Through an unusual chain reaction, a vote on stripping Alchemix of a reward gauge ended up on a completely different tangent.

It all followed quite naturally if you were following along in realtime. In discussing rewards distribution, the perception of retribution towards Saddle got raised, and Spaceman Sam authored CIP-XX:

Contrary to popular belief, Curve has valid and enforceable IP rights in its software code. Pursuant to the LICENSE 41, Curve can and should protect its position in the marketplace with enforcement of those IP rights. Profits from such enforcement should benefit veCRV.

The conversation exploded from here, even getting written up in CoinTelegraph, the rare news source that recognizes that writing about the most popular DeFi protocols is a great way to get traffic.

The community straw poll generally favored the move.

Nonetheless, a lot of people weighed in negatively on CT. We reviewed the objections and broke them down into a few major categories.

Lack of Opportunity

The most definitive argument came from the big brain Curve team. You can’t squeeze blood from a stone.

Oh… you don’t have any lunch money? Well, uh, go ask your parents for some and then you can give it to us.

Lawyers are Terrible

Most lawyers I know are the biggest fans of lawyer jokes, so hopefully it won’t be controversial to point out that lawyers are awful.

Speaking as somebody who has had many of my startups get rekt the moment lawyers stepped in to help, my first impulse is to keep the lawyers on a different planet, ideally the one with the most noxious atmosphere.

The flip side to this is the reality is that Curve is no longer a small startup. It’s a multibillion dollar protocol sitting on a massive war chest. If it does nothing, opposing lawyers may see these billions of dollars as an opportunity. In other words, Curve might get dragged through the legal system one way or another.

Tactically, once a startup hits it big, they can afford to throw their weight around and leverage the legal system to crush opposition. Facebook and Amazon are now the largest lobbyists in the USA. For Curve’s sake, why not get first crack at establishing the legal boundaries of the space, but doing so from a position of offense instead of defense?

The Spirit of DeFi

The most common objection to the proposal was that maneuvering through the legal system is opposed to the decentralized spirit of this movement.

The purist train of thought is to let the code speak for itself. Let the DeFi space exist in a sort of an international waters until it grows so large it subsumes the traditional world.

To some degree, it’s tough to ignore the parallels with Bitcoin’s cypherpunk origins. At the outset Bitcoin was appealing to the most anarchic factions. Today though, the Bitcoin energy has shifted to finding its way onto corporate balance sheets and nation-state legal codes. All of this is a bit removed from its original purpose, but it’s where the opportunity lies.

It’s tough to imagine DeFi not heading in the same direction — how many Billys get locked before the next growth opportunity has to be the traditional sources of wealth, all of whom would need lawyers to get involved?

Procedural

A lot of more procedural questions came up in the dialog, which was largely the point of the proposal — to open discussion on the unknowns.

Many people brought up the idea of how a DAO can establish legal standing, along with the fact the code is already owned by an existing legal entity.

A few people brought up the idea of using Wyoming’s new law, although I believe it would have a few incompatibilities (their law requires a DAO’s smart contracts be upgradable I believe, but no serious DeFi site would create such a vulnerability.)

The proposal’s author and potential inductee into the Lawyer Hall of Fame (if such a thing exists) has thought this through and believes establishing standing to be easy enough.

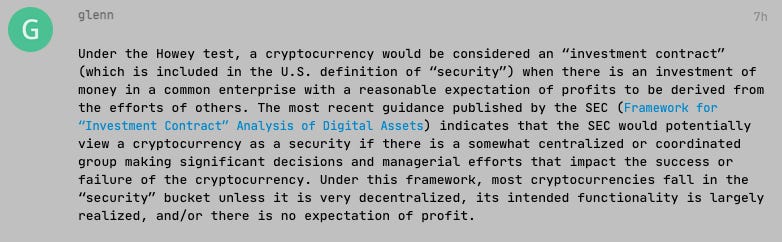

Another point that got raised a few times is that it could potentially backfire. In particular it opened debate about if $CRV would pass the Howey Test, and if this could invite too much scrutiny.

Again though, the best defense is a strong offense. Speaking from some experience here, the regulators like to claim the easiest scalps. When organizations demonstrate more muscle, they appear as more imposing targets — not that they aren’t also at risk, but it takes a bit more planning for the G-men build a case because they know they’ll be going up against good lawyers.

The procedural questions are also quite interesting in terms of the evolving technology.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial or legal advice. Author is a $CRV maximalist.