It’s been a tough day…week…month…quarter… shoot, it’s been a tough existence for the ETH-derivative stablecoin protocol.

A short upwards correction in the past 24 hours notwithstanding, what’s been going on with the protocol lately that might justify the continued sadism of investors?

Surprisingly, the TVL chart doesn’t look nearly as bad as the token price chart. Since the infamous hack of late March, Prisma saw a sudden outflow, but since this time TVL has stayed relatively constant around $50MM.

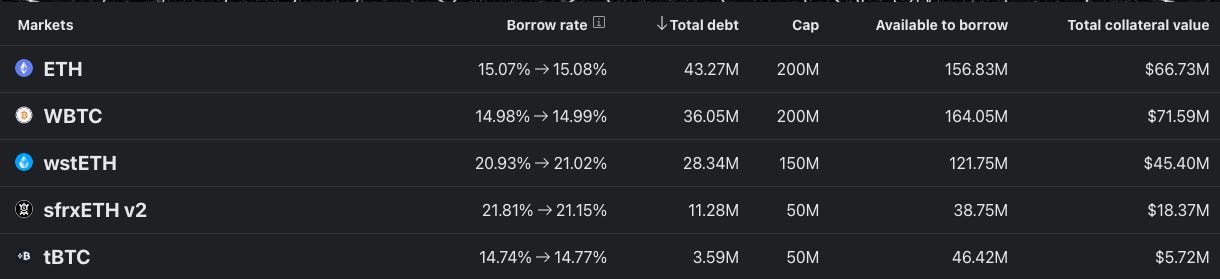

This TVL is used to mint stablecoins (LSTs —> $mkUSD and LRTs —> $ULTRA). Both stablecoins took a hit in the wake of the hack, but have somewhat stabilized at an aggregate market cap in the low eight figures.

Certainly a far cry from its heyday, but notably both stablecoins have mostly held their peg as the protocol is walking through its darkest valley.

Meanwhile, for the team, it’s business as usual. Over the past week, the always superlative Prisma Risk team delivered a must-read report on Stader Labs ETHx, which led to the LST getting onboarded as collateral for $mkUSD. This marks a total of 5 LSTs and 3 LRTs supported by the protocol.

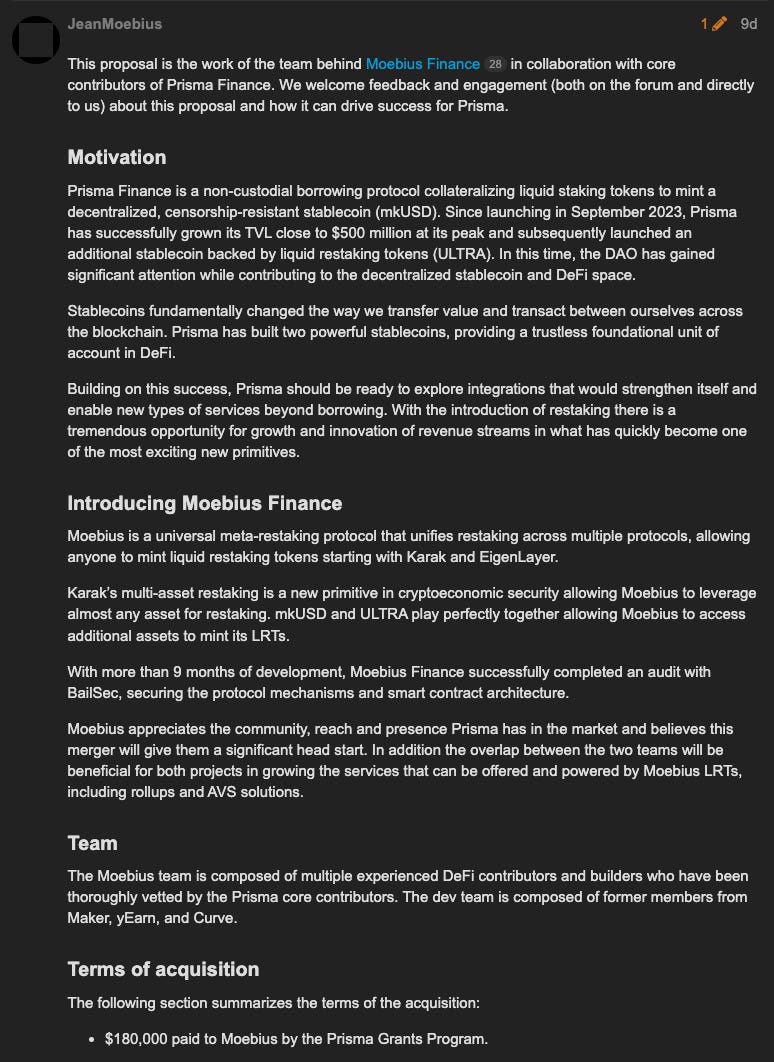

Meanwhile, the team looks to be moving forward with an acquisition of Moebius Finance

They’re also proceeding with a recovery plan for the hack victims, even with the knowledge that it remains plausible the funds may ultimately be recovered.

Our coverage from the hack…

March 28, 2024: After the Storm Comes the Rainbow ⛈️🌈

All decent people abhor the too-frequent hacks in DeFi.

In many respects, it looks almost like the business is operating as usual around Prisma.

The clear weakness, as alluded to above, is that the markets have hammered the speculative value of the token to new depths. However, much of the other activity around the token is also continuing apace.

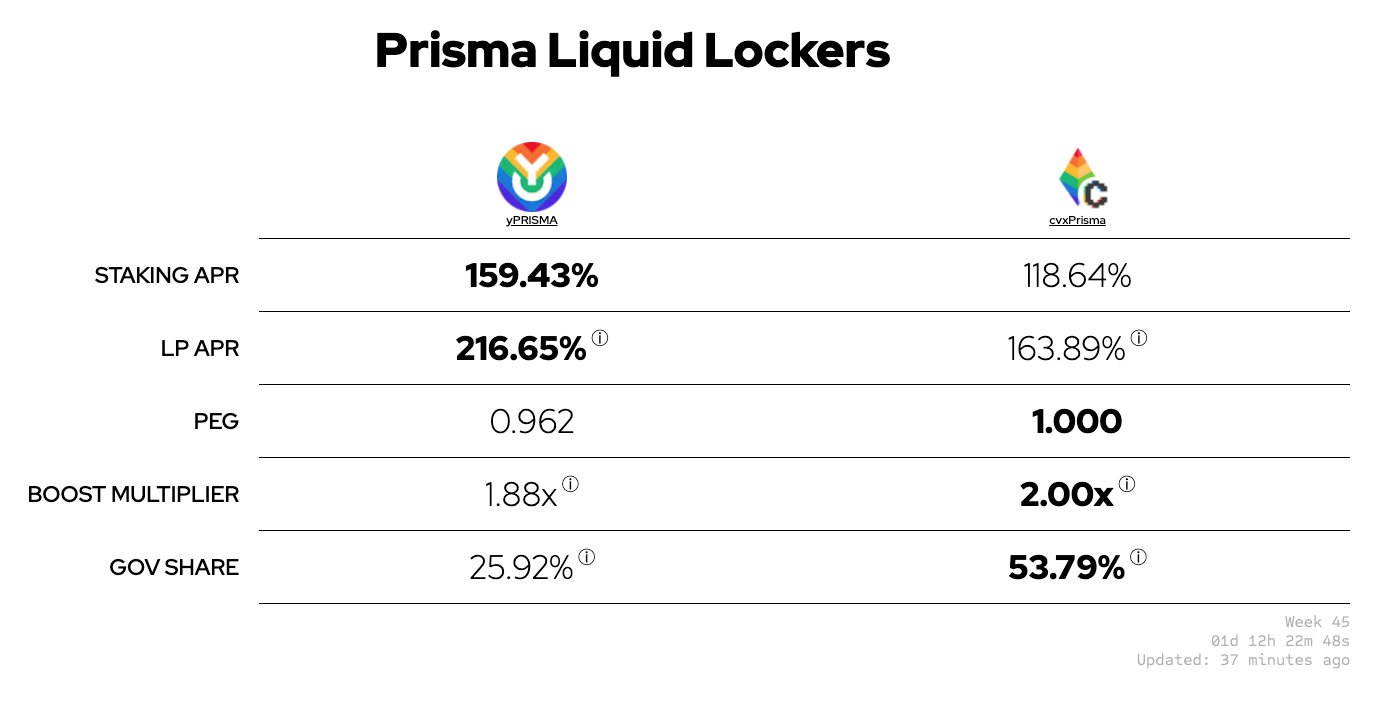

The story of $PRISMA governance is most heavily that of its two liquid lockers, $yPRISMA and $cvxPRISMA, which are approaching 80% dominance.

Historically it’s been dominated by $cvxPRISMA, although the recent relaunch of $yPRISMA, using the same mechanics as the recent relaunch of $yCRV, has somewhat scattered the activity.

Based on emissions, this napkin math puts this around 60% of emitted $PRISMA ends up locked, a rate that’s been rather consistent both before and after the hack.

By most metrics, Prisma the protocol is relatively healthy, at worst suffering from slight attrition. Yet the $PRISMA token price has been nuked, to the point that lockers are seeing comically high yields.

If nothing changes (certainly the least likely assumption in DeFi), buying a $PRISMA and staking it would pay it back in under a year, heavily in $mkUSD. So what do the bears know, and when did they know it?

Of course, one possible argument could be that nothing has changed about Prisma, but the macro landscape shifted from under. That is to say, when it launched the narrative was LSTs, then it became LRTs, but perhaps the market has simply shifted away from these narratives.

There is some evidence of to support this claim. Though it was sluggish to gain popularity at start, the raw $ETH market is now the largest $crvUSD market by debt.

If the ever-transient narrative has shifted back to naked ETH, as opposed to derivatives, or derivatives of derivatives, then we’ll wind up back where all roads start and end: at Prisma’s progenitor Liquity. In the realm of ETH-backed stablecoins, Liquity remains OG and champion, a fact undisputed even among Prisma fans. The upcoming launch of Liquity v2 and the $BOLD stablecoin would also give Liquity some exposure to the LST market, should there still happen to be any narrative oomph left in this sector at the time.

So, one may could argue $PRISMA’s price woes are simply a reflection of market concerns about long-term fundamentals. While this explanation has some satisfying intellectual coherence, it obviates the simple truth that “long-term” mindsets and “fundamentals” have no place in crypto. Our asylum is populated almost entirely by short-term trading focused lunatics, who only care if a token is likely to 100x in the next week.

Short-term price analysis is hardly our forte, as our investment philosophy is DeFi maximalism: one way fiat → BTC/ETH/DeFi tokens expecting TVLs reach multiple trillion dollars over a long enough time horizon. To this end, we’re irrationally long $PRISMA, $LQTY, and all others, and we mostly tune out short-term price fluctuations as noise.

But since you asked, here’s what we’ve heard…