June 22, 2021: Bearly Believable 🐻📉

Is the Rational Markets Hypothesis the biggest casualty of this cycle?

If you think this is bad, just wait until China bans Bitcoin again next year.

Each time around the mining ban gets better production quality. Check out the visuals!

As Bitcoin dips below $29K, a fresh new range of liquidations is being triggered. Good thing too… the poor bears were starving.

It’s a market notable for its cruelty. They’re not just wiping everybody out, but even taking cheap potshots at the survivors fleeing for better opportunities.

Downturns like this really challenge the belief that markets are rational. Of course, they may be rational in the long term, but it’s tough to remember this when you’re getting put through the spin cycle.

Still, if markets are rational, why would proof of stake Ethereum be tanking harder than Bitcoin on news of China banning mining?

If markets are rational, shouldn’t DeFi tokens, which are currently printing cash, be ascendant?

If markets are rational, why haven’t the doggy coins been humanely euthanized?

Although the crypto markets do tend to attract the smartest people alive, it also pulls in plenty of dumb money.

It’s inevitable that people have to dabble in contracts they don’t fully understand. From personal observation, I’d estimate that fewer than 5% of people even attempt to read the source code of contracts they ape into, even though it’s made public for all.

Even if you did read it, would it make a difference? Even the auditors, whose job is to read contracts and find lethal bugs, are unable to find lethal bugs.

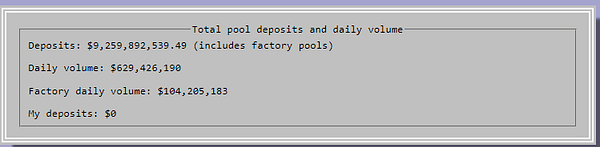

Few humans alive even pretend to understand Curve v2, but it hasn’t stopped hundreds of millions of dollars from testing out tricrypto just based on Curve’s reputation for excellence.

One nice thing about crypto… as a community, even if we frequently get rekt, we end up cultivating a wisdom of the crowds. It’s accumulated not necessarily through a careful parsing of the code, but the collective wisdom accumulated and transmitted by the survivors of multiple market nukes. Given the rapid boom bust cycles in crypto, this collective wisdom accumulates even faster than traditional markets. So even the bottom 10% of the IQ curve in crypto are relatively smarter than bottom 10% of the IQ curve in traditional markets.

So it goes that the frequent market nukes end up being so vitally important to the circle of life. We simply have no more efficient mechanism to enforce rationality upon the markets.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist and holds positions in ETH, BTC, DOGE, and the Tricrypto Pool.