Want to know the rarest of all tokens these days?

It’s call Hopium… or occasionally it’s wrapped into Copium.

We occasionally ask OGs which was worse, the doldrums of 2019 or this current bear market. 2019 still edges out the current market, but results are tightening.

For the first phase of this most recent bear market, it wasn’t so bad. Every other sector of the economy was also getting hammered simultaneously, so we never really saw any exodus of talent or activity. After all, where would you go? It felt like the bull market would just pick up steam whenever the economy flipped back on.

Lately though, the landscape has changed, and not in crypto’s favor. The VC firehose is redirecting towards AI. The US stock market is picking up steam, yet crypto markets continue going sideways to downwards. The onslaught from regulators is fierce and shows no signs of abating.

Arguably we don’t deserve a bull market until the tourists fully evacuate the premises. If so, the crypto scene may get bloodier before things improve. Are you ready for our industry to turn increasingly player-versus-player? With liquidity drying up, the only way to survive crypto winter may be to cannibalize whomsoever remains.

How depressing, right?

Well, we count ourselves as perma-bulls, so we’ll be here for the journey. As scarce as hopium may get, we’ll keep glomming onto random good news to keep our stores of optimism replenished.

Here is what’s got us feeling bullish today.

Lending Markets

For a long time the degen dream had been to have an LP position in Curve, let it accrue value through, say, Convex, then lend it out to play some leveraged farming games.

Finally, it may be happening! Yesterday Silo launched markets for Curve LP tokens.

Initial markets include ETH/stETH, LUSD-3CRV, and FRAX-USDC, with more likely to come soon.

They also made moves to recruit $CRV whales to their lending platform, in the event others decide to tighten up their platform.

It’s not merely Silo getting into the game. Gearbox is exploring adding a variety of volatile v2 pools.

crvUSD

Speaking of lending, we’re encouraged by the rapid uptick of adoption of $crvUSD. The “test-in-prod” experiment soared past $30MM. Demand for the stablecoin has gotten so high that borrowing rate spiked to over 10%.

We imagine growth will cool off until the peg keepers return to equilibrium and the borrow rate trickles back down, which shows every indication of happening soon enough.

DeFi is turning into LSDFi, a trend that $crvUSD timed it perfectly.

Conic

Undoubtedly, the biggest beneficiary of $crvUSD has been Conic. The rush to mint $crvUSD has been almost entirely to flow into the Conic Omnipool and its double digit yield.

It’s showing some signs of saturation — with borrow rates at 10% and yields dropping to about 13%, there’s now little sign that you can do much better than just directly yield farming your LSDs.

Except… looks as though Conic is ready for more.

Conic got onto normie’s radars the other day as the $CNC price spiked briefly amidst altcoin pain. We don’t offer price commentary in this blog, but it is worth highlighting just how thin liquidity is for our favorite altcoins. A sudden change in sentiment, and… well, you get the picture.

The Terrible Twos

Convex is one such token we expect could mount a sudden turnaround in a bull market. Convex was once the exemplar of brilliant tokenomics and a well-architected protocol.

Convex turned two yesterday, but the celebration felt decidedly more muted than its first birthday. So young, but already it’s so over?

We remain bullish. Their Medium post pointed to exciting future developments on the horizon for Convex, including additional expansions to other chains/L2s, further utility for cvxFPIS, on-chain voting, further decentralization, and additional project integrations.

In fact, just after the post dropped, the beleaguered Binance casino launched an integration with Convex.

TriCrypto-NG

We maintain our position that TriCrypto NG is going to have the most immediate impact on Curve. It hasn’t caught quite the popular attention that $crvUSD has, but by the raw numbers it maintains the slight edge. TVL for the new TriCrypto pools just passed $50MM, with $crvUSD collateral just behind at $44MM.

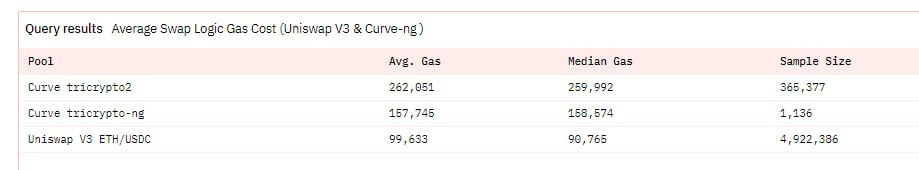

More importantly though, the activity remains quite impressive.

The ETH-USDC pair remains among the biggest routes in all of crypto trading, and NG is starting to pick up its share of this volume.

Both TriCrypto pools still have just $20MM in TVL, so their trading activity is still dwarfed by the classic TriCrypto2 pool, which still has $181MM in the pool. However, incentives are starting to shift, so we may well expect the Next Generation TVLs will flippen the original series soon enough.

Given that Curve’s advantage is slippage, not gas, the pool would need more TVL to fulfill its potential by facilitating higher value trades. That is, if you’re trading $100K, you don’t particularly sweat a few bucks worth of gas, but you’ll care a lot about how much you ultimately receive. At the moment, you’ll obviously go through the old gas guzzler pool:

You would lose almost half an ETH trading this amount on the more optimized TriCrypto NG while TVLs are still low.

When TVL catches up, then we may expect to see all trades route naturally through the new NG pools. Low slippage and half the gas? That would win every day.

The encouraging tea leaves at this stage is simply how many smaller trades are finding their way through the TriCrypto NG pool as more and more aggregators and routers start to support the new pool. Just yesterday CoWSwap joined the fun, thanks to based Yearn devs:

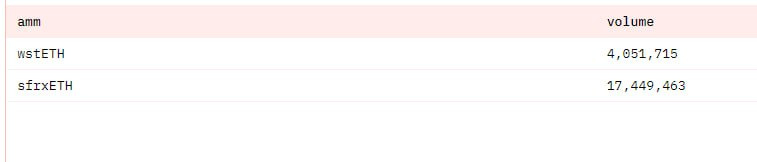

None of this subtracts any excitement from the new $crvUSD architecture, which is growing nearly as fast. However, the effects of $crvUSD on trading infrastructure is mostly limited to trading via $crvUSD and the supported LSD collateral types, which are new markets that don’t already have a bunch of pre-existing trading activity.

Nonetheless, the early utilization for these new LLAMMAs since inception has been very encouraging, even with the $crvUSD ecosystem relatively nascent:

Best place to watch both $crvUSD and TriCrypto NG activity is the Telegram group.

Vyper

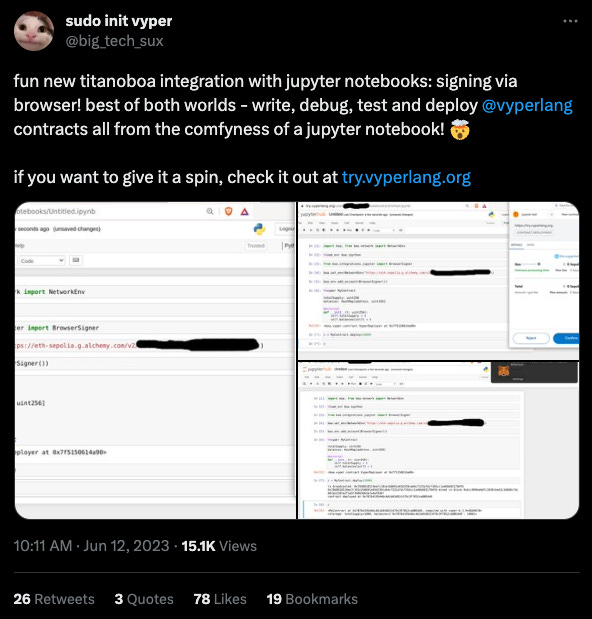

Finally, we note that the release of Vyper 0.3.9 has freed the devs to work on other more general improvements to the Vyper ecosystem, and they are not slowing pace. Pythonistas can now utilize Titanoboa and even deploy directly from within Jupyer Notebooks

A demo notebook from Fiddy shows off the power here.

Encouragingly, the new Uniswap v4 is also using Vyper for some of their smart contracts.

Uniswap v1 was actually written in Vyper before they went toward Solidity. If two rival AMMs can agree on Vyper in 2023, what’s your excuse anon devs?