June 30, 2023: The Mystic 🔮🚨

Did an innovative new source and the Fiddy Indicator predict the future?

No Llama Party today… and expect they’ll be similarly sporadic over the next month. Mebbe try going to a real party instead of spending all day online with your imaginary internet friends?

Depeg Alert

The Fiddy Indicator klaxon blared this morning, this time from a new source.

OK, we’ll grant you… a rise from 33% USDT to 42% isn’t exactly a depeg, and under ordinary circumstances would have simply fallen under the radar.

Just hours later the SEC would reject the Bitcoin spot ETF applications and our beloved computer coins would promptly dump.

But, wait a second… what was this magical alarm that turned out to be alfa? How did it predict the future?

The alert came from the new Twitter account @curvelpmetrics, the handiwork of Xenophon Labs. The team received a grant from the Curve Grants Committee and Llama Risk to study predictive analytics that could be used to identify potential depegs before they happen.

The astute researchers have identified several metrics which may correlate with an actual depeg, such as the Shannon entropy (a measure of the overall token balances) and net swap flow (token flow into/out of a pool).

They wrote up their results in several great places that are highly worth a weekend read.

Substack link:

Fascinating stuff! Follow or HFSP (NFA)

$TUSD

We warned you about the $TUSD issues earlier this week, and the fallout continues.

June 28, 2023: $TUSDepeg? 🌇💥

Tomorrow we’ll likely zoom out to look at the late breaking news that BIS is looking to build a CBDC platform using Curve’s v2 pools, so drop your reply guy takes over the next 24 hours if you want to be included in the newsletter… For now though, it’s $TUSD’s turn in the barrel!

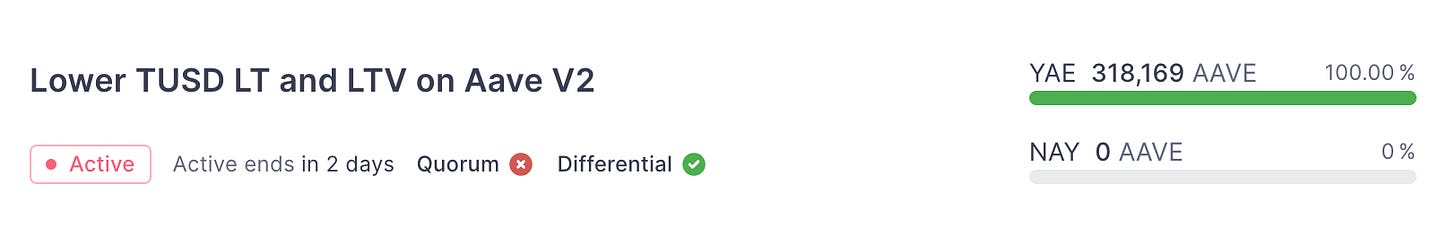

Since publication, Aave is voting on booting $TUSD.

The Conic team also decided to put it up for a vote to get booted.

It’s presently unanimous, implying $TUSD is soon to get the heave ho.

This was clearly done because of risk factors, but a nice side effect is that it might actually cause Conic’s $crvUSD omnipool to see increased yields, since the $TUSD yield was actually dragging it down.

Incidentally, this adjustment would ordinarily have the effect of increasing the imbalance in Peg Keeper pools. Fortunately Conic is also voting on adding the $crvUSD Peg Keepers to the $USDT/$USDC omnipools. Read Fiddy’s great proposal and vote!

Reserve

Big congratulations to Reserve Protocol!

Accomplishing this, especially amidst an otherwise hostile regulatory environment, is quite the impressive feat.

Reserve has been on an absolute tear lately, with several tokens launched by the community through its platform.

Not financial advice of course, but you might try taking a look at their Curve pool yields… maybe you might like what you see… 👀

TriCrypto

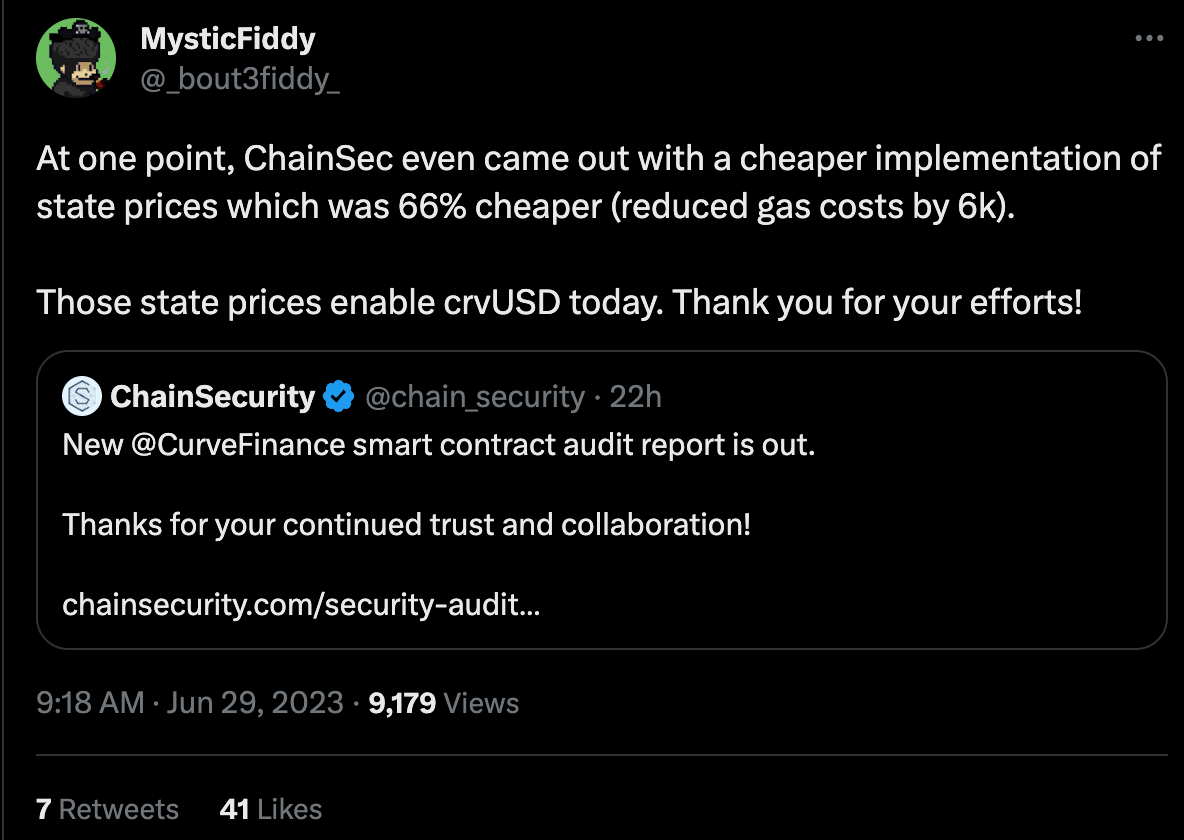

The TriCrypto pools are already humming, and now you can stick around these pools with greater confidence thanks to this ChainSecurity audit.

Auditing TriCrypto NG is a very tough job. The contract involves extremely advanced math. Kudos to ChainSecurity for not just rubber stamping it, but actually recommending improvements that would ripple positively throughout the ecosystem.

If you have TriCrypto LP tokens by the way, what are you doing with it?

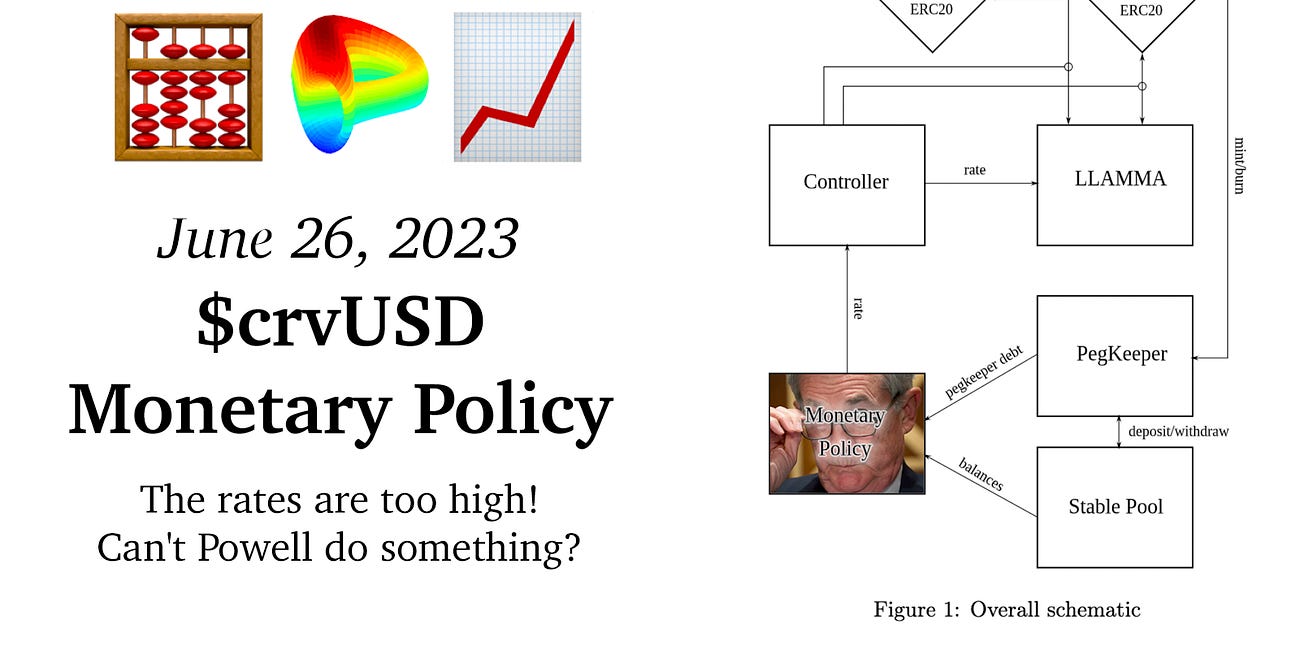

$crvUSD

Interest rates are back down! Powell did something?

June 26, 2023: $crvUSD Monetary Policy 🧮📈

In the United States, and its sphere of influence, rising interest rates became a major flashpoint over the past year, affecting markets including real estate, stocks, and all of our crypto bags. Here is a graph of the severe interest rate changes over the past year.

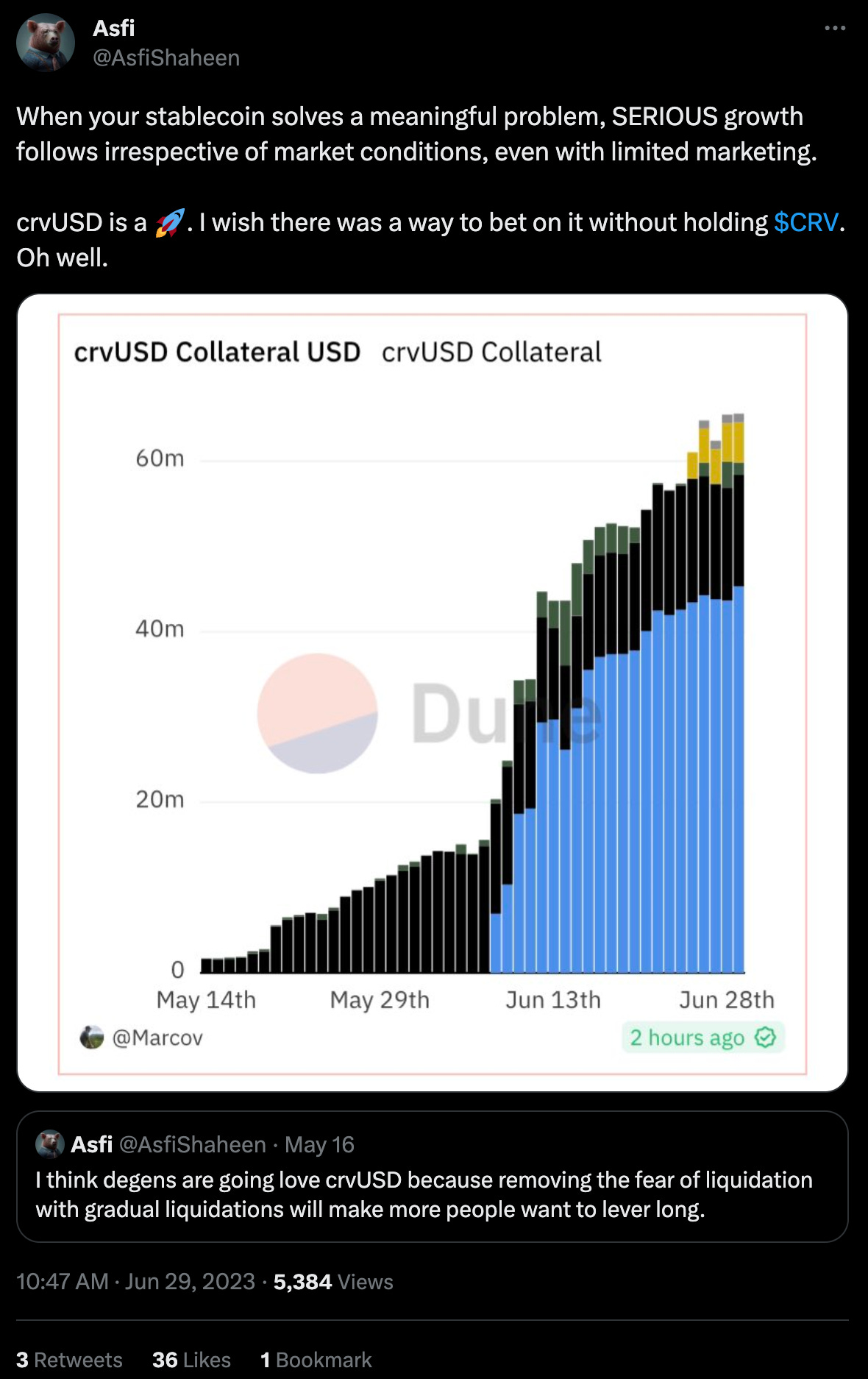

With lowering interest rates, volume has begun flowing back into $crvUSD. The token sailed past a $50MM market cap and is still flying.

We mostly believe that market cap is mostly correlated with interest rates, but we’ll see if this holds as more and more utility for the new stablecoin gets opened up. This past week the first onramp/offramp was announced, and rumors have it that Mt Pelerin is in fact legit (not financial advice of course, ape carefully).

The OKX wallet also announced a $crvUSD integration.

For the latest on $crvUSD, we recommend you take a look at the Curve Monitor dashboard, which just added a nice Premia column.

The “premia” is calculated as the difference between the borrowing rate and the best yield, (currently Conic) — with interest rates down it’s double digits. With other ETH yields in the mid single digits and BTC yields in the low single digits, you can see how it’s a particularly appetizing destination.

Not financial advice, of course.