Leviathan News interviews Knows, who broke the news that BIS is exploring the Curve v2 algorithm for international settlements.

The Mariana Trench! The deepest part of our world's oceans, a place of darkness and pressure, yet full of life and mystery.

Imagine, if you will, sinking beneath the surface, slowly descending into the deepest depths of the sea. As we journey deeper, the sunlight fades, replaced by a vast, unending darkness. We are in the realm of the eternal night, where the pressures are crushing, and the temperatures are near freezing, yet life persists.

This is a world untouched by human hands, a world where the sea floor plunges over 7 miles below the surface, a world where the tallest mountains would be dwarfed by the sheer depth. Here, at the bottom of the Mariana Trench, lies the Challenger Deep, the lowest point in Earth's crust.

In this realm of eternal darkness, we are reminded of our smallness, our insignificance in the grand scheme of the universe. We are but fleeting visitors to this alien world, and yet, we are inextricably linked. For it is the sea, with its vastness, its depth, its mystery, that gives our planet life, that gives us life.

As we ascend, leaving the trench behind, we are filled with a sense of awe and reverence. The Mariana Trench, a testament to the unknown, to the power and the mystery of the sea, serves as a reminder that we are but visitors on this blue planet, forever bound by the pull of the tides, the call of the sea, the lure of the deep.

Buckle up, fam. Is this… national adoption?

Let’s get the important disclaimers out up front: we don’t recommend anybody rush out to buy $CRV or make any other big financial moves based on this exciting news.

We don’t talk financial advice or price action on the Substack, but our default rule of thumb is that if you care about “number go up” the $CRV token is the most disappointing token for you and you should absolutely look elsewhere. We only tend to get along with the chads who are passively cash flowing for the long-term, not those looking for a short-term pump. Short-term, Curve has a habit of releasing paradigm-shifting products and then seeing its token dump.

Even if this news actually meant that nation-states are moving their battlefronts to the Curve Wars, we’re still probably years away, and degens only have about a one-week time horizon. So no rash moves, people. Besides which, we don’t interpret this news to mean nations are joining the Curve Wars.

Nonetheless, we’ll take a victory lap. Some observers have long lamented “there’s no real innovation in DeFi, we’re just rebuilding TradFi.” We’ve turned blue in the face screaming back that the Curve v2 algorithm is ackshually an unprecedented innovation unlike anything that TradFi has ever imagined… easily worthy of a Nobel Prize in Economics (after giving the honor to Satoshi Nakamoto opens the floodgates to crypto innovators).

The concept of pools that automatically and efficiently manage liquidity remains indistinguishable from magic, and we strongly believe Curve v2 pools remain vastly underappreciated.

The announcement that Project Mariana will explore using this algorithm begins to scratch the surface of this algorithm’s potential.

Cross border settlement volume is estimated to be in the trillions, an order of magnitude larger than the entire cryptocurrency market.

For context… Curve TVL is only measured in the billions. Tapping into the settlements markets could provide an easy 1000x. Even if Curve captured the settlements market, there’s even bigger markets that might be a good fit for some applications of Curve v2 pools or potential offshoots. Forex? Derivatives trading? Some of these markets are estimated in the quadrillions. As the cliche goes, “we’re so early…”

The market potential is vast, and henceforth it’s fitting that the BIS innovation hub titled their search for a means to improve this market “Project Mariana” — referencing the deepest point on planet Earth’s oceans.

Curve pools function a bit like a black hole, but maybe the Mariana Trench is a more apt analogy. Curve pools are exceptionally suitable at attracting deep liquidity.

We’ve seen over the past two years how brilliantly Curve’s TriCrypto serves not just as a bespoke hub for trading three volatile assets, but that its LP token serves as a suitable asset/hedging instrument in its own right.

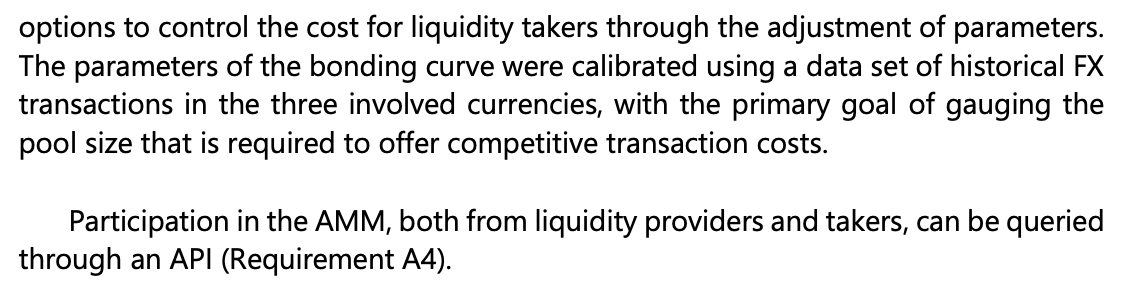

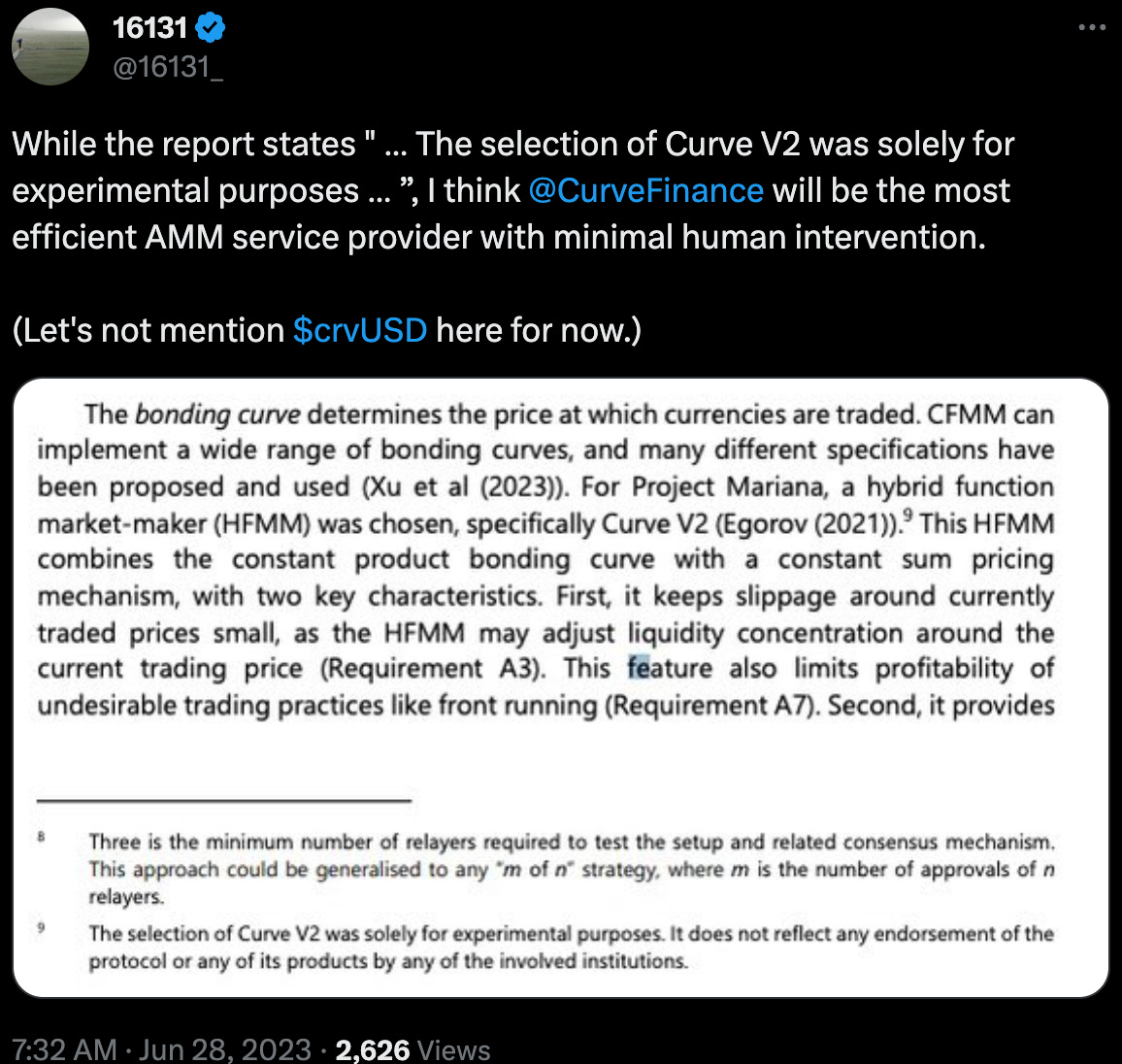

It’s inevitable, given the constraints of Project Mariana’s search criteria, that they would land on the Curve v2 algorithm. The entire PDF is worth a read, but we highlight here.

The difference between Uniswap v3 and Curve v2 when judged on this front means there was really just one possible choice. Uniswap v3 gets points for gas efficiency, given their requirement liquidity providers absorb the onus of rebalancing liquidity. But Project Mariana needed a more passive solution. Moving billions of dollars, the slight savings in gas fees become inconsequential relative to concerns like slippage.

Curve v2 pools are still relatively poorly understood, but it’s not a surprise that anybody who took the time to do their homework would recognize their power as a solution. While the biggest banks may be slower and more constrained in their ability to innovate compared to DeFi, but they still employ sharp financial minds with a keen mathematical sense.

Even if the theory behind Curve v2 pools is elusive to most observers, the experimental evidence from Mich operating it publicly for 2 years amidst intense volatility has to convince even the most hardened skeptics.

What does it mean for Curve? Probably nothing. The paper goes out of its way to distance itself from the Curve protocol itself.

This disclaimer is spiritually akin to the “blockchain, not bitcoin” refrain bankers once used to distance themselves from degens. Perhaps it’s standard CYA, or perhaps they were infected with the idea that cryptocurrency is “rat poison squared”.

Optimistically, we’re slightly inclined to think they ultimately decide it easier to build atop the existing infrastructure than launch their own, but we agree this could go either way.

Our understanding is that the code is publicly viewable, but that the math is proprietary and the IP is owned by Mich’s company Swiss Stake. Even if they do opt to launch outside of Ethereum, we’d expect at minimum they’d be required to license use of the algorithm should they seek to use it as a base layer for modern finance. They wouldn’t cite Egorov in official publications, and invite him onto panels, if their plan was to simply steal the algorithm.

It’s also notable in that the BIS used to be a leading opponent of cryptocurrency. Was this Mich’s appearances on a BIS panel that began to convince them to change their mind?

We’re watching something great… it’s a major step towards watching exactly how DeFi and TradFi ultimately overlap.

So what of the idea that Curve would be come an app for CBDCs? We’ve heard decentralization advocates wax poetic about the evils of a central bank digital currency for some time. Is Curve striking a deal with the devil?

We don’t see it this way. Of course, we’re very wary of the dystopian nightmare some governments are trying to sneak in under the label of a “CBDC.” Yet historically, governments tend to engage in a push and pull with their citizens before landing on a decent compromise. We see no reason why a CBDC need necessarily be Orwellian. We believe the better approach is to advance a positive statement of principles (ie a CBDC bill of rights) that we’d consider palatable and draw a hard line against the worst excesses.

More from our prior article:

Sept. 27, 2022: CBDC Gud Coin? 💵 🏦🇺🇸

We know a CBDC is coming. Is there a path to making it… dare we say it… a gud coin? A “good” CBDC is unlikely. The path toward it is convoluted and narrow. But it’s possible, and we should all hope that it happens. Let’s consider this path.

We drop this mostly so we don’t get accused of abandoning some principles to shill for the big banks.

It really feels like a watershed moment, not just for Curve, but more broadly for DeFi and the entirety of cryptocurrency. Judging by the gleeful reactions, CT tends to agree.

We look forward to your thoughts!