth, despite reprehensible conditions screams, bullish to me.

Indeed, the trading fees have been awesome lately, to the point where it’s becoming appetizing for LPs to sit even in non-incentivized pools. Surely not the quintuple digit yield some desired in the bull, but it feels quite cozy to make any gains when everything else is exploding.

Finally, some musings on the possible source of this uptick in FUD.

We have two hypotheses to explain this. One is simply that a lot of people are feeling terribly emotional in the bear market. This would be nothing new — the previous bear markets have been agonizing displays of badly broken people’s worst impulses. No reason our current bear crunch should be different.

Another possibility is that the FUD is but one prong in a potential upcoming attack. We still don’t have anything beyond speculation on who tanked LUNA, but it looks coordinated. Vultures gotta eat too, and vultures with billions at their disposal might be hovering above the DeFi leaderboards and eager to take a bite of anything vulnerable. The billions in value sitting in Curve has got to look mighty tasty, so it wouldn’t be surprising if they’re probing for a soft spot to sink their beak into.

It’s not uncommon for traders to circulate a base layer FUD about an asset they’re about to try to crash hard. It provides some level of cover and plausible deniability. The FUD needn’t even be believable — like whenever China annually bans Bitcoin mining and ETH nukes harder as a result 🙄

Therefore, one could make a reasonable argument that some vulture capitalists may be laying the groundwork to try to nuke $CRV prices to oblivion and see if it forces capitulation. Even scarier, perhaps they believe they’ve found a previously undetected vulnerability and are ready to exploit it. They employ a lot of smart people at these firms, so it’s within the realm of plausibility

If so, we’ll soon get real evidence about whether a “death spiral” is possible. As always in crypto, if you’re not mentally prepared for a 99% nuke, you shouldn’t be in the space. My take is that Curve would survive fine in a 99% drop in price, but I’m certainly not looking forward to seeing this proved out in practice.

In the meantime, as repetitive as it can be, continue fighting the FUD-sters. They may be arguing in bad faith, but slay their hype with hard evidence and taunts of Curve’s many successes. Whenever the market turns around, we’ll celebrate!

Let us know anybody we missed!

Disclaimers! In addition to flywheel assets, author has a stake in mentioned assets including ETH and BTC.

Well done