It’s quite clear the TriCrypto pool is a huge hit. $40MM in volume per day, $125MM locked, a 9% APY + up to 36% CRV rewards. Plus nobody understands it, and it’s always the most fun to ape into things you don’t understand!

Wait a second though… what if you want to make an informed investment decision? What then?

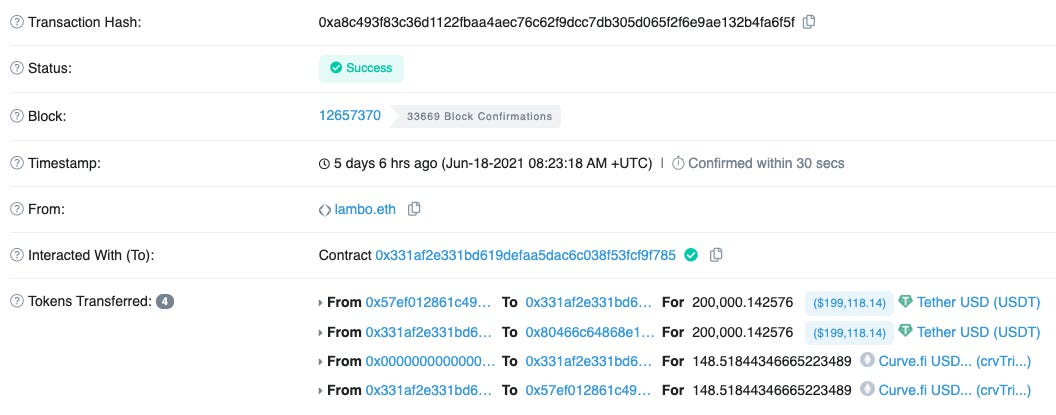

Let’s explore a couple of real world examples and see how they fared as crypto markets tanked. Poking through the blockchain, we found our guinea pig — somebody with the vanity name lambo.eth. Utter perfection on so many levels.

Unless there’s any backdoors we’re not aware of, Lambo aped in exactly one time. June 18th at 8:23 AM UTC for about $200K, when the price of ETH was $2,234 and BTC was $36,630.

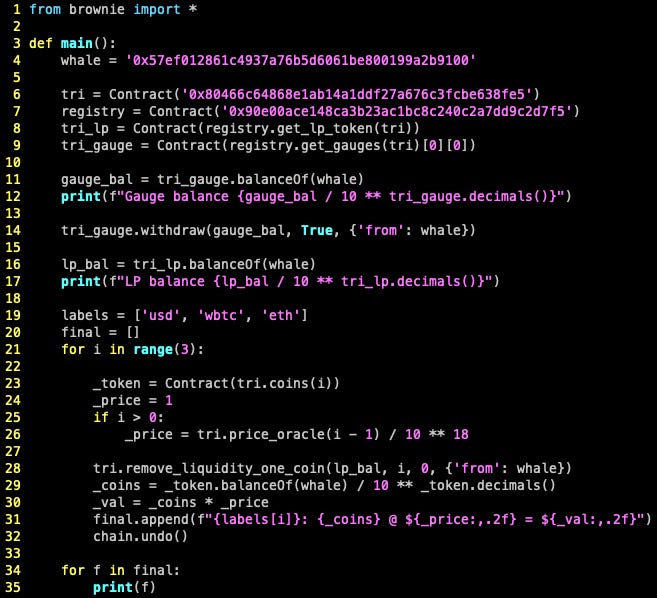

Life is good for Lambo! Let’s see what happens if they try to withdraw today. We put together a simple brownie script you can try at home.

Which gives us:

usd: 180825.316647 @ $1.00 = $180,825.32

wbtc: 5.38450657 @ $33,848.56 = $182,257.77

eth: 92.64986725953396 @ $1,985.33 = $183,940.49

Wait a second, what gives? Why did his $200K drop by nearly $20K? Isn’t Curve supposed to minimize impermanent loss?!?!

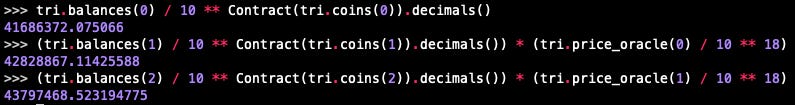

The TriCrypto class of pools rebalances consistently and these are volatile assets. Since they first aped, BTC dropped 8.2% and ETH dropped 12.5%. The pool is roughly balanced (32% - 33% - 34%) so we expect a nice 6.9% loss.

So amongst everything (some slippage and fees), Lambo’s portfolio value has dropped about 7.5% from entry, sitting at $184K instead of the $199K he used to ape in. SFYL.

Lambo’s purchasing power is down no matter how you slice it. If they’d held the $200K they could currently buy over 100 ETH, now the best they can do is to withdraw 92.6. Maybe they consider ETH to be at a relative low and cash out to ET on the gamble that it goes back up, but it’s still gambling at this point.

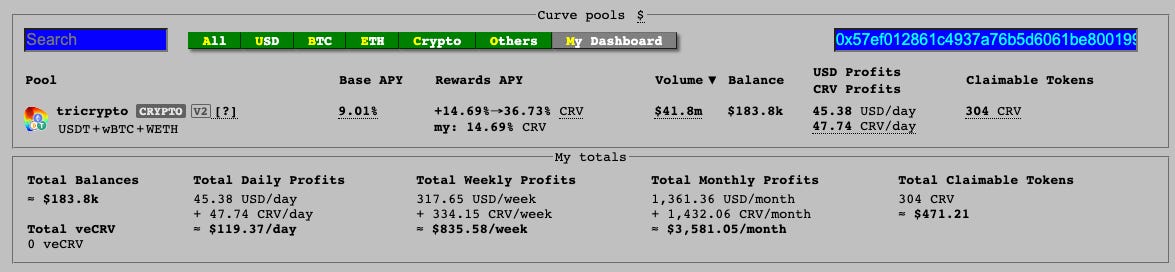

On the bright side Lambo earned 304 in $CRV tokens in just a few days time. Also, there’s about $50 / day from trading fees. It’s tough to tease out the effect of this base APY effect given the larger price movements, but it’s still free money, albeit coming at a time of loss.

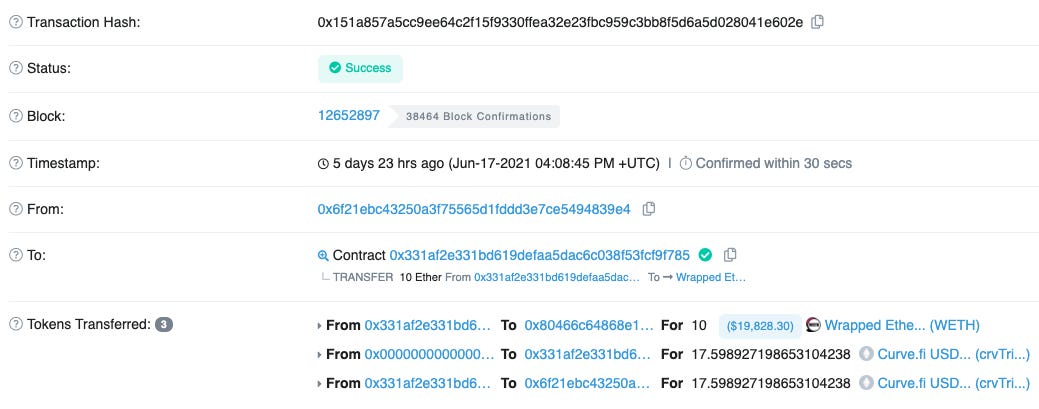

Let’s look at the flip side… another address without no vanity name who dropped in 10 ETH at about the same time. Crypto prices were at a relative high at this point, $38,161 and ETH at $2,372

Since Lambo lost after aping in dollars, we would expect this new user to be in the opposite situation. Lambo saw the other assets in the pool decline, causing purchasing power to drop. Our new friend should therefore be in the best position then, since ETH happened to be the worst performing asset of the three.

Re-run the same brownie script with this new address, and what does it look like right now?

usd: 21825.365994 @ $1.00 = $21,825.37

wbtc: 0.78910953 @ $33,532.63 = $26,460.91

eth: 10.838628891388243 @ $1,975.75 = $21,414.47

The 10 ETH they put in is now worth about $20K instead of the $24K it started at, so we do in fact see their portfolio balance drop in dollar terms. Across the board though, they see relative purchasing power increase in terms of their ETH deposit.

They can withdraw 10.8 ETH instead of the initial 10, amounting to an 8% real gain all things considered. They can also withdraw ~$22K worth of dollars, also a bonus from the $20K they could have gotten if they had simply held their ETH and sold it.

They also get a really good bonus against BTC thanks to some last minute volatility while writing this article. At the outset, their ETH could only purchase 0.62 BTC, but at the moment they could get 0.79

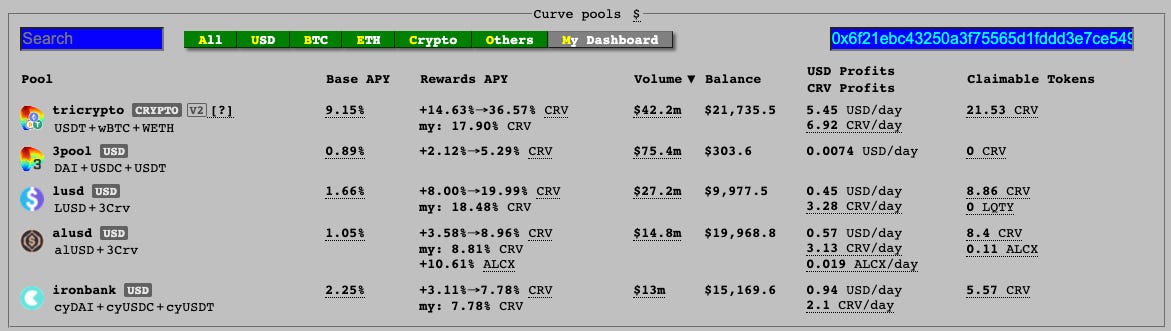

The dashboard reflects the position as such:

It’s a riskier pool no doubt, especially given that it contains three volatile assets. If you want safety, you might consider the classic the traditional pools are still a better option. However, as you can see from these examples, there’s a lot of ways to play these new pools.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist and holds positions in ETH, BTC and the Tricrypto Pool.