Following a series of closer than usual Curve DAO votes, yesterday’s is the most contentious to date. This is why DAOs exist people!

The philosophical question at stake: should extra $CRV rewards be given to something already earning $CRV rewards.

If you don’t understand why this could be problematic, perhaps you’re also the type to shy away from recursion.

Sounds like a fairly anodyne question, right? Why so contentious?

Well, this action amounts to a direct slap in the face to the $alUSD pool, one of everybody’s favorites. The direct outcome would be to specifically shut off rewards to $alUSD, so it would only accrue rewards indirectly through exposure to Yearn.

The text of the proposal is similarly blunt:

Remove alUSD gauge so the pool stop receiving CRV. As pointed out by community members, alUSD is collaterized by Yearn Vaults which make around 25% of their yield from dumping CRV. We would like to propose to remove the gauge from Curve as this essentially allows leveraged CRV farming via Alchemix as the Alchemix loaned is paid back using interest from Yearn vaults selling CRV to accrue interest without mentioning alUSD can also be deposited into Yearn vault leveraging the amount of CRV received.

A number of other peripheral issues get raised by this too, particularly the effect of Curve dumping. A bit more background is provided in this video:

Curve Dumping

One hypothetical benefit of this proposal is that less $CRV would go toward strategies that simply dump $CRV.

Nobody contends that $CRV dumping is wrong. The proposal directly quotes "we believe Yearn-type farming of CRV is fair game.”

However, the machiavellian effect of the proposal may redound to the benefit of $CRV. At the moment not only does $CRV sent towards these pools get auto-dumped, but these pools receive a greater than average amount of $CRV. This ensures extra sell pressure on $CRV. Downward spiral.

If you’re voting only on your pocketbook and not principles, you might find CIP-67 to be compelling.

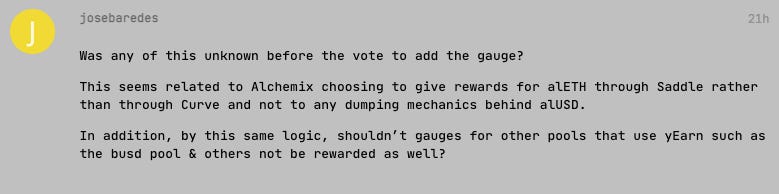

On the other hand, the effect of the extra sell pressure may be overstated if it’s being balanced out by free market effects:

Optics

Unfortunately for all parties involved, the optics don’t look good. Optics matter more than people would care to admit in this space, and everybody comes out of this fiasco a bit dirtier.

For Alchemix’s side, implementing an inferior Curve knock-off lowers the perception of the project’s quality. Heretofore I’d always dreamed of owning one full $ALCX so my descendants could live like barons. Now, I’m worried — what if their integration with Saddle disappears because of, say, legal issues?

For Curve’s side, it presents the appearance of retribution. It was likely an attempt at consistency, but users did not interpret it as such.

For Saddle Finance, they look like sloppy plagiarists. Maybe they’re not? But VCs unloading money into such a potential liability reeks of criminal negligence.

Of course, at the end of the day, smart investors presumably observe the optics to be primarily attempts at persuasion and consider this as just one factor in their decisions.

A lot of people made very principled statements in the debate. We won’t bother linking here because let’s face it: there’s no principles in finance except making money.

Traditional finance was already full of dirty scumbags. Now we’re rebuilding it among a population of self-declared degens? If you’re looking for angels, you certainly came to the wrong corner of the internet.

Straw Poll

We’re seeing the strength of the DAO system playing out here in realtime, as this ultimately may come down to community vote. Of course, nobody has any illusions that DAOs are a level playing field. Wealthy participants have a greater say, just like all democratic governments.

The Curve team has announced its vote is undecided. The most commonly voiced opinion appears to be veCRV holders intent to vote against.

Yet the vote may end up getting tilted by Convex, which locked their CRV instead of dumping it and ended up with a much larger number of votes. Interesting brinksmanship…

Additional Proposals

Kicking the hornet’s nest was a great exercise in getting suggestions from the community. A lot of community members weighed in with additional ideas. Some looked to elevate the fight.

Some proposed compromise.

But the most interesting idea to emerge was from Astronaut Sam Miorelli, the idea of hiring lawyers with the DAO to enforce IP.

Interesting…

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist, staked into the $alUSD pool, and undecided on CIP-67.

Curve looks like a petulant child about this. You can't have a pool, now we're going to throw a tempertantrum after you went to our competitor.