March 12, 2021: ETH Devs BUIDL Fast ⚡🏗️

Reviewing the Optimism Dai Bridge and other development progress

Here are today’s trends to watch from Curve Market Cap

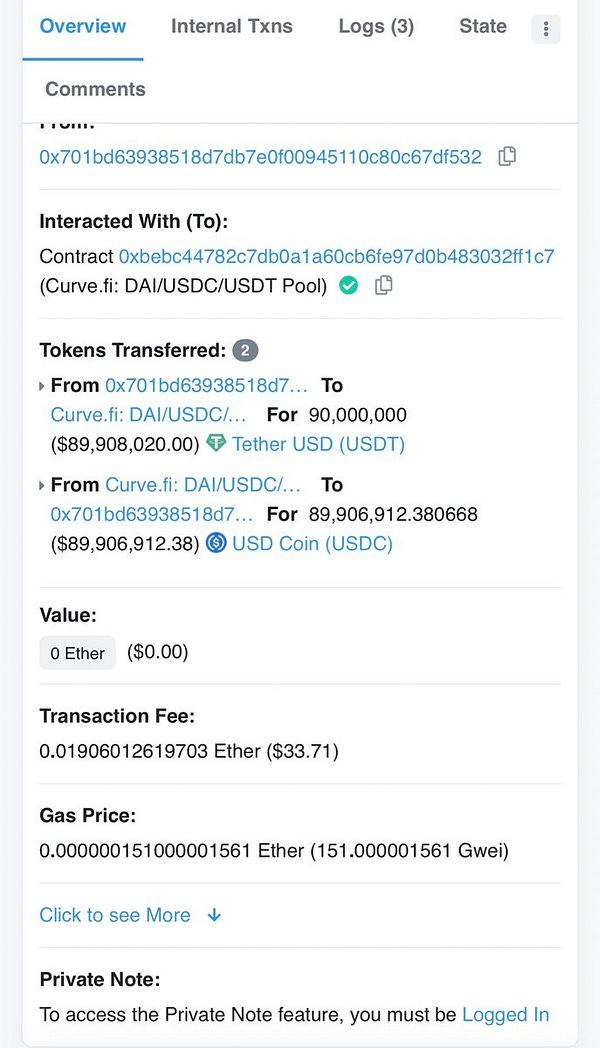

Gas prices are edging higher, but whales DGAF. They just keep dumping their money into Curve pools and NFT auctions.

Behind the scenes there’s a wild amount of BUIDL-ing happening which could have the long-term effect of lowering gas prices. Of particular excitement is MakerDAO’s solution to 1-week settlement times, an Optimism Dai Bridge that will support near instant transfer proposed by Sam MacPherson.

This is accomplished by logging all pending transactions to a Canonical Transaction Chain stored on L1. This chain still takes a week to settle, but at least it’s readable. Meanwhile, if you need funds immediately, Maker can provide an fDAI token that serves as a claim against the L1 chain while it is still being verified.

If you want more info, make sure to mark your calendars for this upcoming call:

Fast withdrawals aren’t expected to be ready until at least Q3 of 2021, but it’s a big step towards making Optimism a functional L2 solution.

Oh, and you're a bigot if you call it ETH2. The politically correct term is “Consensus Layer,” as opposed to the old school “Application Layer.”

There’s been a flurry of activity among Ethereum dev team lately, and some of the moves are inviting criticism. Vitalik proposed a mechanism to allow quicker merging, which could be useful in strong-arming miners into accepting EIP-1559.

A thoughtful thread by Ali Atiia discusses the issues with the potential cartelization of rollups. TRIGGER WARNING: he deadnames the Consensus Layer.

Weekends are for building, so for all we know by Monday all these changes may be ready to ship.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Newsletter is an independent roundup of interesting trends in cryptocurrency, never financial advice. Author is a $CRV maximalist and has a little $ETH lying around.