The wave of new v2 pools continues to wind its way through Curve and Convex governance. Last week we covered the active gauge votes at the time, most of which would go on to pass. This week we highlight four new pools moving towards a gauge.

cvxFXS/FXS

We needn’t belabor this one, because we already covered it in significant depth yesterday.

We do note that the arbitrage opportunity we reported yesterday apparently is narrowing. It was sitting at 20% yesterday, and today has already dropped to 8%. Gonzo journalism FTW! 💪💪💪

rETH/wstETH

Don’t get confused, start writing half your newsletter, and then have to tear it up because you got the wrong $rETH, because I certainly didn’t.

Not to be confused with the previous StaFi $rETH pool, this new pool is Rocket ETH which is also calling itself $rETH and adding an $rETH / $wstETH pool. Here we use $rETH to refer to Rocket ETH.

The two tokens in the pool are both forms of staked ETH, but have distinct mechanics. We’ll begin with $wstETH, the more familiar of the two. Lido’s $stETH is currently one of Curve’s largest Ethereum pools, and has been featured in the last three Votium rounds. The $stETH token allows users to both enjoy the gains from staking Ethereum while remaining broadly liquid. The $stETH tokens keeps its price in $ETH terms, but stakers on Lido gradually accrue $stETH each day to account for the staking rewards. In this case the pool is using a wrapped $stETH, which is redeemable for $stETH but accrues value without rebases to make it more like its native $rETH token.

Where $stETH is plentiful, $rETH is more scarce, just over 100K $ETH staked to date.

Rocket ETH is a similar concept with $stETH, allowing for as low as 0.01 $ETH to be staked for passive stakers. Users can also run a node with 16 $ETH + some native $RPL tokens to operate a staking node directly. A key differentiator between the two services is the level of decentralization. While Lido does not permit permissionless node operation, this is supported by Rocket ETH.

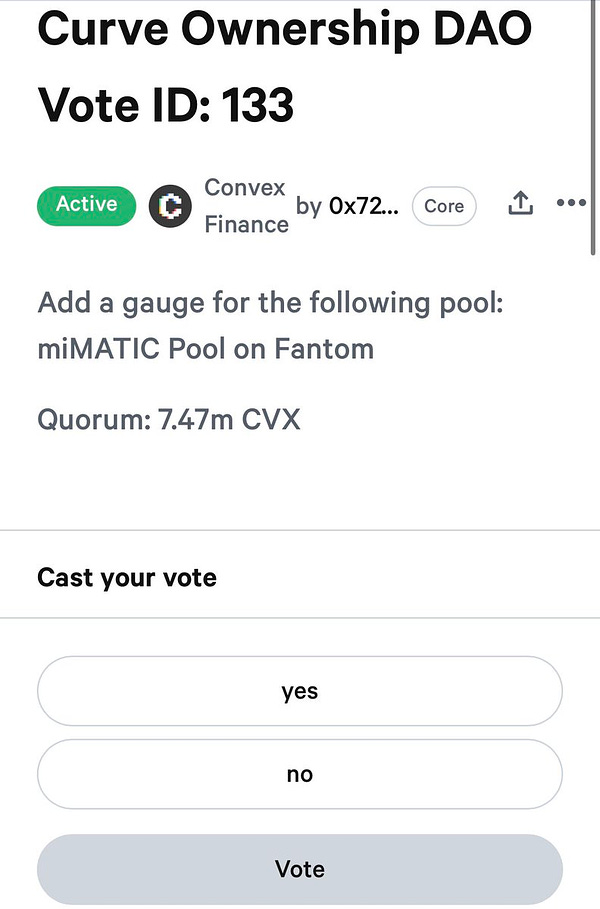

miMATIC

One of the exciting projects to hit the sidechains is miMATIC (by QiDao). Since we first covered them in July, they’ve grown by leaps and bounds.

They’ve been intensely focused on building a strong community with attention and rewards, making it one of the most successful sidechain projects in DeFi. They’ve spread to six different sidechains and attracted $300MM in TVL, with no footprint yet on Ethereum.

We won’t go into too much depth on this, since anything we write would necessarily pale in comparison with the phenomenally detailed write-up done by the Crypto Risk Assessment team, who recommend a vote for this proposal.

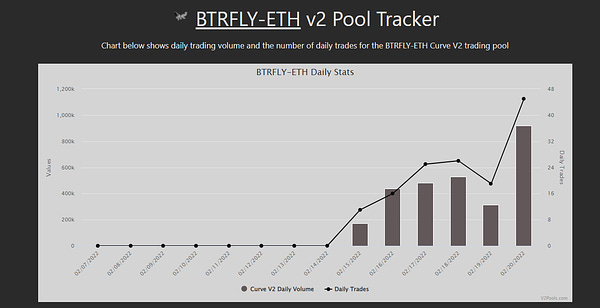

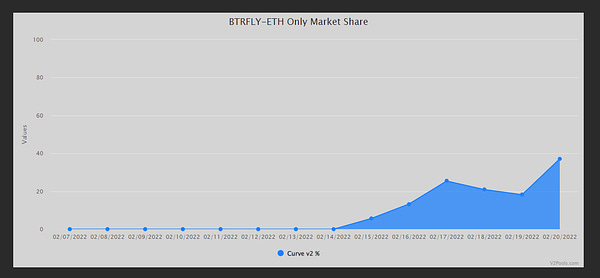

BTRFLY/ETH

Finally, the only vote that hasn’t already passed quorum is Redacted Cartel. For the longest time people were asking my opinion on the protocol, and I thought my computer was glitching because it kept showing up as ██████. It turned out to be intentional self-bawdlerization to add an air of mystery.

The pool is an Olympus DAO fork. Since the Olympus DAO price crash knocked out a ton of OHM forks, the ecosystem has suffered greatly, even becoming a meme in the recent JPEG Cards launch.

In my opinion, the pendulum is likely to swing back the other direction after seemingly overcorrecting. It’s been squeezed to comically low prices that illustrate just how crazy cryptocurrency valuations can get.

In the spirit of not repeating the work of my betters, the mechanics of Olympus and Redacted are already better covered by yuga.eth’s Incentivized Substack, so I’ll refer you there:

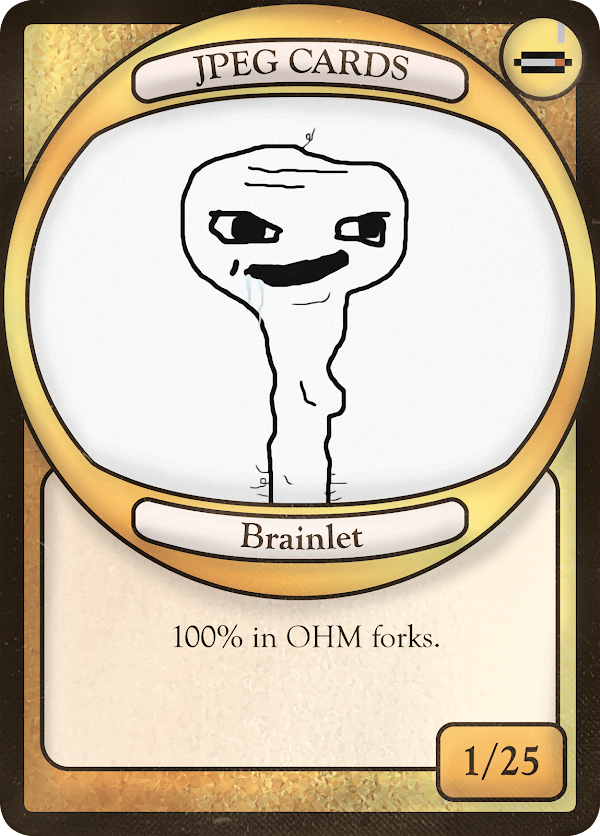

The important takeaway to note is that most Olympus Forks were focused on acquiring treasury assets, but Redacted made a particular focus on flywheel assets like Curve and Convex. These are of course very practical assets that have the benefit of shedding cash flow. This meant Redacted was more likely than other OHM forks to survive the downturn, and indeed they are still kicking. In fact, they are major co-belligerents in the Convex Wars.

Redacted has a full 13.2% of the $CVX market share. Olympus DAO, which independently acquired Convex, also has a 20% claim on Redacted’s treasury. Between Olympus and Redacted, they combine for a 21.9% ownership of CVX, a greater share than FRAX. This coalition is certain to be a key player in the Convex Wars for a long time.