June 5, 2023: Raise the Roof ⬆️🏠

Curve DAO approves $150MM ceiling for wstETH as crvUSD collateral

Gunna be a big week?

A substantial Curve vote passed with overwhelming support this weekend. The great Wormhole Oracle described the ramifications of this vote in exquisite detail in the governance forum. The vote bundles two important actions:

Raise PegKeeper debt ceilings to $25MM

Add $wstETH market with newer contracts and $150MM debt ceiling

The PegKeeper debt ceilings were initially set at $2.5MM — spread among four different PegKeeper pools this totals up to $10MM, the exact cap of the initial $sfrxETH market. On the new CRVUSD tab on the main Curve site, you can see that most of the $crvUSD has indeed found its way into these four pools.

Each of these pools delivers 6-7% boosted rewards. Should more capital find their way into these pools chasing these rewards, we might actually see an upward depeg.

It’s an entirely realistic scenario that more users jump into these pools — these four PegKeeper pools have already found their way into Convex, StakeDAO, and Concentrator frontends.

While holders of $crvUSD might not complain too much about an upward depeg, the performance of the PegKeeper in regulating the stablecoin has been bespoke for the initial trial of the new stablecoin. Let’s keep $crvUSD pegged to a dollar.

At the moment one of the bigger drawbacks of the $crvUSD ecosystem is that the relatively small TVL makes some of this functionality more erratic. Relatively smol deposits/withdrawals can cause quick shifts to the borrow rate (currently around 2.4%). At higher TVLs, these swings should hypothetically become less swingy.

In the upcoming week we’ll see this hypothesis put this to the test. A cap of $150MM for wstETH will be quite fun to watch. Starting with collateral like sfrxETH and wstETH, tokens that appreciate in value as they sit idle, is quite the friendly experience for borrowers. This is the reason pure ether is dubbed “boring” as a collateral type.

Should the $150MM and popularity of $stETH as collateral indeed open up meaningful size for $crvUSD, we would also likely see sufficient room to test onboarding other collateral types. The status of onboarding new collateral types for $crvUSD is described here.

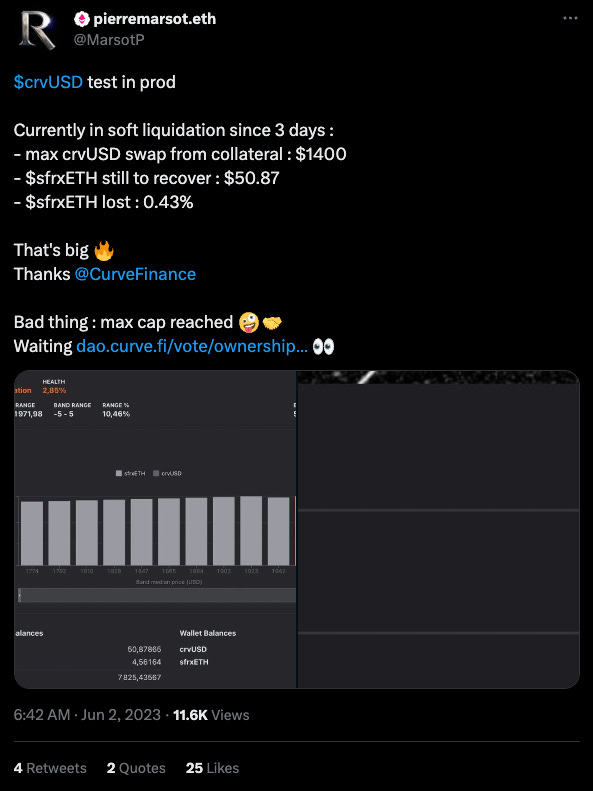

In the meantime, the inaugural $10MM worth of collateral has given early users the chance to try out the experience. It has indeed proved a friendly experience for borrowers relative to other lending platforms thus far.

The $crvUSD launch has given data crunchers reams of test data to munge on. In addition to

’s thread above, check out this incredible animation by twitter.com/theericstoneTriCrypto NG

We previously predicted TriCrypto NG’s launch would have more immediate impact than the $crvUSD launch. We’ll take a victory lap on this prediction based the past week of events, though we acknowledge that the $150MM $wstETH cap came far quicker than expected and may upend the tables.

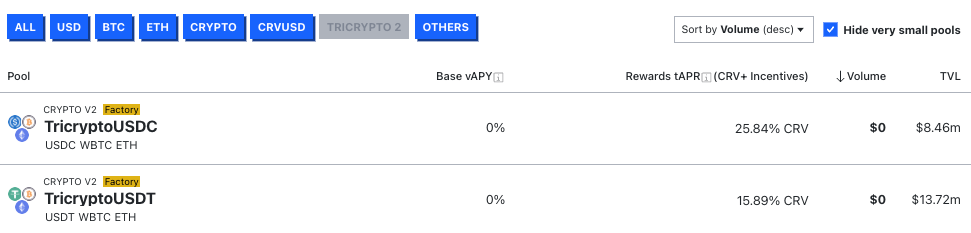

Both products are still being tested with relatively low liquidity. The pair of initial TriCrypto pools, also viewable from the new TriCrypto tab in the UI, have seen TVLs climbing to chase the initial rewards.

At this early stage with TriCrypto NG pools on a similar scale as the crvUSD pools, we are indeed seeing TriCrypto NG having a more substantial effect on the overall Curve ecosystem.

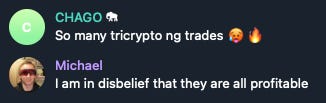

In particular, the Curve Monitor Telegram channel is the best place to follow both crvUSD and TriCrypto NG. While the observers of the channel are pleased with the early performance of crvUSD, nearly all the chatter is reserved for shock and awe concerning the superlative performance of TriCrypto NG.

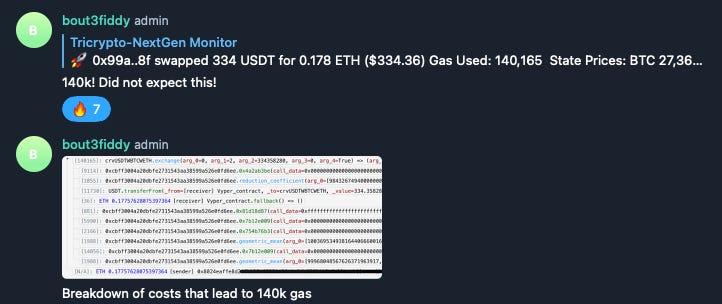

For instance, over the weekend we saw this bad boy…

It was initially thought to be a bug in the reporting monitor. No way could a transaction happen for just 125K gas

Few people expected that TriCrypto NG would get picked up by trading bots so quickly, nor that it would open up the floor for such low transactions. The reaction has been stunned disbelief.

Ladies and germs, we may have some winners on our hands… with trade volumes often in the triple digits (or in one case, low double digits).

Mind you, this is happening with relatively low liquidity in the new TriCrypto pools. As the pools gain TVL they’ll be less subject to slippage, and thus potentially friendlier for traders.

It feels like we’re on the precipice of something big, and we’re thrilled we get to watch it unfold along with you!