More market stumbles may be unwelcome news for Bitcoin maxis partying in Florida, but it’s great news for DeFi. So much great news for DeFi and Curve in particular lately, it’s tough to fit this all in. Here’s the action:

Convex

Anybody who understands DeFi is talking about the incredible run of Convex. *Cough* *Cough* *Ahem* @WSJ.

Although @DefiMoon had devoted a whole department to covering #theLockening wars, it looks to be over just as soon as it started. Convex has already almost lapped Yearn.

Where is this volume coming from? Blockchain sleuths have tied a lot this activity to Alameda. SBF is making a big play at climbing the prestigious wealth / (age * pounds of flesh) leaderboard, while his rival VB suns it in Miami.

But who’s really in charge??!?

The other big happening in Convex land is the state of CRV/cvxCRV, a pool currently earning a whopping 160% APY.

Surprising absolutely nobody (except maybe the WSJ), CRV/cvxCRV has already depegged.

We’re paying a ton of attention to Convex, but don’t forget that it all circles back to the benefit of Curve. What a week for the chaddest proto in DeFi.

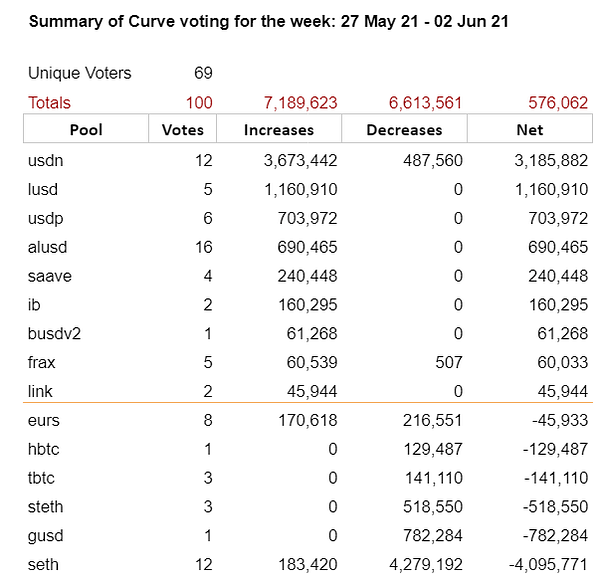

Curve Governance

Since Curve is the hub for all things DeFi, it makes perfect sense that everybody who’s anybody is trying to influence its direction. As a result, we’re seeing a lot more activity than usual around the Curve governance forum.

The much requested votes for off-chain gauges has dropped.

This vote may be more controversial than most votes. @LimZero, second richest individual on the Curve Leaderboards, came out swinging.

Despite this lobbying, both votes are still looking on track to pass.

Curve Future

We’re blessed with so many goodies with V1, and yet Curve is already teasing v2.

Any guesses what it all means? Drop your idle speculation in the comments!

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice, or even coding advice. Author is a $CRV maximalist and has positions in Convex.