If you were asleep during math/history class, this handsome gentleman being eyed by Convex is the marvellous John Napier, 8th Laird of Merchiston and inventor of the logarithm.

Within DeFi, he’s also the namesake of Napier Protocol, which is set to bring a Pendle-style yield trading to the flywheel.

For background on Napier, review our prior coverage:

September 26, 2023: Napier Protocol 🏴🔢

Recently, the crypto community was abuzz about Napier Protocol. It’s great to see this on many levels, if for no other reason than to perhaps raise the profile of its presumptive namesake, John Napier.

Napier hasn’t even launched yet, but it appears it may begin as a key cog within the broader flywheel.

The potential expansion of Convex into $cvxNPR had been heavily rumored to the handful of DeFi zealots still paying attention.

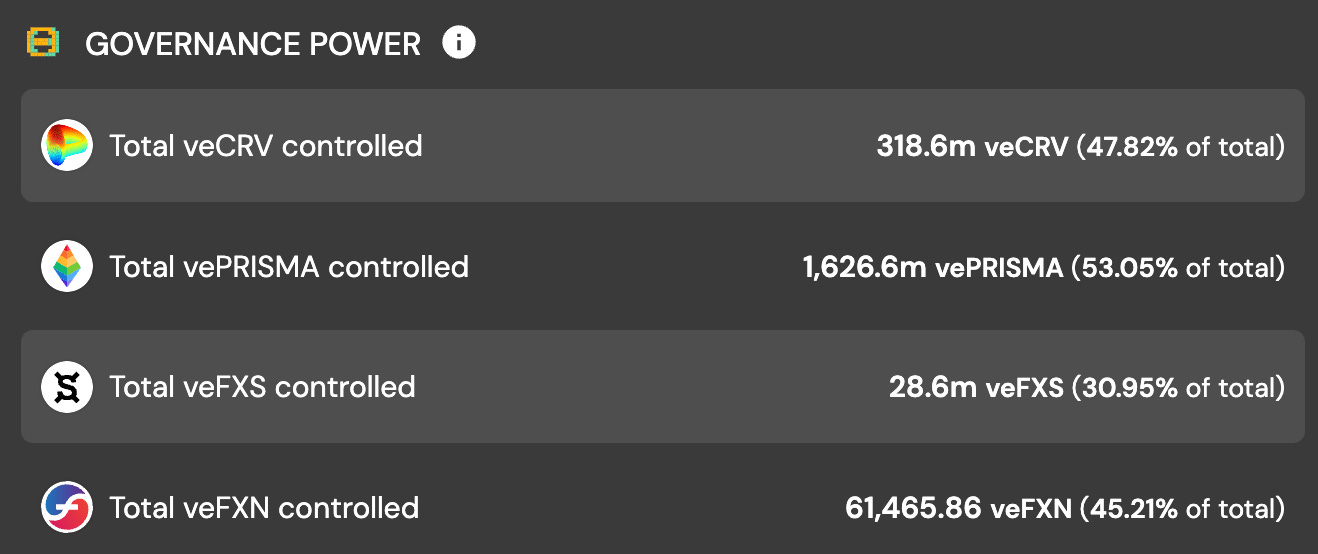

If $cvxNPR does pan out, it would represent the fifth protocol added to Convex’s already potent governance power over DeFi.

Will they stop at five?

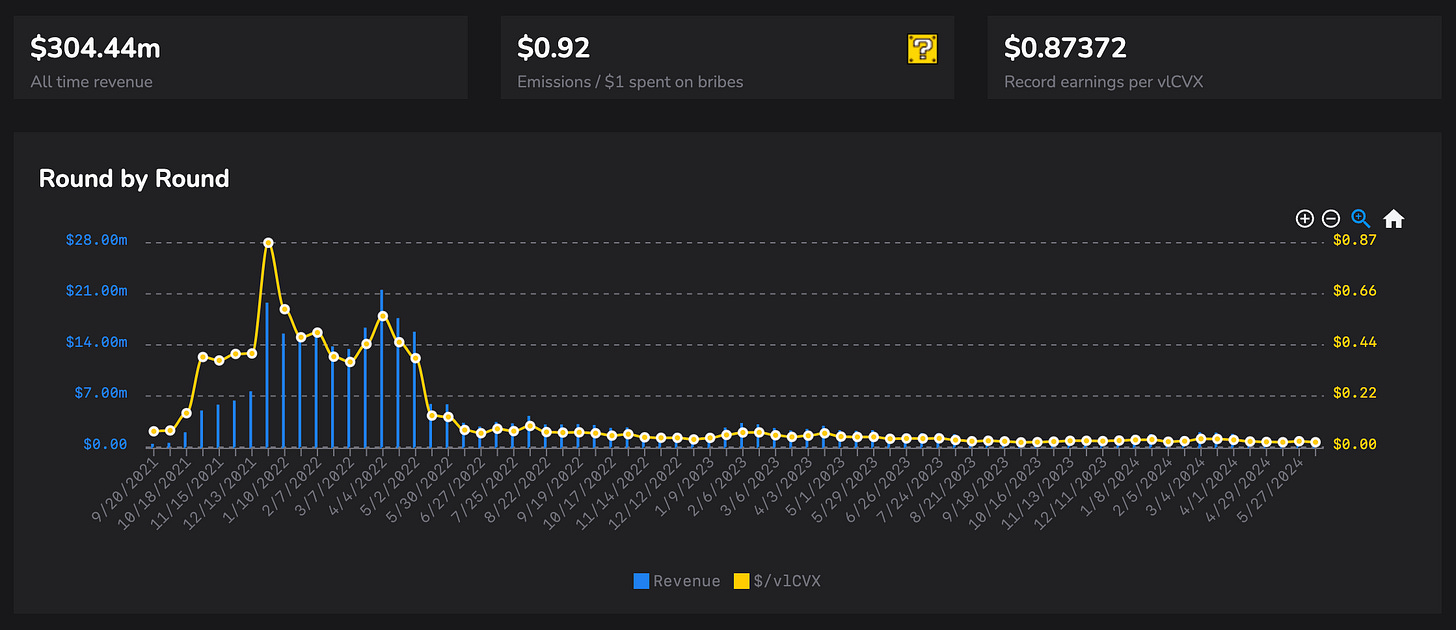

Most of these protocols have been added since Convex’s token price hit all time highs in the prior bull cycle. Throughout the brutal bear market, interest in DeFi all but disappeared, but Convex maintained its grindset core.

The actual operations of Convex were never as dire as one might have assumed from the moribund sentiment. Incentive markets may not have been as exuberant as when DeFi was in full swing, but they never disappeared. In total, Convex has returned nearly its entire market cap as revenue over its lifetime.

Crypto markets are always plenty redacted, but the recent trend of punishing real cash flow tokens amidst memecoin mania was particularly stupid even by crypto standards. Fortunately, money always talks, so this irrational frenzy was always likely to reverse and “real yield” was always a strong foundation.

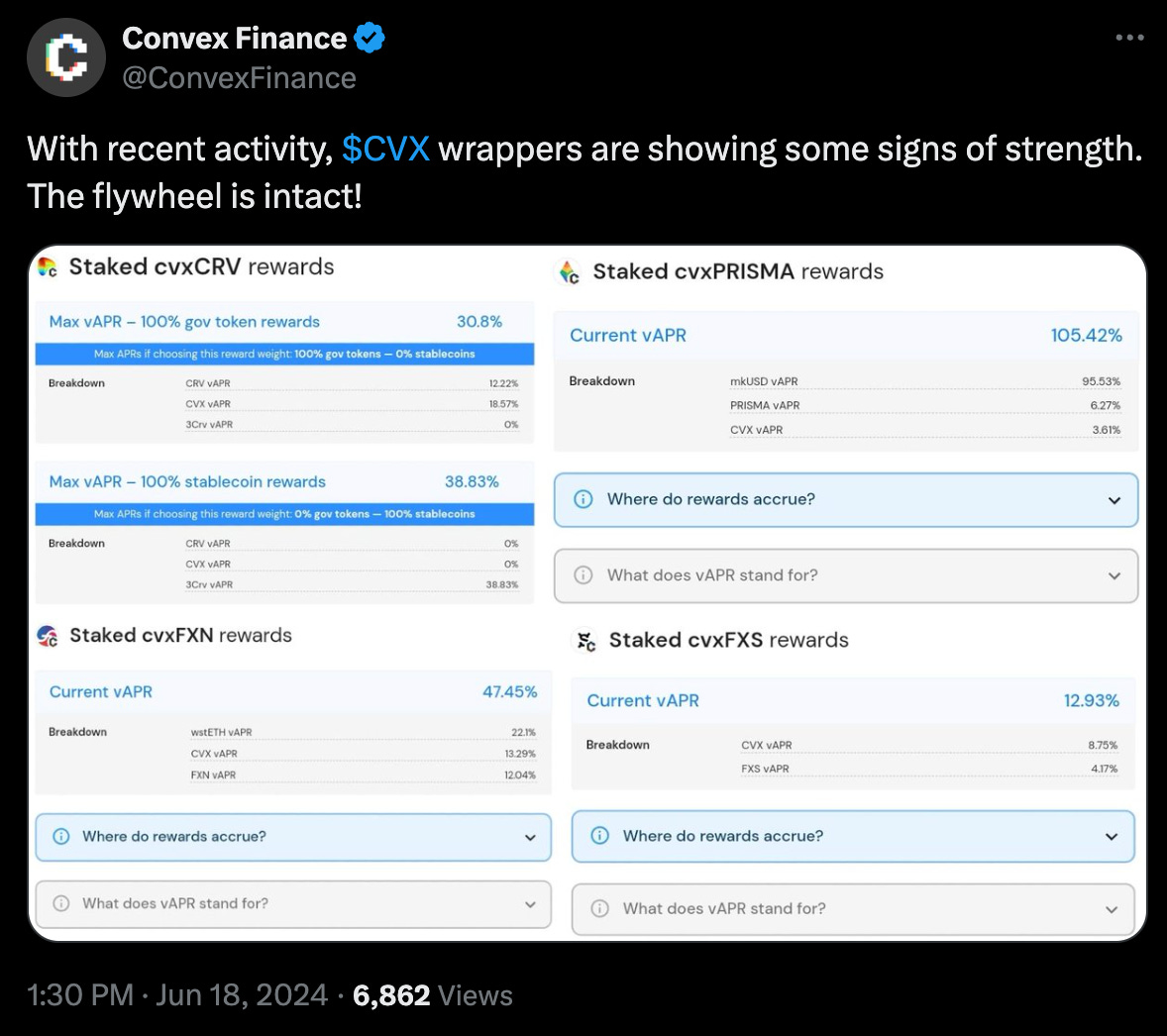

Should cash flows start carrying positive connotations again, the various Convex wrappers all happen to look bespoke…

The largest vAPR of these is Prisma, which you may consider as a proxy for the market’s evaluation of its risk.

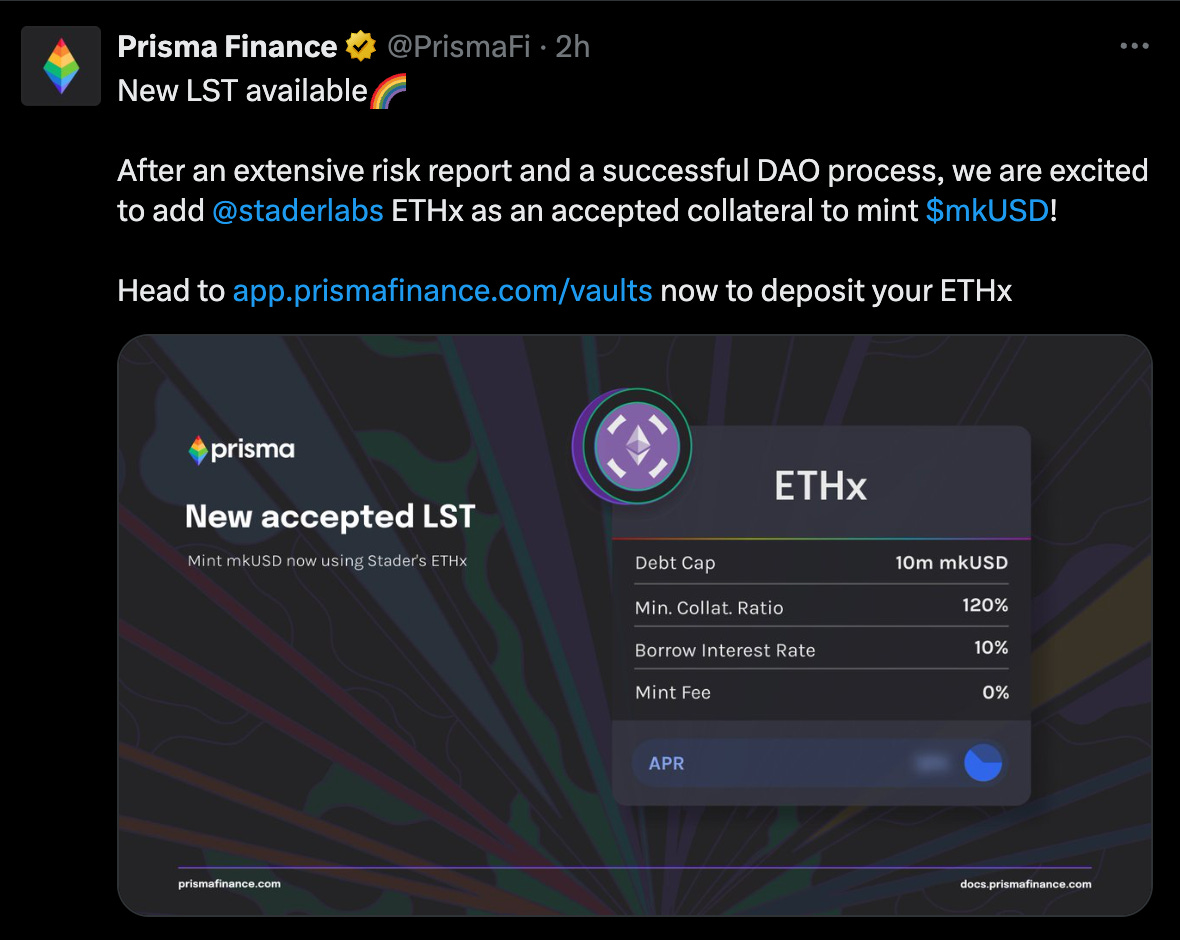

This particular wing of Convex’s empire may have been left-for-dead by the broader market following its tragic hack, but Prisma is also continuing to build in a frenzy.

Most recently they added Stader Labs’ ETHx as collateral for minting $mkUSD.

The disfavored protocol is also debating expanding its own empire with what looks like an acqui-hire.

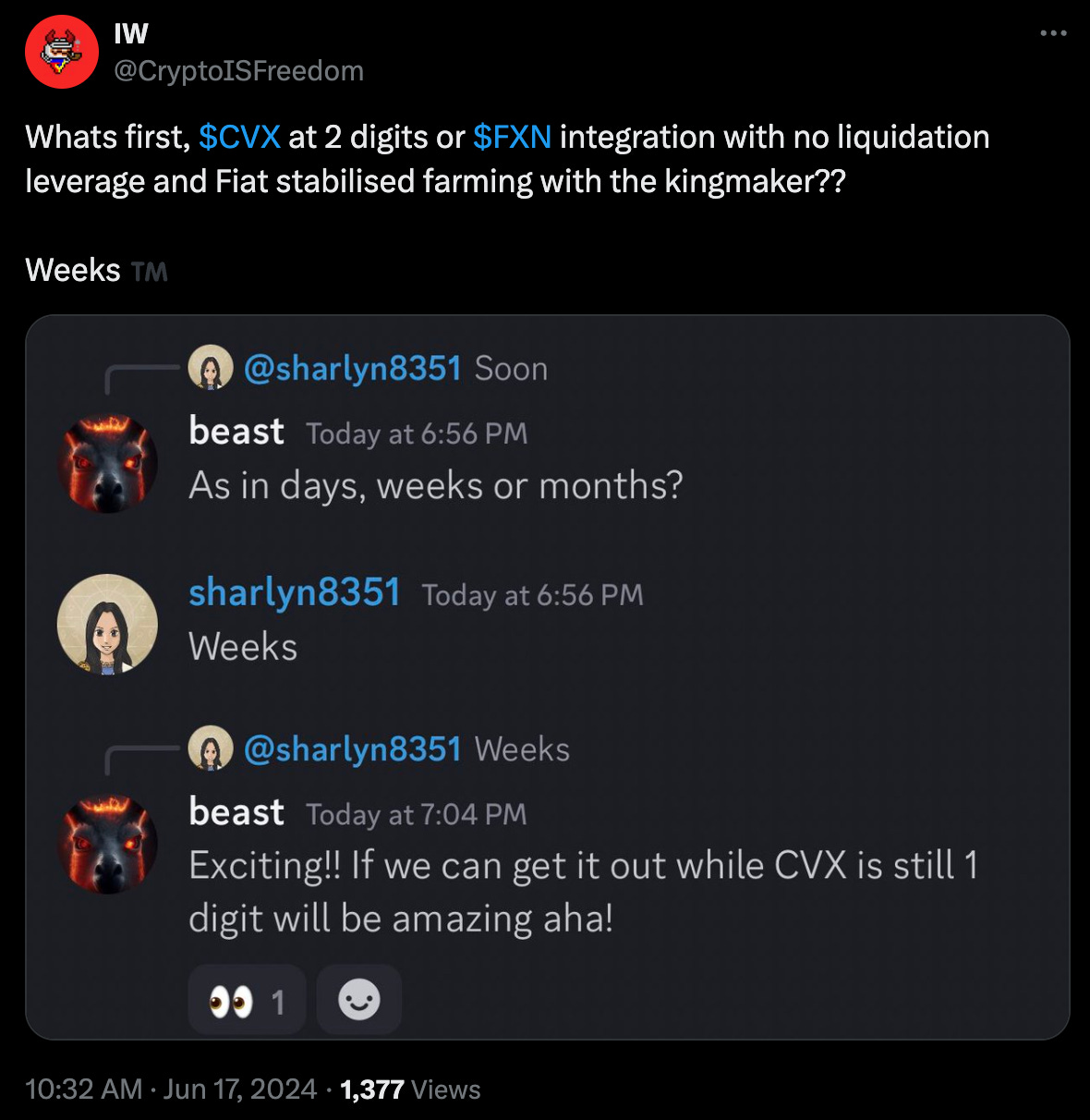

f(x) Protocol, another new member of Convex’s empire, has also been on its own spate of activity. The protocol has been applying its successful stablecoin/leverage formula to several assets, most recently launching $arUSD.

Rumor has it $CVX may well be within its sights.

It’s wonderful to see the various constituent protocols of Convex all finally roaring to life and becoming their own independent and fully mature monsters.

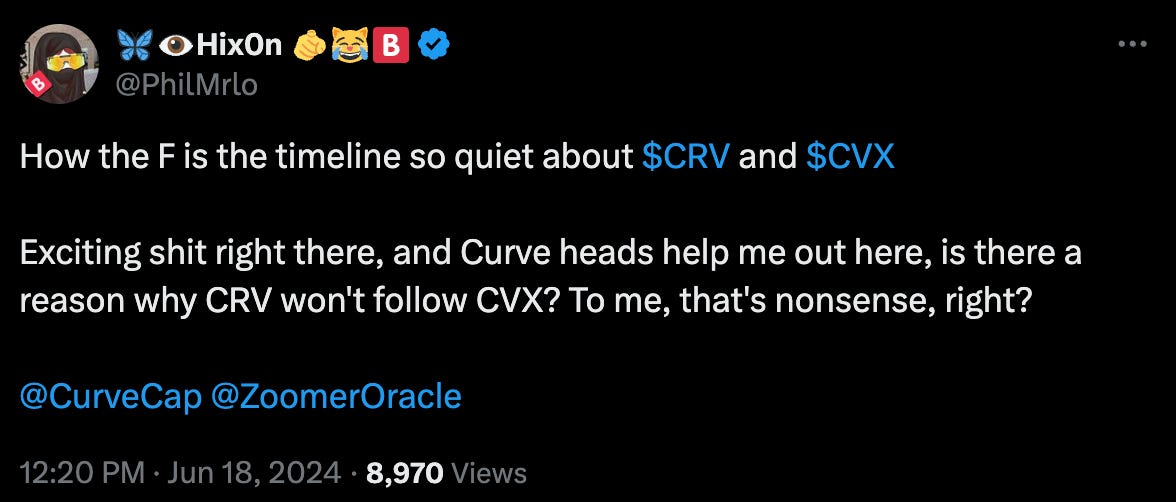

In the prior bull cycle, Convex and Curve were essentially joined at the hip. This time around, Convex is nicely diversified among several protocols. Each protocol may interact with Curve to some degree, but more than ever before these are all maturing into distinct powerhouses of their own.

Ergo, it’s not necessarily the case that these two tokens trade together this cycle.

Maybe more like a soft peg?

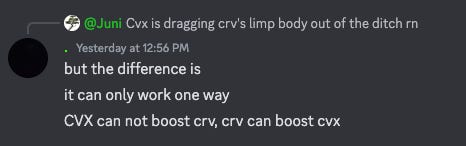

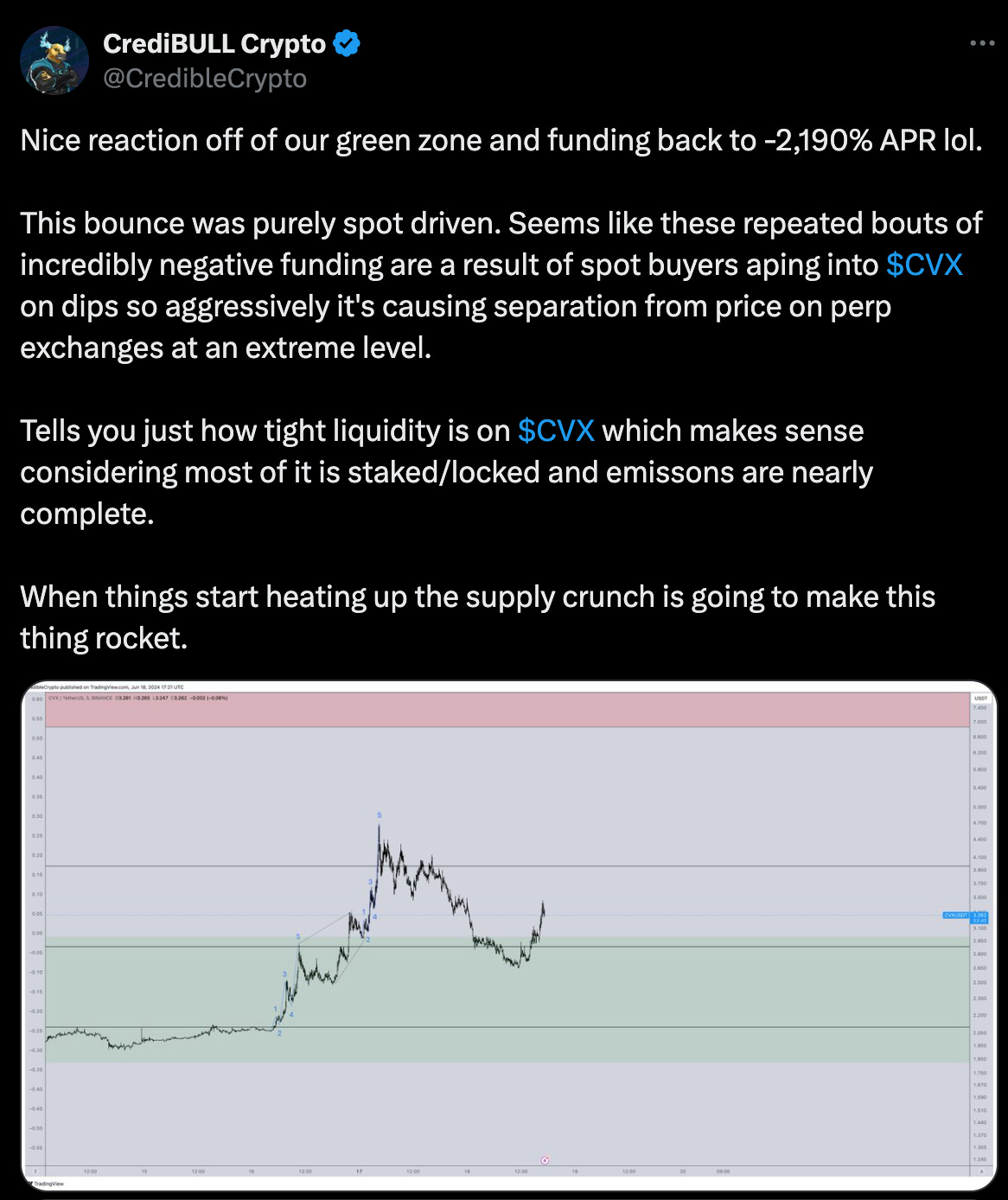

We’re not traders, we’re monodirectional HODL-ers, so we’re the wrong place to look for trading advice. All we can observe is that CVX is capturing the fancy of people who do follow trading markets closer:

Disclaimers! As a DeFi maxi, author is long $CRV, $CVX, $FXS, $PRISMA and FXN 0.00%↑