Having started in Bitcoin, I have to admit they got one thing right. In BTC-fi, simply “HODL-ing” is the dominant strategy. So pure and simple. And it outperformed literally anything else… doing anything, converting to ETH… you simply could not get a better return than simply buying the king of cryptocurrencies and doing nothing.

In Ethereum, your work is simply never done.

Did you buy Ethereum? Oops… you needed to stake it to earn 4% more, otherwise you’re falling behind.

Did you stake? You needed to restake! If you’re not earning points, you’re losing out to everybody who is.

At each step, of course, it introduces a bit more risk, it chews up a bit more time… but that’s the game.

DeFi is this on steroids. For every popular token, there’s a new protocol that will give you that, minus a small fee, but made up for by a generous helping of their own token to stake it. It’s a full time job, but as you get to the end of the line you’re only earning a few extra pennies atop your original stake.

Needless to say, your DeFi token lost value relative to if you just held ETH. And your ETH lost value compared to if you just held BTC. Oh well, bear market things…

For our sake, we drew the line at ETH staking… once it pushed into restaking, we didn’t think it worth the risk nor the investment of time. But we’re in the minority here…

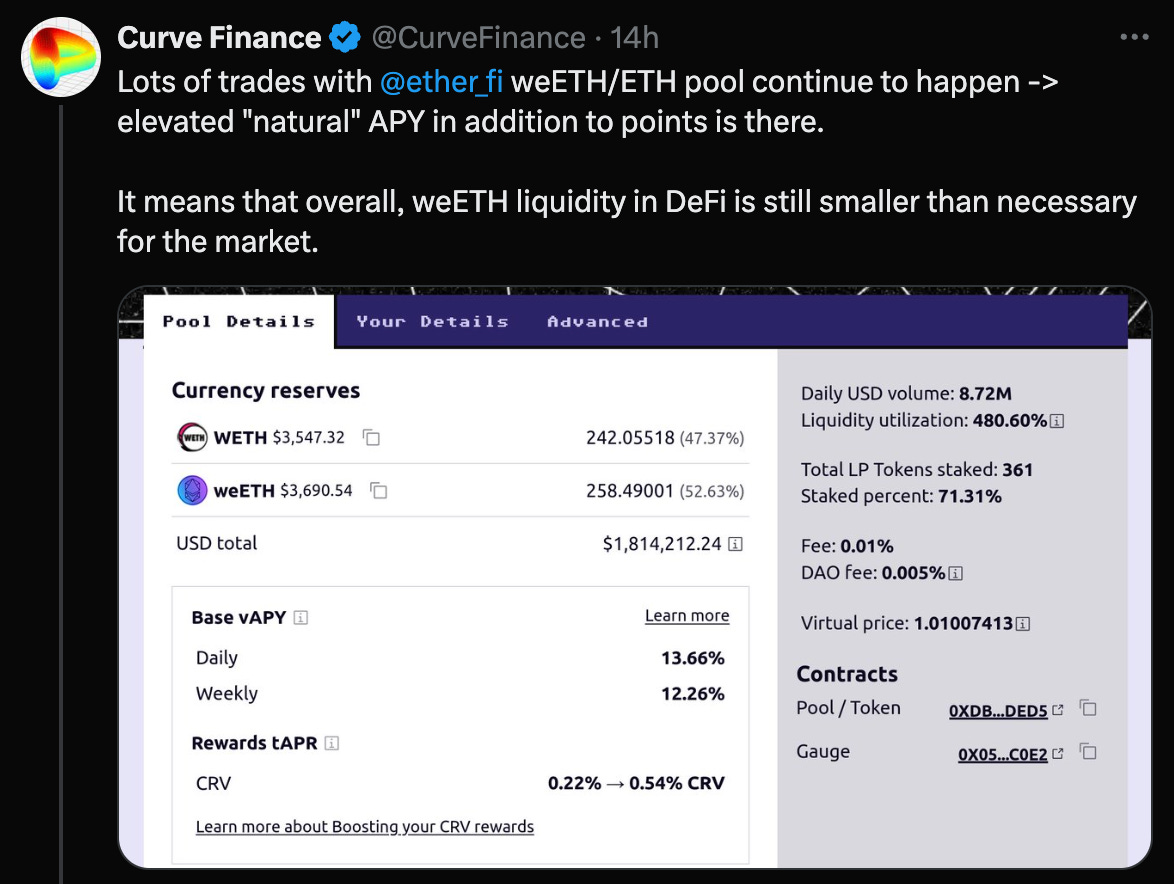

ether.fi’s $weETH is “up only” and earning points to boot, and extremely heavy trading activity.

However, for all the activity, $2MM is not really “size”

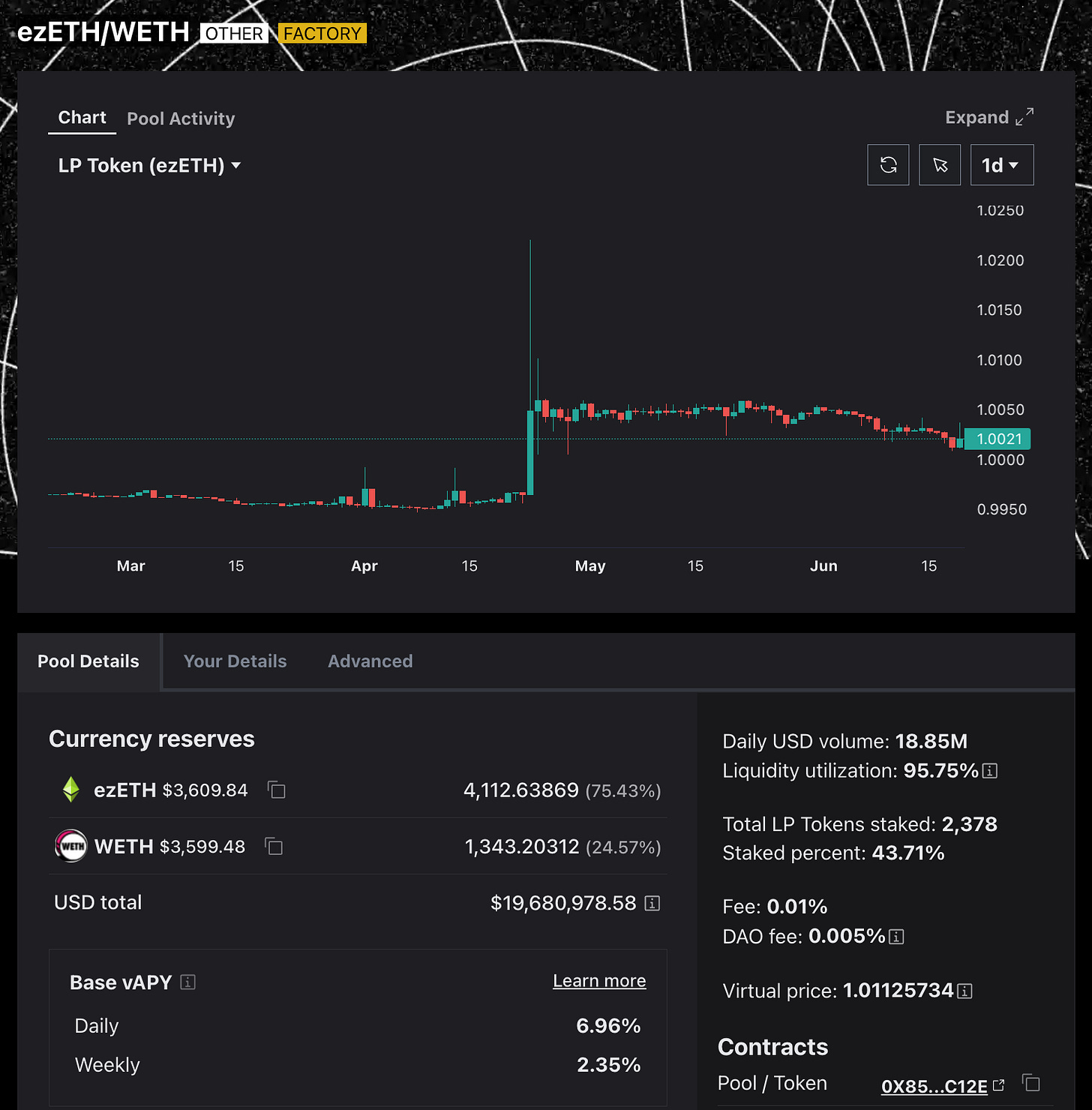

Renzo’s $ezETH is a bit better, with $20MM TVL (enough for Llama Lend?) and very active trading

But that chart be wilding…

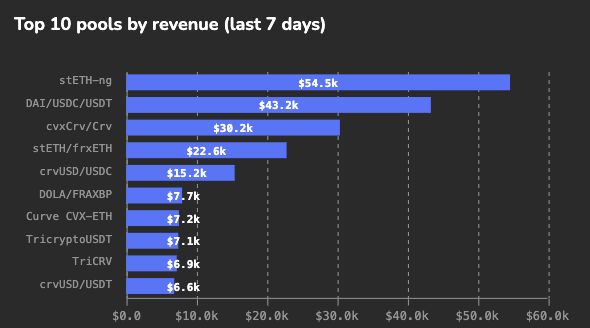

For all the trading in these pools, they don’t even show up on the Curve revenue charts though. The revenues resulting from the frenzy in restaking remains miniscule when compared with the crumbs from Lido, the tried and true king of staking.

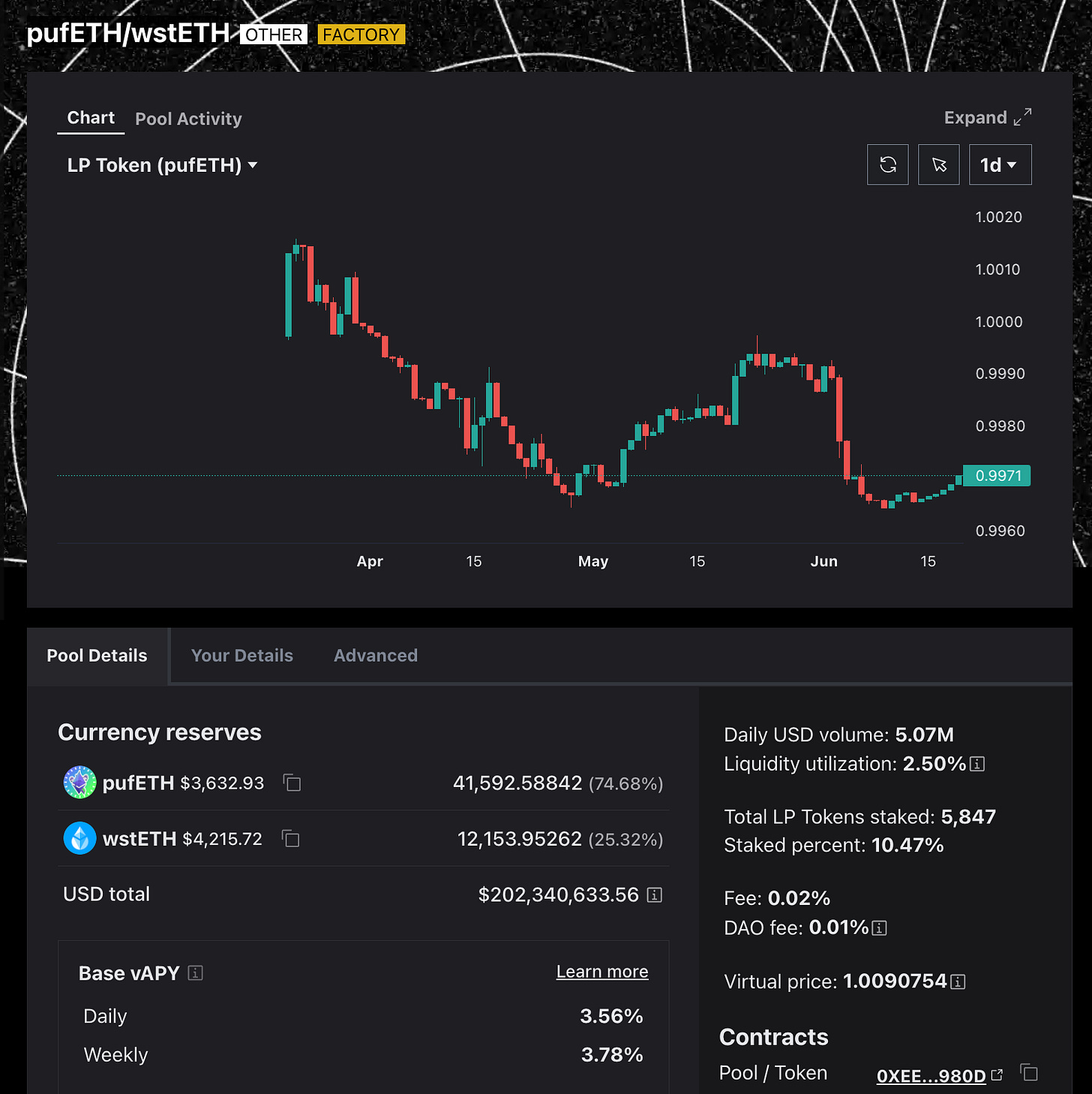

On Curve, it’s the $pufETH / $wstETH pool that’s dominant. Nearly $200MM TVL.

And for those concerned about the fluctuations of the price, it’s the only one with its own Llama Lend market.

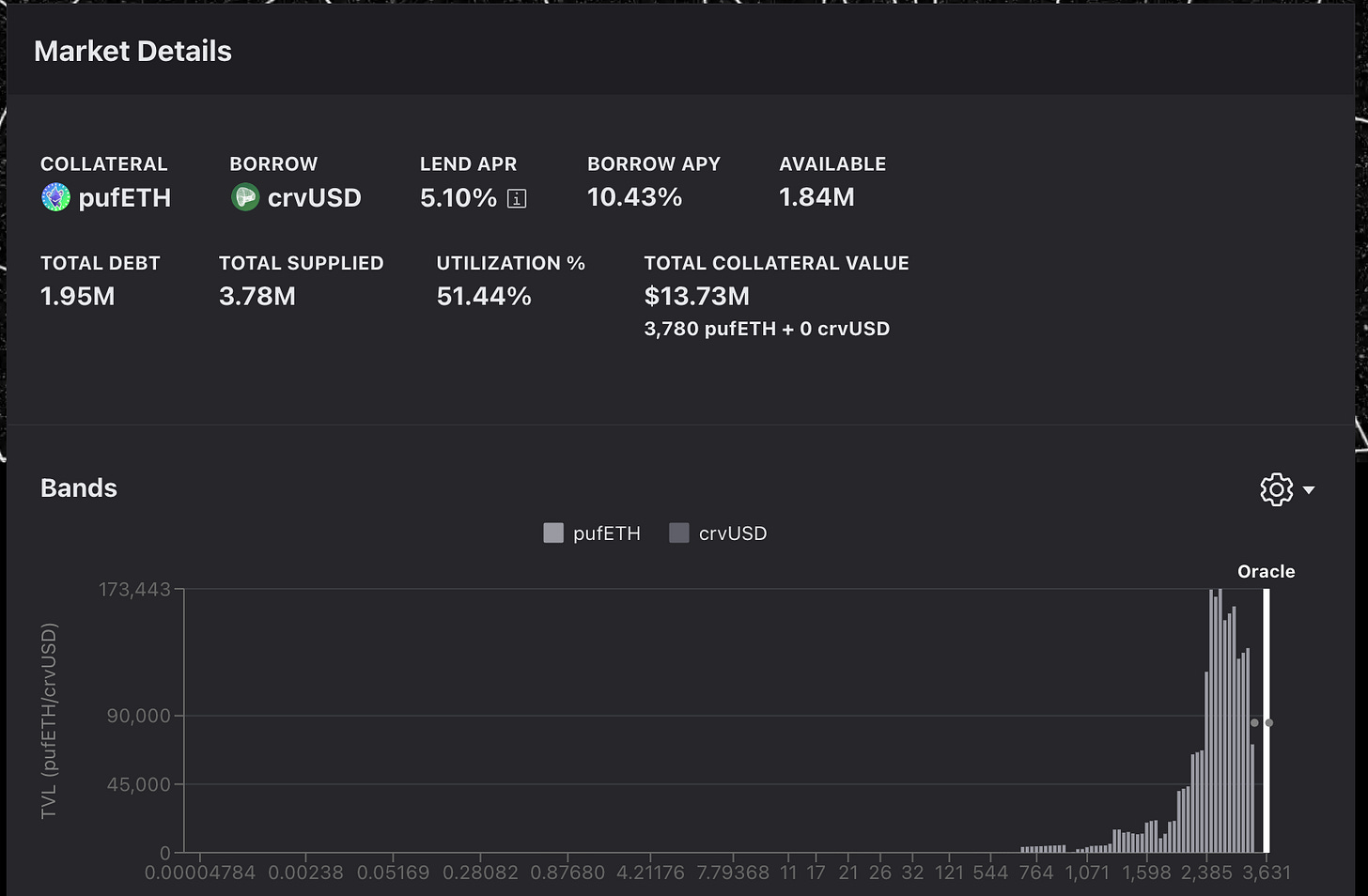

$2MM debt on $3.8MM supplied, for a 10% borrow APY. Plus up to 6.5x leverage for the traders

It’s popular, but not at the 80% target utilization yet. Suppliers of $crvUSD to the pool only get ~5% from interest at the moment, but it’s supplemented with enough $CRV emissions to keep the rate at an attractive 20%.

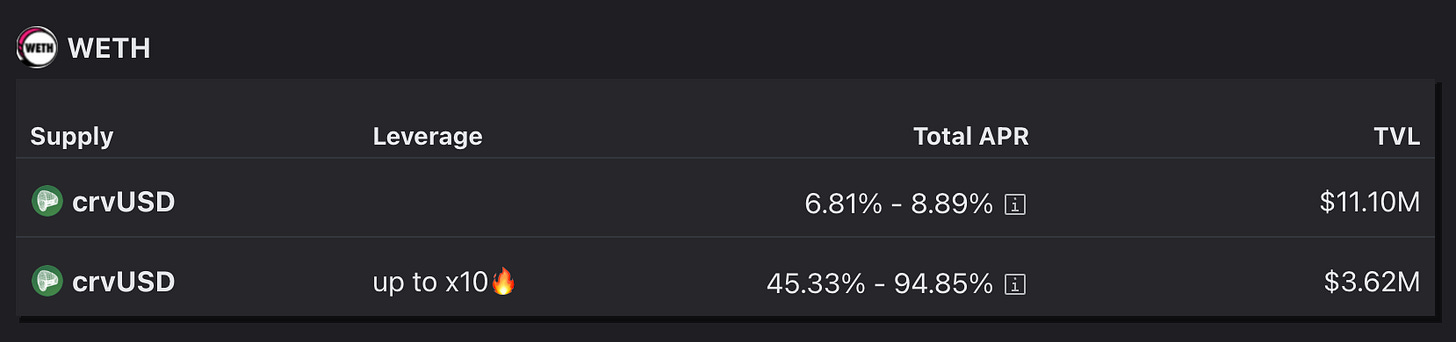

But the pool that’s most being primed for growth is the good ole-fashioned WETH pool. The most recent version of this can support up to 10x leverage, and depositors are given a firehose of $CRV to spur short-term growth.

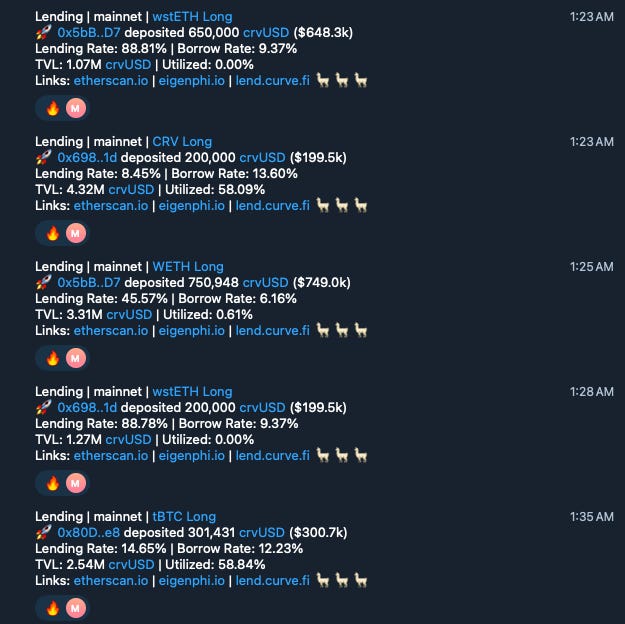

We see big money chasing these various emissions, which of course don’t last, so get it while the gettin’s good.

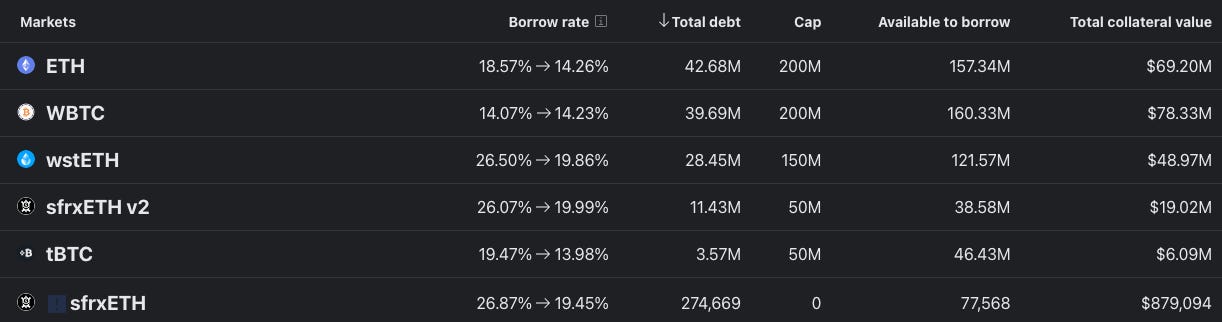

One imagines the huge push for supply in the WETH market is drawing lessons from the sister $crvUSD markets, where WETH has a larger footprint than any LST.

Perhaps simplicity is back on the menu? ETH and WBTC, bringing this all back to basics?

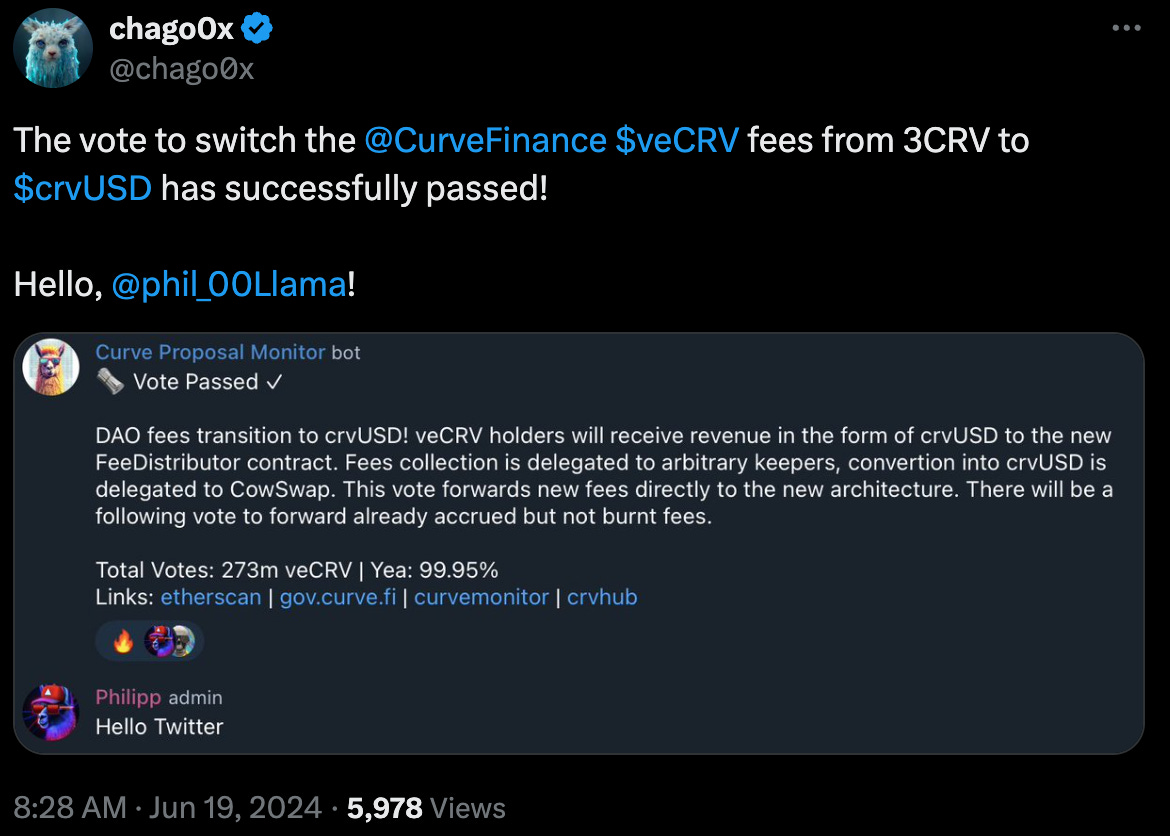

Over time, one expects the addition of leverage markets to Llama Lend to eventually cause rates to equilibrate to those of the $crvUSD markets. Soon we’ll also see the effect of some additional supply sinks for the $crvUSD stablecoin, as the vote to move veCRV fees away from 3CRV passed.

Well, after one more vote that is…

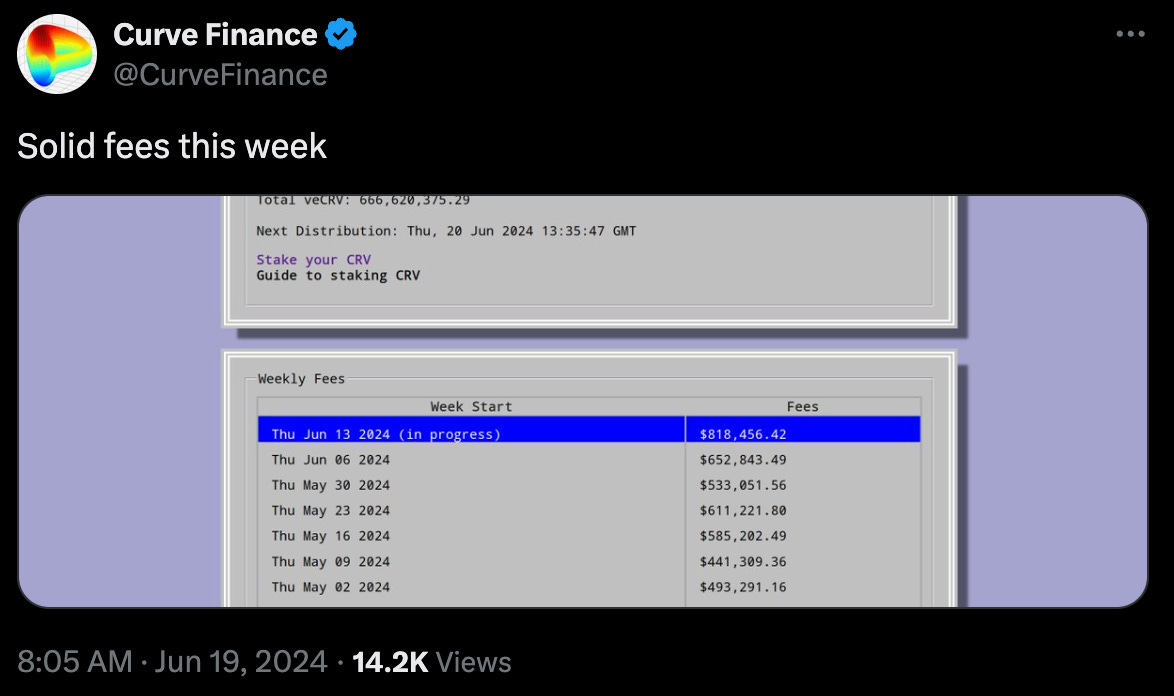

At the moment fees are a bit elevated from the liquidation drama, but each week several hundreds of thousands of dollars worth of fees will be converted into $crvUSD.

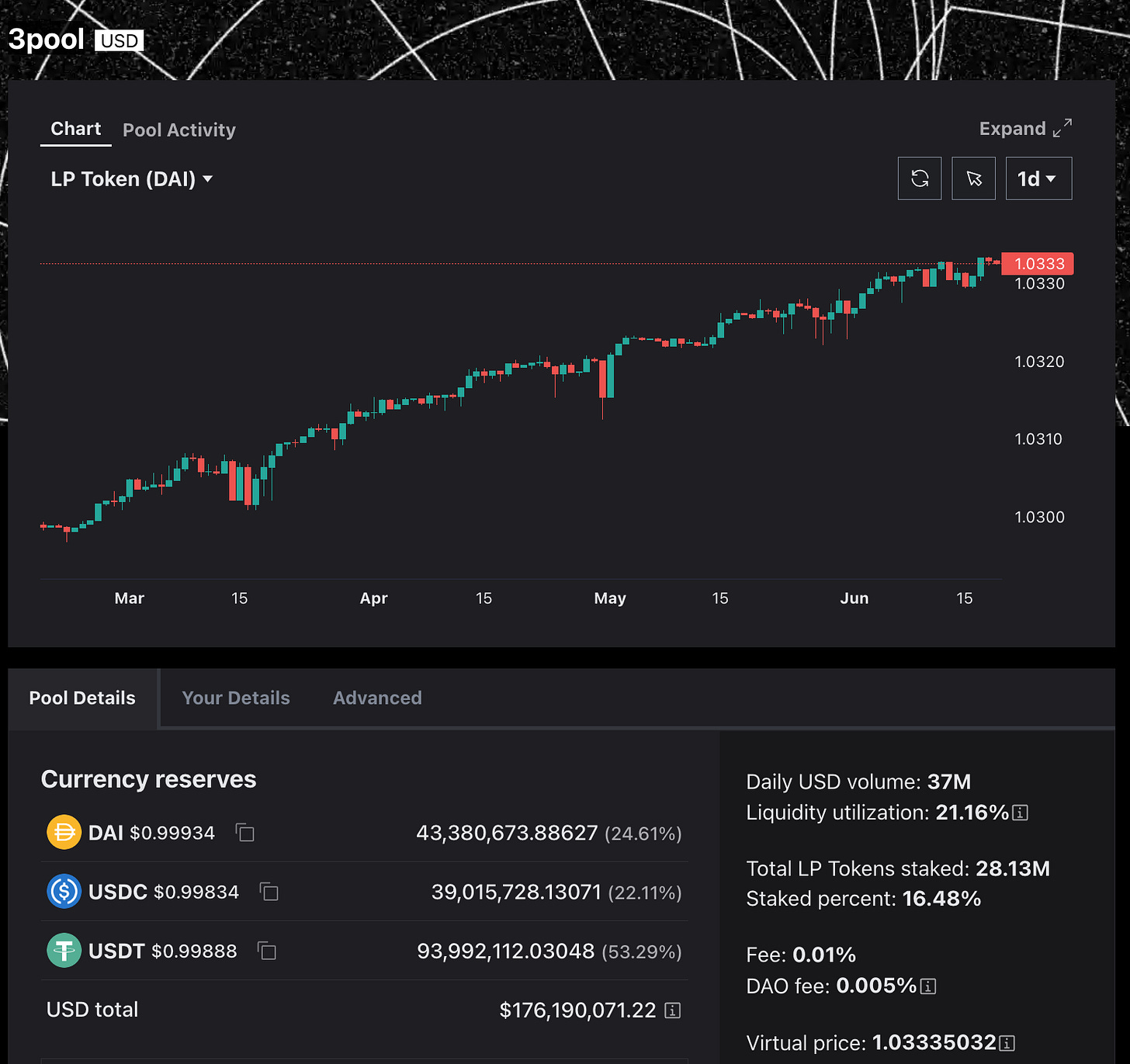

If 3pool is any indicator, some portion of it may be “sticky” — people just leaving it as $crvUSD because they want to chase yields, or are too lazy to swap. Of course, a large portion of this is the Wintermute hacker being unwilling to withdraw. However, $crvUSD may be less sticky, as it doesn’t earn yield passively for doing noight.

For more on restaking wars as they stood at the beginning of the year:

February 7, 2024: Double the Stakes 🃏🎰

Perhaps you noticed that the newest narrative is no longer just ETH staking, but now ETH restaking. With Eigenlayer cracking $4 billion in deposits, a variety of services are scrambling to dominate liquid Eigenlayer staking in the same manner that Lido dominated ETH staking. The only thing growing faster than the entire Liquid Restaking market is the …

Disclaimers! Author has no stake in any restaking token… (but is long $ETH, $wstETH)