June 29, 2021: Money Printer go *CLUNK* 🖨️💸

Leveraged Dollarcoins like $LUSD, $USDP confront a supply crunch

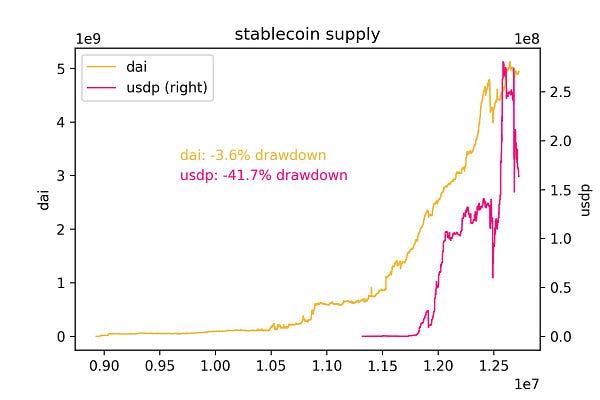

Unit Protocol has observed a large drawdown in total supply of USDP lately, as high as a 42% drop.

In this case, the explanation may be partially related to adjustments to MakerDAO’s stability fees.

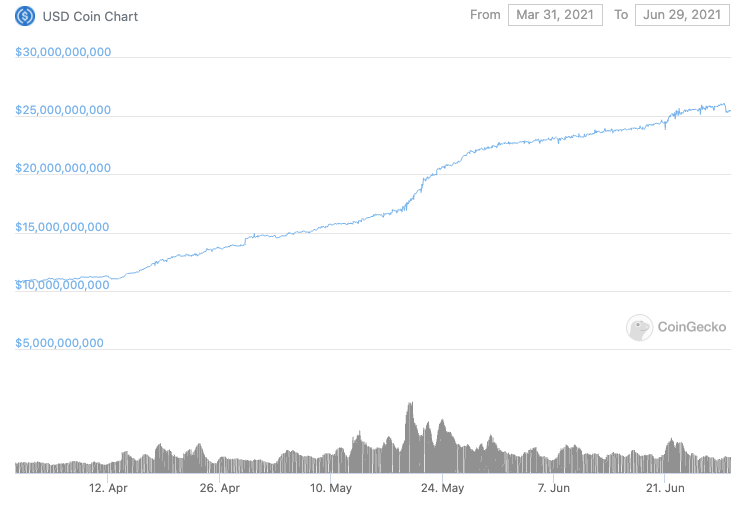

If there are stablecoin supply issues, the issue is not universally distributed among stablecoins. The top coins are generally stable or growing slightly.

For instance, USDC market cap is continuing to grow.

Tether is flat.

As noted by FRAX founder Sam Kazemian in a public telegram chat, the drop in supply appears to mostly affect leveraged stablecoins.

Indeed DAI did suffer a drop during the May crash, although it recovered quickly.

Checking through the Curve array of stablecoins, most didn’t show any supply crunch during the May drawdown. The few we flagged below are the only ones we found that retreated over the past 90 days.

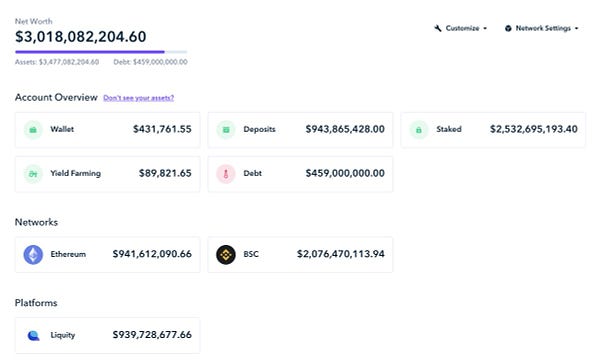

Certainly, the most notable was Liquity, which saw its market cap slashed in half.

As we noted previously, about a billion dollars was dumped into Liquity by Justin Sun, coincidentally about the same amount that disappeared. Wining and dining wives ain’t free.

USDN also took a bit of a dip

Alchemix USD also suffered a small drop in supply, though its timing was unrelated to the May crash.

The aforementioned FRAX also dropped during the worst of the market, but has since more than recovered.

Indeed, the aforementioned coins are leveraged to some degree. The stablecoins backed by dollar reserves tended to see their supply remain stagnant or grow slightly during the dip.

One notable exception was the PAXOS coin, which claims to be fully backed by dollar reserves. Their tumble continues to this day.

The good news is all of the aforementioned stablecoins have mostly held around the $1.00 peg throughout the time period. The consideration is not price but total supply. Given that leveraged stablecoins tend to get minted when altcoins are steadily rising in value, it’s not too much of a stretch to imagine the opposite effect occurring when markets nuke.

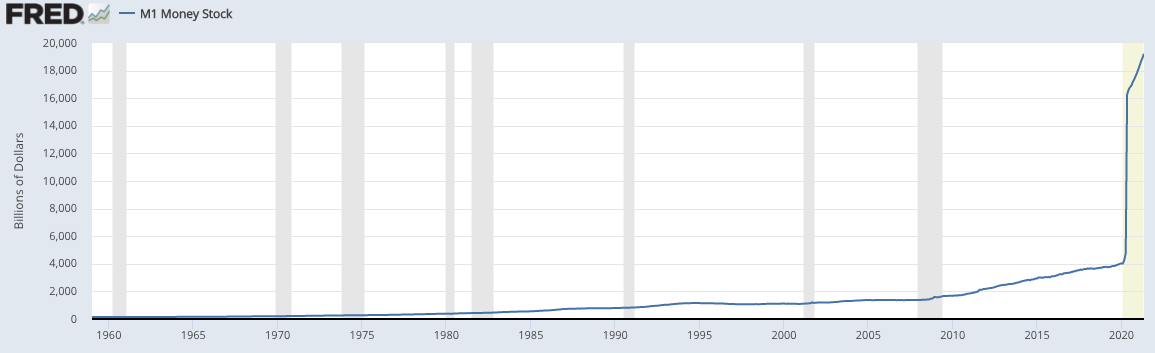

Is this an indicative of a broader loss of demand for stablecoins? Tougher to say. We know supply of actual USD is shooting up by the trillions, so Econ 101 should tell us demand for dollars would adjust accordingly.

We also know that over the past month the dollar has been appreciating in value relative to the crypto markets. A lot of bearish traders are cashing out to dollars as a safe haven until the markets rebound. Then again, is there really a “safe haven” when some DeFi yields fall below inflation rates?

Amidst conflicting indicators, one positive indication for stablecoins is that regulators appear to be warming to the inevitability of stablecoins.

We believe dollarcoin dominance in DeFi is a gift to the USA and free rails for something like a CBDC. Following China’s recent strategic blunders, a wise empire would be seizing the opportunity to secure a leg up on their rival.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist, long USD and holds bags of several of the dollarcoins mentioned here (USDT, USDC, DAI, LUSD, USDN and USDP).